Car Bumpers Market Research, 2033

The global car bumpers market size was valued at $12.8 billion in 2023, and is projected to reach $18.6 billion by 2033, growing at a CAGR of 4% from 2024 to 2033.

Market Introduction and Definition

Car bumpers refer to the protective components positioned at the front and rear of vehicles. Primarily designed to absorb impact during collisions, they serve crucial safety and functional roles. Historically, bumpers were solid metal bars integrated into a vehicle's chassis, aimed at reducing damage to the main body in low-speed impacts. Over time, their design evolved with advancements in automotive engineering and safety standards.

Furthermore, modern car bumpers are typically composed of a combination of materials such as plastic, fiberglass, or composite materials, often reinforced with metal components or energy-absorbing structures. Their design considers both aesthetic appeal and functional efficiency, incorporating features such as sensors for parking assistance, aerodynamic considerations, and pedestrian safety enhancements.

Moreover, cars bumpers help protect vital vehicle components such as headlights, grilles, and engine parts from damage in minor collisions in car bumpers industry. They also contribute to overall vehicle safety by absorbing impact energy and reducing the severity of accidents for occupants and pedestrians alike. As vehicles continue to evolve with advanced technologies, bumpers remain integral to ensuring both safety and structural integrity in the event of collisions, reflecting ongoing improvements in automotive design and safety standards.

Key Takeaways

The car bumpers market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major car bumpers industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

December 2023, TOYODA GOSEI Co., Ltd. announced that it has increased the production capacity of its Toyoda Gosei Irapuato Mexico, S.A. de C.V. It aims to strengthen its automotive exterior part production in the North America region. TOYODA GOSEI Co., Ltd. will majorly focus on fulfilling the increasing demand for large painted product, such as rear spoilers and bumper peripheral components. It has also invested in expanding its manufacturing facility and new equipment installation.

Key Market Dynamics

Technological advancements are significantly increasing demand for car bumpers by integrating innovative features that enhance both safety and functionality. Modern bumpers are now equipped with sensors and cameras for parking assistance, collision detection, and autonomous driving support, which not only improve vehicle safety but also enhance driver convenience. Advanced materials such as high-strength composites and energy-absorbing structures are being used to design bumpers that efficiently absorb impact energy, reducing damage to vehicles and minimizing injury risks. As consumer expectations for smarter, more connected vehicles grow, the demand for technologically advanced bumpers continues to rise, driving market expansion and innovation. Furthermore, rise in consumer preference, and stringent regulation have driven the demand for car bumpers market.

However, high costs linked to advanced bumper materials and technologies pose a significant challenge in the car bumpers market size by limiting affordability and accessibility for both manufacturers and consumers. Advanced materials like carbon fiber composites or adaptive polymers, while offering superior performance and safety benefits, often come at a premium price point. This cost can deter price-sensitive consumers and manufacturers seeking cost-effective solutions. High production and installation costs can increase overall vehicle manufacturing expenses, impacting profit margins for automakers. Addressing these cost challenges through innovative manufacturing processes and economies of scale is crucial to expanding market adoption of advanced bumper technologies. Moreover, environment concern, and supply chain disruption are major factors that hamper the car bumpers market growth.

On the contrary, the rise in demand for smart bumpers represents a lucrative opportunity in the car bumpers industry due to their enhanced functionality and safety features. Smart bumpers integrate sensors, cameras, and advanced electronics to provide capabilities such as parking assistance, collision detection, and pedestrian safety alerts. These features not only improve driver convenience and safety but also align with growing consumer expectations for technologically advanced vehicles. As automotive trends favor connectivity and autonomous driving features, smart bumpers contribute to vehicle intelligence and functionality, positioning manufacturers to meet evolving market demands and capitalize on the expanding segment of smart and connected vehicles.

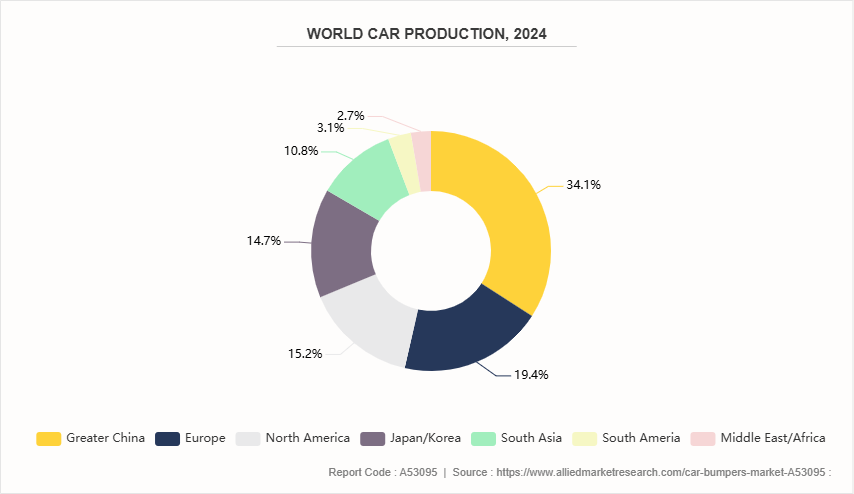

Vehicle Production and Sales Statistics for the Car Bumpers Market

The demand for car bumpers in aftermarket and replacement parts is robust and multifaceted, driven by various consumer needs and market dynamics. As vehicles age or incur damage from accidents, there is a consistent requirement for bumper replacements, fueling a steady demand for aftermarket solutions. These aftermarket bumpers range from affordable options to premium upgrades, catering to diverse consumer preferences and budget considerations.

Moreover, the aftermarket sector plays a critical role in offering flexibility beyond original equipment manufacturer (OEM) offerings. Consumers often opt for aftermarket bumpers to customize their vehicles, whether for aesthetic enhancements or functional upgrades. This includes options for different materials, finishes, and styles that may not be available through OEM channels.

Insurance claims also contribute significantly to the demand for replacement bumpers. Insurance companies often cover the cost of repairing or replacing damaged bumpers, prompting consumers to seek efficient and cost-effective solutions from the aftermarket. Additionally, regulatory standards for vehicle safety continue to evolve, necessitating compliant bumper replacements that meet or exceed safety requirements.

Therefore, the aftermarket and replacement parts segment for car bumpers thrives on its ability to provide diverse choices, affordability, and compliance with safety standards, ensuring a robust and enduring demand globally.

Market Segmentation

The car bumpers market is segmented into type, material, positioning, vehicle type, sales channel, and region. On the basis of type, the market is segmented into standard bumper, deep drop/cowboy bumper, roll pan bumper, step bumper, and tube bumper. As per material, the market is segregated into steel, aluminum, rubber, plastic, and fiberglass. On the basis of positioning, the market segmented into front ends, and rear ends. As per vehicle type, the market segment into passenger cars, light commercial vehicles, heavy duty trucks, buses and coaches, and off-highway vehicles. On the basis sales channel, the market segment into OEM and aftermarket. By region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East Africa.

Regional/Country Market Outlook

The North America region boasts a large automotive industry with established manufacturing capabilities and technological expertise, enabling the production of high-quality bumpers that meet stringent safety and regulatory standards. North America has a significant consumer base with a strong preference for advanced automotive technologies and customization options, driving demand for both OEM and aftermarket bumpers. Moreover, the presence of leading automakers and tier-1 suppliers in the region enhances market competitiveness and innovation. These companies continually invest in research and development to improve bumper designs, integrate new materials, and incorporate smart technologies, aligning with consumer trends towards safer and more connected vehicles.

Furthermore, robust economic conditions and a high level of disposable income among consumers support the adoption of premium bumpers and aftermarket upgrades. This combination of manufacturing prowess, consumer preferences, and industry innovation positions North America as a dominant player in the global car bumpers market share.

Asia-Pacific has emerged as the fastest-growing market for car bumpers due to the region's rapid economic growth has spurred increased vehicle production and sales, driving higher demand for automotive components including bumpers. Countries like China, Japan, India, and South Korea are major contributors to this growth, with a burgeoning middle class and rising disposable incomes fueling consumer demand for passenger vehicles. Furthermore, the automotive industry in Asia-Pacific benefits from cost-effective manufacturing capabilities and a robust supply chain network. This allows for competitive pricing of bumpers and other automotive components, attracting global automakers to establish production facilities in the region. In addition, evolving regulatory standards and safety norms across Asia-Pacific countries are prompting automakers to adopt advanced bumper technologies to enhance vehicle safety and compliance. The shift towards electric vehicles and smart vehicle technologies also plays a significant role, driving the adoption of innovative bumpers that support these advancements.

Thus, Asia-Pacific's dynamic automotive market, coupled with favorable economic conditions and regulatory changes, positions it as a pivotal region driving the rapid growth and expansion of the car bumpers market globally.

In February 2024, MBA Polymers UK Ltd. launched a recycling initiative to convert damaged or end-of-life car bumpers into polymers for reuse in the automotive industry. By collecting bumpers from authorized treatment facilities (ATFs) , insurers, and garages at its U.K. sites, MBA Polymers UK aims to achieve several sustainability goals. These include reducing plastic waste in landfills, lowering carbon emissions associated with material production, and aiding automakers in meeting stringent recycling targets. The initiative supports a circular economy by directly recycling bumpers rather than relying on traditional automobile shredding processes.

In January 2023, Carbingo collaborated with Bumper to form a strategic partnership to enhance the car buying and selling process. Through this collaboration, Bumper will offer instant cash offers to its customers for their vehicles using Carbingo's platform. Simultaneously, Carbingo will utilize Bumper's services to provide comprehensive vehicle history reports, leveraging Bumper's status as an official provider of National Motor Vehicle Title Information System (NMVTIS) data. This collaboration aims to streamline transactions by providing customers with accurate vehicle valuations and detailed histories, ensuring a seamless and efficient experience from valuation to purchase or sale.

Competitive Landscape

The report analyzes the profiles of key players operating in car bumpers market such as Benteler Automotive, Faurecia SA, Hyundai Mobis Co. Ltd., Magna International, Inc., NTF Group, Plastic Omnium, Samvardhana Motherson Group (SMG) , SMP Deutschland GmbH, Tong Yang Group, and Toyoda Gosei Co. Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the car bumpers market.

Industry Trends

In August 2022, Plastic Omnium announced that it is planning to buy Hella’s 33 percent stake in the HBPO joint venture, which makes front-end modules for automobiles. The acquisition will strengthen Plastic Omnium position in segment such as front-end modules including lighting, bumpers, grilles, radar and other driving assistance sensors, and radiators.

In September 2021: Toyoda Gosei Co., Ltd. increased the production capacity at TG Missouri Corporation, one of its production subsidiaries in the U.S. This move helped the company to further develop its production network in the important North American market.

In July 2021, Samvardhana Motherson Automotive Systems Group BV (SMRPBV) and Marelli Automotive Lighting investigated potential new collaborations in intelligently lighted external body pieces, such as front grills and bumpers, as well as other illuminated automotive components.

Key Sources Referred

INTERNATIONAL ENERGY OUTLOOK

Environmental and Energy Study Institute (EESI)

U.S. Department of Energy

ITRI Ltd.

International Hydropower Association

International Energy Agency

World Economic Forum

European Association for Storage of Energy

Key Benefits for Stakeholders

This report provides a quantitative analysis of car bumpers market segments, current trends, estimations, and dynamics of car bumpers market analysis from 2024 to 2033 to identify the prevailing car bumpers market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of car bumpers market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global car bumpers market forecast statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global car bumpers market trends, key players, market segments, application areas, and market growth strategies.

Car Bumpers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 18.6 Billion |

| Growth Rate | CAGR of 4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 434 |

| By Type |

|

| By Material |

|

| By Positioning |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Plastic Omnium, Toyoda Gosei Co. Ltd., Benteler Automotive, Samvardhana Motherson Group (SMG), SMP Deutschland GmbH, Hyundai Mobis Co. Ltd., NTF Group, Faurecia SA, Magna International, Inc., Tong Yang Group |

North America is the largest regional market for car bumpers.

The upcoming trends of Car Bumpers Market include the demand for car bumpers in aftermarket and replacement parts is robust and multifaceted.

The plastic segment is the leading material of car bumpers market.

The global car bumpers market was valued at $12.8 billion in 2023.

Benteler Automotive, Faurecia SA, Hyundai Mobis Co. Ltd., Magna International, Inc., NTF Group are the top companies to hold the market share in Car Bumpers.

Loading Table Of Content...