Bulldozer Market Research, 2032

The global bulldozer market was valued at $5.3 billion in 2022, and is projected to reach $9.7 billion by 2032, growing at a CAGR of 6.3% from 2023 to 2032.

Report Key Highlighters:

- The bulldozer market study covers 14 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The bulldozer market is highly fragmented, with several players including Caterpillar Inc., CNH Industrial N.V., Doosan Infracore Co. Ltd., Komatsu Ltd., Liebherr Machines Bulle SA, Shantui Construction Machinery, Volvo Construction Equipment, XCMG Group, Xuanhua Construction Machinery Development Co., Ltd., and Zoomlion Heavy Industry. Also tracked key strategies such as acquisitions, product launches, mergers, expansion, etc. of the players operating in the market.

A bulldozer is a large, heavy-duty construction machine with a wide, flat blade attached at the front that is used to push large quantities of soil, debris, or other materials during construction or excavation projects. It is equipped with tracks to provide stability and mobility on rough terrain and can be equipped with additional attachments such as rippers, winches, and blades for specific tasks. Bulldozers are commonly used in road construction, mining, forestry, and agriculture, and are available in various sizes and configurations to suit different applications.

The growth of the bulldozer market is driven by increase in mining and extraction activities, expansion of the agriculture sector, and technological advancements. However, changes in regulatory policies related to emissions and other environmental standards and environmental concerns negatively impact the bulldozers market. On the contrary, surge in demand for renewable energy sources, such as wind and solar, is anticipated to create lucrative opportunities for the expansion of the global bulldozers market.

In addition, as the construction equipment industry continues to grow, the demand for bulldozers is expected to increase simultaneously. In addition, the use of bulldozers is expected to become more prevalent in developing countries as they heavily invest in infrastructure development. Furthermore, the trend of renting construction equipment rather than purchasing it outright is expected to drive the demand for bulldozers, as rental companies seek to expand their fleets to meet customer needs. For instance, United Rentals, one of the largest rental equipment companies in the world, recently acquired BlueLine Rental, a company that specializes in renting heavy equipment such as bulldozers, excavators, and backhoes. Moreover, bulldozers are being integrated with advanced technology systems, such as GPS and telematics, to enhance their capabilities. These technologies enable precise positioning, monitoring of machine health, and optimization of operations through data analysis. For instance, Caterpillar D6T GPS Bulldozer: Caterpillar offers the D6T dozer with optional integrated GPS technology. This system, known as Cat Grade Control, utilizes GPS positioning to provide accurate blade control for grading and leveling applications.

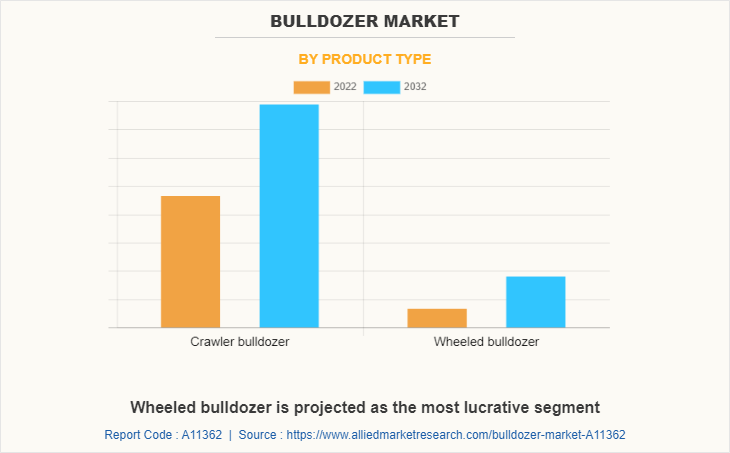

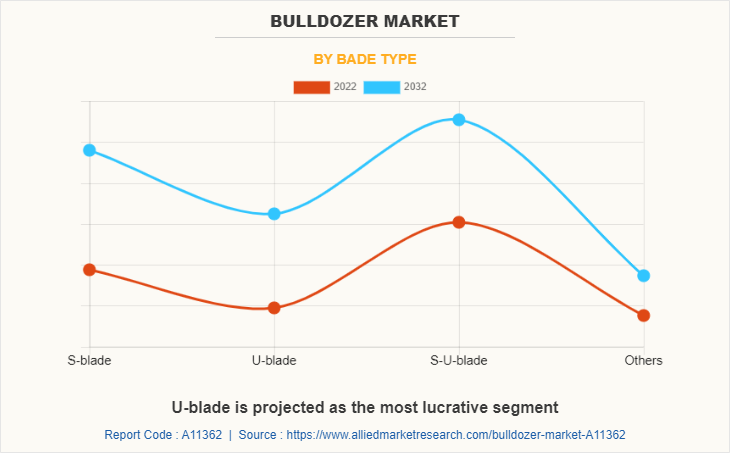

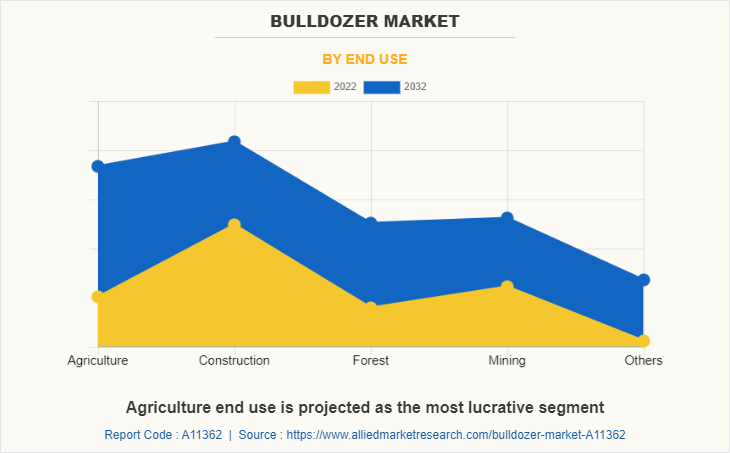

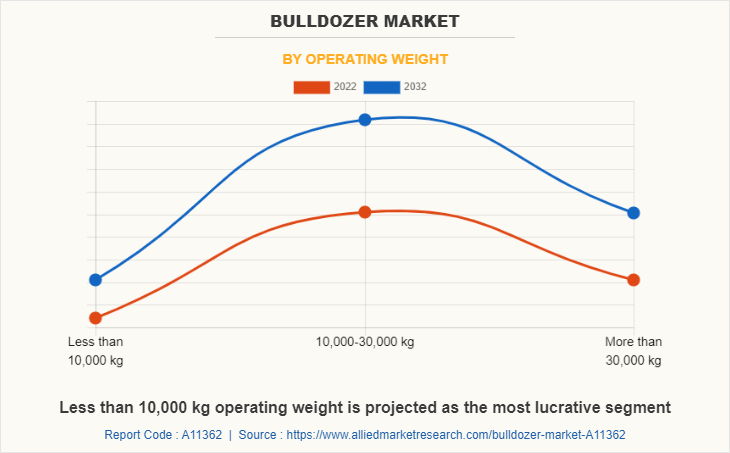

The global bulldozer market is segmented based on product type, blade type, end use, operating weight, and region. By product type, the market is categorized into crawler bulldozers, wheeled bulldozers, and others. Depending on blade type, it is segregated into S-blade, U-blade, SU-blade, and others. By end use, it is fragmented into agriculture, construction, forest, infrastructure, mining, and others. As per operating weight, it is classified into less than 10,000 kg, 10,000–30,000 kg, and more than 30,000 kg.

Key Developments

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- In October 2022, Caterpillar developed its line dozers and launched new electric machines. It is enhanced with new technology, including advanced controls and improved visibility, to increase efficiency and productivity on job sites.

- In August 2022, CNH Industrial N.V., through its brand CASE Construction Equipment launched a new industry-first construction equipment category CASE Minotaur DL550 compact dozer loader. It's also available with an optional, industry-exclusive fully integrated ripper for tearing up tough terrain to simplify dozing and earthmoving operations.

- In June 2022, Doosan Corp. developed DD100, which includes features such as improved visibility to both the front and rear of the machine and comes with a standard rearview camera,122-hp engine, and 10-metric-ton weight with an all-new, high-power design.

- In May 2021, Komatsu Ltd., through its subsidiary Komatsu Europe, new D71-24 dozer. It is the largest ever HST dozer that offers sensational aesthetics, and unrivaled visibility with its distinctive super-slant nose, razor-sharp response, heavyweight performance, and lightweight consumption.

Expansion of the construction and infrastructure industry

Exponential increase in population coupled with rise in urbanization has led to the expansion of the construction sector across the globe, which acts as key driving force of the bulldozer market. In the construction equipment industry, bulldozer market share is around 6%. This is attributed to the fact that increase in construction & infrastructure development projects such as residential, commercial, industrial, and public infrastructure largely drive the demand for bulldozers, especially, in the emerging economies such as India, China, Vietnam, Brazil, and South Africa. For instance, with the new National Infrastructure Pipeline project of India, the country aims to develop social and economic infrastructure such as roads & highways, railway networks, ports, shipping, and inland waterways infrastructure. Expenditure for this is expected to be around $759.76 billion over a period of five years between 2020 and 2025.

Increase in use in agriculture

Bulldozers are increasingly being used in the agriculture sector for a variety of tasks, such as land preparation, site grading, and irrigation. The use of bulldozers for land preparation, in particular, has become popular due to their efficiency and cost-effectiveness. In Thailand, farmers are using bulldozers to prepare their rice paddies for planting. Traditionally, this process involved manually plowing the fields with water buffalo, which is time-consuming and labor-intensive. Bulldozers, on the other hand, can quickly and efficiently level the fields, removing rocks and debris and creating a smooth surface for planting.

Implementation of stringent government regulations

One of the major factors that restrain the growth of the bulldozer market is region-specific government regulations related to the initiation of construction activities. An organization goes through a rigorous and lengthy procedure of gaining a permit after several required checks. To cite an instance, to comply with the emissions regulations set by the European Union (EU), the construction and mining industries have been increasingly using diesel engine bulldozers. However, to ensure that the ecological condition of the area is not compromised, appropriate baseline data is collected beforehand. This data is then used to effectively monitor and evaluate the impact of these diesel engines on the environment and to implement measures to mitigate any negative effects. By gathering baseline data and taking proactive measures, the construction and mining industries can continue to operate while minimizing their impact on the environment.

Surge in demand for natural resources

An increase in demand for natural resources such as minerals, metals, and fossil fuels is a significant driver of the bulldozers market. This is attributed to the fact that bulldozers play a crucial role in the mining and extraction industries, where they are used for clearing land, transporting heavy materials, and leveling sites for mining operations. As global demand for natural resources continues to increase, the mining and extraction industries are expected to expand simultaneously. This, in turn, will lead to increased demand for bulldozers for tasks involved in mining and extraction operations. For instance, in the gold mining industry, bulldozers are used to clear land, remove overburden (rock and soil that covers the gold deposit), and create a level surface for mining operations. Moreover, bulldozers are used to transport ore and other materials within the mine site and build access roads and haul roads for trucks and other heavy equipment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the bulldozer market analysis from 2022 to 2032 to identify the prevailing bulldozer market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the bulldozer market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global bulldozer market trends, key players, market segments, application areas, and market growth strategies.

Bulldozer Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.7 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 450 |

| By Product Type |

|

| By Bade Type |

|

| By End Use |

|

| By Operating Weight |

|

| By Region |

|

| Key Market Players | Zoomlion Heavy Industry, Shantui Construction Machinery Co., Ltd., Liebherr Machines Bulle SA, Caterpillar Inc., KOMATSU Ltd, XCMG Group, Xuanhua Construction Machinery Development Co., Ltd., CNH Industrial N.V., Doosan Corp., AB Volvo |

Analyst Review

The bulldozer market is projected to witness a high growth rate, owing to an increase in construction and mining activities. In addition, it plays a dynamic role in the transportation and movement of materials across different land grades. They are crucial in overload shedding and heaving during road maintenance. Due to crawlers, bulldozers exhibit superior ground-holding ability along with agility even in rough terrains. They are wide enough for the load to be distributed across the machine, preventing them from tumbling even on soft terrains. All these uses make them a suitable choice for numerous applications in construction, road building, and land clearing.

The CXOs further added that the bulldozer market is a rapidly evolving sector, with significant potential for innovation in the coming years. For instance, Komatsu introduced several hybrid bulldozer models, including the D61EXi/PXi-24 and the D155AXi-8, which are equipped with electric motors and batteries that reduce fuel consumption and emissions.

In addition, manufacturers are exploring new technologies to improve the performance and efficiency of their bulldozers. For example, John Deere developed “SmartGrade" technology for its bulldozers, which use advanced sensors and software to automate grading tasks and ensure precision and accuracy.

The global bulldozer market was valued at $5,304.7 million in 2022, and is projected to reach $9,658.0 million by 2032, registering a CAGR of 6.3% from 2023 to 2032.

Caterpillar Inc., CNH Industrial N.V., Doosan Infracore Co. Ltd., Komatsu Ltd., Liebherr Machines Bulle SA, Shantui Construction Machinery, Volvo Construction Equipment, XCMG Group, Xuanhua Construction Machinery Development Co., Ltd., and Zoomlion Heavy Industry.

In the bulldozer market, the leading application is the crawler bulldozer.

The largest regional market for bulldozers is Asia-Pacific.

Expansion of construction and infrastructure industry, increase in use in agriculture and focus on public private partnerships drive the growth of the global bulldozer market during the forecast period.

Loading Table Of Content...

Loading Research Methodology...