Burial Insurance Market Research, 2032

The global burial insurance market was valued at $142.9 billion in 2022, and is projected to reach $370.1 billion by 2032, growing at a CAGR of 10.3% from 2023 to 2032.

Burial insurance is a type of life insurance designed specifically for final expenses. It is also called funeral insurance or final expense insurance. It is typically a whole life insurance policy with a small death benefit, such as $5,000 to $25,000, that is designed to cover the final expenses and funeral costs. Furthermore, this policy offer flexibility in terms of funeral planning. Unlike pre-paid funeral plans, burial insurance allows beneficiaries to choose the funeral home, make decisions regarding the funeral service, and use the funds as needed within the policy's coverage limits.

An increase in the aging population, rising funeral costs, and ease of access and affordability to burial insurance policies drive the growth of the burial insurance market. As the global population continues to age, there is a growing need for financial solutions to cover end-of-life expenses, including funeral and burial costs. Burial insurance provides a way for individuals and families to plan ahead and ensure that these expenses are covered.

Furthermore, the cost of funerals and burials has been steadily increasing over the years. Burial insurance offers a way for individuals to mitigate the financial burden on their families by securing funds specifically designated for funeral expenses. In addition, increasing awareness and marketing efforts by burial insurance providers significantly accelerated the growth of the burial insurance market. Insurance companies and funeral service providers have been actively promoting burial insurance products, creating awareness among consumers about the benefits and importance of planning for funeral expenses. This increased marketing and has contributed to the growth of the burial insurance market.

However, limited awareness and underwriting and eligibility requirements are significant barriers to the burial insurance market growth. Many people are unaware of burial insurance or have a limited understanding of its benefits. This lack of awareness hinders the growth of the market. On the contrary, technological advancements and digital distribution channels have played a crucial role in the growth of the burial insurance market.

Further, increasing awareness and acceptance, and customization and flexibility of burial insurance policies are expected to create lucrative opportunities for the growth of the burial insurance market in the upcoming years. Burial insurance policies offer a high level of customization and flexibility compared to traditional life insurance policies. They are specifically designed to cover funeral and burial costs, and policyholders can choose the coverage amount and duration according to their specific needs. The ability to tailor the policy to individual requirements has made burial insurance more appealing to consumers, driving the market growth.

The report focuses on growth prospects, restraints, and trends of the burial insurance market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the burial insurance market outlook.

Segment Review

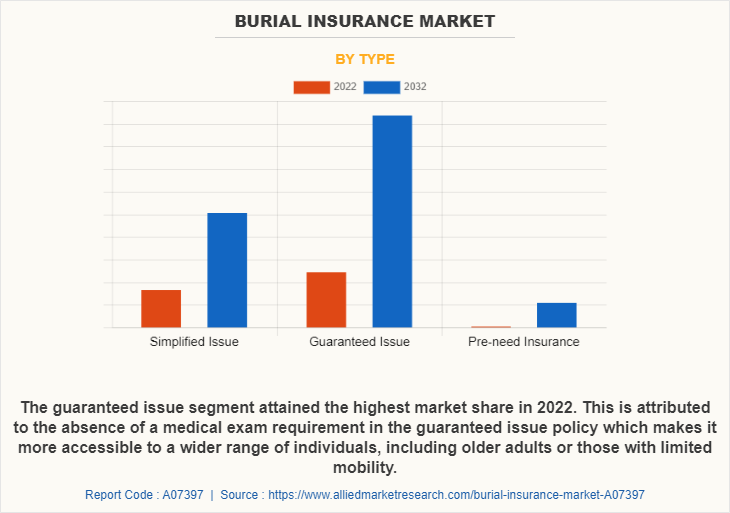

The burial insurance market is segmented into type, age of end user, and region. By type, the market is differentiated into simplified issue, guaranteed issue, and pre-need insurance. Depending on the age of end user, it is fragmented into over 50, over 60, over 70, and over 80. Region wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

By type, the guaranteed issue segment attained the highest burial insurance market share in 2022 and is attributed to be the fastest-growing segment during the forecast period. One of the primary drivers of this segment is the absence of a medical exam requirement. Guaranteed issue burial insurance policies are designed to accept applicants regardless of their health condition or medical history. This appeals to individuals who may have pre-existing health conditions or are unable to qualify for traditional life insurance due to health reasons. Furthermore, the application process for guaranteed issue burial insurance is simple and straightforward. It involves answering a few basic questions about age, gender, and sometimes tobacco use. This ease of application makes it more accessible to a wider range of individuals, including older adults or those with limited mobility.

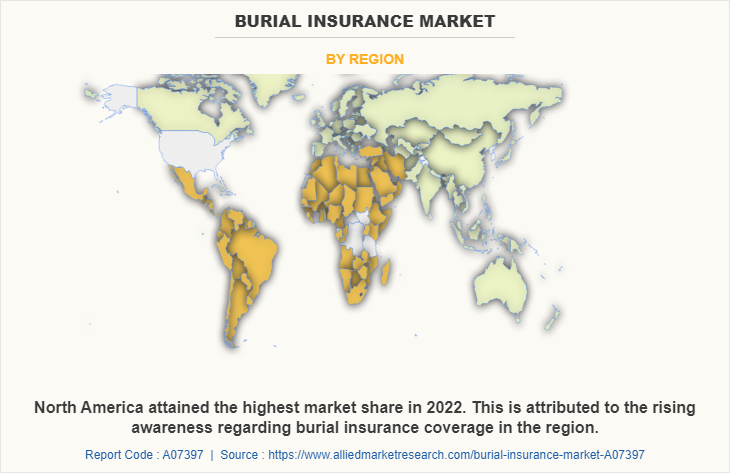

Region wise, North America dominated the market in 2022. This was attributed to the result of the rising awareness regarding burial insurance coverage, an increase in the aging population, rising funeral costs, and growing marketing efforts. Furthermore, the burial insurance market has seen increased marketing efforts by insurance providers and agents in this region. These efforts have raised awareness about burial insurance among the target audience, making more individuals consider it as a viable option. Insurance companies have employed various marketing strategies, including online advertising, direct mail campaigns, and partnerships with funeral homes, to educate consumers about the benefits of burial insurance, which has further fueled the growth of the burial insurance market in North America.

However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. Insurance providers in the Asia-Pacific region are offering burial insurance policies that are easily accessible and customizable to suit individual needs. Companies are adopting digital platforms and online distribution channels, making it convenient for individuals to purchase burial insurance policies. In addition, insurers are providing flexible coverage options, allowing policyholders to tailor their plans according to their specific requirements. These factors fuel the growth of the burial insurance market in the region.

The key players operating in the burial insurance market include Choice Mutual, Colonial Penn, Fidelity Life Association, Foresters Financial, Globe Life and Accident Insurance Company, Mutual of Omaha Insurance Company, Progressive Casualty Insurance Company, Sentinel Security Life Inc., State Farm Mutual Automobile Insurance Company, and The Baltimore Life Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the burial insurance industry.

Country-specific Statistics & Information

The increasing demand for funeral services and the costs associated with them has led to a remarkable global rise in burial insurance. Furthermore, the leading players in the market adopting strategies to strengthen their market positions in the global burial insurance industry, including new technology adoption, product developments, mergers and acquisitions, joint ventures, alliances, and partnerships. For instance, in December 2020, two businesses, Nubank and Chubb, entered into a strategic cooperation to introduce digital insurance products exclusively in Brazil. This digital insurance provides coverage for all forms of funeral costs. The strategic partnership gives thorough coverage of funerals and has marketed the product through digital platforms.

In addition, a press release from the White House states that on April 5, 2022, U.S. President Joe Biden stated that his administration plans to expand the Affordable Care Act (ACA) to improve access to coverage and reduce costs, potentially raising the proportion of Americans who are insured. As a result, more Americans decided to have their health insurance cover funeral costs, raising demand for burial insurance during the forecasted period.

The COVID-19 pandemic has had a positive impact on the burial insurance market size. The pandemic led to a surge in deaths worldwide, creating a higher demand for burial insurance policies. The fear of uncertainty and the need to financially protect close ones drove many individuals to consider purchasing burial insurance.

Furthermore, the pandemic brought attention to the financial risks associated with unexpected deaths. People became more aware of the potential financial burden their families could face in terms of funeral expenses, outstanding debts, and other end-of-life costs. This awareness drove the demand for burial insurance as a means to alleviate these financial concerns. Moreover, many burial insurance providers recognized the unique circumstances brought by the pandemic and introduced specialized coverage options related to COVID-19. These policies aimed to address concerns and provide financial protection for policyholders and their families in case of COVID-19-related deaths. For instance, in June 2022, the Federal Emergency Management Agency (FEMA) offered funeral assistance funding for people to cover funeral costs who died of COVID-19.

Top Impacting Factors

Increase in the Aging Population

The aging population is a significant driver for the burial insurance market. As the population ages, the demand for funeral and burial services increases. Burial insurance provides a way for individuals to plan and cover these expenses in advance, ensuring that their close ones are not burdened with financial obligations after their passing.

In addition, burial insurance companies offer flexible coverage options to meet the diverse needs of individuals. This includes different benefit amounts and policy durations, allowing customers to choose a plan that aligns with their specific requirements. Furthermore, some burial insurance providers establish partnerships to offer benefits such as discounted services, and preferred provider networks, enhancing the overall customer experience. For instance, in April 2021, USAA Life Insurance Company announced a guaranteed issue whole life insurance solution through a strategic partnership with Mutual of Omaha Insurance Company, a leading provider of life insurance solutions. The new product provides USAA members with access to a guaranteed issue whole life insurance solution designed to help cover final expenses, such as burial or funeral expenses.

Customization, Flexibility, and Ease of Access

Burial insurance policies offer a high level of customization and flexibility compared to traditional life insurance policies. They are specifically designed to cover funeral and burial costs, and policyholders can choose the coverage amount and duration according to their specific needs. The ability to tailor the policy to individual requirements has made burial insurance more appealing to consumers, driving the market growth.

Furthermore, burial insurance policies have simplified underwriting processes, making them more accessible to a broader range of individuals. These policies have lower face value coverage and simplified health questionnaires, making them more attainable for people with pre-existing medical conditions or older individuals who may have difficulty obtaining traditional life insurance. Therefore, these factors contributed to the growth of the burial insurance market.

Increase in Awareness and Acceptance

There has been a growing awareness among individuals about the financial burden their families face in the event of their death. As a result, people are more inclined to consider burial insurance as a means to alleviate the financial stress on their close ones. The increasing acceptance of burial insurance has opened up new opportunities for market growth.

In addition, insurance companies and funeral service providers have been actively promoting burial insurance products, creating awareness among consumers about the benefits and importance of planning for funeral expenses. For instance, in January 2023, Choice Mutual Insurance Agency expanded its business in selling final expense insurance policies, which are commonly referred to as burial, mortuary, incineration, and end-of-life insurance.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the burial insurance market analysis from 2022 to 2032 to identify the prevailing burial insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the burial insurance market segmentation assists to determine the prevailing burial insurance market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as burial insurance market trends, key players, market segments, application areas, and market growth strategies.

Burial Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 370.1 billion |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 211 |

| By Type |

|

| By Age of End User |

|

| By Region |

|

| Key Market Players | Sentinel Security Life Inc., Choice Mutual, Colonial Penn, State Farm Mutual Automobile Insurance Company, The Baltimore Life Insurance Company, Foresters Financial, Mutual of Omaha Insurance Company, Fidelity Life Association, Globe Life and Accident Insurance Company, Progressive Casualty Insurance Company |

Analyst Review

Burial insurance, also known as funeral insurance or final expense insurance, is a type of life insurance policy specifically designed to cover the costs associated with a person's funeral, burial, and related expenses. It provides a financial safety net for the family members or beneficiaries left behind to ensure that they are not burdened with the high costs of a funeral. Furthermore, burial insurance policies are generally smaller in coverage compared to traditional life insurance policies. The coverage amount ranges from a few thousand dollars to around $25,000, although it can vary based on the insurance company and the individual's requirements. The payout is made directly to the beneficiary upon the insured person's death and can be used for funeral expenses or other needs as specified in the policy.

In addition, customized coverage options provided by burial insurance providers are significant drivers for the burial insurance market. Burial insurance companies offer flexible coverage options to meet the diverse needs of individuals. This includes different benefit amounts and policy durations, allowing customers to choose a plan that aligns with their specific requirements.

The COVID-19 pandemic led to a surge in deaths worldwide, creating a higher demand for burial insurance policies. The fear of uncertainty and the need to financially protect close ones drove many individuals to consider purchasing burial insurance. Furthermore, the pandemic brought attention to the financial risks associated with unexpected deaths. People became more aware of the potential financial burden their families could face in terms of funeral expenses, outstanding debts, and other end-of-life costs. This awareness drove the demand for burial insurance as a means to alleviate these financial concerns.

The key market players in the burial insurance market are Choice Mutual, Colonial Penn, Fidelity Life Association, Foresters Financial, Globe Life and Accident Insurance Company, Mutual of Omaha Insurance Company, Progressive Casualty Insurance Company, Sentinel Security Life Inc., State Farm Mutual Automobile Insurance Company, and The Baltimore Life Insurance Company. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnerships to reduce the supply and demand gap. With the increase in awareness & demand for burial insurance across the globe, major players are collaborating on their product portfolio to provide differentiated and innovative products.

The burial insurance market size was valued at $142.89 billion in 2022 and is projected to reach $370.11 billion by 2032, growing at a CAGR of 10.3% from 2023 to 2032.

By the end of 2032, the market value of Burial Insurance Market will be $370.11 billion.

Increase in the aging population Rise in funeral costs Customization, flexibility, and ease of access of the policy

The key players operating in the burial insurance market include Choice Mutual, Colonial Penn, Fidelity Life Association, Foresters Financial, Globe Life and Accident Insurance Company, Mutual of Omaha Insurance Company, Progressive Casualty Insurance Company, Sentinel Security Life Inc., State Farm Mutual Automobile Insurance Company, and The Baltimore Life Insurance Company.

The burial insurance market is segmented into type, age of end user, and region. By type, the market is differentiated into simplified issue, guaranteed issue, and pre-need insurance. Depending on the age of end user, it is fragmented into over 50, over 60, over 70, and over 80. Region wise, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...

Loading Research Methodology...