Card Payments Market Research, 2033

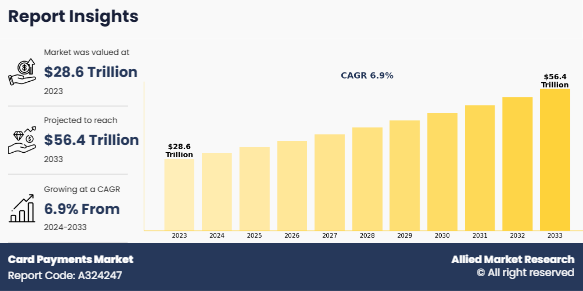

The global card payments market was valued at $28.6 trillion in 2023, and is projected to reach $56.4 trillion by 2033, growing at a CAGR of 6.9% from 2024 to 2033. The card payments market encompasses financial transactions made using credit, debit, and prepaid cards, facilitating seamless and secure payments for consumers and businesses globally. The card payments market is driven by the increasing shift toward digital transactions, fueled by internet penetration and smartphone adoption. The rise of e-commerce has further accelerated card usage, with businesses and consumers relying on secure payment methods for online purchases. In addition, contactless payment technologies, such as NFC and EMV chips, have gained traction, enabling faster and more convenient transactions. Governments worldwide are also promoting cashless economies through policies and financial inclusion programs, further boosting card payment adoption. Leading companies in the card payments industry include Visa, Mastercard, American Express, Discover, UnionPay, JPMorgan Chase, Bank of America, and Barclays, among others, who continue to innovate with security features, embedded AI, and digital wallet integrations to enhance the user experience.

The card payments market has experienced significant growth, with increasing consumer preference for cashless transactions driven by the expansion of e-commerce, digital banking, and fintech innovations. The adoption of contactless payments, fueled by NFC and EMV technologies, has further accelerated card payments industry expansion, especially in urban and high-frequency transaction environments. In addition, government initiatives promoting financial inclusion and digital payment infrastructures have strengthened the ecosystem, making card-based payments more accessible. Key players, including Visa, Mastercard, American Express, Discover, and UnionPay, alongside major financial institutions such as JPMorgan Chase, Bank of America, and Barclays, continue to invest in secure authentication technologies, AI-driven fraud prevention, and digital wallet integrations, ensuring a seamless and secure payment experience for businesses and consumers worldwide.

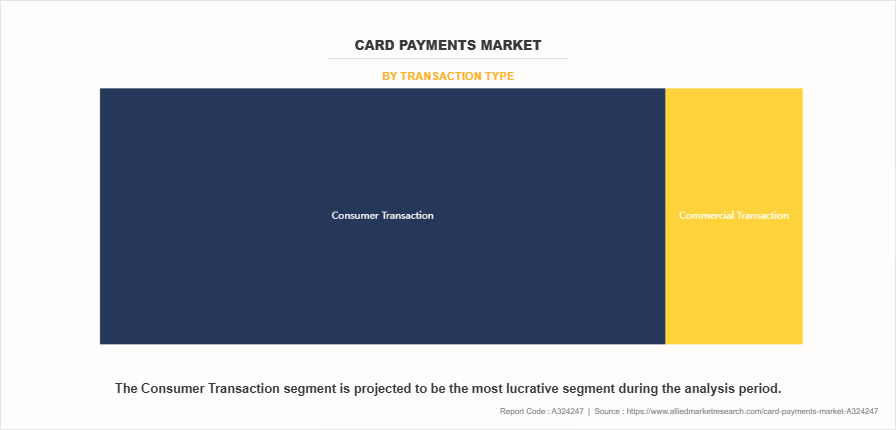

Based on transaction type, the consumer transaction segment dominated the card payments market share in 2023, primarily due to the widespread use of debit and credit cards for retail purchases, e-commerce payments, and daily expenses. The increasing adoption of contactless payments, digital wallets linked to cards, and government efforts to promote financial inclusion have further strengthened consumer card usage. In addition, the convenience, security, and rewards associated with consumer card payments have contributed to their strong card payments market position. However, commercial transactions are showing the highest growth rate during the forecast period, driven by the rising adoption of corporate credit cards, increasing business-to-business (B2B) digital payments, and the growing need for automated expense management solutions. In addition, advancements in real-time payment infrastructure, the integration of virtual cards for procurement and travel expenses, and regulatory support for transparent and efficient business transactions are further accelerating the growth of commercial card payments.

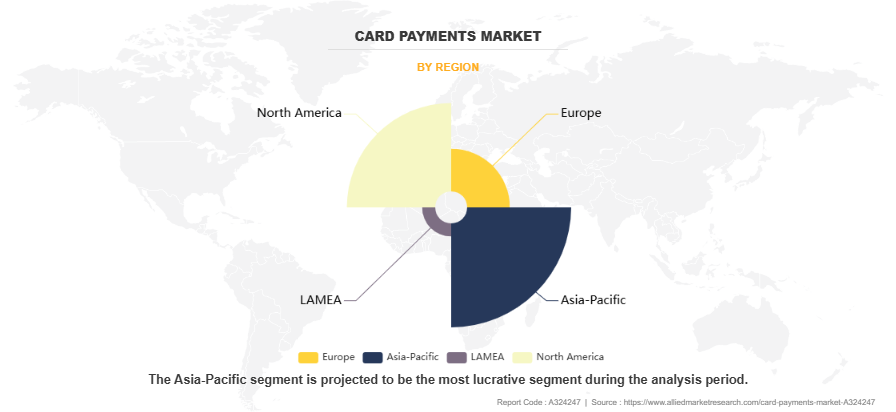

Based on region, Asia-Pacific is dominating the card payments market size, driven by a large unbanked population transitioning to digital banking, rising disposable incomes, increasing urbanization, and strong regulatory support for digital payment ecosystems in countries such as China, India, and Japan. The growing popularity of super apps, expanding digital banking services, and advancements in biometric authentication further boost the card payments market growth. Meanwhile, LAMEA is the fastest-growing region, driven by the rapid expansion of mobile payment solutions, growing remittance inflows, and government-backed financial literacy programs. The increasing collaboration between banks and fintech companies, coupled with the rise of digital-only banks, is accelerating the adoption of card payments across Latin America, the Middle East, and Africa.

The report focuses on the growth prospects, restraints, and trends of global card payments market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the global card payment market.

Segment review

The card payments market is segmented on the basis of card type, transaction type, and region. By card type, the card payments market is divided into debit card, credit card, and prepaid card. In terms of transaction type, the market is segmented into commercial transactions and consumer transactions. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The report analyzes profiles of key players operating in the card payments market such as Visa Inc., Mastercard Incorporated, American Express Company, Discover Financial Services, Barclays PLC, JPMorgan Chase & Co, Bank of America Corporation, UnionPay International, Citigroup Inc., Wells Fargo & Company, Capital One Financial Corporation, U.S. Bancorp, PNC Financial Services Group, Inc., Synchrony Financial, HSBC Holdings plc, Santander Group, Mitsubishi UFJ Financial Group, Inc., BNP Paribas, Royal Bank of Canada, and Australia and New Zealand Banking Group. These players have adopted various strategies to increase their market opportunity and strengthen their position during the card payments market forecast.

Market Landscape and Trends

The card payments market outlook is undergoing rapid transformation driven by digitalization, evolving consumer preferences, and regulatory shifts. The increasing adoption of contactless payments, fueled by advancements in NFC and EMV technology, has significantly enhanced transaction speed and security. Mobile wallets such as Apple Pay, Google Pay, and Samsung Pay are further boosting card-based digital transactions. The growth of e-commerce and online banking has led to a surge in credit and debit card transactions, with businesses integrating secure payment gateways to facilitate seamless digital payments. Moreover, the rise of Buy Now, Pay Later (BNPL) services is reshaping consumer credit, offering alternatives to traditional card-based lending. Regulatory initiatives such as PSD2 in Europe and the Federal Reserve’s push for real-time payments in the U.S. are encouraging competition and security enhancements in the industry. Additionally, financial institutions are leveraging AI, blockchain, and biometric authentication to reduce fraud and enhance payment security. The card payments market is also witnessing increased adoption of virtual and prepaid cards for corporate and individual use, catering to security-conscious consumers. As digital infrastructure expands, the card payments market is expected to maintain strong growth, driven by financial inclusion efforts and emerging fintech solutions.

Top Impacting Factors

Rise in E-commerce Transactions

The rapid growth of e-commerce is a major driver of the card payments market, as consumers increasingly prefer online shopping over traditional retail. The convenience of digital transactions, combined with the availability of multiple payment options, has fueled this trend. Payment cards, including credit, debit, and prepaid cards, are widely used for e-commerce purchases due to their security, ease of use, and integration with digital wallets. In addition, the rise of global e-commerce platforms, cross-border trade, and buy now, pay later (BNPL) services has further boosted card transactions. As more businesses shift to online models, the demand for secure and efficient digital payment solutions continues to grow.

Government Initiatives for Cashless Economy

Governments worldwide are actively promoting cashless economies through regulatory frameworks, incentives, and infrastructure development. Policies encouraging digital payments, including tax benefits, subsidies, and mandatory digital transaction requirements, have accelerated card adoption. Countries like India, China, and Sweden have implemented large-scale digital payment programs, reducing reliance on cash. Furthermore, the expansion of real-time payment networks and central bank digital currencies (CBDCs) is strengthening the digital payment ecosystem. By supporting financial inclusion and transparency, government initiatives are driving the widespread use of card payments across various sectors.

Advancements in Payment Technology

Innovations in payment technology are revolutionizing the card payments market, making transactions more secure and efficient. Contactless payments, EMV chip technology, and biometric authentication have enhanced user convenience while minimizing fraud risks. In addition, tokenization and encryption ensure data security, reducing the chances of cyberattacks. The integration of artificial intelligence (AI) in fraud detection and blockchain technology for transaction transparency is further strengthening the payment infrastructure. Digital wallets, mobile payments, and embedded finance solutions are also reshaping consumer behavior, making card-based transactions more seamless and widely accepted in both online and offline markets.

Cybersecurity Risks and Fraudulent Activities

Despite advancements in security, the card payments market faces significant challenges related to cybersecurity threats and fraudulent activities. Data breaches, phishing attacks, and identity theft pose substantial risks to consumers and businesses. Fraudsters continuously develop new techniques, such as card skimming, account takeovers, and synthetic identity fraud, to exploit vulnerabilities in payment systems. The financial losses from cyber fraud are rising, forcing banks and payment providers to invest heavily in fraud prevention measures. However, maintaining a balance between security and user convenience remains a challenge, as overly complex authentication processes may deter card usage.

High Transaction Fees and Interchange Costs

One of the key restraints in the card payments market is the high transaction fees and interchange costs, which impact merchants, especially small businesses. Payment networks and issuing banks charge fees for processing transactions, which can reduce profit margins for retailers. In some cases, businesses pass these costs onto consumers, making card payments less attractive compared to alternative payment methods such as direct bank transfers or digital wallets. Regulatory interventions, such as interchange fee caps in the European Union, have attempted to address this issue, but challenges remain in regions where such regulations are not enforced. The need for cost-effective payment solutions continues to drive discussions on reducing transaction fees.

Expansion in Emerging Markets

Emerging markets present significant opportunities for the growth of the card payments market due to increasing financial inclusion and digital adoption. In regions such as Asia-Pacific, Latin America, and Africa, the rise of mobile banking, fintech innovations, and government-led financial literacy programs is accelerating card adoption. The availability of low-cost digital payment solutions, partnerships between banks and fintech companies, and expanding point-of-sale (POS) infrastructure are further supporting growth. In addition, the increasing penetration of smartphones and internet connectivity is enabling millions of unbanked individuals to access digital financial services. As cashless economies expand, the demand for card-based transactions is expected to rise significantly in these regions.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the card payments market analysis from 2023 to 2033 to identify the prevailing card payments market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the card payments market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global card payments market trends, key players, market segments, application areas, and market growth strategies.

Card Payments Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 56.4 trillion |

| Growth Rate | CAGR of 6.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 300 |

| By Card Type |

|

| By Transaction Type |

|

| By Region |

|

| Key Market Players | Royal Bank of Canada, American Express Company, BARCLAYS PLC, Santander Group, Citigroup Inc., Wells Fargo & Company, Visa Inc., Bank of America Corporation, Australia and New Zealand Banking Group, HSBC Holdings plc, Mitsubishi UFJ Financial Group, Inc., Discover Financial Services, JPMorgan Chase & Co, BNP Paribas, PNC Financial Services Group, Inc., U.S. Bancorp, Capital One Financial Corporation., UnionPay International, Mastercard Incorporated., Synchrony Financial |

Analyst Review

The card payment market is experiencing rapid growth, driven by increasing digitalization, evolving consumer behavior, and supportive regulatory frameworks. Credit cards currently dominate the market due to their convenience, cashback rewards, and integration with digital wallets, while prepaid cards are witnessing the fastest growth, particularly among the unbanked and underbanked populations. These cards are becoming crucial for payroll distribution, government assistance programs, and financial inclusion initiatives. Region wise, Asia-Pacific leads the market, supported by high smartphone penetration, government-led digital payment policies, and a booming e-commerce ecosystem in countries like China, India, and Japan. On the other hand, LAMEA is the fastest-growing region, fueled by rise in fintech adoption, financial inclusion efforts, and increase in number of cross-border transactions.

The industry's growth is further accelerated by advancements in contactless payments, AI-driven fraud prevention, and fintech partnerships that enhance transaction security and efficiency. However, challenges such as cybersecurity threats, high transaction costs, and regulatory compliance complexities remain key concerns for stakeholders. To stay competitive, leading companies like Visa, Mastercard, American Express, and UnionPay are focusing on expanding into emerging markets, integrating AI-powered solutions, and strengthening digital payment ecosystems. As the market evolves, the emphasis on secure, seamless, and inclusive payment solutions will shape its future, offering significant opportunities for innovation and investment.

The growing preference for contactless payments, mobile wallets, and embedded finance solutions is reshaping the card payment ecosystem. The widespread adoption of NFC-enabled payments, biometric authentication, and blockchain-based security is enhancing the safety and convenience of transactions. In addition, the rise of buy now, pay later (BNPL) solutions integrated with credit cards is further driving market expansion. Consumers are increasingly seeking personalized financial products, pushing financial institutions and fintech companies to develop AI-driven insights, real-time transaction monitoring, and tailored reward programs to enhance customer engagement. The shift toward digital-first banking solutions is also encouraging businesses to adopt virtual cards and tokenized payment methods for greater security and efficiency.

Despite these advancements, the industry faces regulatory challenges, data privacy concerns, and the need for robust fraud prevention mechanisms. Governments worldwide are introducing stringent compliance regulations to protect consumers and ensure transaction security, increasing the complexity for financial service providers. However, this also presents an opportunity for RegTech solutions that leverage AI and automation to simplify compliance processes. As global economies continue their transition toward cashless societies, the success of the card payment market will depend on innovation, security enhancements, and strategic collaborations between traditional financial institutions, fintech firms, and regulatory bodies to create a more inclusive, efficient, and resilient payment ecosystem.

The Card Payments Market is estimated to grow at a CAGR of 6.9% from 2024 to 2033.

The Card Payments Market is projected to reach $56.4 trillion by 2033.

The Card Payments Market is expected to witness notable growth, including government initiatives for a cashless economy, increasing e-commerce transactions, and advancements in payment technology.

The key players profiled in the report include include Visa Inc., Mastercard Incorporated, American Express Company, Discover Financial Services, Barclays PLC, JPMorgan Chase & Co, Bank of America Corporation, UnionPay International, Citigroup Inc., Wells Fargo & Company, Capital One Financial Corporation, U.S. Bancorp, PNC Financial Services Group, Inc., Synchrony Financial, HSBC Holdings plc, Santander Group, Mitsubishi UFJ Financial Group, Inc., BNP Paribas, Royal Bank of Canada, and Australia and New Zealand Banking Group.

The key growth strategies of Card Payments market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...