Carbon Composites Market Research, 2033

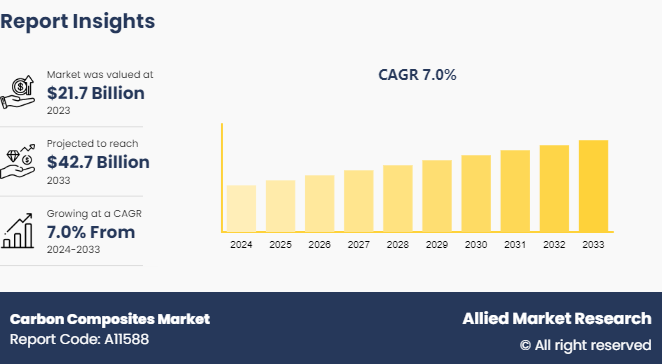

The global carbon composites market was valued at $21.7 billion in 2023, and is projected to reach $42.7 billion by 2033, growing at a CAGR of 7% from 2024 to 2033.

Market Introduction and Definition

Carbon composites are advanced materials consisting of carbon fibers embedded in a matrix of polymer or metal. These composites leverage the high strength-to-weight ratio and rigidity of carbon fibers, making them exceptionally strong and lightweight. Carbon fibers, with their high tensile strength and low density, provide structural integrity and resistance to deformation. The matrix, often a polymer resin like epoxy, binds the fibers together, distributing stress and protecting the fibers from damage.

The properties of carbon composites include high mechanical strength, low weight, and excellent durability. They exhibit superior resistance to corrosion, fatigue, and thermal stress compared to traditional materials. Carbon composites also have high stiffness and are less prone to thermal expansion, which makes them ideal for applications in aerospace, automotive, and sporting goods industries. The combination of these properties results in materials that can perform exceptionally well under demanding conditions, offering both performance benefits and efficiency improvements. However, carbon composites can be costly and challenging to manufacture, limiting their use to applications where their benefits outweigh the costs.

Key Takeaways

- The carbon composites market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major Carbon composites industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The burgeoning automotive industry is significantly propelling the growth of the carbon composites market. As manufacturers increasingly prioritize vehicle performance, fuel efficiency, and safety, carbon composites have emerged as a material of choice due to their exceptional strength-to-weight ratio and durability. The automotive sector’s shift towards lightweight materials to enhance fuel efficiency and reduce emissions aligns perfectly with the benefits offered by carbon composites. Moreover, advancements in automotive design, including electric and autonomous vehicles, are further fueling demand for these high-performance materials. The integration of carbon composites into vehicle structures not only optimizes performance but also contributes to overall sustainability goals. As automotive manufacturers continue to innovate and adhere to stringent environmental regulations, the carbon composites market is expected to experience robust growth, driven by the industry's increasing reliance on these advanced materials.

The carbon composites market faces significant challenges due to the complexity of manufacturing processes. These composites, known for their high strength-to-weight ratio and durability, require intricate production techniques that involve layering and curing carbon fibers in a matrix resin. The need for precision and specialized equipment drives up production costs and limits scalability. Additionally, the labor-intensive nature of these processes and the need for skilled technicians contribute to increased operational expenses. This complexity also extends to quality control, as ensuring uniformity and structural integrity across large volumes can be demanding. Consequently, the high costs and technical barriers associated with carbon composite manufacturing may inhibit market growth, particularly for small and medium-sized enterprises. As industries continue to seek cost-effective solutions, these factors could pose a significant hurdle to the widespread adoption and expansion of carbon composites.

The carbon composites market is expected to witness significant growth, driven by innovative applications across various industries. Carbon composites, known for their exceptional strength-to-weight ratio and durability, are increasingly used in aerospace, automotive, sports equipment, and renewable energy sectors. In aerospace, they enhance fuel efficiency and performance of aircraft. The automotive industry benefits from their use in manufacturing lightweight yet robust components, leading to improved vehicle efficiency and reduced emissions. In sports, these composites contribute to high-performance gear and equipment. Additionally, the rise of wind energy has amplified the demand for carbon composites in wind turbine blades due to their ability to withstand harsh environmental conditions while being lightweight. As these innovative applications expand, the carbon composites market is expected to experience robust growth, driven by continuous advancements and the increasing demand for high-performance materials.

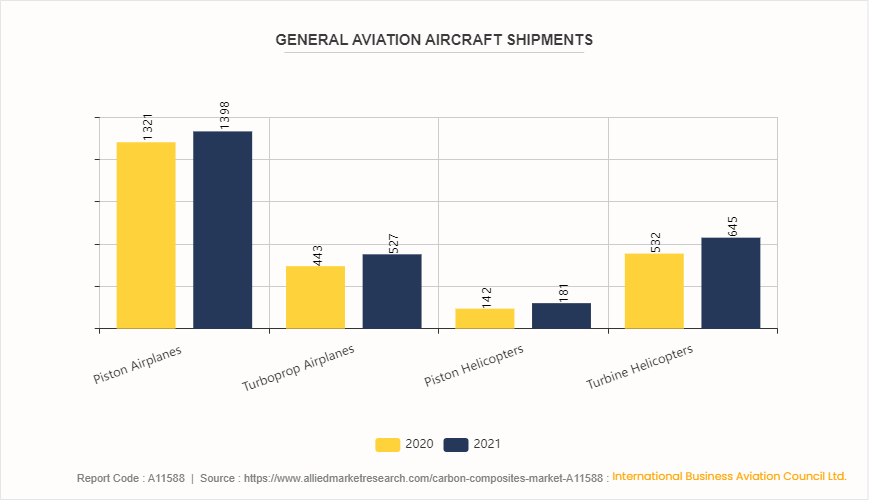

The Increase in General Aviation Aircraft Shipments Will Fuel the Growth of the Carbon Composites Market.

The growth of the carbon composites market is significantly driven by the increasing shipments of general aviation aircraft. As the aviation industry expands, there is a rising demand for lightweight and high-strength materials to improve fuel efficiency and overall performance. Carbon composites, known for their superior strength-to-weight ratio, are increasingly being utilized in aircraft manufacturing to enhance aerodynamics and reduce operational costs. This trend is further supported by advancements in composite technology and a growing focus on sustainable aviation practices. Consequently, the general aviation sector's expansion is expected to substantially propel the carbon composites market forward.

Market Segmentation

The carbon composites market is segmented into matrix, process, application, and region. By matrix, the market is classified into hybrid, metal, ceramic, carbon, and polymer. By process, the market is divided into prepreg layup, pultrusion, winding, wet lamination and infusion, press and injection, and others. By application, the market is divided into aerospace and defense, automotive, wind turbines, sport and leisure, civil engineering, marine, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the carbon composites market include Solvay SA, Nippon Carbon Co Ltd., TORAY INDUSTRIES INC., Teijin Aramid BV, Mitsubishi Chemical Holdings Corporation., Carbon Composites Inc., Hexcel Corporation, Plasan Carbon Composites LLC, SGL Carbon SE, China Composites Group Corporation Ltd.

Recent Key Strategies and Developments

- In September 2023, Teijin Limited agreed to sell its entire stake in GH Craft Co. Ltd, an equity-method subsidiary within its Japanese composites business, to TIP Composite Co. Ltd (Tokyo) . Teijin originally acquired GH Craft in July 2008 as part of its downstream strategy.

- In July 2023, a consultative group comprising the South Korean government, businesses, and research institutions has been formed to enhance the nation's capacity to develop carbon composites, including carbon fiber used in space launch vehicles. The First Vice Minister of Trade, Industry, and Energy, Jang Young-jin, along with representatives from companies involved in the carbon composites value chain and research institutions, announced the launch of the Carbon Composites Jump-up Partnership at the Kensington Hotel in Seoul.

- In April 2023, Solvay and GKN Aerospace extended their collaboration agreement initially established in 2017. This agreement includes developing a joint thermoplastic composites (TPC) roadmap to explore new materials and manufacturing methods for aircraft structures, as well as aiming for future high-rate programs together. Additionally, Solvay will remain a preferred supplier of TPC materials for GKN Aerospace.

- In November 2022, the French startup Fairmat completed a Series A fundraising round, raising $35 million (€34 million) . The company aims to develop a new material from reclaimed carbon fiber composites for use in new products. Leading the funding round are Temasek and CNP (Compagnie Nationale à Portefeuille) , with participation from Pictet Group, Singular, the Friedkin Group International, and other investors. Since its inception, Fairmat has raised a total of $45.5 million (€44 million) .

- In December 2021, Rocket Lab introduced Neutron, the world's first large launch vehicle made from carbon composites. This new rocket, named Neutron, is designed for human spaceflights, deep space missions, and large satellite constellations. Building on the success of the Electron launch vehicle, which served as a learning tool, Neutron features a unique design and materials focused on reusability, with a payload capacity of 8 tons.

Regional Market Outlook

Asia-Pacific is experiencing robust economic growth. The Asia-Pacific carbon composites market is expected to witness significant growth driven by increasing demand across several key industries. The aerospace and defense sector is a major contributor, leveraging carbon composites for their lightweight, high-strength properties to enhance fuel efficiency and performance. The automotive industry is similarly adopting carbon composites to reduce vehicle weight and emissions. Additionally, the sports and leisure sector is embracing these materials for high-performance equipment, such as bicycles and tennis rackets. This multifaceted demand underscores the region's robust market potential, bolstered by technological advancements and rising investment in carbon composite manufacturing capabilities.

- According to the Organization Internationale des Constructeurs d'Automobiles (OICA) , vehicle production in China reached 27.02 million units in 2022, marking a 3% increase over 2021. Despite challenges such as the COVID-19 pandemic, a structural chip shortage, and local geopolitical conflicts, China's auto market saw growth. The International Trade Administration (ITA) confirms that China remains the world's largest auto market in terms of annual sales and production, with domestic production expected to hit 35 million units by 2025.

- The Indian automotive industry experienced significant growth across various sectors. The Society of Indian Automobile Manufacturers (SIAM) reported that from April 2022 to March 2023, India produced 25, 931, 867 vehicles, including passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles. This marks a 12.5% increase compared to the same period from April 2021 to March 2022.

- According to the Japan Automobile Dealers Association and the Japan Light Motor Vehicle Association, Japan saw the sale of 4, 201, 321 new cars in 2022, a 5.6% decline year-on-year, marking the fourth consecutive year of decline. This reduction is attributed to the ongoing global semiconductor shortage, which has limited automakers' production capabilities.

- The aerospace and defense industry is the largest end user of the carbon composites market. The industry's preference for properties like weight reduction, extreme resistance, insulation, and radar absorption has led to a rapid increase in the use of carbon composites in aerospace manufacturing.

- According to an April 2023 press release from Airbus, China's air traffic is projected to grow at an annual rate of 5.3% over the next 20 years, outpacing the global average of 3.6%. By 2041, China will need 8, 420 passenger and freighter aircraft, accounting for more than 20% of the world's demand for new aircraft, which totals around 39, 500 over the next two decades.

- The International Air Transport Association (IATA) reports that by 2030, India is set to become the third-largest aviation market globally, surpassing China and the United States in air passenger numbers.

- Carbon composites are increasingly used in sports equipment due to their superior strength, lightweight nature, and toughness. The rising demand for sports goods is expected to drive the growth of the carbon composites market over the forecast period.

- China's electronics sector recorded stable growth in 2022, with production and investment seeing solid gains. The Ministry of Industry and Information Technology reports that the value added by major enterprises in the sector grew by 7.6% compared to 2021, outpacing the overall industrial growth by four percentage points. This significant boost in demand for electronic goods supports increased demand for carbon composites.

- The sports equipment market in China witnessed growth due to the Beijing Winter Olympic Games in 2022. The Olympics heightened interest in the sports industry, with sports equipment makers and industry practitioners anticipating that this will fuel consumer enthusiasm for sports activities and related consumption.

- Therefore, Asia-Pacific is projected to emerge as a dominant force in the carbon composites market throughout the forecast period.

Patent Analysis of the Global Carbon Composites Market

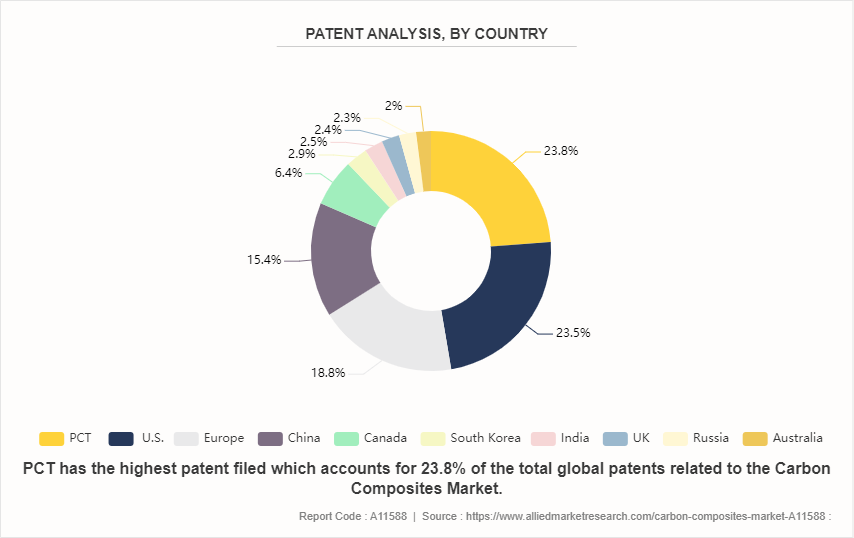

The carbon composites market shows a diverse and competitive patent landscape. PCT leads with 23.8% of patents, indicating strong global interest and innovation. The U.S. follows closely with 23.5%, reflecting its robust R&D capabilities. Europe holds 18.8%, emphasizing its focus on advanced materials. China, with 15.4%, demonstrates its growing influence and investment in carbon composites. Canada (6.4%) and South Korea (2.9%) also contribute significantly, showcasing their technological advancements. India (2.5%) and the UK (2.4%) are emerging players, while Russia (2.3%) and Australia (2.0%) round out the landscape, highlighting their niche contributions and potential growth in this dynamic market.

Industry Trends

- The carbon composites market is experiencing significant growth, driven by a surge in demand across various industries due to their superior strength-to-weight ratio and durability. One important trend is the increasing adoption of carbon composites in the aerospace industry, where they are used to manufacture lightweight, high-strength components for aircraft and spacecraft. For instance, Boeing’s 787 Dreamliner and Airbus's A350 utilize carbon fiber composites extensively to enhance fuel efficiency and reduce overall weight.

- Another trend is the expansion of carbon composites in the automotive sector, where manufacturers are leveraging these materials to improve vehicle performance and fuel efficiency. The use of carbon composites in high-performance sports cars and luxury vehicles, such as those produced by Ferrari and Lamborghini, exemplifies this shift. Additionally, automotive giants such as BMW and Mercedes-Benz are exploring carbon composites for their electric vehicles to offset the added weight of batteries and enhance energy efficiency.

- The construction industry is also increasingly incorporating carbon composites for reinforcing structures and improving durability. For example, carbon fiber reinforced polymer (CFRP) is used in bridge strengthening and retrofitting projects due to its ability to provide structural support while being lighter than traditional materials.

- Moreover, advancements in production technologies, such as automated fiber placement and 3D printing, are making carbon composites more cost-effective and accessible, further driving their adoption across various applications. These trends underscore the versatility and growing importance of carbon composites in modern engineering and manufacturing.

Key Sources Referred

- The Organization Internationale des Constructeurs d'Automobiles (OICA) ,

- The International Trade Administration (ITA)

- The Society of Indian Automobile Manufacturers (SIAM)

- Japan Automobile Dealers Association

- Japan Light Motor Vehicle Association

- The International Air Transport Association (IATA)

- The Ministry of Industry and Information Technology

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carbon composites market analysis from 2024 to 2033 to identify the prevailing carbon composites market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the carbon composites market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global carbon composites market trends, key players, market segments, application areas, and market growth strategies.

Carbon Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 42.7 Billion |

| Growth Rate | CAGR of 7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Matrix |

|

| By Process |

|

| By Application |

|

| By Region |

|

| Key Market Players | Nippon Carbon Co Ltd., Hexcel Corporation, Teijin Aramid BV, TORAY INDUSTRIES INC., Solvay SA, Mitsubishi Chemical Holdings Corporation., Plasan Carbon Composites LLC., SGL Carbon SE, China Composites Group Corporation Ltd, Carbon Composites Inc. |

The carbon composites market was valued at $21.7 billion in 2023 and is estimated to reach $42.7 billion by 2033, exhibiting a CAGR of 7.0% from 2024 to 2033.

Increase in demand in aerospace and defense and automotive industry growth are the upcoming trends of Carbon Composites Market in the globe.

Solvay SA, Nippon Carbon Co Ltd., TORAY INDUSTRIES INC., Teijin Aramid BV, Mitsubishi Chemical Holdings Corporation., Carbon Composites Inc., Hexcel Corporation, Plasan Carbon Composites LLC, SGL Carbon SE, China Composites Group Corporation Ltd.are the top companies to hold the market share in Carbon Composites.

The aerospace and defense is the leading application of Carbon Composites Market.

Asia-Pacific is the largest regional market for Carbon Composites.

Loading Table Of Content...