Car Accessories Market Research, 2033

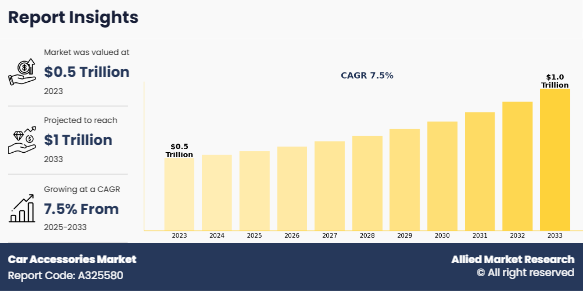

The global Car Accessories Market Size was valued at $513.8 billion in 2023, and is projected to reach $1006.7 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033.

The car accessories market encompasses a wide range of products designed to enhance vehicle aesthetics, performance, comfort, and functionality. These accessories include interior products such as seat covers, floor mats, infotainment systems, and air fresheners, as well as exterior additions like spoilers, alloy wheels, and lighting solutions. Car accessories cater to both functional and aesthetic needs, driven by evolving consumer preferences, technological advancements, and the increasing adoption of electric and connected vehicles. The market is segmented based on product type, vehicle type, distribution channel, and geography, with a strong presence in both OEM (Original Equipment Manufacturer) and aftermarket segments.

Key Takeaways

- The Car Accessories Market Size covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

One of the primary drivers of the car accessories market is the rising global vehicle fleet, fueled by increasing disposable incomes, urbanization, and growing automobile sales. The demand for personalized and technologically advanced accessories is increasing as consumers seek improved comfort, safety, and entertainment in their vehicles. The advent of smart and connected technologies, such as AI-powered infotainment systems and IoT-enabled safety features, has further propelled market growth. Additionally, stringent safety and emission regulations have encouraged the adoption of high-performance accessories like advanced braking systems, LED lighting, and fuel-efficient components. The expansion of e-commerce platforms has significantly contributed to the market's accessibility, enabling consumers to explore a vast range of products and compare prices with ease. The growing trend of car customization, especially among millennials and Gen Z consumers, has also bolstered market demand.

Furthermore, the growing integration of smart technologies in vehicles is revolutionizing the car accessories market, with consumers demanding more convenience, safety, and connectivity. One major advancement is the adoption of AI-powered infotainment systems, which enhance user experience through voice recognition and real-time navigation. According to a 2023 report by the International Telecommunication Union (ITU), over 65% of new vehicles are equipped with AI-driven infotainment systems, with demand growing in both developed and emerging markets. For instance, in December 2023, Garmin launched the Drive Cam 76, a GPS navigation system with built-in dashcam and AI-based driver alerts, improving road safety and navigation efficiency.

Similarly, wireless charging and connectivity solutions are becoming essential, with the Wireless Power Consortium (WPC) reporting a 50% increase in automotive wireless charger shipments in 2023. Tesla's 2024 Model Y update now includes an integrated Qi wireless charging pad, allowing drivers to charge multiple devices seamlessly.

In terms of safety, advanced driver assistance systems (ADAS) are transforming aftermarket accessories. A report by the National Highway Traffic Safety Administration (NHTSA) states that ADAS features can reduce crash rates by up to 40%. In November 2023, Bosch introduced an aftermarket AI-driven dashcam in South Africa, offering real-time hazard detection and lane departure warnings, catering to rising safety concerns.

Additionally, adaptive and LED lighting systems are gaining popularity. The U.S. Department of Energy (DOE) noted that LED headlights improve visibility by 50% while consuming 75% less energy than halogen alternatives. In December 2023, Philips introduced the Ultinon Pro9100 LED headlights in Brazil, significantly enhancing night-time driving safety.

The shift towards smart security systems is also evident. According to a 2023 report by the European Automobile Manufacturers Association (ACEA), vehicle theft rates have decreased by 20% in regions where GPS tracking and biometric authentication accessories are widely used. In January 2024, Viper introduced a new remote start and security system with smartphone integration, improving vehicle security and accessibility.

These technological advancements indicate a shift toward smarter, safer, and more efficient car accessories, with industry players continuously innovating to meet evolving consumer demands.

Despite its growth potential, the market faces several restraints, including fluctuating raw material prices and high initial costs associated with premium accessories. The cost of automotive electronics, in particular, remains a significant challenge for price-sensitive consumers. Counterfeit and low-quality products flooding the market also pose a threat to brand reputation and consumer trust. Additionally, stringent regulations concerning vehicle modifications and aftermarket accessories in certain countries hinder market expansion. For instance, restrictions on certain lighting modifications and exhaust systems in regions like Europe and North America create compliance challenges for manufacturers and retailers.

However, several opportunities exist in the market, particularly in the realms of sustainability, smart technology integration, and emerging markets. The increasing demand for eco-friendly accessories, such as biodegradable floor mats and energy-efficient LED lighting, presents a lucrative avenue for market players. With the growing adoption of electric vehicles (EVs), there is a rising need for EV-compatible accessories, including fast-charging cables, wireless charging pads, and aerodynamic enhancements. Additionally, the rising penetration of autonomous and connected vehicles is expected to drive demand for advanced driver-assistance systems (ADAS), smart dashboard displays, and AI-powered voice assistants. Developing economies, particularly in Asia-Pacific, Latin America, and Africa, offer substantial growth opportunities due to rising vehicle ownership and a growing preference for aftermarket accessories.

The adoption of car accessories in price-sensitive markets remains a challenge due to consumers prioritizing essential vehicle maintenance over non-essential upgrades. In developing economies like India, Brazil, and parts of Africa, high costs associated with premium accessories deter widespread adoption. According to the Indian Ministry of Road Transport and Highways, nearly 70% of vehicle owners in the country focus on essential repairs and servicing rather than aftermarket modifications. Similarly, a 2023 report by Brazil's National Confederation of Transport (CNT) highlighted that over 65% of vehicle expenditures in lower-income segments are directed toward fuel, insurance, and repairs, leaving minimal budget for accessories.

An illustration of this trend can be seen in Kenya, where affordability influences consumer choices. In November 2023, Auto Xpress, a major auto parts retailer, launched budget-friendly seat covers and floor mats priced 30% lower than imported brands to cater to local buyers. This move highlights how companies are adapting to affordability constraints in emerging markets.

According to a report by the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production surpassed 85 million units in 2023, indicating a robust market for accessories. The aftermarket segment, which accounts for a significant Car Accessories Market Share of the car accessories market, is projected to grow at a CAGR of over 6% from 2024 to 2030, as per industry reports. The rising demand for in-car infotainment systems is exemplified by the fact that Apple CarPlay and Android Auto penetration in new vehicles reached over 80% in the U.S. by 2023. In the e-commerce space, platforms such as Amazon, Alibaba, and AutoZone have witnessed double-digit Car Accessories Market Growth in sales, with online sales expected to account for nearly 30% of the total market by 2026. In terms of regional trends, China, India, and Southeast Asian countries are emerging as key markets, with India's automobile accessories industry expected to surpass $12 billion by 2025, driven by increasing vehicle ownership and customization trends. Similarly, in the U.S., the rising trend of off-road and adventure vehicles has led to a surge in demand for roof racks, off-road lighting, and performance-enhancing accessories.

3D printing technology is revolutionizing the car accessories market by enabling rapid prototyping, customization, and cost-effective production. According to the International Federation of Robotics (IFR), the adoption of additive manufacturing in the automotive industry grew by 27% in 2023, with major OEMs and aftermarket players leveraging 3D printing for lightweight and durable accessories. This innovation allows manufacturers to produce intricate designs, such as personalized dashboard trims, aerodynamic spoilers, and custom-fit interior components, with greater precision and reduced material waste.

For instance, in November 2023, Ford announced a partnership with Stratasys to develop 3D-printed interior and exterior vehicle parts, reducing production time by 50% (according to Ford). Similarly, BMWs Additive Manufacturing Campus has been using 3D printing to create customized gear knobs, key fobs, and performance accessories since 2022. With the rising demand for personalization and sustainability, 3D printing is set to play a pivotal role in shaping the future of car accessories manufacturing.

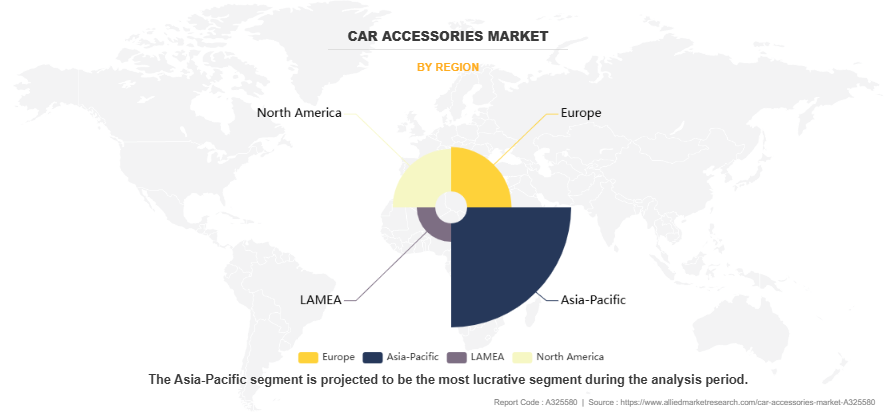

The global car accessories market is segmented on the basis of product type, vehicle type, distribution channel and region. Based on product type, the market is bifurcated into interior accessories and exterior accessories. As per vehicle type, the market is categorized into passenger cars, commercial vehicles and electric vehicles. Depending on distribution channel, the market is further divided into original equipment manufacturer (OEM), and Aftermarket. Region wise, the market is categorized into North America (U.S., Canada, Mexico), Europe (UK, Germany, France, Italy, Spain, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

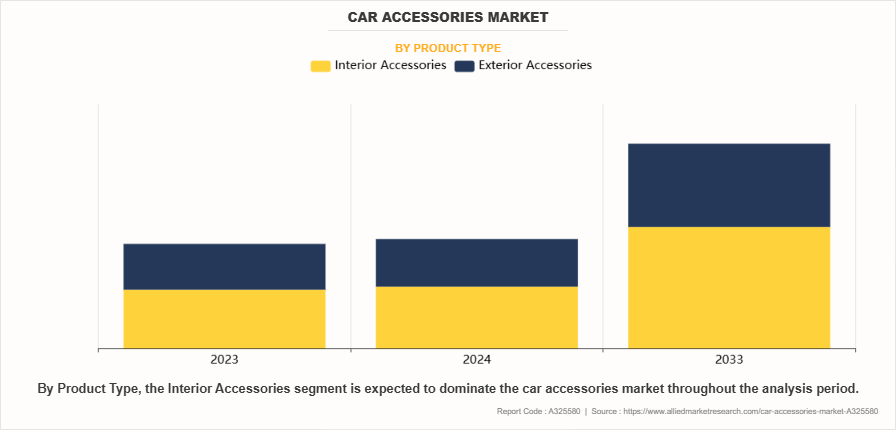

Product Type

Based on product type, the interior accessories segment dominated the global market in the year 2023 and is likely to remain dominant during the Car Accessories Market Forecast period. This is attributed to the increasing consumer preference for enhancing vehicle comfort, aesthetics, and functionality, driving the Car Accessories Market Demand for interior accessories such as seat covers, dashboard trims, infotainment systems, and ambient lighting. Additionally, the growing trend of vehicle customization and personalization further fuels this segment's dominance.

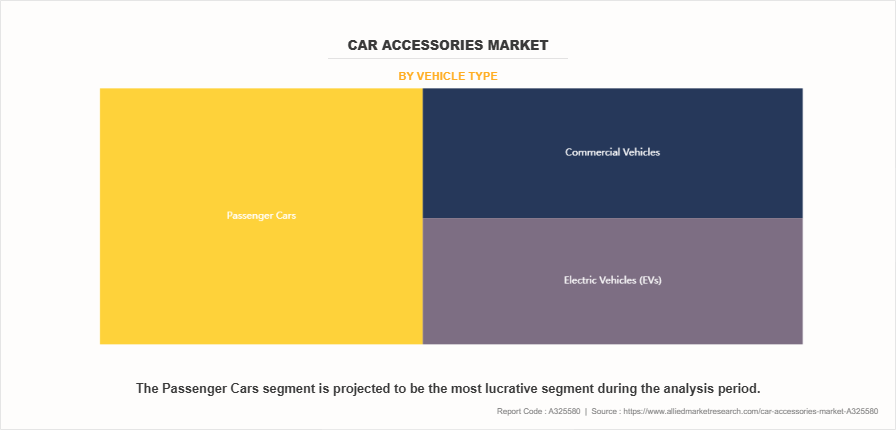

Vehicle Type

Based on vehicle type, passenger cars segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. The passenger cars segment continues to lead due to the rising global production and sales of personal vehicles, coupled with increased disposable income and lifestyle upgrades. The surge in demand for electric and luxury cars, which often come with advanced accessories, also contributes to the segment's growth.

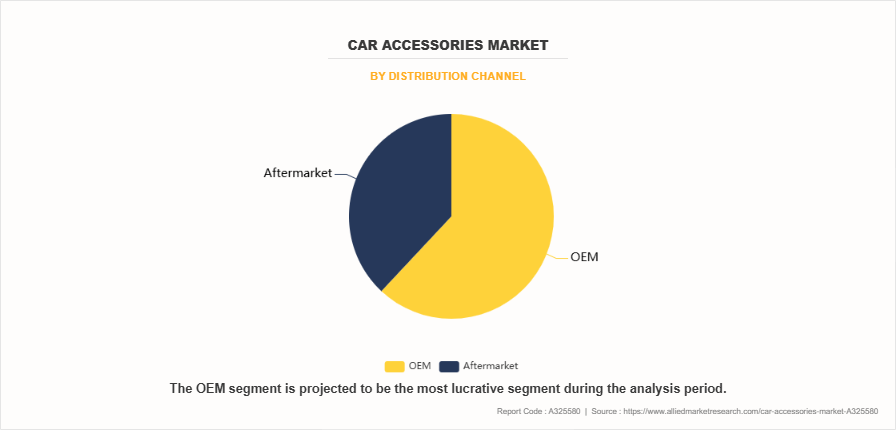

Distribution Channel

Based on distribution channel, the OEM segment dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. The OEM segment dominates as automakers increasingly integrate high-quality accessories during vehicle production to enhance brand value, improve safety, and meet evolving consumer expectations. Moreover, stringent regulations regarding vehicle safety and emissions encourage manufacturers to include advanced accessories as standard features.

Region

Region wise, Asia-Pacific dominated the global market in the year 2023 and is likely to remain dominant during the forecast period. Asia-Pacific remains the leading region in the market due to rapid urbanization, a growing middle-class population, and an expanding automotive industry, particularly in countries like China, India, and Japan. The rising demand for cost-effective and technologically advanced accessories, along with a booming aftermarket industry, further strengthens the region's dominance.

The key players included in the car accessories market analysis are Pioneer Corporation, Garmin Ltd., MOMO S.p.A., Covercraft Industries, Thule Group, Autoliv Inc., HKS Co., Ltd., AutoZone, Inc., RealTruck, Autodoc GmbH, Bimmer Plug, and Car Mate Manufacturing Co., Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the Car Accessories Industry segments, current trends, estimations, and dynamics of the car accessories market analysis from 2023 to 2033 to identify the prevailing car accessories market Car Accessories Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the car accessories market segmentation assists in determining the prevailing Car Accessories Industry opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global car accessories market trends, key players, market segments, application areas, and market growth strategies.

Car Accessories Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1006.7 billion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Product Type |

|

| By Vehicle Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Thule Group, CAR MATE MFG.CO., LTD., AUTODOC SE, WeatherTech, Covercraft Industries LLC, Garmin Ltd., AutoZone, Inc., AUTOLIV, Pioneer Corporation, Bimmer Plug |

Analyst Review

According to the CXO perspective, the global car accessories market is undergoing rapid transformation, driven by evolving consumer preferences, technological advancements, and sustainability trends. The rise of electric vehicles (EVs) and connected cars has significantly influenced demand, with smart accessories such as AI-powered infotainment systems, adaptive lighting solutions, and advanced safety features gaining traction. For instance, in December 2023, Bosch introduced an AI-enabled dashcam in South Africa, leveraging real-time hazard detection to enhance driver safety (according to Bosch). Similarly, the demand for high-performance LED headlights has surged, with Philips launching its Ultinon Pro9100 LED series in Brazil to offer improved energy efficiency and longevity.

The growing emphasis on sustainability is reshaping the market landscape. Many manufacturers are focusing on eco-friendly materials for seat covers, biodegradable car mats, and recycled plastic-based dashboard accessories. A notable example is Continental AG’s 2023 introduction of its PVC-free and 100% recyclable artificial leather for vehicle interiors, aligning with the automotive industry's sustainability goals (according to Continental). Additionally, the expansion of e-commerce platforms has revolutionized distribution channels, making aftermarket accessories more accessible to consumers worldwide. Major players like Amazon, Alibaba, and regional platforms such as MercadoLibre in Latin America and Jumia in Africa have reported a substantial increase in online automotive accessory sales, indicating a shift toward digital purchasing trends.

The CXO perspective also highlights the increasing adoption of off-road and performance-enhancing accessories, particularly in regions where adventure tourism and sports utility vehicles (SUVs) are popular. The Middle East, for example, has seen a surge in demand for off-road tires, skid plates, and high-performance shock absorbers due to the region’s affinity for desert driving. In November 2023, ARB 4x4 Accessories expanded its product lineup in the UAE, catering to the growing market for off-road vehicle modifications.

Safety remains a critical focus area, with regulatory changes and consumer awareness driving investments in advanced driver assistance systems (ADAS) and related accessories. In early 2024, the European Union introduced stricter safety regulations mandating the inclusion of intelligent speed assistance and lane-keeping technology in new vehicles, further fueling demand for aftermarket safety solutions.

The global car accessories market was valued at $513,795.1 million in 2023, and is projected to reach $1,006,722.6 million by 2033, registering a CAGR of 7.5% from 2025 to 2033.

From 2024-2033 would be forecast period in the market report.

$513,795.1 million is the market value of car accessories market in 2023.

2023 is base year calculated in the car accessories market report.

Pioneer Corporation, Garmin Ltd., MOMO S.p.A., Covercraft Industries, Thule Group, Autoliv Inc., HKS Co., Ltd are the top companies hold the market share in car accessories market.

Loading Table Of Content...

Loading Research Methodology...