Carbon Fiber Prepreg Market Research, 2030

The global carbon fiber prepreg market was valued at $9.3 billion in 2023, and is projected to reach $18.4 billion by 2030, growing at a CAGR of 10.2% from 2024 to 2030.

Market Introduction and Definition

Carbon fiber prepreg is a composite material consisting of carbon fibers pre-impregnated with a resin matrix, usually epoxy, before being cured. This advanced material combines the high strength and stiffness of carbon fibers with the versatility and ease of handling of pre-impregnated resins. The carbon fibers provide exceptional mechanical properties, including high tensile strength and modulus, while the resin matrix binds the fibers together and transfers loads between them.

The properties of carbon fiber prepreg include low density, which results in a lightweight material ideal for applications where weight reduction is crucial, such as in aerospace, automotive, and sports equipment. Its high strength-to-weight ratio contributes to excellent performance under stress and strain. In addition, prepreg materials offer precise control over fiber alignment and resin content, ensuring consistent quality and performance. The prepreg must be stored at low temperatures to prevent premature curing, and it is typically cured in an autoclave or oven to achieve the final, fully hardened composite. This process results in a high-performance material with superior durability, stiffness, and resistance to environmental factors.

Key Takeaways

- The carbon fiber prepreg market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2030.

- More than 1, 800 product literatures, industry releases, annual reports, and other such documents of major Carbon fiber prepreg industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The carbon fiber prepreg market is expected to experience significant growth, driven largely by increasing demand from the aerospace and defense sectors. Carbon fiber prepregs, which are pre-impregnated with resin, offer high strength-to-weight ratios and exceptional durability, making them ideal for aerospace applications where performance and efficiency are critical. According to the Boeing Commercial Outlook 2022-2041, the global commercial aviation services market—which encompasses flight operations, maintenance and engineering, ground, station, and cargo operations, among other areas is projected to reach $3, 615 billion by 2041. This forecast is expected to drive significant demand for the market in the coming years.

Aircraft manufacturers are currently focusing on accelerating production to address existing order backlogs. The Boeing report estimates that a total of 41, 170 new airplanes will be delivered globally by 2041. In addition, the report indicates that the aerospace services market in Southeast Asia is anticipated to grow to $245 billion, while in Europe, it is expected to reach $850 million. The aerospace industry utilizes these materials to enhance fuel efficiency and reduce weight in aircraft structures, components, and interiors. Similarly, the defense sector leverages carbon fiber prepregs for advanced military equipment and vehicles that require robust, lightweight materials to withstand extreme conditions. As technological advancements continue to push the boundaries of aerospace and defense innovation, the need for high-performance composite materials like carbon fiber prepregs is projected to rise, fueling market growth. In addition, the increasing focus on reducing carbon footprints and improving energy efficiency further supports the expansion of this market.

The carbon fiber prepreg market faces significant challenges due to high costs associated with the production and procurement of these materials. Carbon fiber prepregs, known for their lightweight and high-strength properties, are essential in industries such as aerospace, automotive, and sports equipment. However, the high cost of carbon fiber itself, coupled with the specialized manufacturing processes required to produce prepregs, poses a barrier to widespread adoption. This financial constraint limits their use to high-end applications where performance justifies the expense. As a result, the market's growth is constrained, particularly in sectors where cost-efficiency is critical. Despite advancements in production technologies aimed at reducing costs, the inherent expense of carbon fiber prepregs continues to inhibit broader market expansion and adoption. Thus, overcoming this cost challenge remains a pivotal factor in driving the growth of the carbon fiber prepreg market.

The carbon fiber prepreg market is projected to witness significant growth due to the increasing focus on recyclable and sustainable alternatives. As industries, particularly aerospace and automotive, seek to reduce their environmental footprint, there is a growing demand for carbon fiber prepregs that incorporate eco-friendly materials and processes. Innovations in recycling technologies and the development of bio-based resins are paving the way for the production of prepregs that not only meet performance standards but also align with sustainability goals. These advancements address the challenge of carbon fiber waste and offer solutions that can be reintegrated into the manufacturing cycle, enhancing the overall circularity of the materials. Consequently, companies investing in sustainable prepreg technologies stand to gain a competitive edge, tapping into the expanding market driven by stringent environmental regulations and consumer preference for green solutions. This shift presents a lucrative opportunity for market growth and development in the carbon fiber prepreg sector.

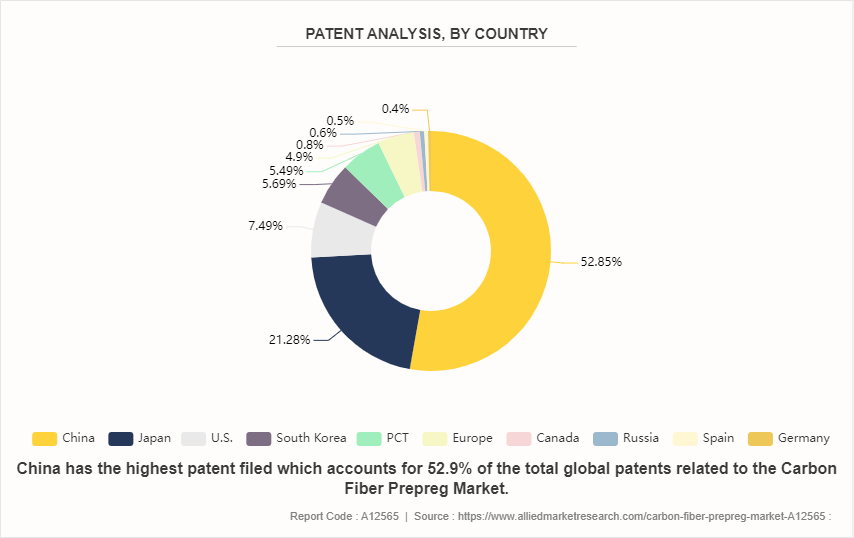

Patent Analysis of the Global Carbon Fiber Prepreg Market

In the carbon fiber prepreg market, China leads with a dominant 52.9% share of global patents, highlighting its significant role in innovation and production within this sector. Japan follows with a notable 21.3%, reflecting its strong emphasis on advanced technology and manufacturing. The U.S. holds a 7.5% share, demonstrating its continued interest and investment in carbon fiber technologies. South Korea and PCT (Patent Cooperation Treaty) countries contribute 5.7% and 5.5%, respectively, indicating active participation in the market. Europe, with 4.9%, shows regional commitment, while Canada, Russia, Spain, and Germany collectively contribute less than 2%, suggesting emerging or niche roles in the global patent landscape.

Market Segmentation

The carbon fiber prepreg market is segmented into resin, process, end-use industry, and region. By resin, the market is classified into thermoset resins, and thermoplastic resins. By process, the market is divided into a hot melt process and solvent dip process. By end-use industry, the market is divided into automotive, aerospace and defense, sports and leisure, wind energy and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Landscape

The major players operating in the carbon fiber prepreg market include Toray Group, ZOLTEK Group, Hexcel Corporation, Mitsubishi Rayon Co., Ltd., GL Group, Royal TenCate N.V., Teijin Limited, Gurit Holdings AG, Axiom Materials, Inc., and Solvay S.A.

Recent Key Strategies and Developments

- In October 2023, The Mitsubishi Chemical Group (MCG Group) has announced its acquisition of full ownership of CPC SRL (CPC) , a renowned Italian company specializing in the production and distribution of carbon fiber reinforced plastic (CFRP) components for automobiles.

- In October 2023, Solvay, a global leader in specialty materials, introduced SolvaLite 716 FR, a fast-curing epoxy prepreg system designed for premium battery electric vehicles (BEVs) . This system is intended for use in various structural components and reinforcements.

- In July 2023, Toray Composite Materials America, Inc. proudly announced a major expansion of its carbon fiber production facility in Spartanburg, South Carolina. This expansion, set to begin in 2025, will increase the facility's capacity by 3, 000 metric tons annually, addressing the growing demand for renewable energy solutions. The project will add 30, 000 square feet to the facility.

- In May 2022, Solvay unveiled an expansion of its SolvaLite product range with the introduction of SolvaLite 714 prepregs. These new prepregs are a next-generation offering, featuring unidirectional carbon-fiber and woven-fabric products pre-impregnated with SolvaLite 714 epoxy resin.

- In April 2022, Archer Aviation Inc. and Hexcel signed a letter of intent outlining a proposed partnership. Under the agreement, Hexcel is set to supply Archer with high-performance carbon fiber prepreg materials to manufacture composite parts for Archer’s aircraft.

- In June 2021, Axiom Materials launched two new narrow prepreg products: AX-6170 and AX-6201XL. AX-6170 is a cyanate ester carbon fiber prepreg designed for high-strength applications such as lithium-ion battery containers. AX-6201XL is a toughened epoxy carbon fiber prepreg intended for structural components in hydrogen fuel tanks.

Regional Market Outlook

Europe is experiencing robust economic growth. The growing aerospace and defense industry in Europe is significantly propelling the expansion of the carbon fiber prepreg market. This growth is driven by the increasing demand for lightweight, high-strength materials that enhance fuel efficiency and performance in advanced aircraft and defense systems. Carbon fiber prepreg's superior properties, such as high tensile strength and resistance to extreme conditions, make it ideal for aerospace applications. As Europe invests in next-generation aerospace technologies and defense capabilities, the need for advanced composite materials such as carbon fiber prepreg is expected to rise, thereby fueling market growth.

- According to the Boeing Commercial Outlook 2022-2041, Europe is projected to receive a total of 8, 550 new aircraft deliveries by 2041, with a market value of $850 billion. This anticipated growth in aircraft deliveries is expected to drive increased demand for optical coatings in the region's aircraft manufacturing sector.

- The Boeing Commercial Outlook 2022-2041 forecasts that the airline fleet in Europe will expand by 4.2% by 2041. To accommodate the growing demand for aviation, approximately 30, 000 to 35, 000 new aircraft are expected to be operational over the next 20 years. This rise in aircraft production is anticipated to boost market growth throughout the forecast period.

- In 2022, the European Defense Agency (EDA) was awarded two new projects, valued at $31.614 million (EUR 30 million) . These projects are Advanced Radar Technology in Europe (ARTURO) and Research in eco-designed ballistic systems for durable, lightweight protection against current and emerging threats (ECOBALLIFE) .

- Therefore, Europe is projected to emerge as a dominant force in the carbon fiber prepreg market throughout the forecast period.

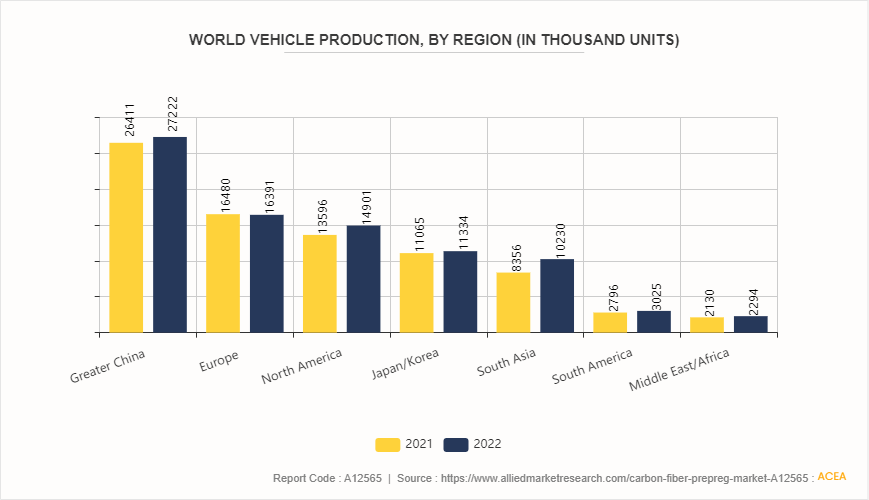

The Expansion in Vehicle Production will Propel the Growth of the Carbon Fiber Prepreg Market

The carbon fiber prepreg market is expected to witness significant growth driven by the surge in vehicle production. As automakers increasingly adopt lightweight materials to enhance fuel efficiency and performance, carbon fiber prepreg emerges as a key component. This composite material, known for its high strength-to-weight ratio, is increasingly used in manufacturing vehicle parts such as body panels, structural components, and interior elements. The automotive industry's shift towards more sustainable and performance-oriented solutions accelerates the demand for carbon fiber prepreg, positioning it as a crucial material in the production of advanced and efficient vehicles. According to ACEA, in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021.

Industry Trends

- The carbon fiber prepreg market is experiencing significant growth, driven by advancements in manufacturing technologies and increasing demand across various industries. One key trend is the rising adoption of carbon fiber prepreg in the aerospace and defense sectors due to its high strength-to-weight ratio and excellent performance characteristics. For instance, companies such as Boeing and Airbus are incorporating these materials in their aircraft to enhance fuel efficiency and reduce overall weight.

- In the automotive industry, carbon fiber prepregs are being utilized to improve vehicle performance and safety, with manufacturers such as BMW and Ferrari integrating these materials into high-performance models.

- In addition, the trend towards sustainability is fostering growth in the carbon fiber prepreg market, as these materials contribute to lighter, more fuel-efficient vehicles and reduced environmental impact.

- Innovations in production techniques, such as automated fiber placement and improved curing processes, are also expanding the application of carbon fiber prepregs.

- Furthermore, the burgeoning use of these materials in sports and leisure equipment, such as bicycles and golf clubs, highlights their versatility and performance benefits. The combination of technological advancements, increased industry adoption, and a shift towards more sustainable solutions are shaping the future trajectory of the carbon fiber prepreg market, making it a pivotal component in the development of next-generation products across various sectors.

Key Sources Referred

- ACEA

- IEA

- European Defense Agency (EDA)

- Boeing Commercial Outlook 2022-2041

- Advanced Radar Technology in Europe (ARTURO)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carbon fiber prepreg market analysis from 2024 to 2030 to identify the prevailing carbon fiber prepreg market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the carbon fiber prepreg market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global carbon fiber prepreg market trends, key players, market segments, application areas, and market growth strategies.

Carbon Fiber Prepreg Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 18.4 Billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2024 - 2030 |

| Report Pages | 350 |

| By Resins |

|

| By Process |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Solvay S.A., Hexcel Corporation, Axiom Materials, Inc., Teijin Limited, Royal TenCate N.V, Toray Group, GL Group, Gurit Holdings AG, Mitsubishi Rayon Co., Ltd., ZOLTEK Group |

| | Others |

The carbon fiber prepreg market was valued at $9.3 billion in 2023 and is estimated to reach $18.4 billion by 2030, exhibiting a CAGR of 10.2% from 2024 to 2030.

Increasing demand in aerospace and defense and growth in automotive sector are the drivers of Carbon Fiber Prepreg Market in the globe.

Toray Group, ZOLTEK Group, Hexcel Corporation, Mitsubishi Rayon Co., Ltd., GL Group, Royal TenCate N.V., Teijin Limited, Gurit Holdings AG, Axiom Materials, Inc., and Solvay S.A. are the top companies to hold the market share in Carbon Fiber Prepreg.

The aerospace and defense is the leading end-use industry of Carbon Fiber Prepreg Market.

Europe is the largest regional market for Carbon Fiber Prepreg.

Loading Table Of Content...