Capacitor Bank Market Research, 2033

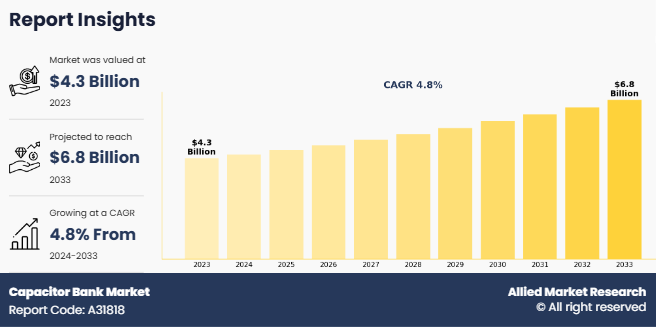

The global capacitor bank market size was valued at $4.3 billion in 2023, and is projected to reach $6.8 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Introduction

A capacitor bank is a collection of several capacitors that are linked in series or parallel and have the same rating, which is used to store electrical energy in every single capacitor connected in a capacitor bank. Therefore, increasing the number of capacitors in a bank increases the amount of energy that is stored in a single device. Power factor correction and harmonic filters are two major applications of capacitor banks that are widely used in the cement, power generation, steel, electric power, pulp & paper, and mining industries. In several end-use industries, fixed type HV and MV capacitor banks are used for indoor and outdoor application. In particular, HV capacitor banks are installed in outdoor application and are surrounded by a fence, while MV capacitors are installed for outdoors or indoors or in the poles of MV overhead lines.

One of the most common applications of capacitor banks is power factor correction. In electrical systems, inductive loads such as motors, transformers, and HVAC systems draw reactive power, leading to inefficient energy usage and higher utility costs. Capacitor banks provide leading reactive power, compensating for the lagging reactive power caused by these inductive loads. This improves the power factor, reduces energy losses, and prevents overloading of equipment and transmission lines.

In industrial environments, nonlinear loads such as variable frequency drives (VFDs), rectifiers, and other electronic equipment introduce harmonics into the electrical system. Capacitor banks, often combined with filters, help mitigate these harmonics, ensuring smoother operation of equipment and compliance with regulatory standards for power quality. In manufacturing plants, capacitor banks are indispensable for ensuring efficient operation of heavy machinery and equipment. Industries such as automotive, steel production, chemical processing, and food processing use capacitor banks to manage large inductive loads and improve energy efficiency.

Key Takeaways

- The capacitor bank market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global capacitor bank markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The key players in the capacitor bank market share are Circutor, Toshiba Corporation (Toshiba), Vishay Intertechnology Inc., Siemens, Enerlux Power s.r.l., Comar Condensatori S.p.A, Hitachi Ltd. (Hitachi), ABB Ltd., Eaton, and EPCOS. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Market Dynamics

Increase in renewable energy integration is expected to drive the growth of market. The integration of renewable energy sources like wind and solar into the power grid is key to transitioning to sustainable energy systems. Capacitor banks play a crucial role in this process by providing reactive power support, stabilizing voltage levels, and improving the power factor of the grid. This enhances the efficient transfer of electricity, reduces energy losses, and supports grid stability, especially during fluctuations in renewable energy output. As renewable energy generation grows, the demand for capacitor banks is expected to increase. In Australia, the Clean Energy Finance Corporation (CEFC) allocated a significant portion of its Household Energy Upgrades Fund to energy-efficient upgrades, including capacitor bank installations in 2024. In addition, Larsen & Toubro’s Digital Energy Solutions expanded globally by deploying advanced technologies such as Hybrid Energy Management and Control Systems (HECS) to optimize grid performance in hybrid plants that combine solar, wind, and energy storage as of 2023.

Grid stability concerns are expected to restrain the growth of the market. The improper installation or operation of capacitor banks lead to significant grid stability concerns, particularly when it comes to overcompensation, voltage fluctuations, or resonance issues. Capacitor banks are designed to correct power factor and provide reactive power support to the grid, but if they are not properly sized, tuned, or maintained, they have adverse effects on the system. One of the primary risks associated with improper capacitor bank operation is overcompensation, where the capacitor bank supplies more reactive power than the system requires. This lead to an increase in system voltage, resulting in voltage fluctuations that damage sensitive equipment, affect the performance of other grid components, and cause instability in the overall power system.

Segments Overview

The capacitor bank market is segmented on the basis of voltage, type, installation, connection type, application, and region. Depending on voltage, the market is segmented into less than 1kV, 1kV to10 kV, 10 kV to 69 kV, and more than 69 kV. On the basis of type, the market is categorized into externally fused, internally fused, and fuseless. On the basis of installation, the market is divided into pole mounted, open air substation, metal enclosed substation, and other. On the basis of connection type, the market is categorized into star connection and delta connection. On the basis of application, the market is divided into power factor correction, industrial, harmonic filter, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

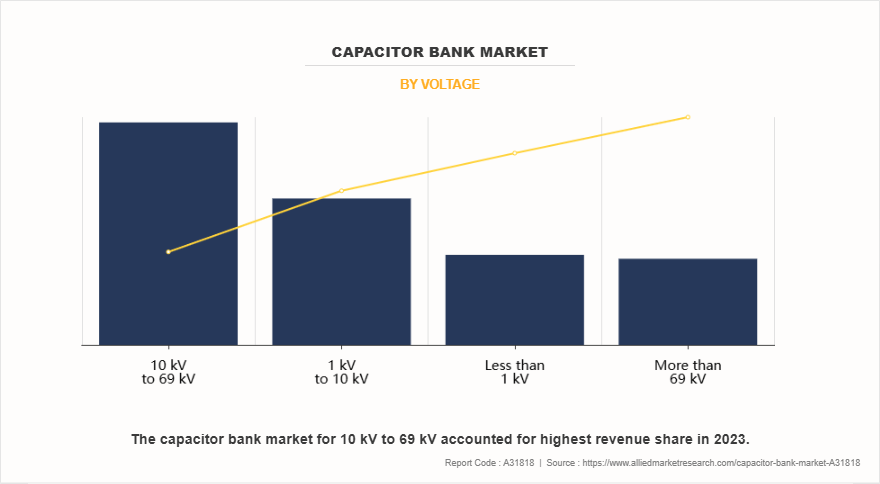

On the basis of voltage, the 10 kV to 69 kV is expected to drive the growth of market in 2023. Capacitor banks are widely used in medium-voltage power systems ranging from 10 kV to 69 kV to improve power quality, enhance voltage stability, and optimize energy efficiency. These banks consist of multiple capacitors connected in series or parallel to provide reactive power compensation, thereby improving the power factor of electrical networks. In utility power grids, capacitor banks play a critical role in voltage regulation and load balancing. At substations operating in the 10 kV to 69 kV range, capacitor banks help maintain proper voltage levels by compensating for reactive power fluctuations due to varying load conditions.

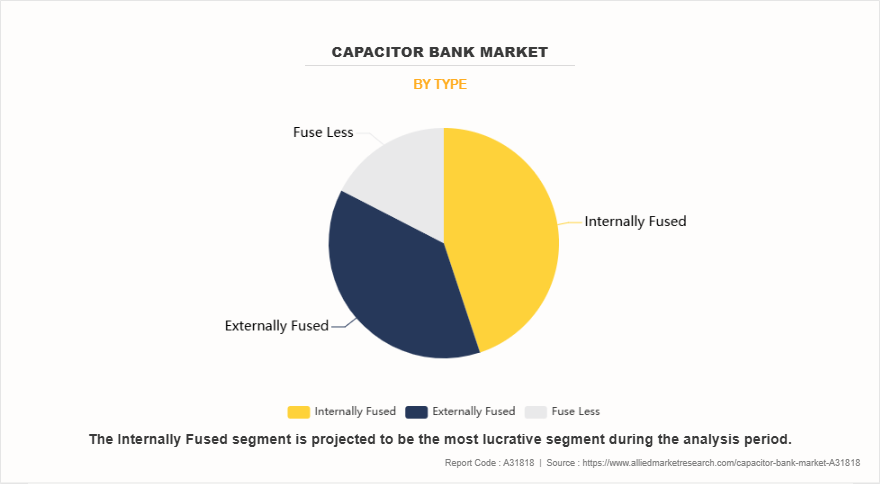

On the basis of type, internally fused segment was the largest revenue generator in 2023 and is anticipated to grow at a CAGR of 5.0% during the forecast period. Internally fused capacitor banks are widely used in power systems for reactive power compensation, power factor correction, and voltage stabilization. These capacitor banks are designed with built-in protection mechanisms that prevent catastrophic failures by isolating faulty capacitor elements within the unit. This self-protection feature enhances system reliability and minimizes the risk of total capacitor bank failure, making them ideal for industrial, commercial, and utility-scale applications.

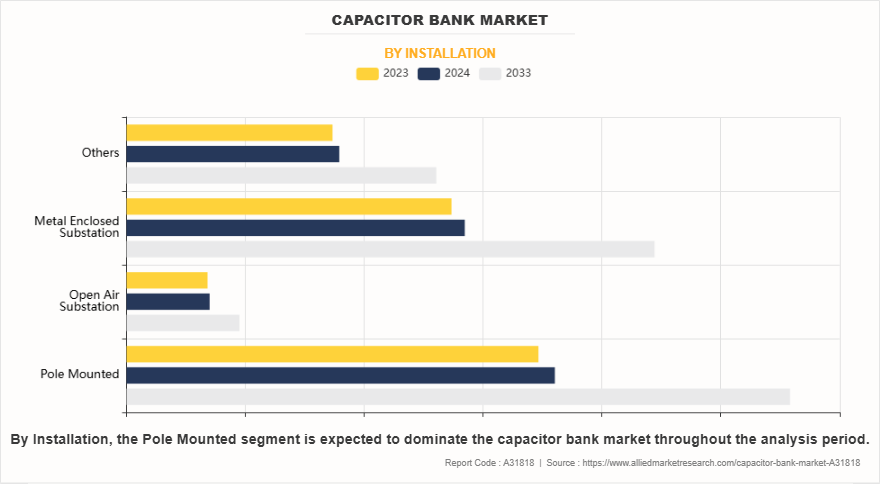

By installation, the metal enclosed substation segment dominated the capacitor bank market in 2023. In metal enclosed substations, capacitor banks are typically installed in a controlled environment to protect them from harsh external conditions such as dust, moisture, and temperature variations. Their enclosure ensures safe operation while reducing the risk of faults or equipment failure. The integration of automated switching mechanisms in these capacitor banks allows dynamic control of reactive power based on real-time demand, thereby preventing overcompensation. This is particularly beneficial in fluctuating load environments, such as industrial facilities, commercial buildings, and renewable energy integration systems.

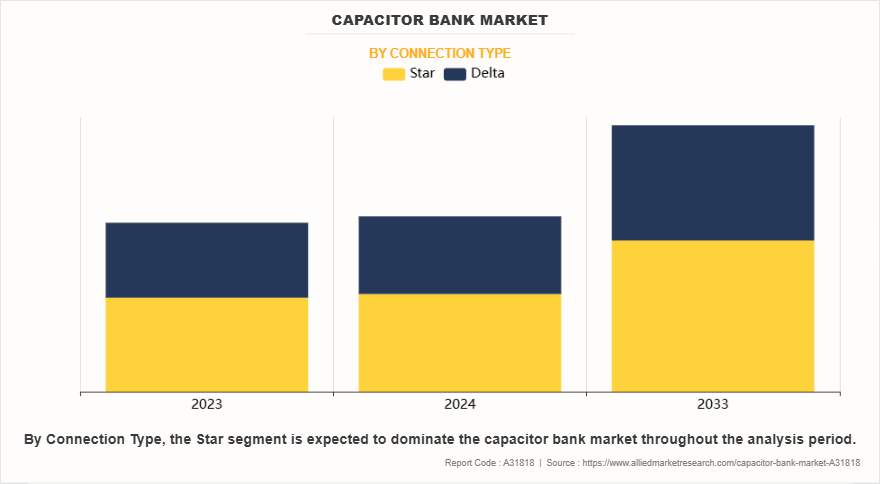

By connection type, the star segment dominated the capacitor bank market in 2023, growing with the CAGR of 5.0% during the forecast period. In a star-connected capacitor bank, the individual capacitors are connected in a three-phase system with a common neutral point. This configuration is beneficial in applications where the system operates with an available neutral or where unbalanced loading conditions might exist. It is commonly used in low to medium voltage systems and in industries requiring improved efficiency in power distribution. In industrial and commercial power networks, capacitor banks in a star connection type are frequently used in motor-driven loads, substations, and renewable energy systems. They help enhance the overall power factor, reduce transmission losses, and improve voltage regulation, leading to more efficient power utilization and cost savings.

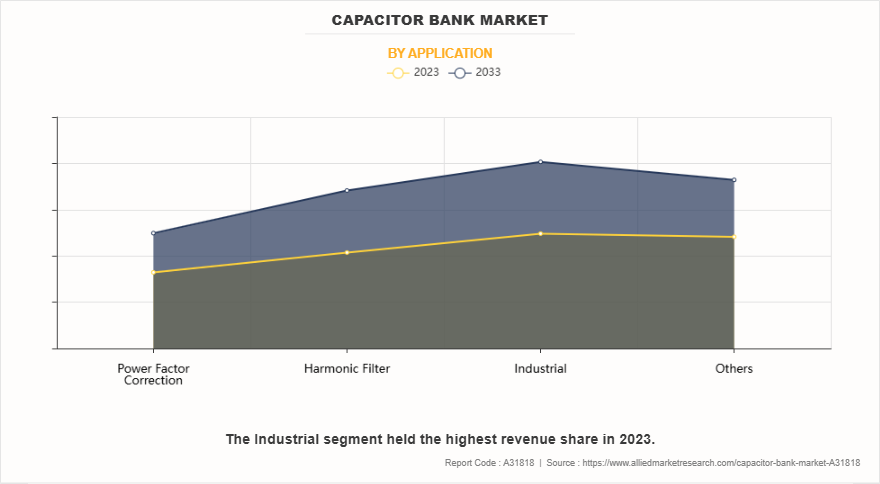

On the basis of application, industrial segment was the highest revenue contributor in the market, representing the CAGR of 5.1% during the forecast period. Capacitor banks are widely used in industrial applications to improve power quality, enhance energy efficiency, and optimize the performance of electrical systems. Industrial machinery often experiences voltage fluctuations due to large load variations or sudden power demands. By providing reactive power support, capacitor banks help maintain a stable voltage level, preventing equipment malfunctions and enhancing the lifespan of electrical components. This is particularly important in industries where precise voltage control is critical, such as manufacturing plants, refineries, and data centers.

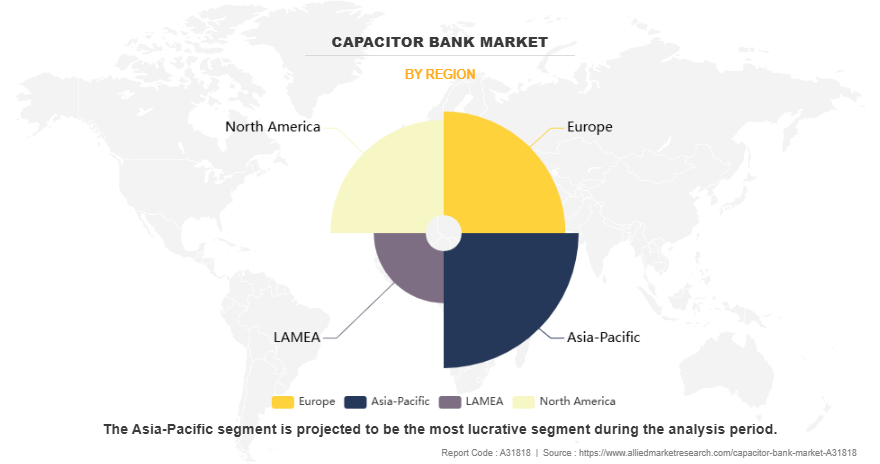

On the basis of region, Asia-Pacific dominated the capacitor bank market in 2023. Countries such as China, India, Japan, South Korea, and Australia are investing heavily in electrical grid modernization to enhance power quality, reduce transmission losses, and improve overall energy efficiency. Capacitor banks play a crucial role in this transformation by providing reactive power compensation, voltage stabilization, and power factor correction across various industrial, commercial, and utility applications. In January 2024, China's State Grid Corporation announced plans to invest approximately USD 70 billion to develop ultra-high voltage transmission lines. This initiative aims to enhance power supply stability and increase the consumption of renewable energy, necessitating the integration of capacitor banks to manage voltage levels and improve power quality.

Competitive Analysis

Key players in the capacitor bank industry include Circutor, Toshiba Corporation (Toshiba), Vishay Intertechnology Inc., Siemens, Enerlux Power s.r.l., Comar Condensatori S.p.A, Hitachi Ltd. (Hitachi), ABB Ltd., Eaton, and EPCOS. These players have adopted several strategies to make their market position strong.

- In February 16, 2023. Vishay announced the introduction of a new series of low impedance Automotive Grade miniature aluminum electrolytic capacitors. These capacitors deliver higher performance in smaller case sizes compared to previous-generation solutions. The 172 RLX series provides 1700 mA in a 10 mm by 12 mm case size, allowing designers to utilize fewer components, thereby increasing design flexibility and saving board space.

- In August 24, 2022, Hitachi Energy inaugurated a new power quality products manufacturing facility in Doddaballapur, Bangalore, India. The USD 12 million facility produces cutting-edge capacitors, units, banks, and power electronic compensators for low, medium, and high-voltage systems. These products are employed in industries, renewable energy, transportation, and power utilities.

Capacitor Bank Industry News

- In September 2023, the Union Cabinet approved a Viability Gap Funding (VGF) scheme aimed at developing 4,000 MWh of BESS projects by the fiscal year 2030-31. This scheme includes a financial support mechanism covering up to 40% of the capital cost, amounting to 3,760 crore, with an overall project outlay of 9,400 crore. The primary objective is to reduce the Levelized Cost of Storage (LCoS) to a range of 5.50 to 6.60 per kilowatt-hour (kWh), thereby making stored renewable energy a cost-effective solution for managing peak power demand across the country.

- In November 2023, ROHM developed the BTD1RVFL series, a new line of silicon capacitors. These devices are gaining popularity in the smartphone and wearable device industries. Due to their extensive experience in silicon semiconductor processing, the company has achieved higher performance in a more compact design. By utilizing thin-film technology, their silicon capacitors offer a greater capacitance in a thinner form compared to the current multilayer ceramic capacitors (MLCCs) available in the market.

- In August 2022, Hitachi Energy launched a new manufacturing facility for Power Quality Products in Doddaballapur, Bengaluru, marking a significant boost to its production capacity. This new plant is designed to produce advanced capacitor units and power electronic compensators, both crucial for enhancing power stability and minimizing energy losses.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the capacitor bank market analysis from 2023 to 2033 to identify the prevailing capacitor bank market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the capacitor bank market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the capacitor bank market growth.

- The report includes the analysis of the regional as well as global capacitor bank market trends, key players, market segments, application areas, and market growth strategies.

Capacitor Bank Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.8 billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2023 - 2033 |

| Report Pages | 398 |

| By Voltage |

|

| By Type |

|

| By Installation |

|

| By Connection Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Enerlux Power s.r.l., TOSHIBA CORPORATION, Vishay Intertechnology, Inc., COMAR Condensatori S.p.A., Hitachi, Ltd., Eaton, Siemens, ABB, Circutor, TDK Electronics AG |

Analyst Review

According to the opinions of various CXOs of leading companies, the rapid expansion of industrial sectors is expected to drive the growth of the capacitor bank market. The rapid expansion of industrial sectors, particularly in developing economies, has contributed significantly to the growing demand for reliable and efficient power solutions. As industries scale up their operations, they consume larger volumes of electricity, which puts a greater load on the existing power infrastructure. Industrial facilities rely on heavy machinery and equipment that cause fluctuations in the power factor, leading to inefficient energy usage, voltage instability, and increased power losses. To mitigate these issues and improve overall energy efficiency, industries are increasingly turning to capacitor banks for power factor correction and voltage stabilization. In 2022-23, the manufacturing sector's Gross Value Added (GVA) grew by 7.3% in current prices over the previous year. Industries such as basic metals, refined petroleum products, food products, chemicals, and motor vehicles were significant contributors, together accounting for about 58% of the sector's total output.

However, maintenance and operational challenges is expected to hamper the growth of the capacitor bank market. Capacitor banks, while essential for maintaining power quality and grid stability, come with significant maintenance and operational challenges. These devices require regular inspections and upkeep to ensure their optimal performance. The internal components of capacitor banks, such as capacitors and insulation materials, can degrade due to environmental conditions, electrical stress, or simple wear and tear. Without proper maintenance, the efficiency of the capacitor bank diminish, leading to increased power losses, equipment failures, or even power outages. Regular monitoring is also necessary to detect early signs of malfunction, such as overheating, abnormal voltage levels, or capacitor leakage, which compromise the system's reliability.

The global capacitor bank market was valued at $4.3 billion in 2023, and is projected to reach $6.8 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

The key players operating in the capacitor bank market include Circutor, Toshiba Corporation (Toshiba), Vishay Intertechnology Inc., Siemens, Enerlux Power s.r.l., Comar Condensatori S.p.A, Hitachi Ltd. (Hitachi), ABB Ltd., Eaton, and EPCOS.

Asia-Pacific is the largest regional market for capacitor bank.

Industrial is the leading application of capacitor bank market.

Increase in demand for smart grid are the upcoming trends of capacitor bank market.

Loading Table Of Content...

Loading Research Methodology...