Calcium Sulfate Market Research, 2033

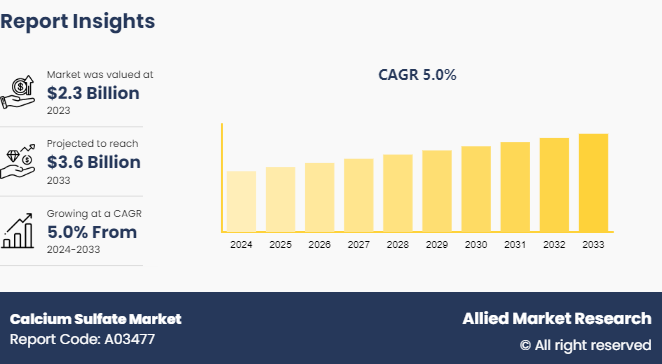

The global calcium sulfate market was valued at $2.3 billion in 2023, and is projected to reach $3.6 billion by 2033, growing at a CAGR of 5% from 2024 to 2033.

Market Introduction and Definition

Calcium sulfate, a chemical compound with the formula CaSO₄, is a naturally occurring substance used widely in various industries. It appears in several forms, including gypsum (CaSO₄·2H₂O), anhydrite (CaSO₄), and plaster of Paris (CaSO₄.5H₂O). Gypsum, the most common form, is found in sedimentary rock formations and is used extensively in construction and agriculture. It is prized for its ability to improve soil structure and provide essential calcium and sulfur nutrients to plants.

Anhydrite, a dehydrated form of gypsum, is used in construction materials and as a drying agent. Plaster of Paris, produced by heating gypsum, is used for making molds, sculptures, and in medical applications such as casts. Calcium sulfate's properties, including its low solubility in water and its ability to form various hydrated and anhydrous phases, make it a versatile material in building, agriculture, and manufacturing. It is also utilized in the food industry as a food additive and in wastewater treatment processes due to its ability to remove impurities.

Key Takeaways

- The calcium sulfate market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major calcium sulfate industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Increase in agricultural production is expected to significantly drive the growth of the calcium sulfate market. Calcium sulfate, commonly used as a soil conditioner and fertilizer, plays a crucial role in improving soil quality and crop yield. As global demand for food rises, driven by population growth and change in dietary habits, the need for enhanced agricultural productivity becomes paramount. Calcium sulfate aids in reducing soil salinity and improving soil structure, which is vital for achieving optimal crop growth. In addition, its use in gypsum-based products for agricultural applications supports sustainable farming practices by enhancing soil fertility and water retention.

The demand for food grains such as rice, wheat, and corn, is expected to rise by 15-25% by 2030, driving increased adoption of gypsum in agriculture. For instance, the Food and Agriculture Organization reports that the area devoted to key cash crops such as sugar cane increased by 5% in India between 2020 and 2021. Similarly, wheat cultivation expanded in China, Russia, and the U.S. during the same period. This surge in agricultural activity has substantially increased the demand for calcium sulfate in these regions. As farmers and agribusinesses increasingly adopt these practices to meet rising food demands and ensure environmental sustainability, the demand for calcium sulfate is anticipated to witness growth correspondingly. This trend highlights the compound's importance in modern agriculture and its potential for continued market expansion.

The environmental impacts of gypsum mining present a significant challenge to the growth of the calcium sulfate market. Gypsum mining, which is crucial for producing calcium sulfate, often results in substantial ecological disruption. This includes habitat destruction, soil erosion, and water pollution due to the release of mining byproducts and chemicals into surrounding environments. In addition, the large-scale excavation and processing required can lead to air quality issues, with dust and emissions contributing to local pollution. These environmental concerns not only pose risks to ecosystems and biodiversity but also lead to increased regulatory scrutiny and compliance costs. As regulations tighten and the push for sustainable practices intensifies, mining companies face higher operational costs and stricter environmental controls. Consequently, these factors can limit production capacity and market growth for calcium sulfate, affecting supply chains and potentially increasing prices for end-users.

The application of calcium sulfate in 3D printing presents a significant growth opportunity for the market. Calcium sulfate, often used as a binder or component in the production of various 3D printing materials, enhances the quality and performance of printed objects. Its properties, such as high thermal stability and ease of handling, make it an attractive choice for creating detailed and durable prints. The rise in demand for advanced 3D printing technologies across industries like aerospace, automotive, and healthcare drives the need for innovative materials, including calcium sulfate-based ones. As 3D printing evolves and expands its applications, the versatility and functionality of calcium sulfate will likely lead to increased adoption and market growth. This trend is further supported by ongoing advancements in 3D printing techniques and the pursuit of high-quality, efficient, and cost-effective materials.

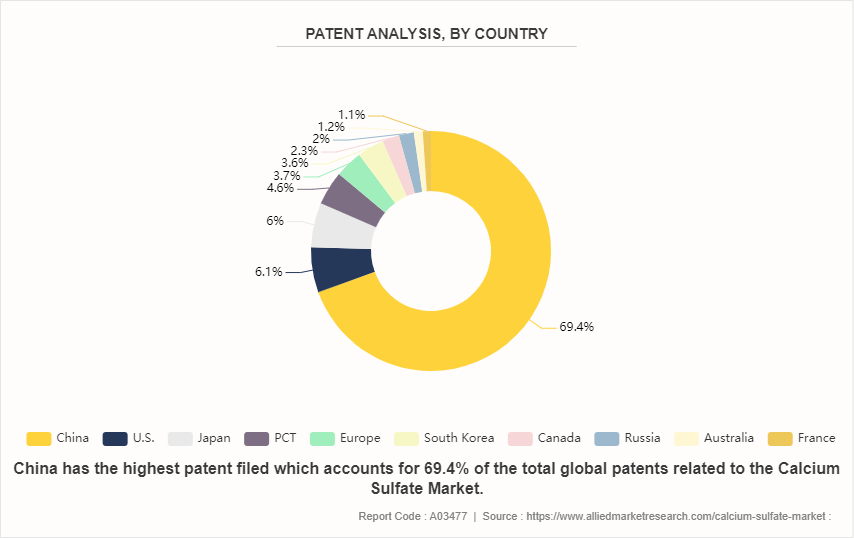

Patent Analysis of the Global Calcium Sulfate Market

In the global calcium sulfate market, China dominates with a significant share of 69.4%, reflecting its extensive production capabilities and demand. The U.S. follows with 6.1%, indicating a notable but smaller market presence. Japan and PCT (Patent Cooperation Treaty) regions hold 6.0% and 4.6%, respectively, underscoring their active roles in innovation and technology. Europe and South Korea account for 3.7% and 3.6%, showing moderate involvement. Canada, Russia, Australia, and France contribute smaller shares, with Canada at 2.3%, Russia at 2.0%, Australia at 1.2%, and France at 1.1%. This distribution highlights China’s central role and the diversified, though less dominant, global patent landscape in calcium sulfate.

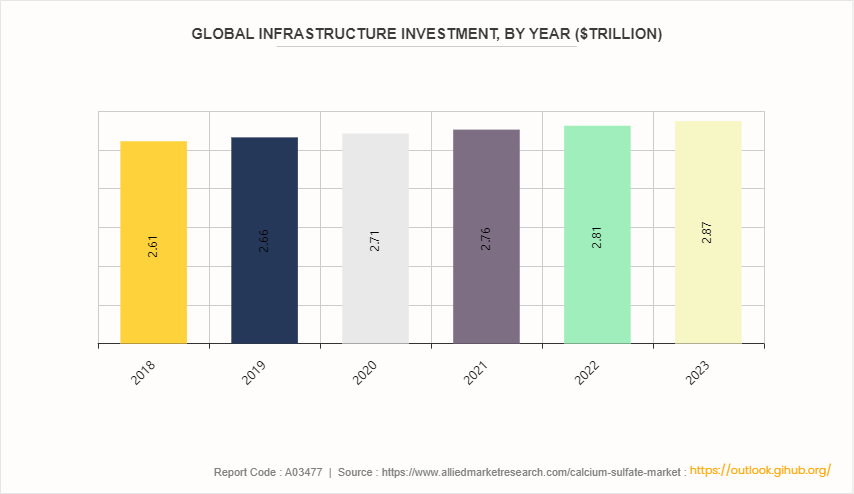

Global Infrastructure Investment to Propel Growth of the Calcium Sulfate Market

The global calcium sulfate market is set to experience substantial growth, driven by increased infrastructure investment. As governments and private sectors invest heavily in construction, including roadways, bridges, and buildings, the demand for calcium sulfate in applications like drywall, cement, and plaster will rise. This mineral's key role as a binding agent and its use in various construction materials will contribute to its market expansion. In addition, the growing emphasis on sustainable and resilient infrastructure solutions will further boost the need for calcium sulfate in modern construction projects globally.

Market Segmentation

The calcium sulfate market is segmented into form, grade, end-use industry, and region. Based on form, the market is classified into anhydrous, and hydrated. By grade, the market is divided into technical grade, food grade, pharma grade, and others. By end-use industry, the market is divided into food and beverages, cosmetic and personal care, building and construction, chemical and petrochemical, pulp and paper, agriculture, pharmaceutical and healthcare, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the calcium sulfate market include LafargeHolcim Ltd., Knauf a/s, American Gypsum Company LLC, National Gypsum Company, Saint-Gobain Group, Carmeuse Group SA, Graymont Limited., Mississippi Lime Company, LLC, Honeywell International Inc., MAPEI S.p.A.

Recent Key Strategies and Developments

- In October 2022, Saint-Gobain acquired Global Gypsum Company, a prominent gypsum wallboard producer in Sub-Saharan Africa. This acquisition has broadened Saint-Gobain's presence in the African market. Founded in Paris in 1665, Compagnie de Saint-Gobain S.A is a French multinational corporation with headquarters located on the outskirts of Paris, in La Défense and Courbevoie.

- In January 2022, Knauf Gips KG introduced a new line of ultra-lightweight floor screeds called Ultraflor. These screeds offer reduced construction time and costs thanks to their minimal thickness and weight. Knauf Group, a multinational, family-owned company founded in 1932 and headquartered in Iphofen, Germany, is renowned for its drywall gypsum boards.

- In December 2021, USG Corporation teamed up with GE Renewable Energy to create gypsum products using synthetic gypsum, a byproduct of flue gas desulfurization systems. Also known as United States Gypsum Corporation, USG is a major U.S. manufacturer of construction materials, including drywall and joint compound. The company is the leading distributor of wallboard in the U.S. and the top manufacturer of gypsum products in North America.

- In June 2021, LafargeHolcim introduced its latest water-repellent construction plaster, Systaic AirPlus, designed to enhance indoor air quality by offering superior moisture buffering capabilities. The Holcim Group, officially known as Holcim Limited, is a Swiss multinational corporation specializing in building materials. It operates in approximately 70 countries and employs around 72, 000 people.

- In March 2020, Yoshino Gypsum unveiled its latest line of fire-resistant gypsum boards, designed to offer enhanced sound absorption and flame-retardant features. Established in 1937 and based in Tokyo, Japan, Yoshino Gypsum Co., Ltd. specializes in producing and supplying gypsum-based building materials.

- In January 2020, Etex has acquired Pladur, Spain's top producer of plasterboards and gypsum products, enhancing Etex’s position in the European calcium sulfate market. Etex NV, a manufacturer of building materials and systems, offers a range of products including tiles, plaster boards, paints and coatings, fire protection materials, slates, roof elements, corrugated sheets, fire-stopping solutions, exterior building materials, and modular building systems. Pladur Gypsum SA, established in 1979 and headquartered in Madrid, Spain, specializes in manufacturing gypsum-based building materials.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. The growth of the calcium sulfate market in the Asia-Pacific region is being driven by the increasing demand from the paper and pulp, and building and construction sectors. In the paper industry, calcium sulfate is used as a filler and coating pigment, enhancing paper quality and brightness. Meanwhile, in construction, it serves as a key ingredient in drywall and cement products. The rapid industrialization and urbanization in the Asia-Pacific region are fueling the expansion of these industries, thereby boosting the demand for calcium sulfate.

- The pulp and paper industry is experiencing growth. According to the China Paper Association, China's total pulp production in 2022 reached 85.87 million tons, marking a 5.01% increase from 2021. In terms of consumption, China used approximately 112.95 million tons of pulp in 2022, up by 2.59% from the previous year. In addition, Invest India reports that India’s paper and paperboard market is projected to grow at an annual rate of 6-7%. The per capita paper consumption in India is 15 kg, and the Indian packaging market is expected to reach $204.81 billion by 2025. Specialty paper manufacturer Nordic Paper has announced plans to invest $78 million in expanding the Bäckhammar pulp and paper production mill in Värmland, Sweden.

- The Japanese construction industry is poised for significant growth, with the World Expo set to take place in Osaka in 2025. The six-month event is projected to draw around 30 million visitors and generate $15 billion in revenue. Meanwhile, Cambodia's construction sector saw substantial investment, attracting $2.27 billion in the first five months of 2023, marking a 138% increase compared to the previous year, according to the Ministry of Land Management, Urban Planning, and Construction.

- In addition, Invest India forecasts that by 2025, the building and construction industry will reach $1.4 trillion. These rising construction activities across Asia-Pacific are expected to drive demand for calcium sulfate, used as an additive, reducing agent, and drying agent, thus boosting the market for calcium sulfate in the region.

- According to the National Bureau of Statistics, China's construction output was valued at approximately $4.9 trillion in 2022, representing a 3.8% increase from 2021. As part of its 14th five-year plan, China intends to invest $1.43 trillion in key construction projects. This growth in the building and construction sector is expected to increase the demand for calcium sulfate, given its beneficial properties, thereby driving the market's growth during the forecast period.

- Therefore, Asia-Pacific is projected to emerge as a dominant force in the calcium sulfate market throughout the forecast period.

Industry Trends

- The use of flue gas desulfurization (FGD) gypsum is increasing due to its cost-effectiveness and widespread availability as a byproduct of coal-fired power plants. FGD gypsum shares a similar composition with natural gypsum and does not compromise the quality of cement. Many countries are encouraging the use of FGD gypsum in construction to mitigate environmental impacts. For example, China utilizes all its FGD gypsum production, which exceeds 30 million tons annually. The expanding use of FGD gypsum is thus a significant trend in the calcium sulfate market.

- There is a growing preference for lightweight construction materials driven by the need to reduce building weight as part of green building initiatives. Manufacturers are developing lightweight gypsum plasterboards and blocks using additives such as polymers and expandable microspheres. These innovations reduce material density while maintaining strength and thermal insulation. For instance, Knauf GmbH offers Supalight gypsum boards that are 30% lighter than traditional boards. This trend towards lightweight materials is expected to influence product development in the calcium sulfate market.

- Established calcium sulfate producers are expanding the capacities of their existing plants through brownfield expansion projects, which are more cost-effective and quicker than building new greenfield facilities. For example, on July 11, 2023, Saint-Gobain invested $235 million to expand its gypsum board manufacturing capacity in North America through brownfield projects. Such expansions allow manufacturers to enhance output from existing gypsum quarries and operations efficiently.

- Recycled FGD gypsum and plasterboards are emerging as viable alternatives to natural gypsum. The adoption of recycled gypsum is rising in the production of plasterboards and cement. Companies such as Knauf Digital GmbH offer recycled gypsum under the REGY brand to support circular economies. In addition, government policies are promoting the use of recycled gypsum. For instance, the European Commission aims to achieve a 10% usage of recycled gypsum across Europe by 2030 as part of its Circular Economy Action Plan.

Key Sources Referred

- United States Department for Agriculture (USDA)

- IEA

- Our World In Data

- The China Paper Association

- Invest India

- The Ministry of Land Management, Urban Planning and Construction

- The National Bureau of Statistics

- India Brand Equity Foundation

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the calcium sulfate market analysis from 2024 to 2033 to identify the prevailing calcium sulfate market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the calcium sulfate market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global calcium sulfate market trends, key players, market segments, application areas, and market growth strategies.

Calcium Sulfate Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.6 Billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Form |

|

| By Grade |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | National Gypsum Company, American Gypsum Company LLC, MAPEI S.p.A, Honeywell International Inc., Carmeuse Group SA, LafargeHolcim Ltd, Saint-Gobain Group, knauf a/s, Mississippi Lime Company, LLC, Graymont Limited |

The calcium sulfate market was valued at $2.3 billion in 2023 and is estimated to reach $3.6 billion by 2033, exhibiting a CAGR of 5.0% from 2024 to 2033.

Asia-Pacific is the largest regional market for Calcium Sulfate.

Growing construction industry and expanding pharmaceutical and food industries are the drivers of Calcium Sulfate Market in the globe.

LafargeHolcim Ltd., Knauf a/s, American Gypsum Company LLC, National Gypsum Company, Saint-Gobain Group, Carmeuse Group SA, Graymont Limited., Mississippi Lime Company, LLC, Honeywell International Inc., MAPEI S.p.A. are the top companies to hold the market share in Calcium Sulfate.

Building and construction is the leading end-use industry of Calcium Sulfate Market.

Loading Table Of Content...