Busbar Trunking Market Research, 2033

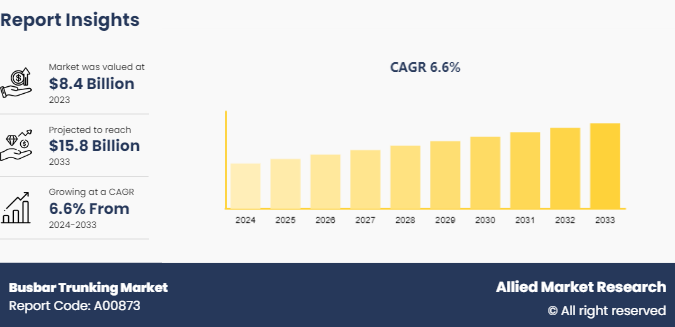

The global busbar trunking market was valued at $8.4 billion in 2023, and is projected to reach $15.8 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Market Introduction and Definition

Busbar trunking systems, also known as busway systems, are an essential component in electrical distribution. A busbar trunking system comprises a set of metal bars enclosed within a protective casing, used to conduct substantial amounts of electrical power efficiently. These systems are typically used to distribute power from a central source to various branches of an electrical distribution network. The metal bars, commonly made of copper or aluminum, provide a robust, reliable, and efficient means of power distribution, minimizing energy loss and enhancing overall system performance.

Busbar trunking systems are designed to handle varying electrical loads, ensuring that power is transmitted with minimal voltage drops and power losses. They are modular, allowing for easy installation, extension, and maintenance. The systems can be customized to meet specific requirements, including current rating, voltage rating, and environmental conditions. Additionally, busbar trunking systems offer high levels of safety and protection, incorporating features such as insulation, segregation, and earthing.

Key Takeaways:

- The busbar trunking industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global busbar trunking market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the busbar trunking market forecast.

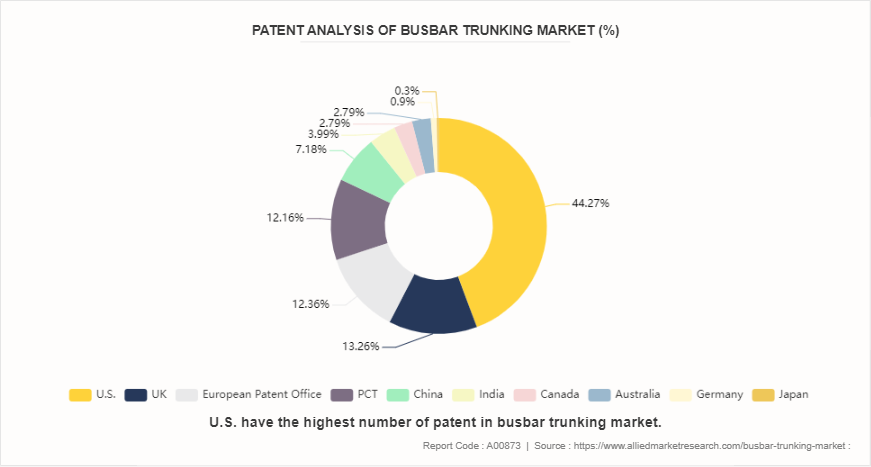

- The busbar trunking market share is highly fragmented, with several players including ABB, Schneider Electric, Siemens, Legrand, Eaton, DTM Elektroteknik, Pogliano BusBar s.r.l., Naxso BBT Srl, DBTS Industries Sdn Bhd, and Starline Holdings, LLC. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the busbar trunking market growth.

Segment Overview

The busbar trunking market is segmented into conductor type, insulation type, end-use industry, and region. On the basis of conductor type, the market is classified into copper, and aluminum. On the basis of insulation type, the market is categorized into air insulated, and sandwich insulated. On the basis of end-use industry, the market is fragmented into industrial, commercial, residential, and other. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

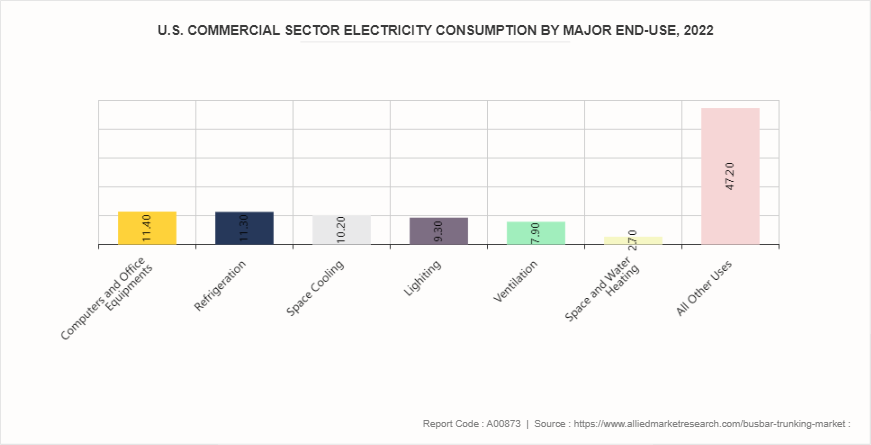

An increase in demand for power distribution in urbanization and industrialization is expected to drive the growth of busbar trunking market during the forecast period. Increasing urbanization and industrialization are leading to higher demand for electricity, necessitating efficient power distribution systems like busbar trunking. Urbanization, characterized by the migration of people from rural areas to cities, results in the expansion of cities and the development of new urban areas. This migration drives the need for extensive electrical infrastructure to support residential, commercial, and industrial activities. As per the U.S. Energy Information Administratio, in 2022, total U.S. electricity end-use consumption increased by approximately 3.2% compared to 2021. Retail electricity sales to the residential sector rose by about 2.6%, while sales to the commercial sector saw a 4.7% increase. The industrial sector experienced a 2.0% rise in retail electricity sales in 2022 compared to 2021, though this was still 4.1% lower than in 2000, the peak year for U.S. retail sales to this sector. In 2000, the industrial sector accounted for about 31.1% of total U.S. electricity retail sales, but this share decreased to 26.0% by 2022.

Busbar trunking systems are gaining popularity due to their numerous advantages over conventional cabling systems. These systems consist of prefabricated electrical distribution systems housed in a protective enclosure, offering a compact, flexible, and efficient solution for power distribution. One of the primary benefits of busbar trunking systems is their reduced installation time. Moreover, busbar trunking systems enhance safety and reliability, making them an ideal choice for modern power distribution needs. Traditional cabling systems are prone to overheating, short circuits, and fire hazards, especially when dealing with high power loads. In contrast, busbar trunking systems are designed to handle high currents efficiently, minimizing the risk of electrical faults and ensuring a safer electrical distribution network.

However, the initial cost of busbar trunking systems is expected to restrain the busbar trunking market trends. The initial costs associated with busbar trunking systems are notably higher than those of traditional wiring systems, presenting a significant barrier to their widespread adoption. This economic hurdle can be particularly prohibitive in cost-sensitive markets, where the upfront investment required for busbar trunking systems may deter potential users despite their long-term benefits. The higher initial costs of busbar trunking systems stem from various factors, including the cost of materials, manufacturing processes, and the complexity of the system itself. Unlike traditional cabling, which primarily consists of copper or aluminum wires encased in insulating materials, busbar trunking systems require more sophisticated components. These include rigid bars made of high-conductivity materials such as copper or aluminum, enclosed in protective casings. The precision engineering and manufacturing required to ensure the reliability and safety of busbar trunking systems add to their cost.

Integration with smart grid technology expected to offer lucrative opportunities in the busbar trunking market during the forecast period. The integration of smart grid technology into the busbar trunking represents a significant advancement in the realm of electrical distribution systems. This integration is not just a technical enhancement; it is a transformative approach that can lead to substantial improvements in the efficiency, reliability, and overall management of power distribution networks. Smart grid technology, however, incorporates advanced sensors and communication technologies that enable continuous monitoring of electrical parameters such as voltage, current, and power quality. This real-time data allows for the early detection of potential problems, such as overloads or faults, thereby preventing power outages and minimizing downtime.

In September 2022, the US Department of Energy (DOE) announced plans to invest USD 10.5 billion to enhance the nation's energy grid with smart grid technologies and other improvements. This funding initiative was organized under the Grid Resilience and Innovation Partnership program, which allocated $2.5 billion for grid resilience, $3 billion for smart grids, and $5 billion for grid innovation. Furthermore, smart grid integration facilitates better control over the power distribution process. Conventional systems usually rely on manual or semi-automatic controls, which can be slow and inefficient. In contrast, smart grids use automated control systems that can quickly adjust the flow of electricity based on real-time data.

Regional Market Outlook

By region, the market is divided into North America, Europe, Asia-Pacific, and LAMEA. In North America, the usage of busbar trunking systems is driven by the increasing demand for reliable and efficient power distribution in commercial, industrial, and residential sectors. The U.S. and Canada are the primary adopters, with significant investments in modernizing electrical infrastructure.

Europe market for busbar trunking systems, with extensive adoption across various industries including manufacturing, automotive, and commercial real estate. Countries such as Germany, France, the United Kingdom, and Italy are key players in this region. The stringent regulatory framework regarding energy efficiency and safety standards, coupled with the focus on reducing carbon footprints, has accelerated the deployment of busbar trunking systems.

The Asia-Pacific region exhibits the fastest growth in the busbar trunking market, fueled by rapid industrialization, urbanization, and infrastructure development. China, India, Japan, and South Korea are at the forefront of this growth. The burgeoning construction sector, along with significant investments in industrial automation and smart city projects, is driving the demand for busbar trunking systems. The region's increasing focus on energy efficiency and the rising adoption of electric vehicles further support the market expansion

Competitive Analysis

Key market players in the busbar trunking market analysis across ABB, Schneider Electric, Siemens, Legrand, Eaton, DTM Elektroteknik, Pogliano BusBar s.r.l., Naxso BBT Srl, DBTS Industries Sdn Bhd, and Starline Holdings, LLC.

Industry Trends

- In September 2021, Vertiv Holdings Company, a global leader in critical digital infrastructure and continuity solutions, announced its acquisition of E&I Engineering Ireland and its UAE-based affiliate, Powerbar Gulf. The acquisition, focused on enhancing Vertiv's position in the busbar trunking systems market in the GCC, was valued at $1.8 billion in upfront consideration, with an additional potential of up to $200 million in cash.

- In April 2021, Tai Sin introduced its Busbar Trunking System (also referred to as Busway or Busduct) and established Singapore's first and only Busbar Test Lab. Busbars have quickly gained popularity as a revolutionary solution for power distribution, thanks to their flexibility and ease of setup and maintenance. Currently, busbar trunking systems are utilized in over 50% of power distribution for data centers, government, industrial, and healthcare projects.

- According to the International Energy Agency (IEA) , India ranks as the third largest energy consumer in the world. This is driven by rising income levels and improving living standards, significantly boosting the power market where busbar systems are gaining popularity to reduce the risk of electrical fires by minimizing the chances of loose connections and overheating.

Historic Trends of Busbar Trunking Market Report

- In the 1920s the concept of busbar systems emerged alongside the rapid development of electrical distribution networks. As industries expanded and electrification became more widespread, there was a growing need for efficient methods to distribute electrical power within factories and industrial facilities.

- In the 1980s, busbar trunking systems experienced widespread adoption and significant advancements. The demand for efficient power distribution solutions increased, leading to the widespread adoption of busbar trunking systems across different sectors. This included industrial facilities, commercial buildings, residential complexes, and public infrastructure.

- In the 1990s rapid technological advancements in electrical engineering led to the development of more sophisticated busbar trunking systems. These included innovations such as compact designs, better thermal management, and the introduction of intelligent monitoring and control systems.

- In the 2010s busbar trunking systems have continued to evolve with a focus on energy efficiency, sustainability, and integration with smart building technologies. Manufacturers have introduced features such as integrated communication systems, advanced monitoring for predictive maintenance, and compatibility with renewable energy sources.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the busbar trunking market analysis from 2024 to 2033 to identify the prevailing busbar trunking market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the busbar trunking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global busbar trunking market trends, key players, market segments, application areas, and market growth strategies.

Busbar Trunking Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 15.8 Billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Conductor Type |

|

| By Insulation Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Naxso BBT Srl, Legrand, ABB, Pogliano BusBar s.r.l., Siemens, DBTS Industries Sdn Bhd, Starline Holdings, LLC, DTM Elektroteknik, Schneider Electric, Eaton |

The integration of smart grid technology are the upcoming trends of busbar trunking market.

Aluminum is the leading application of busbar trunking market

Asia-Pacific is the largest market for busbar trunking.

Key market players in the busbar trunking market include ABB, Schneider Electric, Siemens, Legrand, Eaton, DTM Elektroteknik, Pogliano BusBar s.r.l., Naxso BBT Srl, DBTS Industries Sdn Bhd, and Starline Holdings, LLC.

The global busbar trunking market was valued at $8.4 billion in 2023, and is projected to reach $15.8 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

Loading Table Of Content...