Carbon Monoxide Market Oulook - 2032

The global carbon monoxide market size was valued at $5.6 billion in 2022, and is projected to reach $8.2 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

Report Key Highlighters:

The carbon monoxide market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The carbon monoxide market is highly fragmented, with several players including Air Liquide, Air Products and Chemicals, Inc., American Gas Products, ATCO Atmospheric And Speciality Gases Private Limited., Axcel Gases, Celanese Corporation, Linde plc, Messer, Middlesex Gases & Technologies, Inc., and Sipchem Company.

Carbon monoxide (CO) is an odorless and colorless gas that consists of one carbon atom and one oxygen atom. It is produced by incomplete combustion, which is often associated with the burning of fossil fuels or gasoline. Carbon monoxide is difficult to detect without advanced tools since it is odorless and invisible. It is used as a reducing agent in metallurgical operations and in many other chemical reactions, including the synthesis of methanol.

The surge in the demand for organic and inorganic chemicals is poised to drive significant expansion in the carbon monoxide market size.

The market for carbon monoxide is significantly driven by the rise in demand for both organic and inorganic compounds. The increase in use of these chemicals in manufacturing, construction, and consumer goods, that reflects a growing global economy and technological advancements, as well as the expansion of industrial sectors such as pharmaceuticals, plastics, and textiles, drives the demand for both organic and inorganic chemicals. Furthermore, the demand for innovative materials in industries like electronics, automotive, and renewable energy technologies contribute to the growth.

Organic molecules, that consist of a broad range of substances such as polymers, acids, and alcohols, frequently require carbon monoxide as an essential component during their production. The synthesis of methanol, a vital organic compound widely used in the chemical industry, is a prime example. According to the Methanol Institute, global methanol production takes place in Asia, North and South America, Europe, Africa, and the Middle East. Approximately 90 methanol facilities globally produce about 110 million metric tons of methanol annually. A key component in the manufacture of methanol is carbon monoxide, which also serves as a precursor for other compounds including acetic acid and formaldehyde. Thus, rise in demand for organic and inorganic chemicals is expected to drive the growth of the carbon monoxide industry.

The rise in mining and metal extraction activities is poised to be a significant driver for the carbon monoxide market.

The rise in mining and metal extraction activities drives the growth of the carbon monoxide industry. The increased demand for metals globally, fueled by the growth of infrastructure, innovations in technology, and the growing need for minerals in renewable energy technologies, is the main driver for a surge in mining and metal extraction activities. According to the World Economic Forum, in July 2023, the Group of 20 (G20) leaders emphasized the importance of responsible, sustainable, and diversified supply chains for the energy transition, particularly for essential minerals. The mining and processing of metals like copper, aluminum, zinc, cobalt, lithium, and nickel that are needed for clean energy technologies whether for generation, transmission, or storage makes this especially important. In addition, the mining industry is experiencing increased activity due to growing commodity prices and economic expansion in emerging markets.

Carbon monoxide is an essential reducing agent in metallurgical operations that helps remove metals from their ores. Its common use is in the reduction of iron ore to produce steel and iron. Melted iron and carbon dioxide are produced in blast furnaces when carbon monoxide and iron oxides combine. The demand for carbon monoxide in metallurgical operations rises with the globe's increasing demand for steel, driven by the growth of infrastructure and industrial expansion, leading to the increase in carbon monoxide market trends.

Moreover, carbon monoxide serves as a reducing agent in many chemical reactions involved in the extraction of non-ferrous metals including copper and lead. For example, carbon monoxide converts copper oxide to elemental copper during the extraction of copper from copper oxide ores, increasing the operation's metallurgical efficiency. The need for non-ferrous metals is increasing due to industries like electronics, automotive, and renewable energy, which in turn is driving up the use of carbon monoxide in metal extraction processes. Thus, surge in use of carbon monoxide in mining and metal extraction activities is expected to boost the growth of the carbon monoxide market share during the forecast period.

The health problems associated with carbon monoxide exposure restrain carbon monoxide market forecast as it is a dangerous gas and have negative effects on human health. It is difficult to detect carbon monoxide without specific equipment as it is tasteless, odorless, and colorless. The main concern is that it attaches itself to hemoglobin in red blood cells more easily than oxygen, resulting in carboxyhemoglobin and a decrease in the blood's ability to carry oxygen. This might result in hypoxia, that would deprive essential tissues and organs of oxygen and could have dangerous effects on health. According to the Occupational Safety and Health Administration (OSHA), Permissible Exposure Limit (PEL) for CO is 50 parts per million (ppm). OSHA standards prohibit worker exposure to more than 50 parts of CO gas per million parts of air averaged during an 8-hour time period.

Symptoms including headaches, nausea, dizziness, and confusion may occur from an acute exposure to high quantities of carbon monoxide. Extended or increased exposure may result in more serious consequences, such as organ damage, coma, and in severe situations, death. The carbon monoxide market analysis shows that exposure to carbon monoxide may have detrimental consequences on vulnerable populations, including infants, the elderly, and people with pre-existing medical issues. Thus, health hazards on exposure to carbon monoxide hinders the carbon monoxide market growth.

The use of carbon monoxide as a preservative in the food and beverage industry has generated a significant opportunity for expansion for the carbon monoxide market. Modified atmospheric packaging (MAP), a commonly used technology to extend the shelf life and improve the appearance of fresh meat, especially red meat products like beef and lamb, uses carbon monoxide. In MAP, oxygen is replaced and the atmospheric conditions inside the sealed package are altered by introducing a carefully regulated mixture of gases, including carbon monoxide, into the packing.

Carbon monoxide's capacity to maintain fresh meat's color is a major benefit of utilizing it in MAP. A naturally occurring process known as oxymyoglobin oxidation occurs in meat in response to oxygen exposure, and the resultant production of metmyoglobin, a brownish color. People's perceptions of meat quality are impacted by this brown color as they frequently associate it with decreased freshness. By combining with oxymyoglobin, carbon monoxide, on the other hand, creates a stable molecule that stops metmyoglobin from converting and keeps fresh meat's desired dark red color. Customers are reassured of the product's freshness by this color stability, that also enhances the meat items' aesthetic appeal on the store shelf. Thus, increased use of carbon monoxide as a preservative in the food sector created lucrative growth opportunity for the expansion of the market.

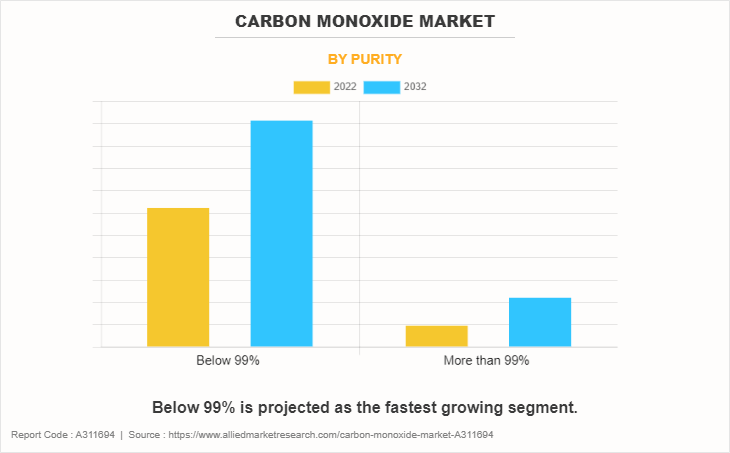

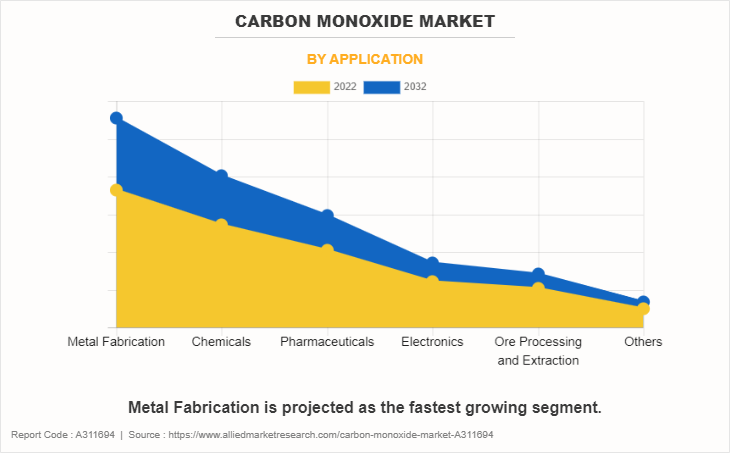

The carbon monoxide market is segmented based on purity, application, and region. By purity, the market is bifurcated into below 99% and more than 99%. On the basis of the application, it is categorized into metal fabrication, chemicals, pharmaceuticals, electronics, ore processing and extraction, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Carbon Monoxide Market By Purity

The Below 99% segment accounted for the largest share of in 2022 and is expected to register the highest CAGR of 4.2%. This can be attributed to the fact that below 99% segment encompassed versatile applications across industries, from manufacturing to healthcare. The demand surged due to its critical role in diverse processes, establishing it as a crucial component across sectors and contributing to its market dominance.

Carbon Monoxide Market By Application

The metal fabrication segment accounted for the largest share in 2022 and is expected to register the highest CAGR of 4.5%. The metal fabrication segment claimed the largest share in the carbon monoxide market, driven by extensive use in metallurgical processes. Its pivotal role in reducing metal oxides and producing alloys led to heightened demand, making it a cornerstone in the metal fabrication industry and consequently securing the dominant market share.

Carbon Monoxide Market By Region

Asia-Pacific garnered the largest share in 2022. Asia-Pacific dominated the market share due to rapid industrialization, robust economic growth, and increasing demand for carbon monoxide across diverse sectors. The region's manufacturing, chemical, and energy industries contributed significantly to the heightened consumption, positioning Asia-Pacific as the primary contributor to the overall market share.

The major players operating in the global carbon monoxide market are Air Liquide, Air Products and Chemicals, Inc., American Gas Products, ATCO Atmospheric And Speciality Gases Private Limited., Axcel Gases, Celanese Corporation, Linde plc, Messer, Middlesex Gases & Technologies, Inc., and Sipchem Company.

Other players include Al-Barrak Group Company, Butler Gas Products, Chengdu Taiyu Industrial Gases Co., Ltd., Gruppo SIAD, Gulf Cryo, LOTTE INEOS CHEMICAL CO.,LTD, NEXAIR, PT Samator Indo Gas Tbk., and Topsoe A/S.

Strategic developments undertaken by key players

In May 2023, Air Products and Chemicals, Inc. announced that it will construct, own, and run two new global carbon monoxide (CO) production plants in Texas. The total output of the La Porte and Texas City plants will exceed 70 million standard cubic feet per day (MMSCFD) and they will be connected to the largest CO pipeline network in the world, which is now located along Air Products' Gulf Coast. This expansion will increase the growth of the carbon monoxide market.

In December 2022, Air Liquide, that runs four production facilities at South Korea's Yeosu National Industrial Complex, recently signed a long-term contract to supply Kumho Mitsui Chemical (KMCI), a global leader in the chemical sector, with additional hydrogen and carbon monoxide. Through this agreement, Air Liquide can help KMCI expand its methyl diphenyl diisocyanate (MDI) production by 200,000 tons annually. Polyurethane for high-tech materials and insulation is made using this isomer.

In January 2021, Air Liquide and BASF SE signed a long-term contract in the Yeosu National Industrial Complex in South Korea to extend the terms of Air Liquide's existing agreements. Air Liquide increased the contractual volumes devoted to BASF by 20% by taking advantage of the start-up of its fourth hydrogen and carbon monoxide plant in this significant industrial complex in 2020. This agreement will boost the growth of the carbon monoxide market.

In July 2020, Linde plc announced the start-up of a state-of-the-art hydrogen and carbon monoxide plant in Clear Lake, Texas (TX), in addition to a new air separation unit in LaPorte, Texas. As per a long-term agreement previously announced, the facilities will provide Celanese with oxygen, nitrogen, and carbon monoxide; furthermore, the units will supply hydrogen to other consumers via Linde's U.S. Gulf Coast pipeline system. The new air separation unit is connected to Linde's nitrogen and oxygen pipeline network, providing Celanese and other surrounding clients with a secure and consistent supply of these gases.

Public Policies

Occupational Exposure Limits (OELs): Regulatory authorities establish permissible exposure limits to protect workers from the health hazards associated with carbon monoxide exposure in workplaces. OELs define the maximum allowable concentration of carbon monoxide in the air during a specified time.

Emission Standards: Environmental agencies set emission standards to control the release of carbon monoxide into the atmosphere from industrial processes, vehicles, and other sources. These standards aim to reduce air pollution and minimize the environmental impact of carbon monoxide emissions.

Safety Measures in Industries: Guidelines address the safe production, storage, and transportation of carbon monoxide in industries where it is used as a raw material or reducing agent. Safety protocols include measures to prevent leaks, ensure proper ventilation, and implement emergency response plans.

Hydrogen Production Regulations: As carbon monoxide is a key component in hydrogen production, regulations may focus on sustainable practices, carbon capture, and emissions reduction in the context of the clean energy transition.

International Standards: Harmonization of standards across countries and regions ensures a consistent approach to the use of carbon monoxide on a global scale. International organizations may play a role in developing and promoting standards for the safe handling and utilization of carbon monoxide.

Chemical Industry Compliance: Regulations address the inclusion of carbon monoxide in chemical synthesis processes, ensuring safe practices and adherence to industry-specific guidelines. Compliance measures may cover storage, handling, and transportation within the chemical manufacturing sector.

Monitoring and Reporting: Companies using carbon monoxide may be required to implement monitoring systems to track emissions and ensure compliance with established standards. Reporting requirements may include regular submission of data on carbon monoxide usage, emissions, and safety measures.

Research and Development Support: Regulatory frameworks may encourage research and development activities to explore innovative technologies that enhance the safety and sustainability of carbon monoxide use.

Public Awareness and Education: Regulations may include provisions for public awareness and education programs to inform stakeholders about the risks associated with carbon monoxide and best practices for safety.

Impact‐¯Of‐¯Russia‐¯Ukraine‐¯War‐¯On‐¯the Carbon Monoxide Market

Geopolitical tensions and conflicts may disrupt supply chains, affecting the production and transportation of raw materials, including those used in carbon monoxide production.

Uncertainty and geopolitical instability may lead to volatility in energy markets, impacting the cost of production and potentially influencing the pricing of carbon monoxide.

Geopolitical events may influence market confidence and investment decisions. Industries may reassess their strategies and investments, affecting the overall demand for carbon monoxide.

Geopolitical situations sometimes lead to changes in regulations or trade policies. These changes may impact the regulatory environment for the production, transportation, and use of chemicals, including carbon monoxide.

Widespread geopolitical conflicts may have broader economic consequences, potentially affecting global economic growth. Economic downturns or uncertainties can, in turn, influence industrial activities and demand for chemicals.

The geopolitical situation may prompt a reassessment of energy policies and accelerate or decelerate efforts toward sustainable and clean energy solutions, potentially impacting industries connected to these initiatives.

The overall sentiment in financial markets and industries may be influenced by geopolitical events. Confidence or uncertainty in the market can affect investment decisions and operational activities.

Geopolitical events may lead to fluctuations in currency values. Currency exchange rates can impact the cost of importing and exporting chemicals, potentially affecting the carbon monoxide market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carbon monoxide market analysis from 2022 to 2032 to identify the prevailing carbon monoxide market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the carbon monoxide market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global carbon monoxide market trends, key players, market segments, application areas, and market growth strategies.

Carbon Monoxide Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.2 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Purity |

|

| By Application |

|

| By Region |

|

| Key Market Players | Celanese Corporation, Air Liquide, middlesex gases & technologies, inc., Linde plc, ATCO Atmospheric And Speciality Gases Private Limited., Sipchem Company, Air Products and Chemicals, Inc., American Gas Products, Axcel Gases, Messer |

Analyst Review

According to the insights of the CXOs of leading companies, the global carbon monoxide market is poised for significant growth during the forecast period, driven by increase in demand for both organic and inorganic chemicals. The surge in mining and metal extraction activities, coupled with a substantial need for carbon monoxide across various end-use sectors such as pharmaceuticals, automotive, and plastic and polymer industries, is a key factor propelling market expansion. However, challenges such as health risks associated with carbon monoxide exposure and the unpredictability in feedstock material prices are restraining market growth.

The CXOs further added that the growing utilization of carbon monoxide as a preservative in the food and beverage industry offers lucrative opportunities for growth. Moreover, the industry is characterized by a high number of new market entrants that seek to tap lucrative opportunities in the global market while existing players enter strategic collaborations to increase capacities and expand their reach into emerging markets.

The global carbon monoxide market was valued at $5.6 billion in 2022, and is projected to reach $8.2 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032.

The leading applications of carbon monoxide are it is used as a reducing agent or raw material in metallurgy, fuel manufacturing, chemical industry, and other industries.

Technological advancements and rise in demand for sustainable energy solutions are the upcoming trends of carbon monoxide Market in the world.

Asia-Pacific is the largest regional market for carbon monoxide.

The major players operating in the global carbon monoxide market are Air Liquide, Air Products and Chemicals, Inc., American Gas Products, ATCO Atmospheric And Speciality Gases Private Limited., Axcel Gases, Celanese Corporation, Linde plc, Messer, Middlesex Gases & Technologies, Inc., and Sipchem Company.

Loading Table Of Content...

Loading Research Methodology...