Business Travel Accident Insurance Market Research, 2033

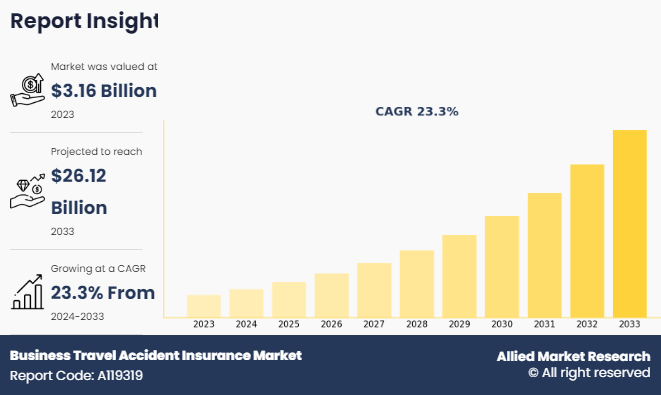

The global business travel accident insurance market size was valued at $3.2 billion in 2023, and is projected to reach $26.1 billion by 2033, growing at a CAGR of 23.3% from 2024 to 2033. Business travel accident (BTA) insurance provides insurance coverage for a company's employees while they are traveling on business. This type of accident insurance pays a benefit to an employee or their beneficiaries if the employee is seriously injured or killed while traveling for the company. BTA policies are carried out by companies that have key employees who frequently travel to meet clients, between different sites within the company, and/or on offshore assignments. The premiums are paid by the employer; however, benefits are paid directly to employees or their beneficiaries.

Increase in global business travel is fueling the growth of the business travel accident insurance market. As more companies expand their operations internationally, employees often find themselves traveling frequently for business meetings, conferences, and collaborations. With this rise in travel, there is rise in awareness among businesses about the potential risks employees face, such as accidents or unforeseen health issues while on these trips, which drives the adoption of business travel accident insurance policies. Furthermore, rise in awareness of travel risks is a significant driver for the business travel accident insurance market growth. In addition, in the current dynamic business landscape, companies recognize that their success is linked to the health and satisfaction of their workforce. As a result, there is a growing corporate commitment to providing comprehensive support for employees.

This emphasis on employee well-being extends to ensuring their safety and security during travel, prompting businesses to invest in business travel accident insurance. Thus, the growth of the business travel accident insurance market is propelled by increasing emphasis that corporations place on the well-being of their employees.

However, high cost associated with business travel accident insurance policies acts as a significant barrier for businesses looking to invest in BTA. On the contrary, advancements in technology transform the business travel accident insurance market, offering lucrative growth opportunities in the upcoming years. With rise of sophisticated data analytics and artificial intelligence, insurers better assess and mitigate risks associated with business travel. This allows for more personalized and competitive insurance packages tailored to individual travel patterns and specific needs, enhancing the overall appeal of these insurance offerings. ‐ƒ

Key Findings:

By type, the multi-trip travel insurance segment accounted for the largest Linux software market share in 2023.

By application, the domestic segment accounted for the largest Linux software market share in 2023.

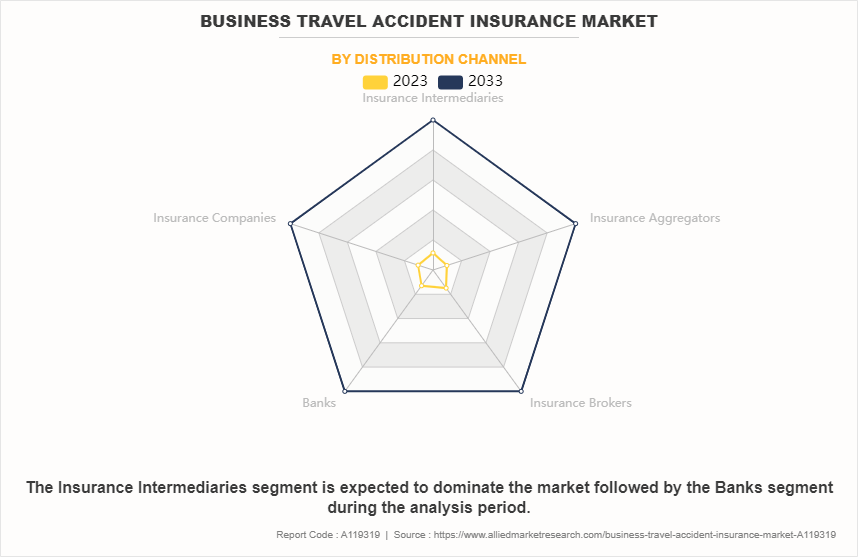

By distribution channel, the insurance intermediaries segment accounted for the largest Linux software market share in 2023.

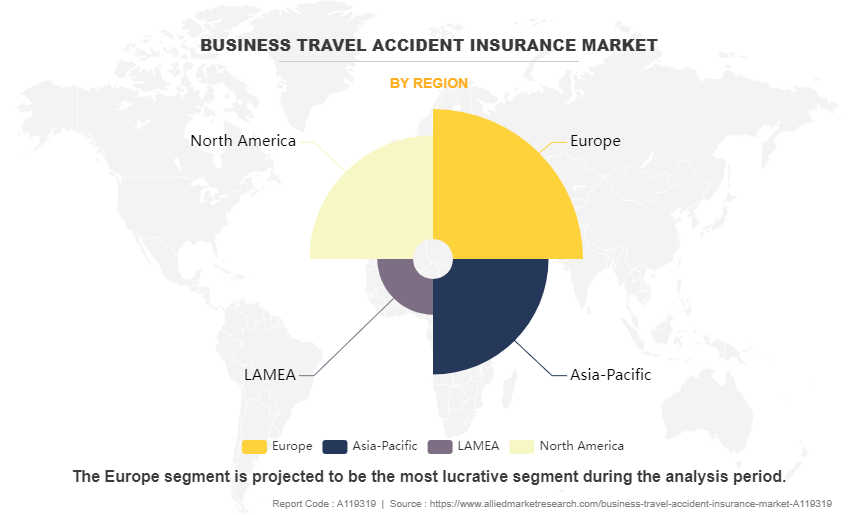

Region wise, Europe generated the highest revenue in 2023.

Segment Review

The business travel accident insurance market size is segmented into type, application, distribution channel, and region. On the basis of type, the market is classified into single-trip travel insurance and multi-trip travel insurance. By application, the market is divided into domestic and international. On the basis of distribution channel, the market is categorized into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of distribution channel, the business travel accident insurance industry is divided into domestic and international. In 2023, the domestic segment dominated the market in terms of revenue, this is attributed to increasing trend of professionals traveling within their own country for work, which has created a higher demand for insurance coverage tailored to domestic business trips. However, the international segment is expected to be the fastest-growing segment during the forecast period, owing to rise in globalization of businesses. As more companies expand their operations globally, employees frequently travel internationally for work on international trips for work. The complexity and unique challenges of travel abroad, including diverse healthcare systems and potential unforeseen events, emphasize the need for specialized insurance coverage.

By region, Europe dominated the market share in 2023 for the business travel accident insurance market, owing to increase in globalization of businesses, which has led to rise in corporate travel, emphasizing the need for comprehensive insurance coverage. Furthermore, increase in awareness of potential risks and the emphasis on corporate responsibility drives the growth of the market in Europe. However, Asia-Pacific is expected to be the fastest-growing region during the business travel accident insurance market forecast period owing to the rapid economic development in the region and rise in awareness of travel-related risks.

Competition Analysis:

Competitive analysis and profiles of the major players in the global business travel accident insurance market share include AXA SA, Metlife Services And Solutions, LLC., Arch Capital Group Ltd., Zurich American Insurance Company, Chubb Limited, The Hartford, American International Group, Inc., Starr International Company, Inc., Visitorscoverage Inc., Tata AIG General Insurance Company Limited. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the Business travel accident insurance market trends globally.

Recent Developments in Business Travel Accident Insurance Industry

In July 2024, Oriental Insurance, a subsidiary of OFG Bancorp, launched new personal accident insurance product in collaboration with Chubb Insurance Co. of Puerto Rico. This new product aims to provide customers with digital tools that streamline the process of quoting and purchasing insurance. By integrating these tools, Oriental Insurance seeks to make the insurance process more accessible and convenient for its users. The new personal accident insurance product, available online via Chubb Studio, offers coverage of up to $75,000 in the event of accidental death.

Top Impacting Factors

Rise in global business travel

Increase in global business travel is fueling the growth of the business travel accident insurance market analysis. As more companies expand their operations internationally, employees often find themselves traveling frequently for business meetings, conferences, and collaborations. With rise in travel for businesses, there is rise in awareness among businesses about the potential risks that employees face, such as accidents or unforeseen health issues while on these trips.

Furthermore, the globalization nature of business ventures exposes employees to different environments, health systems, and potential hazards. To mitigate these risks, companies increasingly recognize the importance of providing business travel accident insurance to their employees. BTA insurance offers financial protection in case of accidents as well as contributes to the overall well-being and security of employees, fostering a sense of confidence and loyalty within the workforce. Therefore, surge in global business activities is increasing the demand for business travel accident insurance as a responsible risk management strategy for both employers and employees.

For instance, in July 2022, Chubb partnered with Royal Brunei Airlines (RB) to offer travel insurance to the airline's passengers. The partnership was launched in Brunei with more countries and territories to follow in subsequent phases. Chubb's travel insurance offers extensive coverage for accidents, unexpected overseas medical expenses (including COVID-19 medical cover), and travel inconvenience (including loss of luggage, travel documents and trip cancellation). In addition, passengers have access to medical and travel services provided by Chubb Assistance's 24-hour hotline, if they require help or advice during their trip.

Rise in awareness of travel risks

Rise in awareness of travel risks drives the growth of the business travel accident insurance market outlook. As more people go on business trips globally, there is increased recognition of the potential dangers and uncertainties associated with travel, ranging from accidents and injuries to unexpected health issues. This growing awareness has prompted businesses to prioritize the well-being and safety of their employees.

Furthermore, companies now understand the importance of providing comprehensive protection to their traveling workforce. Business travel accident insurance addresses these concerns by offering financial coverage for medical expenses, emergency assistance, and other unforeseen circumstances. This proactive approach to mitigating travel-related risks safeguards employees as well as aligns with the evolving expectations of corporate responsibility. Therefore, rise in awareness of travel risks is a significant growth factor driving businesses to invest in business travel accident insurance as an integral part of their duty to ensure the welfare of their employees during work-related trips.

Corporate emphasis on employee well-being

Growth of the business travel accident insurance market opportunity is propelled by increasing emphasis that corporations place on the well-being of their employees. In the current dynamic business landscape, companies recognize that their success is closely related to the health and satisfaction of their workforce. As a result, there is surge in corporate commitment to provide comprehensive support for employees, even when they are away on business trips. This emphasis on employee well-being extends to ensuring their safety and security during travel, prompting businesses to invest in business travel accident insurance. This corporate emphasis on employee well-being acts as a key driver propelling the growth of the business travel accident insurance market.

Business Travel Accident Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 26.1 billion |

| Growth Rate | CAGR of 23.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Chubb Limited, MetLife Services and Solutions, LLC., The Hartford, VisitorsCoverage Inc., Tata AIG General Insurance Company Limited, Starr International Company, Inc., Zurich American Insurance Company, AXA SA, Arch Capital Group Ltd., American International Group, Inc. |

Analyst Review

Business travel accident insurance provides financial protection to individuals traveling for business purposes against unforeseen events such as accidents, injuries, illnesses, or death.. Depending on the insurance plan, coverage includes emergency medical services, trip interruption, terrorism coverage, baggage loss, emergency medical evacuation, and others. Furthermore, the company purchases a business travel accident (BTA) insurance plan for all business traveler employees and pays all the premiums. As per the policy guidelines, each employee is insured for a maximum amount of coverage, called the principal sum. The insurance provider calculates the principal sum according to employees’ designation and annual compensation.

Key players in the business travel accident insurance market have adopted partnership, acquisition, and product launch as their key development strategies to sustain their growth in the market. For instance, in September 2023, Everest Insurance, the insurance division of Everest Group, Ltd., a global underwriting leader providing best-in-class property, casualty, and specialty reinsurance and insurance solutions, launched Everest Business Travel Accident Insurance to its accident and health portfolio. The customizable solution combines insurance protection with travel, medical, and security assistance services for corporate and not-for-profit employers, employees, and accompanying guests during domestic and international travel.

For instance, in July 2024, Oriental Insurance, a subsidiary of OFG Bancorp, launched new personal accident insurance product in collaboration with Chubb Insurance Co. of Puerto Rico. This new product aims to provide customers with digital tools that streamline the process of quoting and purchasing insurance. By integrating these tools, Oriental Insurance seeks to make the insurance process more accessible and convenient for its users. The new personal accident insurance product, available online via Chubb Studio, offers coverage of up to $75,000 in the event of accidental death. Therefore, such strategies adopted by key players propel the growth of the business travel accident insurance market.

The business travel accident insurance market is evolving rapidly, driven by changes in corporate travel dynamics, technological advancements, and shifting global priorities.

The domestic segment is the leading application of the Business Travel Accident Insurance Market.

Europe was the largest regional market for Business Travel Accident Insurance in 2023.

$26.1 billion is the estimated industry size of Business Travel Accident Insurance in 2033.

AXA SA, Metlife Services And Solutions, LLC., Arch Capital Group Ltd., Zurich American Insurance Company, Chubb Limited, The Hartford, American International Group, Inc., Starr International Company, Inc., Visitorscoverage Inc., Tata AIG General Insurance Company Limited. are the top companies to hold the market share in Business Travel Accident Insurance.

Loading Table Of Content...

Loading Research Methodology...