Bulb Market Research, 2034

Market Introduction and Definition

The global bulb market size was valued at $63.1 billion in 2023, and is projected to reach $104.7 billion by 2034, growing at a CAGR of 4.8% from 2024 to 2034. A bulb is a device that converts electrical energy into light. It consists of a sealed glass enclosure containing a filament or gas that emits light when an electric current passes through it. The most common types include incandescent, fluorescent, and LED bulbs. Incandescent bulbs use a heated wire filament, while fluorescent bulbs employ mercury vapor and phosphor coating. LED bulbs use semiconductor technology to produce light efficiently. Bulbs are essential for indoor and outdoor lighting, providing illumination for homes, offices, streets, and various applications. They come in different shapes, sizes, and wattages to suit various needs. Since their invention in the late 19th century, electric bulbs have revolutionized lighting, significantly impacting human activities, productivity, and quality of life by extending usable hours and improving visibility in dark environments.

Key Takeaways

The bulb market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of bulb industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The rise in demand for residential and commercial lighting has significantly boosted the bulb market size, driven by increased urbanization, population growth, and higher living standards. In residential settings, the desire for enhanced home aesthetics, energy efficiency, and smart home integration fuels the need for advanced lighting solutions. Similarly, commercial spaces seek improved lighting for productivity, ambiance, and energy savings. As businesses and consumers increasingly prioritize modern, efficient, and customizable lighting options, the demand for bulbs, particularly energy-efficient LEDs and smart bulbs, has experienced a rapid surge in recent years. The growing preference for high-performance lighting solutions in both homes and businesses stimulates bulb market expansion, encouraging manufacturers to innovate and meet the evolving needs of residential and commercial customers. Thus, the surge in demand has driven significant growth and investment in the bulb market.

However, the high initial cost of advanced lighting technologies, such as LED and smart bulbs, restrains market demand by limiting their affordability for a broad consumer base. Despite their long-term energy savings and efficiency, the upfront investment required for these advanced lighting solutions is anticipated to be prohibitive, particularly for budget-conscious consumers and small businesses. The cost barrier can deter adoption, which may lead to slower market penetration compared to more affordable traditional lighting options. In addition, the high cost may lead to slower replacement cycles and reduced enthusiasm for upgrading existing lighting systems. As a result, the Bulb Market Share has faced challenges in achieving widespread acceptance and growth, with the initial cost serving as a significant restraint that hampers the broader adoption of advanced lighting technologies.

Furthermore, the development of smart lighting systems with IoT integration creates substantial opportunities in the bulb market, particularly as Generation Z increasingly drives technology adoption. Gen Z and millennials values convenience and innovation, which has made them more inclined to embrace smart lighting solutions that offer remote control, automation, and customization. IoT-enabled smart bulbs cater to these preferences by integrating seamlessly with smart home systems, voice assistants, and mobile apps, which enhances user convenience and energy efficiency. As Generation Z and tech-savvy consumers seek sophisticated and interconnected products, the demand for smart lighting systems in the bulb industry is expected to grow rapidly. Thus, the trend is anticipated to boost bulb market expansion and encourage manufacturers to innovate, aligning their offerings with the evolving needs and preferences of a tech-oriented consumer base.

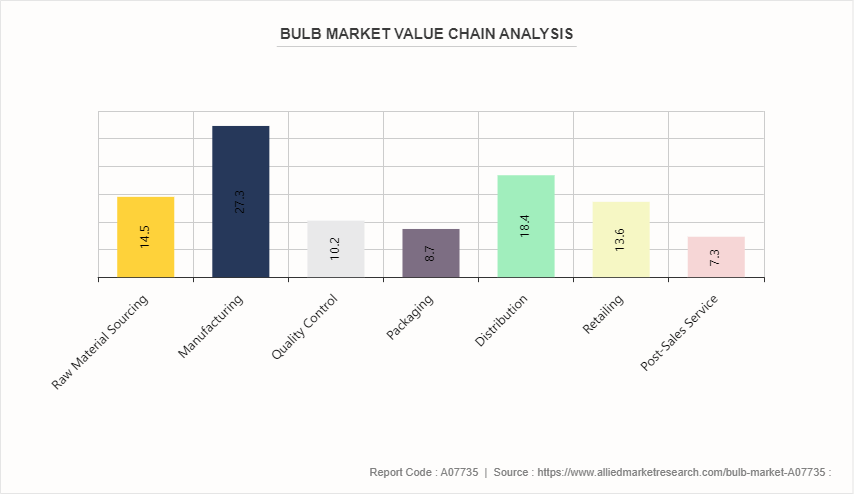

Value Chain Analysis of Global Bulb Market

The value chain of a bulb begins with raw material sourcing, where materials such as glass, tungsten, phosphors, and LEDs are acquired. In the manufacturing stage, these components are assembled into bulbs through processes like filament production, bulb shaping, and coating. Quality control follows to ensure that bulbs meet performance, safety, and durability standards. After quality checks, bulbs are packaged to protect them during transport. Distribution involves shipping the bulbs to wholesalers, retailers, and direct customers. Retailing occurs through various channels, including online platforms, supermarkets, specialty stores, and hardware stores. Once purchased, bulbs are used by consumers in various settings. Finally, post-sales service handles return, warranties, and customer support.

Market Segmentation

The global bulb market is segmented into product type, technology, application, distribution channel, and region. On the basis of product type, the market is categorized into incandescent bulbs, led bulbs, halogen bulbs, fluorescent bulbs, compact fluorescent lamps, and others. As per technology, the market is classified into smart bulbs and non-smart bulbs. On the basis of application, the market is divided into residential, commercial, and industrial. According to distribution channel, it is fragmented into supermarkets/hypermarkets, specialty stores, departmental stores, online sales channel, and others. Region wise, the hair bulb market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In the North America region, major factors driving the growth of the bulb market include increasing demand for energy-efficient lighting solutions, such as LEDs, which offer significant cost savings and environmental benefits. Government regulations and incentives promoting energy efficiency and sustainability also play a crucial role. The rise in smart home technology and IoT integration boosts the adoption of advanced lighting systems. Moreover, urbanization and infrastructure development in these regions create opportunities for modern lighting solutions in residential, commercial, and industrial settings. Consumer preference for customizable and aesthetically appealing lighting options further fuels market growth, encouraging manufacturers to innovate and cater to diverse needs across North America.

In the Asia-Pacific region, growth opportunities in the bulb market are driven by rapid urbanization, increasing infrastructure projects, and rising disposable incomes, which boost demand for modern and energy-efficient lighting solutions. The shift toward LEDs and smart lighting systems is fueled by growing environmental awareness and government regulations promoting energy efficiency. In addition, expanding middle-class populations in countries such as China and India present significant market potential. New and innovative brands, such as Wipro Lighting, Lumenpulse, and OSRAM China, are entering the market with advanced lighting technologies and smart solutions. These brands are focusing on energy efficiency, IoT integration, and customizable lighting designs, catering to the evolving needs of consumers and businesses in the region, thereby driving bulb market growth and innovation in recent years.

Industry Trends:

According to the U.S. Department of Energy (DOE) , LED lighting uses at least 75% less energy and lasts 25 times longer than incandescent lighting. In 2023, LEDs accounted for 60% of the residential lighting market in the U.S., significantly reducing overall household energy consumption. This shift is driving the market toward more energy-efficient bulbs, thereby increasing the demand for LEDs and reducing the bulb market share of traditional incandescent bulbs.

The European Union's Ecodesign Directive mandates that all new light bulbs meet specific energy efficiency criteria. As of 2023, the EU has phased out inefficient incandescent bulbs and requires new bulbs to achieve a minimum efficiency of 80 lumens per watt. These regulations are accelerating the market transition toward more efficient lighting technologies, boosting the adoption of LEDs and CFLs during the bulb market forecast.

Competitive Landscape

The major players operating in the bulb market include Acuity Brands, Cree, Eaton, Everlight Electronics, GE Lighting, Nichia Corporation, Osram, Philips Lighting, Seoul Semiconductor, and Zumtobel Group.

Recent Key Strategies and Developments

In April 2024, IKEA launched a new version of its TRÅDFRI Smart LED Bulb for colored lighting. The bulb aims to provide affordable smart lighting options, complementing IKEA's range of smart home products.

In April 2023, Signify Malaysia launched a range of sustainable and energy-efficient lighting products in July 2023. The Philips Ultra Efficient LED includes advanced LED bulbs and tubes that consume 60% less energy than standard products, providing up to 50, 000 hours of light.

In June 2022, Philips Hue launched its new Lightguide smart bulb series, featuring the Ellipse, Globe, and Triangular models. The launch aimed to provide aesthetic lighting options for smart homes.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bulb market analysis from 2024 to 2034 to identify the prevailing bulb market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bulb market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bulb market trends, key players, market segments, application areas, and market growth strategies.

Bulb Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 104.7 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2034 |

| Report Pages | 290 |

| By Product Type |

|

| By Technology |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Everlight Electronics co.,Ltd., NICHIA CORPORATION, GE Lighting, Eaton, Seoul Semiconductor Co., Ltd, Zumtobel Group, acuity brands, Cree, Philips Lighting, ams-OSRAM AG. |

Upcoming trends in the global bulb market include smart lighting integration, energy-efficient LEDs, IoT connectivity, and eco-friendly manufacturing.

The leading application of the bulb market is in residential lighting, driven by widespread use in homes for general illumination.

Based on region, Asia-Pacific held the highest market share in terms of revenue in 2023.

The global bulb market was valued at $63.1 billion in 2023.

The major players operating in the bulb market include Acuity Brands, Cree, Eaton, Everlight Electronics, GE Lighting, Nichia Corporation, Osram, Philips Lighting, Seoul Semiconductor, and Zumtobel Group.

Loading Table Of Content...