Cardiovascular Prosthetic Devices Market Research, 2031

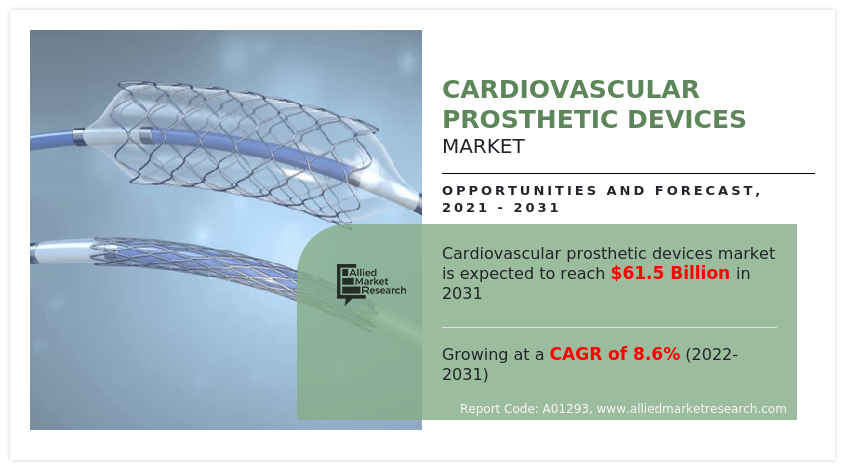

The global cardiovascular prosthetic devices market was valued at $26,937.8 million in 2021 and is estimated to reach $61,469.8 million by 2031, growing at a CAGR of 8.6% from 2022 to 2031.Cardiovascular prosthetic devices are implantable or external devices that replace or assist parts of the cardiovascular system, such as the heart, arteries, or veins. Examples of cardiovascular prosthetic devices include pacemakers, implanted heart valves, artificial vascular grafts, and stents. These devices significantly improve quality of life and are normally installed by a heart surgeon. They are also used to treat a number of cardiac conditions, including valvular heart disease, congenital heart defects, arrhythmias, coronary artery disease, and heart failure. Aortic aneurysm repair, valve replacement, endovascular stenting, ventricular assist devices, transcatheter aortic valve replacement (TAVR), and other procedures all involve these cardiovascular prosthetic devices.

Historical overview

The prosthetic heart valves market size was analyzed qualitatively and quantitatively from 2021 to 2031. The prosthetic heart valves market experienced growth at a CAGR of around 11.1% from 2022 to 2031. Most of the growth during this period was derived from North America owing to the rise in the number of cardiovascular prosthetic devices industry who manufacture cardiovascular prosthetic devices, increase in disposable incomes, and the well-established presence of domestic companies in the region.

Market Dynamics

Growth of the global cardiovascular prosthetic devices market is majorly driven by rise in the number of cardiovascular surgeries, increase in the prevalence of cardiovascular disorders,increase in number of cardiovascular prosthetic devices industry and rise in number of product launch and product approvals. Rise in the number of populations suffering from cardiovascular diseases increases the number of cardiac surgeries. This factor is anticipated to drive the application of cardiovascular prosthetic devices and boosts the cardiovascular prosthetic devices market growth. Cardiovascular prosthetic devices are artificial implants used to help support the heart and its functions. They may be used to replace damaged heart valves, help divert blood flow, or assist with cardiac pacing and other functions. These devices are typically implanted by a cardiac surgeon and can have a significant impact on quality of life. They may be used to treat a variety of cardiac diseases, such as congenital heart defects, arrhythmias, coronary artery disease, heart failure, and valvular heart disease. Thus, rise in prevalence cardiovascular diseases is anticipated to drive the growth of market. For instance, according to report shared by Center for Disease Control and Prevention (CDC), in 2020, it was stated that, coronary heart disease is the most common type of heart disease, killing 382,820 people in U.S. Moreover, in 2020, about 2 in 10 deaths from coronary artery disease (CAD) happen in adults less than 65 years old.

Cardiovascular prosthetic devices are used in different types of cardiac surgeries such as coronary artery bypass grafting (CABG), valve replacement, aortic aneurysm repair, endovascular stenting, ventricular assist devices, transcatheter aortic valve replacement (TAVR), transcatheter mitral valve repair (TMVR) percutaneous transcatheter aortic valve implantation (PTAVI), transcatheter tricuspid valve repair (TTVR), left atrial appendage closure (LAAC), transcatheter mitral valve replacement (TMVR), percutaneous pulmonary valve implantation (PPVI), transcatheter pulmonary valve replacement (TPVR), endovascular aortic aneurysm repair (EVAR). Increase in number of cardiovascular surgeries is anticipated to drive the application of cardiovascular prosthetic devices and boosts market growth. For instance, according to National Library of Medicine in September 2022, it was reported that, more than 200,000 heart valve replacement surgeries are performed annually worldwide, with a predicted increment to 8,50,000 per year by 2050. In addition, according to National Library of Medicine in August 2022, almost 400,000 coronary artery bypass grafting (CABG) surgeries are performed each year making it the most-performed major surgical procedure.

Moreover, cardiovascular diseases are the leading cause of death globally. Hypertension and obesity are two of the major risk factors for cardiovascular diseases. Hypertension, or high blood pressure, puts extra strain on the heart and can lead to heart attack, stroke, and other complications. Obesity, on the other hand, increases the risk of developing hypertension, high cholesterol, and other health problems that can lead to heart disease. Both hypertension and obesity are associated with increased levels of inflammation, which can damage the heart, increase the risk of atherosclerosis (hardening of the arteries), and increase the risk of developing other serious cardiovascular diseases. This factor is anticipated to drive the number of cardiovascular surgeries and fuels market growth.

On the other hand, the growth of the cardiovascular prosthetic devices market share is anticipated to be constrained by the high cost of cardiovascular prosthetic devices and cardiovascular surgeries. Cardiovascular prosthetic devices are costly and may not be affordable for many people, especially in low- and middle-income countries. In addition, high cost of heart valve replacement surgery is anticipated to restrain the growth of the market. For instance, the average cost of heart valve replacement surgery ranges from $6,200 to $8,200. The cost is dependent on the kind of valve used i.e., mechanical or tissue valve. Moreover, risk of complications associated with the implantation of cardiovascular prosthetic devices, including infection, stroke, and death and lack of skilled personnel and trained clinicians in the field of cardiovascular prosthetics can be a barrier to providing good quality care. This factor is anticipated to hinder the growth of cardiovascular prosthetic devices.

The COVID-19 pandemic has significant impact on the cardiovascular prosthetic devices market. The disruption to supply chains and healthcare systems has caused delays in the availability of cardiovascular prosthetic devices and has also led to an increase in the cost of these devices. In addition, the pandemic has caused a decrease in the volume of surgeries that require the use of cardiovascular prosthetic devices, as many hospitals postponed elective surgeries to focus on treating COVID-19 patients. This has resulted in a decrease in the demand for these devices. Thus, this factor is anticipated to have a negative impact on the cardiovascular prosthetic devices market. For instance, according to a report shared by National Library of Medicine in March 2022, it was stated that, there was a 52.7% reduction in adult cardiac surgery volume and a 65.5% reduction in elective cases in the U.S.

In addition, according to the Journal of Arrhythmia, it was reported that, there is a reduction in the pacemaker implantation procedure by 73% was observed during the COVID-19 pandemic period.

On the other hand, post-pandemic impact of COVID-19 on the cardiovascular prosthetic devices market is positive owing to rise in the number of cardiovascular surgeries and increase in the number of consultations for cardiac disorders. Additionally, the pandemic is expected to drive the adoption of digital health solutions, such as telehealth, remote patient monitoring, and artificial intelligence-based diagnostics, which could lead to an increase in the numbers of diagnosis of patients suffering from cardiovascular diseases. This factor is anticipated boost the growth of the cardiovascular prosthetic devices market.

Segmental Overview

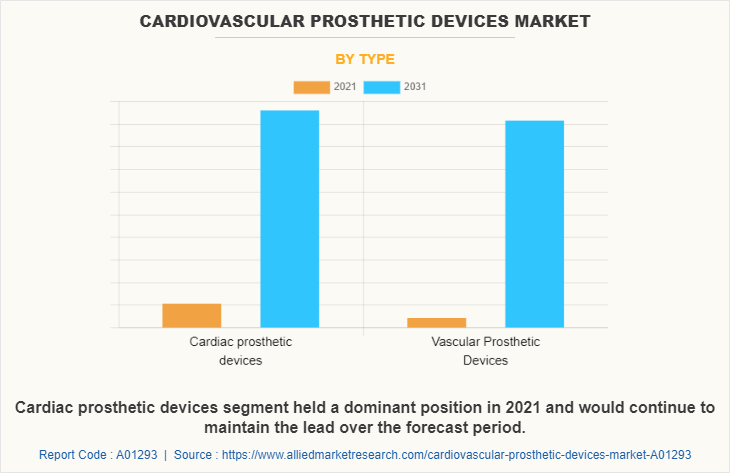

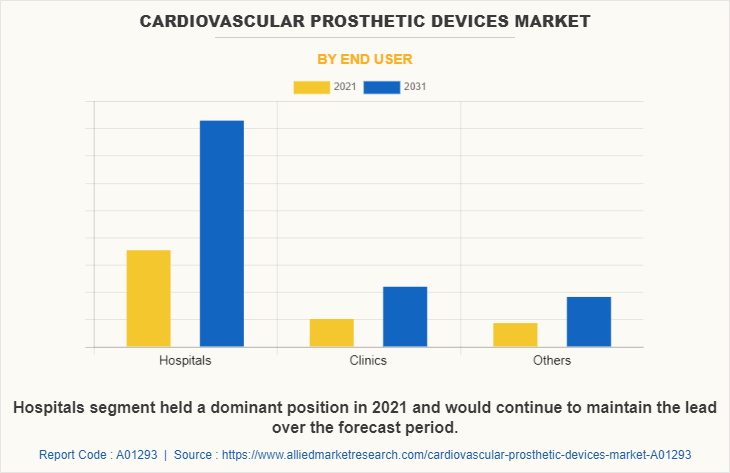

The cardiovascular prosthetic devices market share is segmented into Type, End User, and Region. On the basis of type the market is segmented into cardiac prosthetic devices and vascular prosthetic devices. Cardiac prosthetic devices include prosthetic heart valves, pacemaker, ventricular assist devices and others. Others include annuloplasty rings, synthetic sutures, tissue patches. Vascular prosthetic devices include stents, synthetic grafts, and others. Others includes patches, vascular clip, and vascular embolization device. On the basis of end users the market is segmented into hospital, clinics, and others. Others includes cardiac centers and ambulatory surgical centers On the basis of region; the market is analyzed across North America(U.S., Canada, Mexico), Europe (Germany, France, UK, Italy, Spain and Rest of Europe), Asia-Pacific(Japan, China, India, Australia, South Korea and Rest of Asia Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa and Rest of LAMEA).

On the basis of type, the market is segmented into cardiac prosthetic devices and vascular prosthetic devices. The vascular prosthetic devices segment dominated the market in 2021 and is expected to continue this trend during the forecast period, owing to rise in number of product launch and products approvals for drug-eluting stents and increase in number of companies that manufactures coronary stents.

On the basis of end user, the market is divided into hospitals, clinics, and others. The hospitals segment dominated the market in 2021 and is expected to continue this trend during the cardiovascular prosthetic devices market forecast period, owing to rise in expenditure by the government to develop healthcare infrastructure and increase in number of numbers of populations suffering from cardiovascular diseases.

North America cardiovascular prosthetic devices market size is expected to grow during the forecast period owing to rise in the number of populations suffering from cardiovascular diseases such as arrhythmias, heart valve disease, and other structural heart defects. Thus, rise in number of cardiovascular diseases cause increase in number of cardiovascular surgeries. This factor is anticipated to increase the application of prosthetic devices and drives the market growth. For instance, according to Center for Disease Control and Prevention (CDC), it was reported that, around 20.1 million adults aged 20 years and older have coronary artery disease (CAD). Moreover, according to the American Heart Association (AHA), in 2019, it was also reported that around 40% of the U.S population between the age of 40 to 59 years are diagnosed with cardiovascular disease.

Asia-pacific cardiovascular prosthetic devices market size is expected to witness growth during the forecast period owing to increase in prevalence of coronary and peripheral artery disease and rise in number of geriatric populations are the major factors responsible for growth of the market. For instance, according to the United Nations Population Fund (UNFPA), geriatric population in Asia-Pacific is anticipated to increase by three-fold reaching 1.3 billion by 2050. The geriatric population is more prone to develop coronary artery diseases, owing to aging, which causes weakening of blood vessels and muscles of heart; thereby, supporting regional growth.

Moreover, rise in number of cardiovascular surgeries such as stent implantation procedures drive growth of the market. According to the American Heart Association (AHA), in 2019, it was reported that around 4.5 lakh patients undergo angioplasty, each year, in India. Moreover, the region has the potential to adopt stent implant system, owing to increase in number of population and rise in prevalence of ischemic heart diseases, which propels the market growth.

COMPETITION ANALYSIS

Some of the major companies that operate in the global cardiovascular prosthetic devices market include Abbott Laboratories, B. Braun Melsungen, Medtronic, Edwards Lifesciences, Boston Scientific, Johnson & Johnson, Artivion, Inc., Biotronic, Meril Life Sciences Pvt. Ltd. and W. L. Gore & Associates, Inc.

Some examples of product approval in the market

In September 2021, Abbott Laboratories, a pharmaceutical and medical equipment manufacturing company announced that the U.S. Food and Drug Administration (FDA) has approved the company's Epic Plus and Epic Plus Supra Stented Tissue Valves to improve therapy options for people with aortic or mitral valve disease.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cardiovascular prosthetic devices market analysis from 2021 to 2031 to identify the prevailing cardiovascular prosthetic devices cardiovascular prosthetic devices market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cardiovascular prosthetic devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cardiovascular prosthetic devices market trends, key players, market segments, application areas, and market growth strategies.

Cardiovascular Prosthetic Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 61.5 billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 248 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Meril Life Sciences Pvt. Ltd., Abbott Laboratories, B Braun Melsungen AG, W. L. Gore & Associates, Inc., Edwards Lifesciences, Biotronic, Medtronic plc, Artivion, Inc., Johnson and Johnson, Boston Scientific Corporation |

Analyst Review

Cardiovascular prosthetic devices are medical devices that are used to replace or supplement damaged or missing heart tissue. These can be used to replace a damaged heart valve, divert blood flow, or assist with cardiac pacing and other functions. The devices are typically implanted by a cardiac surgeon and can have a significant impact on quality of life.

Increase in the number of product launches and product approvals for cardiovascular prosthetic devices and rise in the number of adoption of strategies such as collaboration, acquisition, and partnership by market players drive the market growth. For instance, in September 2021, Abbott Laboratories, pharmaceutical and medical equipment manufacturing company, announced that the U.S. Food and Drug Administration (FDA) has approved Epic Plus and Epic Plus Supra Stented Tissue Valves of the company to improve therapy options for people with aortic or mitral valve disease.

The top companies that hold the market share in Cardiovascular Prosthetic Devices Market market are Abbott Laboratories, B. Braun Melsungen, Medtronic, Edwards Lifesciences, Boston Scientific, Johnson & Johnson, Artivion, Inc., Biotronic, Meril Life Sciences Pvt. Ltd. and W. L. Gore & Associates, Inc.

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to rise in expenditure by government organization to develop the healthcare sector, increase in the prevalence of cardiac diseases and increase in the number of geriatric populations.

The key trends in the Cardiovascular Prosthetic Devices Market market are rise in number of product launches and product approvals for cardiovascular prosthetic devices and increase in prevalence cardiac diseases

The base year for the report is 2021.

Yes, Cardiovascular Prosthetic Devices Market companies are profiled in the report

The total market value of Cardiovascular Prosthetic Devices Market market is $26,937.8 million in 2021 .

The forecast period in the report is from 2022 to 2031

The market value of Cardiovascular Prosthetic Devices Market market in 2022 was $29,227.6 million

Loading Table Of Content...