Butyl Adhesives Market Research, 2032

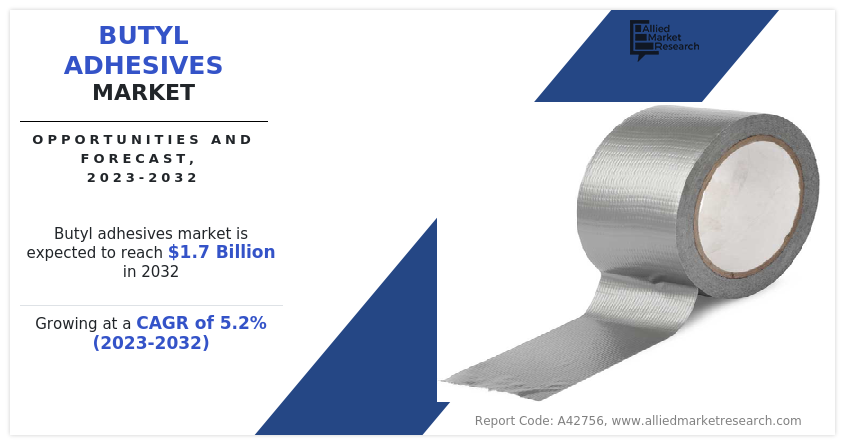

The global butyl adhesives market was valued at $1.0 billion in 2022 and is projected to reach $1.7 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. The escalating demand for the construction industry and the exponential growth in the renewable energy sector stand as a pivotal driver propelling the demand for butyl adhesives in the global market.

Butyl adhesives are adhesive compounds primarily composed of butyl rubber and is known for their exceptional sealing and adhesive properties. They are derived from isobutylene and isoprene and offer excellent flexibility, durability, and resistance to moisture, heat, and chemicals. Butyl adhesives form strong bonds with various substrates, including metals, plastics, glass, and rubber, making them ideal for sealing joints, seams, and gaps in construction, automotive, and manufacturing applications. They exhibit low permeability to gases and liquids, providing reliable air and water tightness. They are easy to apply without primer or surface treatment, butyl adhesives are valued for their versatility and reliability in bonding and sealing.

Key Takeways:

- Quantitative information mentioned in the global butyl adhesives market includes the market numbers in terms of value ($Million) concerning different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided on the basis of product type, end-use industry, and region. The study is expected to contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s Five Force Analysis, key regulations across the region, and value chain analysis.

- A few companies, including Henkel Corporation., H.B. Fuller Company., Bostik, 3M, General Sealants, RENOLIT SE, L'ISOLANTE K-FLEX S.p.A., and Sika hold a large proportion of the butyl adhesives market.

- This report makes it easier for existing market players and new entrants to the butyl adhesives industry to plan their strategies and understand the dynamics of the industry, which helps them make better decisions.

Market Dynamics

The escalating growth in the construction industry is a significant driver propelling demand for the butyl adhesives market growth. Butyl adhesives, known for their excellent sealing and bonding properties, play a crucial role in various construction applications. A significant application area for butyl adhesives lies in the fitting of windows and doors, where they create robust and long-lasting seals, improving both energy efficiency and resistance to adverse weather conditions. In addition, butyl adhesives are widely used in roofing applications, where they ensure watertight seals between different roofing materials, contributing to the longevity and structural integrity of buildings.

Moreover, butyl adhesives find extensive use in the construction of curtain walls and cladding systems, where they help bond glass, metal, and composite panels securely, providing both structural support and weather resistance. The growing demand for infrastructure development, residential housing, and commercial projects globally further boosts the need for butyl adhesives in the construction sector. In addition, stringent building codes and regulations emphasizing energy efficiency and environmental sustainability drive the adoption of high-performance adhesive solutions like butyl adhesives.

The construction sector has grown quickly as a result of major developments in infrastructure projects, a focus on affordable housing, and the application of modular building technology. The Department for Promotion of Industry and Internal Trade (DPIIT) reports that foreign direct investment (FDI) in India's development and construction activity sectors reached $26.17 billion and $26.30 billion, respectively, between April 2000 and December 2021. In 2021, infrastructure operations accounted for $81.72 billion, or 13% of all FDI inflows.

With ongoing urbanization and infrastructure expansion projects across emerging economies, the construction industry's growth trajectory is expected to sustain, consequently fueling the demand for butyl adhesives in the coming years.

The renewable energy sector is projected to significantly impact the demand for butyl adhesives market share in the coming years. The International Energy Agency (IEA) predicts that by 2025, renewable capacity will contribute to 35% of global power generation. In addition, electricity demand is expected to grow by 3% annually over the next three years compared to 2022, with a significant portion of global consumption in China.

The primary application lies within the assembly and installation of photovoltaic (PV) modules used in solar energy systems. Butyl adhesives serve a crucial role in bonding the various components of solar panels, such as glass, metal frames, and junction boxes. Their excellent adhesion properties ensure the structural integrity and longevity of solar modules, essential for withstanding outdoor exposure and environmental stresses.

As the global shift towards renewable energy sources accelerates to mitigate climate change and reduce dependence on fossil fuels, the demand for solar power generation systems continues to rise. This increasing deployment of solar installations, both at utility-scale and distributed levels, directly drives the demand for butyl adhesives. According to Invest India, India witnessed the highest year-on-year growth in renewable energy additions, with a remarkable 9.83% increase in 2022. The installed solar energy capacity has surged by 30 times in the last 9 years, and currently, it is at 72.31 GW as of November 2023.

Furthermore, technological advancements in solar panel design and manufacturing processes are likely to further bolster the demand for specialized butyl adhesives tailored to meet the evolving needs of the renewable energy sector. Consequently, the renewable energy sector emerges as a significant driver shaping the growth trajectory of the butyl adhesives market, offering opportunities for manufacturers and suppliers to capitalize on this expanding market segment.

However, the higher costs can indeed act as a significant restraint to the growth of the butyl adhesive market. As these adhesives are often formulated with specialized materials and undergo complex manufacturing processes, they tend to have a higher price point compared to other adhesive options. This can pose challenges, particularly in industries where cost efficiency is a primary concern. Companies may hesitate to adopt butyl adhesives if they perceive them as too expensive, opting instead for cheaper alternatives, even if they may not offer the same level of performance or durability. Moreover, in price-sensitive markets or during economic downturns, customers may prioritize cost-saving measures, further impeding the growth of the butyl adhesive market.

The higher costs can also impact downstream industries, as manufacturers may need to pass on the increased expenses to consumers, potentially reducing demand for products that utilize butyl adhesives. Furthermore, competitors offering lower-priced alternatives may gain a competitive edge, further eroding the market share of butyl adhesives. Furthermore, the packaging industry is experiencing a significant shift towards the adoption of butyl adhesives, creating lucrative opportunities within the butyl adhesives market. One of the primary drivers behind this trend is the increasing demand for efficient and reliable packaging solutions across various sectors such as food and beverage, pharmaceuticals, consumer goods, and more.

According to India's Brand Equity Foundation (IBEF), the Food and Grocery market accounts for over 70% of total retail sales. One of the main forces behind flexible packaging use in the nation is department stores in urban food marketplaces and unit packaging in rural food markets. The USDA Foreign Agricultural Service estimates that there were 12.79 million traditional retail grocery stores in India in 2021, and by the middle of 2023, that number was predicted to rise to 13.05 million. The growing retail market is expected to boost the demand for flexible packaging in the food segment.

Butyl adhesives offer numerous advantages in packaging applications, including excellent adhesion to a wide range of substrates, high track, moisture resistance, and flexibility. These properties make butyl adhesives ideal for bonding diverse materials commonly used in packaging, such as plastics, paperboard, metal foils, and films. Moreover, the rising focus on sustainability and environmental consciousness has propelled the demand for butyl adhesives in packaging. Unlike solvent-based adhesives, butyl adhesives are typically solvent-free or have low volatile organic compound (VOC) content, reducing environmental impact and meeting regulatory requirements. Thus, the rising adoption of butyl adhesives in the packaging industry presented a lucrative growth opportunity for the expansion of the butyl adhesives market. Thus, the rising adoption of butyl adhesives in the packaging industry provides a lucrative opportunity for the butyl adhesives market.

Segment Overview

The butyl adhesives market is segmented based on type, end-use industry, and region. By type, the market is divided into tape and paste. By end-use industry, it is categorized into building and construction, automotive, packaging, electronics, and others. region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

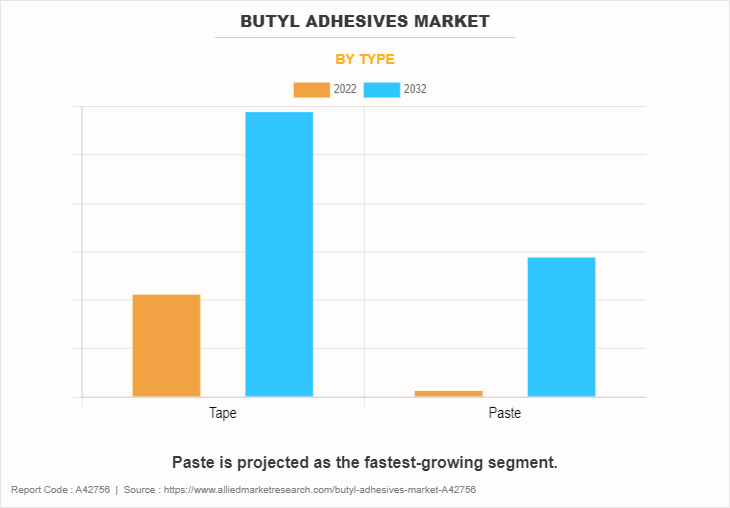

The tape segment accounted for the largest share in 2022. The increasing demand for tape in the butyl adhesives market is driven by several factors, including its versatility in various applications such as construction, automotive, and packaging. In addition, its strong bonding capabilities, weather resistance, and ease of application contribute to its growing popularity among consumers and industries alike. Paste is expected to register the highest CAGR of 5.3%. Increasing demand for the paste segment in the butyl adhesives market can be attributed to its ease of application, superior bonding strength, versatility in use across various industries like construction, automotive, and packaging, as well as its ability to seal joints effectively, providing durable and long-lasting adhesion solutions.

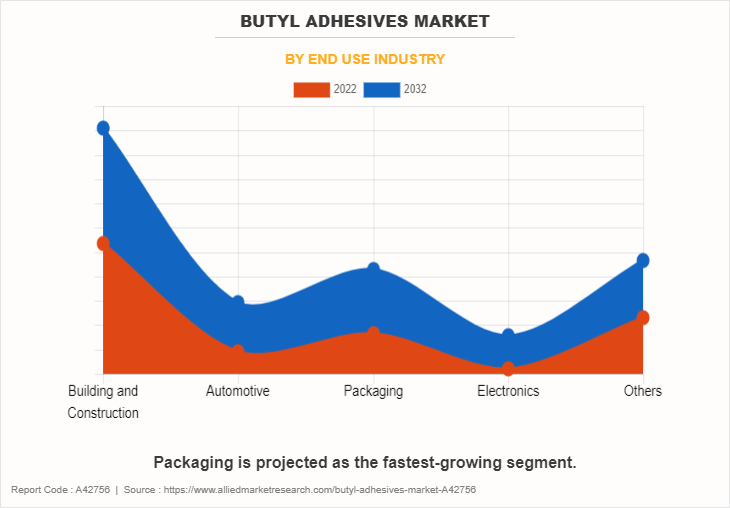

The building and construction segment accounted for the largest share in 2022. The demand for butyl adhesives in the building and construction industry is bolstered by factors such as urbanization, infrastructure development, and growing demand for energy-efficient construction materials. In addition, the versatility, durability, and weather resistance of butyl adhesives make them ideal for various construction applications, further driving market growth. Packaging is expected to register the highest CAGR of 5.7%. The demand for packaging in the butyl adhesives market is rising due to factors like the growth of e-commerce, increased consumer preference for convenience packaging, expanding food and beverage industries, stringent regulations regarding product safety, and advancements in packaging technologies, all driving the need for reliable adhesive solutions.

Asia-Pacific garnered the largest share in 2022. The Asia-Pacific butyl adhesives market is experiencing robust growth driven by increasing demand from the construction, automotive, and packaging industries. Key factors such as rapid urbanization, infrastructure development, and expanding manufacturing activities contribute to the market's expansion.

The Indian Institute of Packaging (IIP) reports that during the past ten years, the country's packaging consumption has increased 200%, from 4.3 kg per person per year (ppp) in FY10 to 8.6 kg ppa in FY20. Despite the significant gain over the last decade, there is still plenty of room for growth in this business when compared to other industrialized countries around the globe. In addition, technological advancements and rising investments further propel market growth in the region.

Competitive Analysis

The major players operating in the global butyl adhesives market are Henkel Corporation., H.B. Fuller Company., Bostik, 3M, General Sealants, RENOLIT SE, L'ISOLANTE K-FLEX S.p.A., Sika, GUIBAO and Nitto Denko Corporation.

Other players include Dow, MAPEI S.p.A., CHEMENCE, HS Butyl, PPG Industries, Inc., deVan Sealants, Inc. THREEBOND INTERNATIONAL, INC.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the butyl adhesives market analysis from 2022 to 2032 to identify the prevailing butyl adhesives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the butyl adhesives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global butyl adhesives market trends, key players, market segments, application areas, and market growth strategies.

Butyl Adhesives Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.7 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 220 |

| By Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Sika AG, Renolit SE, The 3M Company, H.B. Fuller Company, L'ISOLANTE K-FLEX S.p.A.,, Nitto Denko Corporation, General Sealants, GUIBAO, Bostik SA., Henkel Corporation |

Analyst Review

According to the insights of the CXOs of leading companies, the increasing demand from various end-use industries such as construction, automotive, and manufacturing will drive the demand for the market. Butyl adhesives offer superior properties such as excellent adhesion, flexibility, and weather resistance, making them ideal for applications in sealing, bonding, and insulating. Moreover, the rising focus on energy-efficient construction and automotive manufacturing further boosts the demand for butyl adhesives due to their ability to provide effective insulation and sealing, thereby reducing energy consumption.

However, the volatility in raw material prices, particularly petroleum-based feedstocks used in the production of butyl adhesives can hamper the market. Fluctuations in oil prices can significantly impact the cost of production, thereby affecting profit margins for manufacturers and potentially leading to increased product prices for consumers. In addition, stringent regulations about environmental sustainability and VOC emissions pose challenges for butyl adhesive manufacturers to ensure compliance while maintaining product performance and cost-efficiency.

The CXOs further added that the growing emphasis on sustainable and eco-friendly adhesive solutions has increased R&D efforts to explore bio-based alternatives and enhance the environmental performance of butyl adhesives will offer opportunities to the market. Moreover, expanding applications in emerging industries such as renewable energy, electronics, and medical devices offer new avenues for market expansion. With continuous technological advancements and evolving customer requirements, manufacturers could develop tailor-made solutions that address specific industry needs, thus widening their market reach and bolstering competitiveness.

The global butyl adhesives market was valued at $1.0 billion in 2022 and is projected to reach $1.7 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032.

The escalating growth in the automotive industry and growing demand for energy-efficient buildings are the drivers of the of the Butyl Adhesives Market.

Building and construction is the leading end-use industry of Butyl Adhesives Market.

Advancements in butyl adhesive formulations for medical applications is the upcoming trend of Butyl Adhesives Market in the world.

Asia-Pacific is the largest regional market for Butyl Adhesives.

The major players operating in the global butyl adhesives market are Henkel Corporation., H.B. Fuller Company., Bostik, 3M, General Sealants, RENOLIT SE, L'ISOLANTE K-FLEX S.p.A., Sika, GUIBAO and Nitto Denko Corporation.

Loading Table Of Content...

Loading Research Methodology...