Business Travel Insurance Market Outlook – 2030

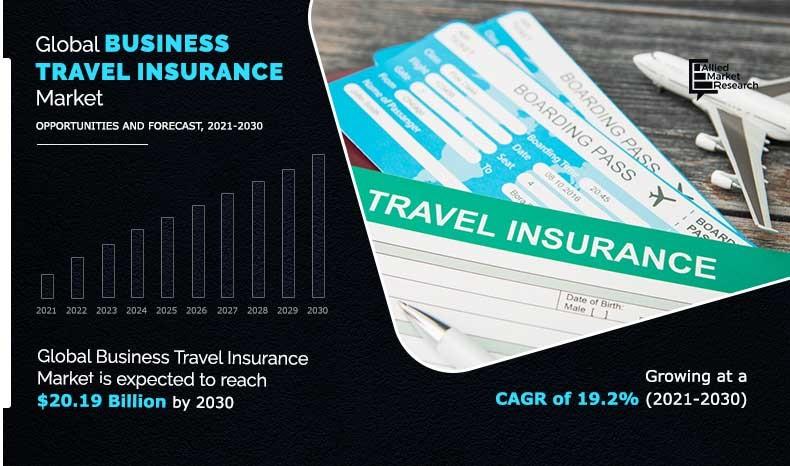

The global business travel insurance market size was valued at $3.61 billion in 2020, and is projected to reach $20.19 billion by 2030, growing at a CAGR of 19.2% from 2021 to 2030. The business travel insurance provides security and safety during unexpected emergency medical evacuation for employees during travelling. Furthermore, business travel insurance covers companies against financial uncertainties that arise from unfortunate instances such as injuries, accidents, loss of baggage, terrorist attacks, and flight cancellation.

Moreover, increase has been witnessed in demand for travel insurance from business, as it provides immediate coverage for personal belongings & business equipment and delivers coverage against damage caused by the insured to a third person, which drives the growth of the business travel insurance market across the globe. Furthermore, customized coverages are covered under business insurance policy, and are available at an extra premium cost depending on customer needs and demands, which fosters the growth of business travel insurance market across the globe.

In addition, rapid increase in national and international travel of businesses fosters the growth of business travel insurance market. Moreover, the key factors driving the growth of the global business travel insurance market trends include increase in use of digital distribution channel among the insurance providers to boost the business sales and implementation of government regulations during the cross-border travelling.

However, lack of awareness among business owners toward travel insurance policy hampers the growth of business travel insurance market. On the contrary, increase in spending of business on different types of insurance and adoption of digital tools, such as artificial intelligence (AI), application program interface (API), global positioning system (GPS), and data analytics for delivering affordable insurance policy are expected to provide lucrative opportunity for the expansion of the global business travel insurance market.

b, the multi-trip travel insurance segment is contributing largest market share in 2020 and is expected to witness significant growth rate during the forecast period, owing to increase in prevalence of unforeseen diseases such as injuries, illness, or death of employees during the travelling. In addition business travelers tends to travel multiple time in year, thus to reduce the cost of various damages and to increase the safety of the products enterprises are adopting multi-trip travel insurance coverage plans which is driving the growth of the market.

Region wise, the business travel insurance market was dominated by Europe in 2020. This is attributed to the fact that most of the businesses across the UK, Germany, and France have adopted business travel insurance during the COVID-19 outbreak which enhances the growth of the market. However, Asia-Pacific is expected to witness significant growth rate during the forecast period, owing to availability of large number of travel insurance providers such as Chubb, TATA AIG, and Bajaj Allianz across Asian countries.

The report focuses on the growth prospects, restraints, and trends of global business travel insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on global business travel insurance industry.

By Coverage Type

Multi-Trip Travel Insurance segment is projected to be the most lucrative segment

Segment Overview

The global business travel insurance market is segmented into coverage type, distribution channels, application and region. By coverage type, the market is segregated into single-trip travel insurance and multi-trip travel insurance. On the basis of distribution channels, it is categorized into insurance intermediaries, insurance companies, banks, insurance brokers and insurance aggregators. As per the application, the market is bifurcated into domestic and international. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Distribution Channels

Insurance Intermediaries segment will maintain the lead during 2021 - 2030

Competitive Analysis

The key players operating in the global business travel insurance market industry include Allianz, American International Group Inc., Assicurazioni Generali S.P.A., AXA, Chubb, Nationwide, Seven Corners Inc., TravelSafe, USI Insurance Services LLC, and Zurich. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the industry.

By Application

Domestic segment will dominate the market throughout the forecast period

COVID-19 Impact Analysis

The emergence of COVID-19 is expected to have a negative impact on the growth of the business travel insurance market. The business travel insurance has significantly decline during the COVID-19 pandemic. This is attributed to the lockdown implemented across various countries and ban on national and international travel. In addition, as the movement of people across borders has come to a standstill due to countries which have closed their borders for visitors, the traveler preferences for domestic destinations have increased tremendously in the market. Moreover, rise in number of flights cancellations has resulted in a greater number of insurance claims, which has been negatively impacting the growth of the market after COVID-19 outbreak.

By Region

Asia-Pacific region would exhibit the highest CAGR of 21.2% during 2021 - 2030

Top Impacting Factors

Rise in National and International Business Travel

Rapid increase in national and international travelling for business to purchase raw materials from suppliers is accelerating the business travel insurance market growth across the globe. With rise in business tourism, the incidence such as cancelled flights, accidents, health issues, theft or loss of baggage, natural calamities, and other such occurrences of uncertainties has been increasing during travelling. This fosters the demand for business travel insurance, thereby contributing toward the growth of the global market.

Moreover, rapid digitalization in the corporate and tourism sectors and surge in penetration of Internet of Things (IoT) various business have boosted international travelling of business, which notably contributed toward the growth of the market, globally. Furthermore, increase frequency of international travelling of medium-sized business for meeting new clients, expanding their business, and learning new business trends has positively impacting the growth of the business travel insurance market.

Increase in Use of Digital Distribution Channel Among the Insurance Providers

With increase in penetration of internet, end users across the globe have shifted toward the use of digital channels for purchasing of insurance policies such as travel insurance, worker compensation insurance, and employee’s health insurance promotes the growth of the market. Increase in use of several online portals such as direct airline sites and online travel agencies (OTAs) and company websites & applications further fosters the growth of the online insurance market.

In addition, digital insurance distribution channels have been providing several benefits to corporate owners, such as employees can immediately receive health treatment bill payment and can buy travel insurance coverages from top-rated providers. For instance, according to survey conducted by the TravelInsurance.com in 2019, digital channel offers several ways to compare from multiple travel insurance companies to purchase affordable insurance policy, which fuels the growth of market.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of global business travel insurance market forecast along with the current trends and future estimations to elucidate the imminent investment pockets.

- Information about key drivers, restraints, and opportunities and their impact analysis on global business travel insurance market share is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2021 to 2030 is provided to determine the market potential.

Business Travel Insurance Market Report Highlights

| Aspects | Details |

| By COVERAGE TYPE |

|

| By DISTRIBUTION CHANNELS |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | USI INSURANCE SERVICES LLC, AXA, SEVEN CORNERS, INC, AMERICAN INTERNATIONAL GROUP INC, CHUBB, NATIONWIDE, ASSICURAZIONI GENERALI SPA, ZURICH, TRAVELSAFE, ALLIANZ GROUP |

Analyst Review

The adoption of business travel insurance has increased over time, due to rapid increase in national and international travelling for businesses. Moreover, the key factors driving the growth of the global business travel insurance market trends include increase in use of digital distribution channel among insurance providers to boost the business sales and strengthened government regulations toward cross-border travelling. In addition, business travel insurance providers are looking forward to expand their insurance policies to provide modified coverages for their consumers, which accelerates the growth of market during the upcoming years.

Most of the intermediators across the UK, Germany, France and other countries of Europe have been offering business travel insurance to their customers, which is expected to provide lucrative opportunities for the market growth. Moreover, emerging countries in Asia-Pacific and North America are projected to offer significant growth opportunities during the forecast period.

The global players such as Assicurazioni Generali S.P.A., Axa, Chubb and Nationwide are focusing toward product development and increasing their geographical presence, owing to intense competition among local vendors and rise in need to increase the market share of these companies. In addition, these players are adopting various business strategies such as product launch, product development, and partnership to strengthen their foothold in the market.

For instance, in March 2021, Allianz, one of the leading insurance providers across the globe, developed their existing business travel insurance product by allowing specific medical and cancellation claims options. In addition, it will accommodate claims for trip cancellation and emergency medical care for customers having positive coronavirus cases as well as cancellation claims for customers traveling to South Korea, China, Lombardy, and Veneto regions of Italy.

Furthermore, several business travel insurance providers across the globe have announced partnership with travelling agencies to offer affordable insurance services. For instance, February 2019, American International Group, Inc. partnered with Finnair, which is one of the largest airlines services providers, together launched an insurance site at finnair.com selling AIG’s insurance products. In addition, the site aims at providing multiple products for business travelers and to increase security & protection during the trip. This is considered as an important factor contributing toward the growth of market across the globe.

The Business Travel Insurance Market is estimated to grow at a CAGR of 19.2% from 2021 to 2030.

The Business Travel Insurance Market is projected to reach $20.19 billion by 2030.

To get the latest version of sample report

Increase in use of digital distribution channel among insurance providers and strengthened government regulations etc. boost the Business Travel Insurance market growth.

The key players profiled in the report include Allianz, American International Group Inc., Assicurazioni Generali S.P.A., AXA, and many more.

On the basis of top growing big corporations, we select top 10 players.

The Business Travel Insurance Market is segmented on the basis of coverage type, distribution channels, application and region.

The key growth strategies of Business Travel Insurance market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Insurance Aggregators segment would grow at a highest CAGR of 25.0% during the forecast period.

Asia-Pacific region will dominate the market by the end of 2030.

Loading Table Of Content...