Carbon Credit Trading Platform Market Research, 2032

The global carbon credit trading platform market was valued at $112.4 million in 2022, and is projected to reach $556.8 million by 2032, growing at a CAGR of 17.4% from 2023 to 2032.

Carbon credit trading platform plays a critical position in the effort to fight climate change and promote sustainable practices across the globe. These platforms facilitate the trade of carbon credits, which symbolize a unit of carbon dioxide (or equal greenhouse gases) that an entity has decreased or removed from the atmosphere. By engaging in carbon credit trading, companies and organizations offset their carbon emissions, help sustainable projects, and make contributions to the common reduction of greenhouse fuel emissions.

The increase in awareness of climate trade and its potential effects on the surroundings and human well-being is one of the key factors which drives the carbon credit trading platform industry. Governments, businesses, and people worldwide have become more conscious of their carbon footprints and seek high-quality methods to reduce their emissions. Carbon credit score trading is an answer to transparent carbon trading with the aid of presenting a mechanism to finance and assist initiatives that minimize greenhouse gas emissions or promote renewable energy.

Technological developments play a big role in the growth of the carbon credit trading platform market. The development of blockchain technology has revolutionized the way carbon credits are tracked and traded. Blockchain ensures transparency, security, and traceability of carbon credits, which is integral for constructing confidence and credibility in the market.

Moreover, governments and international agreements, such as the Paris Agreement, have similarly prompted the carbon credit trading market growth. Countries dedicated to specific emission reduction targets often set up countrywide or regional cap-and-trade systems, creating a demand for carbon credits that are traded on platforms. In addition, international cooperation and help for carbon discount initiatives in growing nations have extended the markets attain and impact zero carbon emission targets.

Despite these driving factors, the carbon credit trading platform market faces certain challenges. One of the principal challenges is the establishment of standardized methodologies for measuring and verifying carbon emission reductions. Ensuring the accuracy and credibility of carbon credits is crucial to preserve the integrity of the market. Moreover, some regions and industries lack the imperative infrastructure and attention to participate completely in carbon savings trading, hindering market growth.

However, several growth opportunities exist within the carbon credit trading platform market. The surge in adoption of corporate social duty and sustainability initiatives by companies has created a demand for carbon credits as a way to show dedication to environmental stewardship. Furthermore, the integration of carbon credit trading with other sustainable finance instruments, such as green bonds, offers new avenues for market expansion and innovation.

Collaboration among governments, businesses, and environmental corporations is critical for advancing the carbon credit trading platform market. Public-private partnerships and initiatives help sustainable initiatives and clean technologies foster an extra robust and numerous market landscape.

"Go Green, Earn Green: Carbon Credit Trading Platform for a Sustainable Future"

In the ever-evolving landscape of climate change mitigation and sustainable commercial enterprise practices, carbon credit trading platforms have emerged as an imperative tool for corporations and humans looking to offset their carbon footprints and actively make contributions to a greener planet. The phrase "Go Green, Earn Green" flawlessly encapsulates the ethos of these platforms, as they enable organizations to not solely display their dedication to environmental accountability, however, in addition, capitalize on the monetary incentives furnished by way of carbon credits.

At the core of this burgeoning market is the concept of carbon credit, which is a tradable commodity representing a reduction or removal of greenhouse gas emissions equivalent to one metric ton of carbon dioxide (CO2). Carbon credit trading platforms serve as intermediaries, connecting entities with surplus carbon credits (typically achieved through emission reduction projects) to those seeking to offset their emissions. This process fosters a dynamic marketplace, where organizations purchase these credits to compensate for their unavoidable carbon emissions, thereby achieving carbon neutrality.

The benefits of collaborating in such a platform are two-fold. First, it empowers businesses to limit their carbon footprint without sacrificing boom and profitability. By investing in carbon credits, organizations meet sustainability targets, comply with environmental regulations, and improve their public image as eco-conscious entities, all while pursuing their financial objectives.Second, carbon credit trading offers financial incentives, allowing companies to earn revenue by selling their excess carbon credits. For environmentally friendly enterprises, this represents an additional revenue stream, further motivating them to adopt sustainable practices and contribute to a low-carbon economy.

The "Go Green, Earn Green" objective not only resonates with businesses however also with individual consumers who are environmentally aware and seek to align their purchasing decisions with sustainable values. Many carbon credit trading platforms now offer opportunities for individuals to participate, allowing them to offset their carbon footprints and actively contribute to a sustainable future.

As the global push for sustainability intensifies, carbon credit trading platforms are positioned to play an instrumental role in driving positive environmental change. By encouraging businesses and individuals to adopt green practices and facilitating carbon credit transactions, these platforms act as catalysts for a more sustainable future, where ecological consciousness and economic prosperity harmoniously coexist. As businesses continue to recognize the financial and ethical significance of environmental responsibility, the carbon credit trading platform market is poised for substantial growth, forging a path toward a greener world.

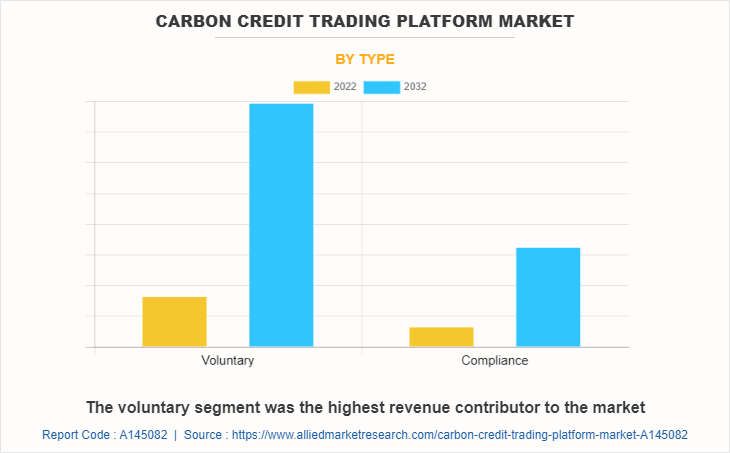

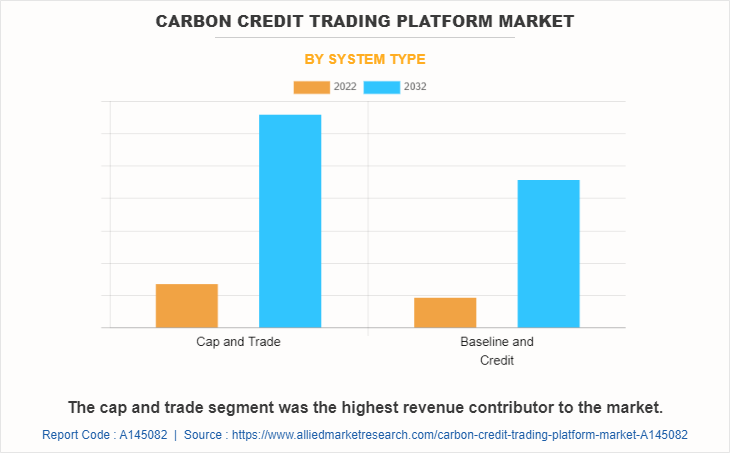

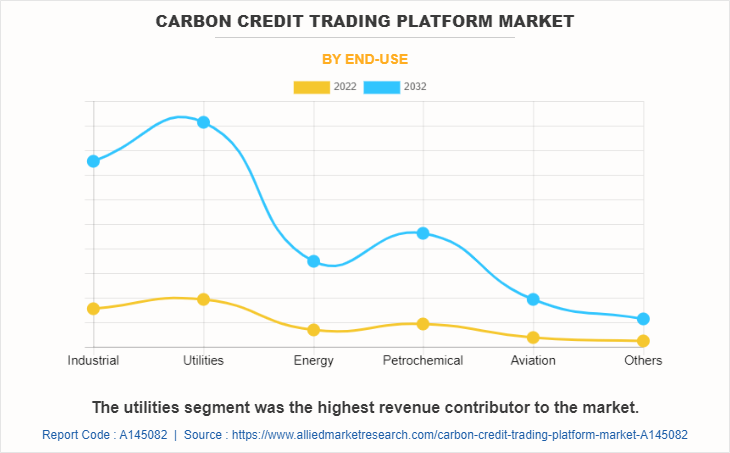

The carbon credit trading platform market is segmented on the basis of type, system type, end use, and region. On the basis of type, it is bifurcated into voluntary and compliance. On the basis of system type, it is categorized into cap & trade and baseline & credit. On the basis of end use, it is segregated into industrial, utilities, energy, petrochemical, aviation, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, the voluntary segment dominated carbon credit trading platform market share in 2022, accounting for nearly three-fourths of the global carbon credit trading market share revenue, and is estimated to maintain its leadership status throughout the carbon credit trading platform market forecast period. the rapid expansion of industrial sectors, which includes manufacturing plants creates a substantial demand for carbon credit trading as they release harmful gases which cause the greenhouse effect.

Based on system type, the cap-trade segment held the highest market share in 2022, accounting for nearly three-fifths of the global carbon credit trading market revenue, and is estimated to maintain its leadership status throughout the forecast period. It can be adjusted over time to respond to changes in emission reduction targets, technological advancements, and economic conditions.

Based on the end-use, the utilities held the highest market share in 2022, accounting for more than one-third of the global carbon credit trading market revenue, and are estimated to maintain their leadership status throughout the forecast period. This is mainly due to the increase in the construction of solar farms, and wind farms for renewable power generation which can be used for the exchange of carbon credits.

Based on region, Europe held the highest market share in terms of revenue in 2022, accounting for more than two-fifths of the global carbon credit trading market revenue, and is likely to dominate the market during the forecast period. Europe has implemented strict environmental regulations, through the European Union Emissions Trading System (EU ETS), which has created a strong demand for carbon credits and trading platforms. In addition, European countries have set ambitious targets for carbon neutrality, which drives companies to actively seek carbon credits to offset their emissions.

Key players that operate in the global carbon credit trading platform market are Nasdaq Inc., European Energy Exchange AG, Carbon Trade Exchange, Xpansiv Data Systems Inc., CME Group Inc., Climate Impact X, Carbonplace, Likvidi Technologies Ltd., BetaCarbon Pty Ltd., and Carbonex Ltd. Furthermore, AirCarbon Exchange Carbon Compass, CarbonDelta, CBL Markets, ClearBlue Markets, Equilibrio, ETS Registry, EvoExchange, First Climate, Markit Environmental Registry, The Climate Trust, and Verified Carbon Standard (VCS) are also some more companies which are not profiled in the market report.

The unique services and innovative approaches of the abovementioned companies contribute to the advancement of the carbon credit trading platform market, enabling more efficient, sustainable, and environmentally friendly practices for corporates to move toward sustainability.

Competitive landscape:

Nasdaq Inc.:

Nasdaq is a prominent global stock exchange operator that has expanded its focus to include environmental markets, including carbon trading. As of 2021, they have been involved in developing and operating carbon marketplaces and platforms, providing the infrastructure for carbon credit trading. Their strategy includes offering efficient trading systems, reliable data analytics, and risk management tools to facilitate carbon credit transactions.

European Energy Exchange AG (EEX):

EEX is a leading European energy exchange that facilitates trading in various energy-related commodities, including carbon credits. Their strategy likely involves creating a transparent and regulated marketplace for carbon allowances and credits in compliance with the European Union Emissions Trading System (EU ETS). They may also provide clearing and settlement services for carbon contracts.

Carbon Trade Exchange (CTX):

Carbon Trade Exchange is an online marketplace that connects buyers and sellers of carbon credits globally. Their strategy involves providing a user-friendly platform that allows participants to trade verified carbon credits efficiently. They may also offer services to verify the authenticity and quality of carbon credits listed on their platform.

Xpansiv Data Systems Inc.:

Xpansiv is a company that focuses on creating marketplaces for ESG (Environmental, Social, and Governance) commodities, including carbon credits. Their strategy involves using blockchain and other technologies to create a unique digital identity for each carbon credit, allowing for greater transparency and traceability in carbon credit trading.

CME Group Inc.:

CME Group is one of the world's largest derivatives exchanges, and they offer futures and options contracts on various commodities, including carbon credits. Their strategy likely involves providing standardized carbon futures contracts to help companies manage their carbon risk and exposure. They also offer tools and data services related to carbon markets.

Climate Impact X:

As of my last update, Climate Impact X was a new initiative aiming to create a global marketplace for high-impact carbon credits. Their strategy involves focusing on projects that have a significant positive impact on climate change and creating a unique marketplace to trade these credits.

Carbonplace:

Carbonplace is a company that aims to support sustainable projects by connecting them with individuals and businesses interested in offsetting their carbon footprint. Their strategy involves working with various project developers to verify and list high-quality carbon credits on their platform, which then be purchased by individuals and organizations.

Likvidi Technologies Ltd.:

Likvidi Technologies is a company that offers software solutions for energy and environmental markets. Their strategy involves providing carbon trading platforms and risk management tools to help participants navigate the complexities of carbon markets.

Carbonex Ltd.:

Carbonex is an Australian company that operates a digital marketplace for carbon credits. Their strategy involves facilitating the trading of Australian Carbon Credit Units (ACCUs) and potentially expanding to include other carbon credit types.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carbon credit trading platform market analysis from 2022 to 2032 to identify the prevailing carbon credit trading platform market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the carbon credit trading platform market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global carbon credit trading platform market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global carbon credit trading platform market trends, key players, market segments, application areas, and market growth strategies.

Carbon Credit Trading Platform Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 556.8 million |

| Growth Rate | CAGR of 17.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 243 |

| By Type |

|

| By System Type |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | European Energy Exchange AG, Nasdaq Inc., Xpansiv Data Systems Inc., CME Group Inc., Climate Impact X, Likvidi Technologies Ltd., BetaCarbon Pty Ltd., Carbonex Ltd., Carbon Trade Exchange, Carbonplace |

Analyst Review

According to the insights of CXOs in the carbon credit trading platform market, recognizing the huge growth potential of the carbon credit trading platform industry is driven by several factors. One key driver is the expansion in environmental regulations and issues surrounding ordinary electrical wiring systems. CXOs understand that there is a developing demand for carbon credit trading platform solutions that offer increased safety, durability, and sustainability.

CXOs accept it as true that the market for carbon credit score buying and selling platforms is expected to proceed to witness a considerable boom in the coming years. CXOs understand the importance of supplying advanced and progressive elements in their products to meet the evolving desires of customers. This consists of adopting technologies such as AI, IoT, and robotics to enhance the performance and effectiveness of carbon credit trading platform systems. By leveraging these innovations, CXOs intend to provide their customers with revolutionary solutions that optimize electrical wiring practices and contribute to sustainable outcomes.

Sustainability is a key center of attention for CXOs in the carbon credit trading platform market. Customers, stakeholders, and regulators all recognize the value of environmentally responsible solutions, according to CXOs. Therefore, CXOs attempt to strengthen and promote products and manufacturing procedures that minimize environmental impact. This includes the usage of recyclable materials, lowering carbon emissions during production and promotion of energy-efficient installations. By aligning their operations with sustainability goals, CXOs intend to entice environmentally aware customers and enhance their corporate reputation.

CXOs recognize that technological developments play an essential role in the expansion and innovation of the carbon credit trading platform market. CXOs emphasize the importance of staying at the forefront of emerging technologies such as information analytics, automation, and remote monitoring. By leveraging these technologies, CXOs optimize their manufacturing processes, improve operational efficiency, and ensure regulatory compliance. This dedication to technological advancement lets CXOs supply low-cost and efficient options to their clients, while driving innovation in the industry.

Blockchain and Digitalization, Integration with Financial Markets, Greater Transparency and Reporting are the upcoming trends of Carbon Credit Trading Platform Market in the world.

Utilities is the leading application of Carbon Credit Trading Platform Market.

Europe is the largest regional market for Carbon Credit Trading Platform.

Compliance the fastest growing carbon credit trading platform type with a CAGR of 17.9%.

Baseline and credit the fastest growing carbon credit trading platform system type with a CAGR of 17.6%.

$556.8 million is the estimated industry size of Carbon Credit Trading Platform

Nasdaq Inc., European Energy Exchange AG, Carbon Trade Exchange, Xpansiv Data Systems Inc., CME Group Inc., the top companies to hold the market share in Carbon Credit Trading Platform

Loading Table Of Content...

Loading Research Methodology...