Carbon Black Market Research, 2031

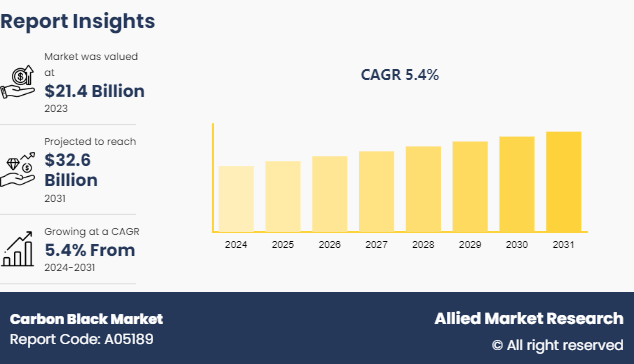

The global carbon black market was valued at $21.4 billion in 2023, and is projected to reach $32.6 billion by 2031, growing at a CAGR of 5.4% from 2024 to 2031.

Market Introduction and Definition

Carbon black is a finely divided form of elemental carbon produced through the incomplete combustion or thermal decomposition of hydrocarbons. It consists of spherical particles ranging in size from 10 to 500 nanometers, with a high surface area-to-volume ratio. Carbon black finds widespread industrial use due to its unique properties, including high conductivity, excellent UV resistance, and reinforcement capabilities in materials such as rubber and plastics. It is extensively used as a pigment and reinforcing agent in tires, coatings, inks, and plastics. The varying grades of carbon black offer specific characteristics tailored to different applications, from providing durability in automotive tires to enhancing UV protection in plastics and imparting conductivity in electronic components.

Key Takeaways

- The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

- The carbon black market is fragmented in nature among prominent companies such as Cabot Corporation, Aditya Birla Group, PCBL, Vizag Chemical, Kizashi Carbon, Vinayak Industries, Contec, Astrra Chemicals, Epsilon Carbon Private Limited., Omsk Carbon Group, and Tokai Carbon Co., Ltd.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities) , public policy analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global carbon black market such as undergoing R&D activities, regulatory guidelines, and government initiatives are analyzed across 16 countries in 4 different regions.

- More than 3, 500 carbon black-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global carbon black market.

Key Market Dynamics

Factors such as increase in disposable income, technological upgrades, and rise in original equipment manufacturers (OEMs) have led the automotive sector to witness significant growth. For instance, according to a report published by India Brands Equity Foundation, total automobile exports from India stood at 47, 61, 487 in January 2023. The automotive industry serves as a primary driver for the carbon black market, owing to its extensive use in tire manufacturing. Carbon black is an indispensable component in tire formulations due to its ability to improve tire durability, enhance tread wear resistance, and provide crucial properties such as strength and stiffness.

Furthermore, rise in demand for a wide range of consumer goods has led to rapid industrialization in both developed and developing economies such as the U.S., China, India, and others. As industrial sectors expand globally, particularly in manufacturing, construction, and infrastructure development, the demand for rubber-based products continues to grow wherein carbon black is widely used in manufacturing a wide range of rubber-based industrial products such as conveyor belts, hoses, seals, gaskets, and others. These applications benefit from carbon black's reinforcement properties, which enhance the strength, resilience, and longevity of rubber products. This factor may further augment the growth of the carbon black market in the growing industrial sector.

However, the carbon black industry is sensitive to fluctuations in the prices of raw materials, particularly crude oil and natural gas, which are primary feedstocks for carbon black production. The volatility in raw material prices can impact production costs and profit margins for carbon black manufacturers. Fluctuations in feedstock prices can also affect pricing strategies and contract negotiations with customers, making it challenging to maintain stable profitability amidst market uncertainties.

On the contrary, technological advancements in carbon black production have led to the development of specialty grades tailored to specific applications. High-performance carbon black grades, such as those with controlled particle size distribution and surface chemistry, are increasingly sought after in advanced applications like conductive polymers, lithium-ion batteries, and specialty coatings. These specialty grades offer superior properties such as enhanced conductivity, improved dispersibility, and compatibility with advanced materials, driving their adoption across diverse industries.

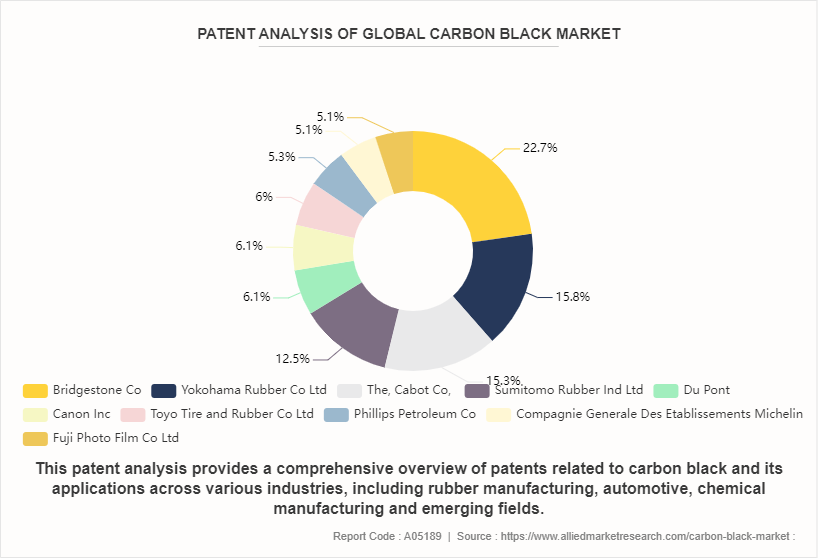

The analysis encompasses patent trends, key patent holders, technological advancements, market segmentation, competitive landscape, and future-outlook within the carbon black market. Patent filings related to carbon black have shown a steady increase over the past decade, indicating growing interest and investment in carbon black research and development.

Key patent holders in the carbon black market include rubber companies, automotive companies, research institutions, universities, and chemical manufacturers. Companies such as Bridgestone Co, Yokohama Rubber Co Ltd, The, Cabot Co, Sumitomo Rubber Ind Ltd, Du Pont, Canon Inc, Toyo Tire And Rubber Co Ltd, Phillips Petroleum Co, Compagnie Generale Des Etablissements Michelin, and Fuji Photo Film Co Ltd hold significant patent portfolios covering various aspects of carbon black production, formulation, and applications. Research institutions and universities contribute to patent filings related to novel uses and production methods of carbon black.

Market Segmentation

The carbon black market is segmented on the basis of grade, manufacturing process, application, and region. By grade, the market is bifurcated into standard carbon black and specialty carbon black. By manufacturing process, the market is categorized into furnace black, thermal black, and others. By application, the market is classified into rubber, plastic, inks and coatings, battery electrodes, and others. Region-wise the market is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Asia-Pacific represents a significant market for carbon black, driven by numerous factors such as rapid industrialization, escalating demand from automotive sector, rise in plastic manufacturing sector, and others.

- China and India, two of the largest economies in the APAC region, have been experiencing rapid industrialization and economic growth. This industrial boom drives the demand for carbon black, which is a crucial component in the manufacturing processes of various products.

- The automotive industry is a major consumer of carbon black, primarily for the production of tires and other rubber components. China is the world’s largest automotive market, and India is rapidly catching up, with a significant increase in both vehicle production and sales. Japan also remains a key player in the global automotive market. According to a report published by International Trade Administration in 2023, China continues to be the world’s largest vehicle market by both annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. The demand for tires, which use carbon black for strength and durability, is directly proportional to vehicle production. As these countries continue to expand their automotive industries, the need for high-performance tires and automotive components drives the consumption of carbon black.

- Additionally, the growth of electric vehicles (EVs) in these markets further stimulates demand for specialized carbon black grades used in conductive polymers and battery components.

- Moreover, infrastructure development and construction projects are proliferating across the Asia-Pacific region, particularly in China and India, driven by urbanization and government initiatives. Carbon black is essential in the construction industry for applications such as asphalt modification, concrete reinforcement, and protective coatings.

Competitive Landscape

The major players operating in the carbon black market include Cabot Corporation, Aditya Birla Group, PCBL, Vizag Chemical, Kizashi Carbon, Vinayak Industries, Contec, Astrra Chemicals, Epsilon Carbon Private Limited., Omsk Carbon Group, and Tokai Carbon Co., Ltd. In January 2023, Braskem S.A. acquired taulman3D, a leading 3D filament supplier of nylon, recycled PETG, and PET filaments to aerospace, automotive, healthcare, industrial, government and higher education professionals worldwide. This strategic acquisition has enhanced the product portfolio of Braskem S.A. for 3D printing filament.

Industry Trends

- In April 2023, Birla Carbon, a unit of Adity Birla Group of Companies has developed new carbon black that can be used across tire, mechanical rubber goods, energy systems, plastics, inks, and coatings industries. The new carbon black developed by Birla Carbon is regarded as a high-quality sustainable alternatives to traditional carbon blacks. This event may surge the potential applications of new carbon black across various end-use sectors; thus, fueling the growth of the carbon black market.

- In August 2023, VMware Carbon Black has launched new cloud native detection and response capabilities that provide its carbon black container customers security teams with real-time, unified visibility and context into containers and Kubernetes environments.

Key Sources Referred

- National Promotion and Facilitation Agency

- U.S. Development Authority

- Science Direct

- International Trade Administration

- Invest In India

- Press Information Bureau

- U.S. Environmental Protection Agency

- European Union (EU) Regulations

- Automotive Industries Association

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carbon black market analysis from 2024 to 2031 to identify the prevailing carbon black market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the carbon black market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global carbon black market trends, key players, market segments, application areas, and market growth strategies.

Carbon Black Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 32.6 Billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2024 - 2031 |

| Report Pages | 350 |

| By Grade |

|

| By Manufacturing Process |

|

| By Application |

|

| By Region |

|

| Key Market Players | Vizag Chemical, PCBL, Contec, Kizashi Carbon, Epsilon Carbon Private Limited, Vinayak Industries, Aditya Birla Group, Cabot Corporation, Contec, Astrra Chemicals |

Rise in demand from automotive sector, rapid growth of industrial manufacturing sector, and rise in demand for rubber-based products are the upcoming trends of carbon black market in the globe.

Rubber is the leading application of carbon black market.

Asia-Pacific is the largest regional market for carbon black.

The carbon black market was valued at $21.4 billion in 2023, and is projected to reach $32.6 billion by 2031, growing at a CAGR of 5.4% from 2024 to 2031.

Cabot Corporation, Aditya Birla Group, PCBL, Vizag Chemical, Kizashi Carbon, Vinayak Industries, Contec, Astrra Chemicals, Epsilon Carbon Private Limited., Omsk Carbon Group, and Tokai Carbon Co., Ltd. are the top companies to hold the market share in the carbon black market.

Loading Table Of Content...