Business Income Insurance Market Research, 2031

The global business income insurance market was valued at $14.93 billion in 2021, and is projected to reach $33.54 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

Financial loss an organization experiences when its activities are interfered is referred to as business income coverage risk. This loss consists of both visible components such as decreased sales and increased labor costs, and invisible components such as loss of possible future income streams, owing to reputational risk. Insurance for business revenue and insurance for commercial property are complementary. For instance, if a wind event significantly destroys roof of business, it is forced to be closes for over a month. A business property insurance coverage pays for the roof repair. An insurance policy for company income could provide coverage for income lost during a shutdown.

Availability of several business income insurance providers and rise in need for insurance policies among businesses to protect them against various situations are the main drivers of the business income insurance market growth. The business income insurance market, however, is constrained in its expansion by expensive insurance premiums for business income coverage and lack of knowledge among small enterprises about the sector. On the other hand, it is anticipated that in the years to come, the market will see tremendous growth, wing to spike usage of telematics devices in retail, construction, and healthcare sectors as well as adoption of advance technologies in commercial insurance.

The report focuses on growth prospects, restraints, and trends of the business income insurance market analysis. The study provides Porter's five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the business income insurance market outlook.

The business income insurance market is segmented into Type, Coverage, Loss Type, Distribution Channel and Industry Vertical.

Segment review

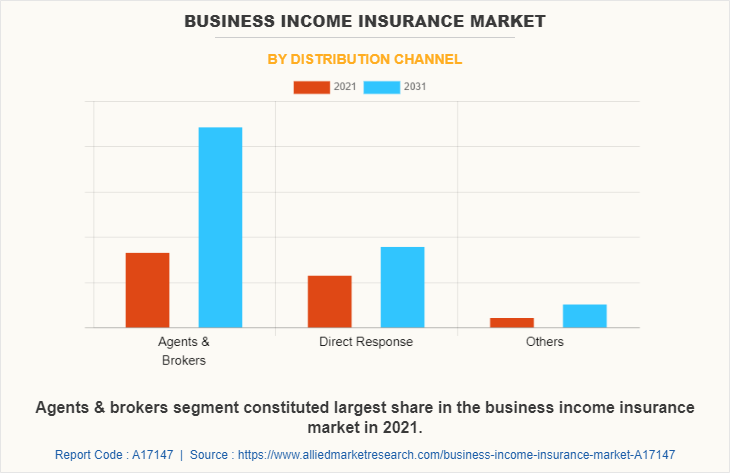

The business income insurance market is segmented into type, coverage, loss type, distribution channel, industry vertical, and region. By type, the market is differentiated into standard business income insurance and extended business income insurance. Depending on coverage, it is fragmented into profits/lost revenue, taxes & loan payments, mortgage, rent & lease payments, employee wages & payroll, relocation costs, and others. The loss type covered in the study includes fire, theft, wind, lightning, and others. The distribution channel segment is segregated into agents & brokers, direct response, and others. By industry vertical, it is segmented into manufacturing, retail, construction, IT & telecom, healthcare, energy & utilities, transportation & logistics, and others. The manufacturing segment is further segregated into automotive, consumer electronics, foods & beverages, and others. The foods & beverages segment is further segmented into large enterprises and small & medium sized enterprises. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By distribution channel, the agents & brokers segment acquired a major share in the business income insurance market in 2021. This is attributed to the fact that purchasers prefer agents & brokers to acquire business income insurance as consumers have little understanding of appropriate plans to buy for their industry.

Region wise, North America dominated the business income insurance market in 2021. It is attributed to the fact that collaboration between traditional insurance companies and InsurTech firms has led to rise in newer models and revenue streams, higher profitability, and reduced operational costs in the North America.

Key players operating in the global business income insurance market include American International Group, Inc., Allianz, Allstate Insurance Company, AmTrust Financial, ASSURANT, INC., AXA, Chubb, Employers Mutual Casualty Company, Farmers, Liberty Mutual Insurance Company, Munich RE, Nationwide Mutual Insurance Company, Next Insurance, Inc., State Farm Mutual Automobile Insurance Company, Swiss Re, The Hartford, The Travelers Indemnity Company, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the business income insurance industry.

COVID-19 Impact Analysis

The COVID-19 outbreak had a negative effect on the market for business income insurance. Business risks are covered by business income insurance plans in all industrial sectors, including manufacturing, communications, logistics, transportation, and oil & gas. Moreover, owing to business interruptions experienced by a number of worldwide industries as a result of the pandemic, business income insurance has suffered. The perception of insurance among consumers has significantly changed as a result of the COVID-19. To protect themselves from danger and cover business losses during the pandemic, company owners opt to get business income insurance plans.

Top Impacting Factors

Increase in need for insurance policies among enterprises

The business is subject to a number of dangers as there are many dangers involved in running a business, however, insurance helps to reduce the responsibilities. Business income insurance can help the firm carry on operations in the case of a tragedy. The danger of a major loss or closure affects both the company and the insurance provider. A business can reduce the risk of doing business by purchasing commercial credit risk insurance, which guards against customer bankruptcy. Moreover, the firm can pay for litigation and claims without experiencing a substantial financial loss owing to the commercial liability insurance coverage which is included in business income insurance. Furthermore, due to the remote working option provided by IT businesses, hackers are also attempting to take advantage of the COVID-19 scenario by compromising accounts, stealing data, and stealing money. For instance, a poll done in June 2020 by nextcaller.com found that the corona virus pandemic has led to a 50% rise in fraud calls to business owners. The market for business income insurance and cyber insurance is expanding as a result of the rise in the number of such incidents among business owners.

Adoption of business income insurance in managing business liabilities

It is never certain that a company will continue to turn a profit each year. The company could at some time experience an unexpected loss. In such situation, insurance can offer financial assistance to reduce the risk. There can be an event that results in catastrophic loss. Such events can be avoided if the company has current business income insurance. A significant financial loss, though, can be hazardous if the company's insurance isn't in place. Moreover, insurance assists in recovering the majority of a business's financial losses in the event of a significant loss. In addition, it also keeps the company from being under financial strain. The business income insurance lowers the risk of financial loss in the event of a crisis by allowing the company to continue functioning without interruption. Additionally, it safeguards against robbery or unnatural money loss while in transit. Thus, the adoption of business income insurance in managing business liabilities in driving the growth of the market.

Availability of large number of insurance providers

Over the years, there has been a noticeable rise in the number of business income insurance coverage carriers, mostly as a result of a development in the number of enterprises and the variety of company coverage. Due to the abundance of insurance carriers, there is fierce rivalry among different companies that offer a variety of coverage for companies of all sizes. Additionally, the presence of several business insurance carriers has helped the market environment because a wide range of insurance products are now accessible for all sizes and types of businesses. Furthermore, business owners are increasingly adopting business income insurance coverage based on the premium charged for the policies, as the premium remains constant throughout the market. This is expected to boost growth of the business insurance market share.

KEY BENEFITS FOR STAKEHOLDERS

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the business income insurance market size and forecast from 2021 to 2031 to identify prevailing business income insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the business income insurance market trends assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the business income insurance market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global business income insurance market share, trends, key players, market segments, application areas, and market growth strategies.

Business Income Insurance Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Coverage |

|

| By Loss Type |

|

| By Distribution Channel |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | AmTrust Financial, American International Group, Inc., The Hartford, Nationwide Mutual Insurance Company, AXA, The Travelers Indemnity Company, Farmers, Allianz, Employers Mutual Casualty Company, ASSURANT, INC., Liberty Mutual Insurance Company, Chubb, Allstate Insurance Company, Next Insurance, Inc., State Farm Mutual Automobile Insurance Company, Munich RE, Zurich, Swiss Re |

Analyst Review

Predictive analysis, artificial intelligence, and other advance technologies are being quickly adopted by the business income insurance industry to assure improved claim management and adequate risk mitigation. In addition, commercial insurance carriers now have a greater understanding and ability to forecast behavior of business owners, owing to the use of artificial intelligence and predictive analysis. This has caused significant patterns to emerge in the industry.

The market expansion for business income insurance, however, has been significantly hampered by the propagation of COVID-19 virus. This has led to increase in geopolitical risk, a shift in consumer preference for local insurers, and closure of several business verticals internationally. The COVID-19 outbreak had a significant impact on the business income insurance market as businesses among all verticals were disrupted across the globe. However, during this global health crisis, there was an increase in demand for business income insurance, owing to rise in awareness among businesses. This, as a result promoted demand for business income insurance, thereby leading to rise in opportunities to grow in upcoming years.

The business income insurance market is fragmented with the presence of regional vendors such as American International Group, Inc., Allianz, Allstate Insurance Company, AmTrust Financial, ASSURANT, INC., AXA, Chubb, Employers Mutual Casualty Company, Farmers, Liberty Mutual Insurance Company, Munich RE, Nationwide Mutual Insurance Company, Next Insurance, Inc., State Farm Mutual Automobile Insurance Company, Swiss Re, The Hartford, The Travelers Indemnity Company, and Zurich. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for business income insurance across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The Business Income Insurance Market is estimated to grow at a CAGR of 8.8% from 2022 to 2031.

The Business Income Insurance Market is projected to reach $33.5 billion by 2031.

Rise in adoption of business income insurance to prevent uncertain disasters promotes growth of the business income insurance market. In addition, rise in awareness among businesses about business income insurance since the pandemic drives the market growth.

The key players operating in the Business income insurance market analysis include American International Group, Inc., Allianz, Allstate Insurance Company, AmTrust Financial, ASSURANT, INC., AXA, Chubb, Employers Mutual Casualty Company, Farmers, Liberty Mutual Insurance Company, Munich RE, Nationwide Mutual Insurance Company, Next Insurance, Inc., State Farm Mutual Automobile Insurance Company, Swiss Re, The Hartford, The Travelers Indemnity Company, and Zurich.

The key growth strategies of Business Income Insurance Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...