Brick Making Machines Market Research: 2031

The Global Brick Making Machines Market Size was valued at $2.1 billion in 2021, and is projected to reach $3.3 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031. Brick making machine are used to make bricks from raw materials such as sand, aggregate, cement, water and other materials. Bricks normally requires 2 days to 20 days to dry and remove moisture totally. These machines has single die, dual die or multi die to form brick at a time.

Market Dynamics

The increase in government expenditure for infrastructural development, such as improvement of roads and bridges, is expected to rise. Growth in demand for construction & infrastructure developments largely drives the market growth. Industries, such as construction and tunnels, require different types of bricks. By 2040, the global population is estimated to grow by approximately two billion with the urban population growing by 46%, triggering massive demand for infrastructure support such as roads, subways, tunnels, common areas, and commercial infrastructures. Therefore, expenditure by governments on infrastructural development drives the brick making machines market growth.

Development in manufacturing technology of brick making is one of the major driving factors of the market. Attributed to the demand for fast paced manufacturing with accuracy, precast machineries are rapidly developing. For instance, in February 2021, SnPc Machines, a Haryana-based startup launched its unique, fully-automated, brick making machine. In addition, company also received National Startup Award from the Government of India. Such strategies also help to overcome the problem of scarcity of lack of skilled labors. Thus, development of technology makes work easier and drives the growth of the brick making machine market.

However, brick making machines are large equipment that is expensive. Therefore, customers who are not able to buy such expensive machine opt for traditional brick making. Thus, not all customers can afford to buy such expensive equipment. Moreover, getting loan on higher interest rates to buy the equipment is not feasible for many customers. Moreover, for different brick required different machinery for brick manufacturing. Not all manufacturing machines can be owned by customers due to financial limitations. These factors restraint the growth of the global brick making machines industry.

The demand for brick making machine decreased in the year 2020, owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic led to shut-down of the production of bricks for the end-user, mainly owing to prolonged lockdowns in major countries. This has hampered the growth of the brick making machines significantly during the pandemic. The major demand for brick making machine was previously noticed from countries including China, U.S., Germany, Italy, and the UK, which was severely affected by the spread of coronavirus, thereby halting demand for brick making machine. This is expected to lead to re-initiation of construction industry at their full-scale capacities, which is likely to help the brick making machines to recover.

Furthermore, rapid urbanization and industrialization in developing countries has given rise to construction activities. Rise in demand for construction & infrastructure developments largely drives the market. Industries, such as roads & railways, tunnels, residential & non-residential construction, and mining, are continuously developing, which, in turn, is creating the need for construction of new infrastructure. This leads to rise in demand for different types of bricks, thereby creating a major opportunity in emerging countries for growth of the brick making machine market.

Segmental Overview

The brick making machines is segmented on the basis of type, die type, machine, and region. By type, the market is divided into automatic and semi-automatic. By die type, the market is divided into single die, dual die and multi die. By machine , market is divided into mobile and stationary.

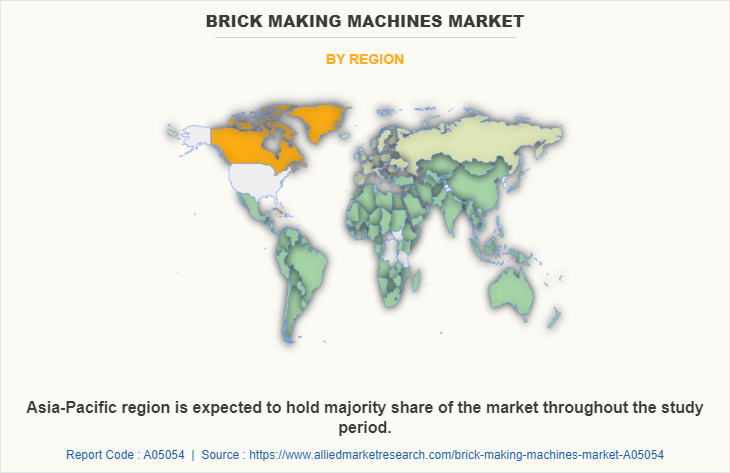

Region wise, the global brick making machines analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

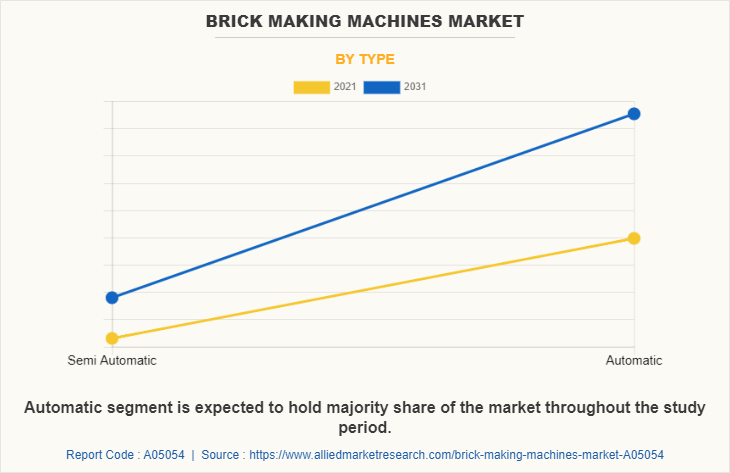

By Type:

The brick making machines are categorized into automatic and semi-automatic. The semi-automatic brick making machines are considered in this segment. These machines are used to produce different bricks such as concrete brick, fly ash brick, hollow brick, interlocking brick, clay brick, cement brick, and red brick. In automatic segment, brick making machines perform tasks such as raw material mixing to forming bricks automatically. The automatic segment is expected to exhibit the largest revenue contributor during the forecast period and also expected to exhibit the highest CAGR share in the by type segment in the brick making machines market forecast period.

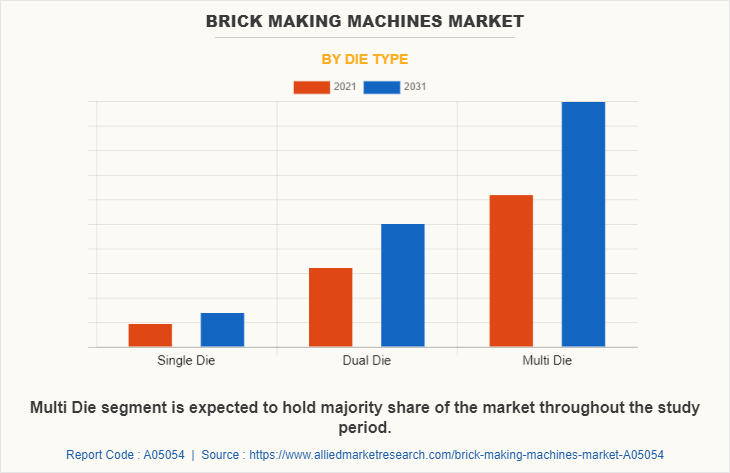

By Die Type:

The brick making machines is classified into single die, dual die and multi die. In this segment machines with single die are considered for brick making machine market. These machines can produce single brick at a time. These machines are compact as compared to other machinery and suitable for low to medium production rate. The dual die segment brick making machine can produce two brick at a time. These machines are large in size as compared to single die machinery and suitable for medium production rate. In the multi die segment the brick making machine can produce multiple brick at a time. These machines are large in size as compared to single die or dual die machinery and suitable for high production rate. Multi Die segment is expected to exhibit largest revenue during forecast period and is expected to exhibit highest CAGR share in die type segment in brick making machines during forecast period.

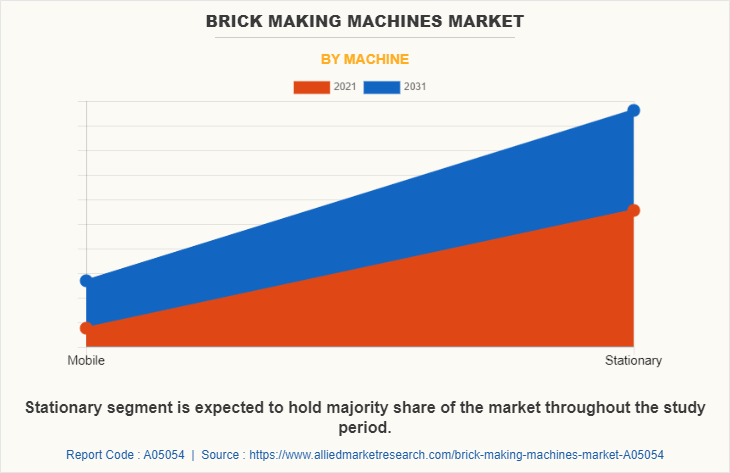

By Machine:

The brick making machines is divided into mobile and stationary. Mobile brick making machine is the most compact and cost-effective brick-making machine. The majority of the work is done manually in this system. So, in comparison to other machines, this system require additional workers. The mortar is made manually in this process, then transported to the machine, and the dry bricks are collected manually. It has the benefit of not needing the use of pellets in the production of bricks. The machine places the bricks on the ground.

Moreover, stationary brick building machine is ideal for projects that need a larger production line capacity. These machines have various capacities. In an eight-hour shift, the smallest brick building machine can manufacture 4000 pieces, and the largest can produce 10.000 pieces of standard blocks. Stationary segment is expected to exhibit largest revenue share in the machine segment in the brick making machines during forecast period. The mobile segment is expected to exhibit largest CAGR during forecast period.

By Region:

The brick making machines is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest revenue in brick making machines share. And LAMEA is expected to exhibit highest CAGR during forecast period.

COMPETITION ANALYSIS

The major players profiled in the brick making machines include Zhengzhou Yingfeng Machinery Co.,Ltd, Chirag Concrete Machine Private Limited., J.C. Steele & Sons Inc., SnPC Machines Pvt. Ltd., Jayem Manufacturing Co., ZCJK Intelligent Machinery Wuhan Co., Ltd, Shankar Engineering Corporation, Aimix Group Co., Ltd., Global Impex, Wangda Bricks Machinery.

Major companies in the market have adopted acquisition and product launch as their key developmental strategies to offer better products and services to customers in the Brick Making Machines.

Some examples of Expansion in the market

In April 2022, Marico has expanded its world-class production facility in Gujarat to increase the production capacity of cosmetic goods like hair oils, gels, and moisturizers. It had to ensure that the top node's inventory was working as effectively as possible. In order to understand the needs of manufacturing, it collaborated with AddverbAdd and engaged in extensive data mining with production and inventory data. Business expansion creates demand for construction and driving the demand for brick making machine.

In January 2022 - Fuji Electric Co. Ltd has expands its Plant Systems Center at its Tokyo Factory to strengthen plant system development and production system to expand the systems business. The new facility accounts for a total floor area of 13,030-meter square. Business expansion creates demand for construction and driving the demand for brick making machine.

In February 2021, Finland has launched a national smart campus program to upgrade and deliver 6G mobile networks in the Nordic country by 2030. This will also create the demand for infrastructure development this in turn drive the market.

In November 2021, E-magazine published by Archi Expo, it states “Curitiba, Brazil to Inaugurate First Public Smart Building in 2022“ in December, City Hall will start building the Program’s first 788 new housing units, investing R$ 56 million (approximately US$ 10 million). Such development activities will need bricks and other products for construction. This is anticipated to drive the growth of the brick making machine market.

In August 2022, European Investment Bank (EIB), supports social and affordable housing in Hanover with €60 million. This has led to increase in demand for brick for construction applications. Such developments drive the market and are expected to boost the brick making machine market.

In February 2022, UR Linkage Co Ltd has presented a study plan to invest in the construction of a 2,000 unit Japanese standard housing project in Siem Reap. Such factors are anticipated to drive the residential real estate market during the forecast period. Thus, this is driving the need for the brick making machines, which, in turn, is boosting the growth of the brick making machines market share.

The product launch in the market

In April 2022 - Mitsubishi Electric has launched a new campaign to highlight how the company is addressing India’s social challenges in the industry, infrastructure, life, and mobility. The launch and progressive promotion of two digital videos, each lasting 120 seconds, created with the themes of industry and infrastructure would be the first stage of the campaign, according to the business.

In November 2021, Brickmaker Ibstock has launched its new business unit, invested around £50m in order to brick slip system factory. By means of this investment manufacturer of clay bricks and concrete products setup a new brand-new venture – Ibstock Futures – will be headquartered in London and will help diversify the business.

In May 2021, SnPc Machines, a Haryana-based startup has launched its first unique, fully-automated, brick making machine. By means of this launched company aimed to increases its production throughout India.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the brick making machines market analysis from 2021 to 2031 to identify the prevailing brick making machines market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the brick making machines market outlook and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global brick making machines market trends, key players, market segments, application areas, and market growth strategies.

Brick Making Machines Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.3 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 220 |

| By Type |

|

| By Die Type |

|

| By Machine |

|

| By Region |

|

| Key Market Players | J.C. Steele & Sons Inc., Wangda Bricks Machinery, Shankar Engineering Corporation, Zhengzhou Yingfeng Machinery Co.,Ltd, Chirag Concrete Machine Private Limited., Aimix Group Co., Ltd., Global Impex, SnPC Machines Pvt. Ltd., ZCJK Intelligent Machinery Wuhan Co., Ltd, Jayem Manufacturing Co. |

Analyst Review

The global brick making machines market witnessed a huge demand in Asia-Pacific followed by North America. The highest share of the Asia-Pacific market is attributed to increase in demand for infrastructure development in residential and non-residential construction.

A brick producing machine is a device that uses hydraulic pressure and electrical vibration to make bricks. These machines come in various levels of automation and capabilities. Growth in demand for construction & infrastructure developments largely drives the market expansion. By 2040, the global population is estimated to grow by approximately two billion with the urban population growing by 46%, triggering massive demand for infrastructure support such as roads, subways, tunnels, common areas, and commercial infrastructure. In addition, getting loan on higher interest rates to buy the equipment is not feasible for many customers. Moreover, for different brick such as clay brick, cement brick and other types, requires different types of machineries are required for manufacturing. Not all manufacturing machines can be owned by brick manufacturers due to financial limitations. These factors restraint the growth of the global brick making machine market. Furthermore, rise in demand for construction & infrastructure developments largely drives the market growth. Industries, such as roads & railways, tunnels, residential & non-residential construction, and mining, are continuously developing, which, in turn, is creating the need for construction of new infrastructure. This has led to rise in demand for different types of bricks, thereby creating a major opportunity in emerging countries for growth of the brick making machine market.

The major players profiled in the brick making machines include Zhengzhou Yingfeng Machinery Co.,Ltd, Chirag Concrete Machine Private Limited., J.C. Steele & Sons Inc., SnPC Machines Pvt. Ltd., Jayem Manufacturing Co., ZCJK Intelligent Machinery Wuhan Co., Ltd, Shankar Engineering Corporation, Aimix Group Co., Ltd., Global Impex, and Wangda Bricks Machinery.

The global brick making machines market was valued at $2,053.9 million in 2021, and is projected to reach $3,263.0 million by 2031, registering a CAGR of 4.6% from 2022 to 2031.

The forecast period considered for the global brick making machine market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global brick making machine market report can be obtained on demand from the website.

The base year considered in the global brick making machine market report is 2021.

The major players profiled in the brick making machine market include Aimix Group Co., Ltd., Chirag, Global Impex, Jayem Manufacturing Co., J.C. Steele & Sons Inc., SnPC Machines Pvt. Ltd., Shankar Engineering Corporation, Wangda Bricks Machinery, ZCJK Intelligent Machinery Wuhan Co., Ltd, and Zhengzhou Yingfeng Machinery Co.,Ltd.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on type, the multi die segment dominated the market in 2021.

Loading Table Of Content...