Cancer Insurance Market Research, 2032

The global cancer insurance market size was valued at $61.7 billion in 2022, and is projected to reach $159.9 billion by 2032, growing at a CAGR of 10.2% from 2023 to 2032.

Cancer insurance will help in providing large amounts of payment cover to the policy holders in relation to cancer diagnosis. The expenditure of treatment and other related expenses that will not be covered by basic health plan that are included in the cancer insurance plan. The policy reduces the financial burden of patients suffering from cancer issues. The supplemental benefits associated with cancer insurance policy will help in reducing the cover gap in relation to standard health policies such as high deductibles, co-payments and out of pocket expenses.

Cancer insurance market policy is helpful in offering income benefit option in case when the earning member of the family is suffering from cancer. The insurance offers a large amount of income to the family. Furthermore, in case of death of the cancer patient the family continues to receive the income benefit for a specified number of years subjecting to specific terms and conditions. Cancer policy helps in safeguarding family against deadly diseases without hampering hard earned savings of the family.

Major benefit associated with cancer insurance market policy is that the policyholder can continue with the cancer plan even after diagnosis of early-stage cancer. In case of tumor getting cleared in the early stage the insurance companies waive off premiums for next three to five years. Furthermore, some insurance companies are also offering the option to increase the sum in case of any non-claims during a policy period.

Cancer insurance is kind special coverage that is developed to manage the uncertainties such as cancer. The cancer insurance plays an important role reducing the financial burden associated with cancer treatment, thus delivering an important support during difficult times. Cancer insurance market comes with various benefits such as lump sum payment, immediate financial assistance. Furthermore, in case of early stage of cancer, the cancer insurance policy can remove future premium payments.

Moreover, there are various large cancer insurance provider market companies that are offering outstanding cancer insurance solutions. Cigna Group provides lump sum cancer insurance solutions and cancer treatment insurance solutions. United Health are providing critical illness insurance solutions, fast track drug approval program solution and others. CVS Health are providing cancer care and management solutions and transform oncology care programs. Prudential Plc are providing protector critical illness insurance plan, stay healthy cancer protection plan and others. UNUM Group provides unum critical care and cancer premiums. Aviva Plc is providing cancer pledge solution. Allianz is providing Allianz cancer protect solution. China life is providing crisis care term insurance plan, stay healthy cancer protection plan, elite care critical illness insurance plan, joyful care critical illness insurance plan, and others

The report focuses on growth prospects, restraints, and trends of the cancer insurance market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the cancer insurance market outlook.

Key Takeaways

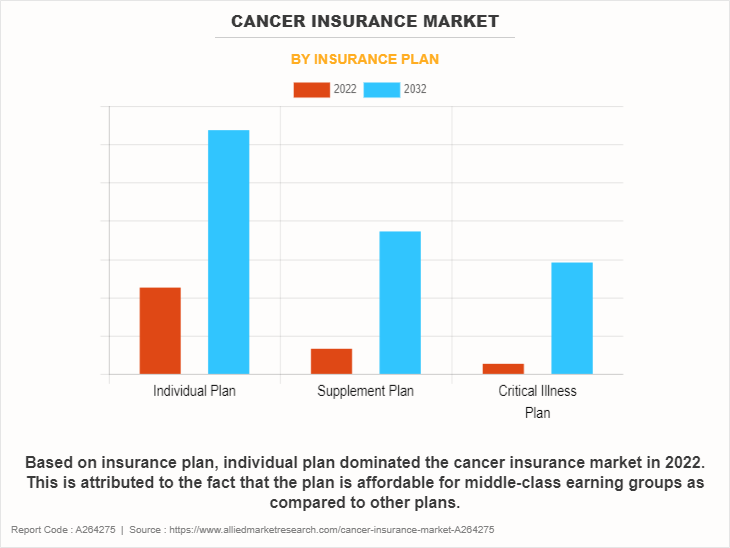

Based on insurance plan, the individual plan segment held the largest market share in the cancer insurance industry in 2022

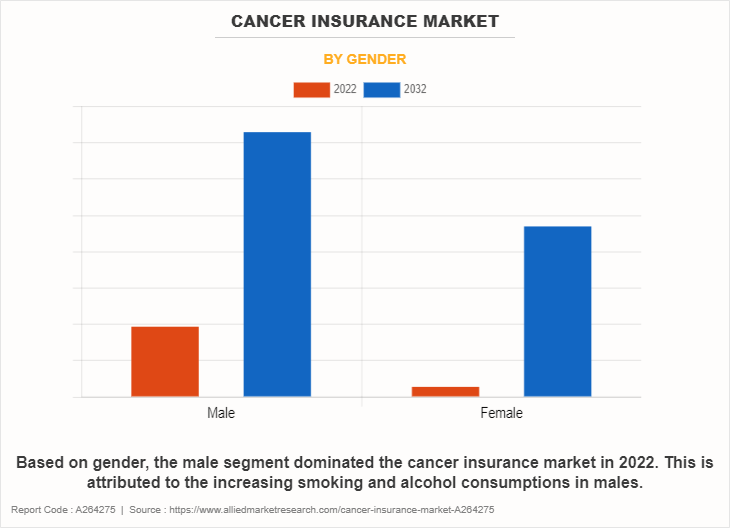

Based on gender, the male segment held the largest market share in the cancer insurance industry in 2022

Based on region, the North America segment held the largest market share in 2022.

Segment Review

The global cancer insurance market is segmented into insurance plan, gender, and region. By insurance plan, the market is divided into individual plan, supplement plan, and critical illness plan. By gender, the market is bifurcated into male and female. Region-wise, the cancer insurance market is studied across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Based on insurance plan, the individual plan segment held the largest market share in 2022. However, the critical illness plan is growing at an increasing rate due to lump-sum payment provided upon diagnosis of covered critical illness that include cancer, heart attack, stroke and others.

Based on gender, the male segment held the largest market share in 2022. However, the female segment is growing at fair CAGR due to chances of cancer increasing in the segment.

Based on region, the North America segment held the largest market share in 2022. However, the Europe segment is growing at a fair CAGR due to increasing cancer cases in the region.

Competition Analysis

Competitive analysis and profiles of the major players in the cancer insurance market share include AXA, Aflac, Mutual of Omaha, Aviva Plc, Prudential Plc, UNUM Group, CVS Health, China Life, Cigna Group and United Health. These players have adopted various strategies to increase their market penetration and strengthen their position in the cancer insurance industry.

Recent Product Launch in the Cancer Insurance Market

In October 2023, AXA launched CareForAll solution. CareForAll aims to serve customers living with chronic disease, the silver-haired patients, and critical illness survivors, enabling them to access critical illness insurance as needed.

In September 2023, Aflac, Hitachi and GlobalLogic Japan Ltd. collaborated with each other to establish a Cancer Ecosystem to provide comprehensive support for employees and their families facing societal issues surrounding cancer.

Recent Collaboration and Joint Venture in the Cancer Insurance Market

In November 2022, Aflac and Trupaion entered into an agreement to offer high-value pet insurance in Japan. Thus, implementing this move Aflac will take advantage of Aflac’s Insurance expertise and Trupanion’s pet insurance expertise.

In September 2023, Aflac, Hitachi and GlobalLogic Japan Limited collaborated with each other and established a cancer-based ecosystem and provided a comprehensive support for the employees and families that are facing societal issues that surrounds cancer.

Swiss RE collaborated with income insurance and launched cancer insurance product in Singapore in August 2023. The new product is called complete cancer care. The product offers continuous care and financial support to people diagnosed with cancer.

Market Landscape and Trends

The Cancer insurance market size is growing due to increasing cancer cases, and other medical problems. Cancer insurance assists in offering supplement benefits such as deductibles, co-pays and non-medical expenses such as transportation and lodging. The cancer insurance market is also acting as a life insurance for cancer patients. The insurance providers also help to offer increasingly customized options that helps in catering of individual requirements and preferences thus helping policyholders to select coverage levels, benefit amounts and additional riders based on specific needs. Furthermore, there has been a greater emphasis on the rising awareness in relation to early cancer detection and preventive care, driving interest in cancer insurance products that offer benefits for screening test and wellness programs.

Top Impacting Factors

Growing technological advancement in cancer treatment

Cancer treatment involves high technology, important therapies and immunotherapies. These innovative solutions are making cancer treatment process more efficient and target oriented. For instance, gene editing tools are one of the latest technologies that are used for cancer treatment. The tools help specialists to modify genes that are used for cancer development and helps in more positive cancer treatment. Furthermore, combination of technology and cancer insurance benefits is providing more better alternative for the users. Moreover, advanced cancer insurance policies cover experimental and cutting-edge therapies that are not widely available or covered by traditional health insurance. This is appealing to individuals seeking access to the latest and most effective treatments. Therefore, all these factors are expected to drive the cancer insurance market share growth for the forecast period.

Increasingly Aging Population

Cancer importance and risk are increasing among adults. High number of individuals are dealing with cancer diagnosis. This trend is leading to high demand for cancer insurance market. For instance, world population prospects 2022 stated that the population above the age of 65 is growing more rapidly as compared to the populaton below the age of 65. Furthermore, older individuals have fixed income and limited resources especially for those individuals who are retried or those who are in the process of retiring. Cancer insurance provides a financial safety net during a stage of life when individuals are more vulnerable to unexpected healthcare costs. Therefore, all these factors are expected to accelerate cancer insurance market growth during the forecast period.

Pre-existing Conditions and Coverage Gaps

Cancer insurance policies often includes pre-existing condition clauses, which can miss coverage for individual with cancer history and cancer pre-existing conditions. This loophole is decreasing the talented pool of eligible individuals and is limiting market growth. Furthermore, generally, the cancer insurance do not cover all types of cancer insurance policies as certain types of cancer and pre-cancer conditions are removed from the coverage and waiting periods are high. These coverage gaps can reduce the effectiveness of cancer insurance in providing comprehensive financial protection.

Rising Cancer Cases

Awareness is increasing in relation to cancer diagnosis activities. People are becoming increasingly interested into the potential financial impact of cancer insurance policy. Furthermore, people are looking forward to additional protection that is more advantageous than normal health plan. Moreover, the risk of cancer is increasing at a global scale thus increasing the cancer risk for the people. For instance, WHO stated the cancer lead to a large number of deaths worldwide accounting for nearly 10 million deaths in 2020. Due to high prevalence of cancer cases, cancer insurance base of customers is growing potentially high. Therefore, all these factors are expected to provide cancer insurance market opportunity for the forecast period

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cancer insurance market analysis from 2022 to 2032 to identify the prevailing market.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cancer insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cancer insurance market trends, key players, market segments, application areas, and market growth strategies.

Cancer Insurance Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Insurance Plan |

|

| By Gender |

|

| By Region |

|

| Key Market Players | AXA, CVS Health, UNUM Group, China Life, Prudential Plc, United Health, Mutual of Omaha, Aflac, Cigna Group, Aviva Plc |

Analyst Review

Cancer insurance is a kind of health benefit and protection that helps in dealing with cancer uncertainties. The solution supports in challenging period by reducing the health-related financial expenditure impact on the person. Cancer insurance policy is formed to help patients with finance. The policy covers a different range of expenditures in relation to cancer diagnosis and treatment such as hospital stay, chemotherapy, radiation therapy and other related expenditures. The primary aspect of selecting cancer insurance policy is that the applicant should not be suffering from cancer during the selection.

Key players in the cancer insurance market adopted product launch as their key development strategy to sustain their growth in the market. For instance, in September 2020, China Life Insurance Singapore launched agency channel. The company aims to penetrate the local insurance industry and build a trusted and experienced team of at least 500 consultants within the next five years, that aims to provide utmost services to local clients and high net worth clients. Furthermore, in September 2023, Cigna Global launched a new, customized health benefits plan that aims at supporting the health and vitality of globally mobile people aged 60 and older. Moreover, in May 2023, Union Bank of India launched women cancer care solution. The solution is designed to provide coverage for cervical cancer, breast cancer, and ovarian cancer treatment. Therefore, such strategies are being adopted by key players to propel the growth of cancer insurance market. Furthermore, in December 2022, AXA Life Insurance launched cancer protect, an innovative solution plan in Egypt. The solution helps in providing financial protection in case of cancer diagnosis. In keeping with AXA's objective to serve as a one-stop shop for all of its clients' protection requirements in Egypt by 2021, this innovative new plan aims to support cancer patients and their families financially while also enabling them to continue living the standard of living that they have grown accustomed to. In addition, in May 2022, Tata AIG launched a new health related product. Tata AIG Criti-Medicare provides cash hospitalization, wellness services which is optional, critical illness, and a 360-degree cancer benefit as its three basic benefits. The solution includes two levels of coverage, smart century premier plan covers 100 critical illnesses and smart half century plan covers 50 critical illnesses. The insured can benefit from a 70% premium waiver in case of a critical illness diagnosis. The 360-degree cancer plan includes coverage for palliative care, counseling, hotel stays, travel expenses, and ongoing and future medical care. These players have adopted product launch strategy to increase their market penetration and strengthen their position in the cancer insurance industry.

The Cancer insurance market is growing due to increasing cancer cases, and other medical problems. Cancer insurance assists in offering supplement benefits such as deductibles, co-pays and non-medical expenses such as transportation and lodging.

Individual Plan

North America

$61.66 Billion

AXA, Aflac, Mutual of Omaha, Aviva Plc, Prudential Plc, UNUM Group, CVS Health, China Life, Cigna Group, and United Health

Loading Table Of Content...

Loading Research Methodology...