Cargo Insurance Market Research, 2032

The global cargo insurance market size was valued at $71.4 billion in 2022, and is projected to reach $106 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032. Insurance for goods that are transported between locations is known as cargo insurance. Cargo insurance is used to protect the cargo against financial losses that may occur during transport of cargo via land, air, or marine transportation.

The cargo insurance policy offers various coverage options such as damage caused to the cargo due to natural calamities, vehicle accidents, piracy, war, and others. Having cargo insurance is extremely important as cargo insurance reduces financial liability and incurs the damage caused to cargo or shipment. The rising popularity of cargo insurance can be attributed to its ability to offer protection from financial loss due to the loss of damaged cargo. Land cargo insurance is basically used for domestic cargo as it is used for shipping cargo within a country. Also, the popularity of air cargo transport is increasing across the world. This is because annually air cargo transports over $6 trillion worth of goods which accounts for approximately 35% of the world trade by value.

According to the International Chamber of Shipping, the leading shipping organization, states that every year 11 billion tons of goods are transported by ship. European Union shipping accounted for 80% of total export and import in 2019 by volume. Also, the annual shipping trade reached more than $14 trillion in 2019. Such high volume of cargo being shipped across countries has led to an increase in the demand for cargo insurance as it protects the cargo from the risk of damage, theft, or loss of goods during transit. For instance, rise in international trade and logistics, with an increase in the volume of cargo being shipped via airplanes, ships, trains, or trucks needs to be protected from natural disasters, accidents, delays, and other damages. In such cases, the cargo insurance plays a major role in compensating the owner of cargo for any financial losses incurred during the shipment of goods. Also, legal compliance issued across several countries requires businesses to have cargo insurance to comply with the custom regulations.

Lack of technical expertise and rising risk of cybersecurity threats, piracy, and terrorism require insurance providers to continually assess and adapt their coverage offerings. This is one of the major factors anticipated to restrain the cargo insurance market growth. The advancement of technologies, such as autonomous vehicles and drones, introduces new risks and challenges in insuring cargo transportation. Insurance companies need to stay abreast of emerging risks and develop innovative solutions to address evolving technological landscapes. The understanding and perception of cargo insurance coverage can vary among stakeholders in the supply chain. Some shippers and businesses may underestimate the risks involved or have misconceptions about their existing coverage. All these factors are projected to hamper the market revenue growth during the forecast period.

The logistics transportation sector has expanded owing to rising e-commerce and online shopping trends. The likelihood of mishaps, luggage theft or loss, and other occurrences of uncertainty while travelling have increased along with the demand for e-commerce. In order to reduce the risks brought on by such occurrences, consumers are choosing cargo insurance. The growth of e-commerce and the increasing importance of last-mile delivery create opportunities for cargo service providers, technology companies, and insurance providers. Insurers can develop tailored insurance solutions to address the unique risks associated with last-mile delivery, such as theft, accidents, and liability issues. By understanding the evolving needs and challenges of the e-commerce sector, insurance providers can support businesses in managing risks and ensuring smooth last-mile delivery operations. Integration of tracking systems, mobile applications, and real-time communication platforms allows customers to track their deliveries, receive notifications, and provide feedback. Delivery personnel benefit from optimized routes, digital proof of delivery, and tools for efficient task management.

The key players profiled in this report include Allianz, AXA, Aon PLC, American International Group Inc, Arthur J. Gallagher & Co., Chubb, Lloyd's, Marsh LLC, Zurich Insurance Group Ltd, and Lockton Companies. Investment and agreement are common strategies followed by major market players. For instance, on June 13, 2023, the Property & Inland Marine Division of Great American Insurance Group announced the introduction of Cargo AdvantageSM, a comprehensive motor truck cargo product that offers extensive protection against risks that are specific to the transportation of cargo.

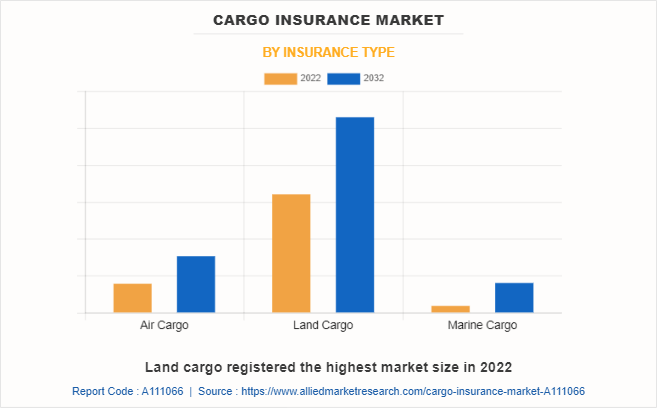

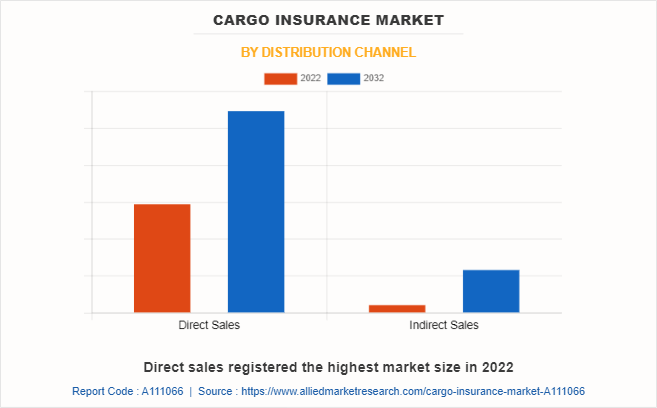

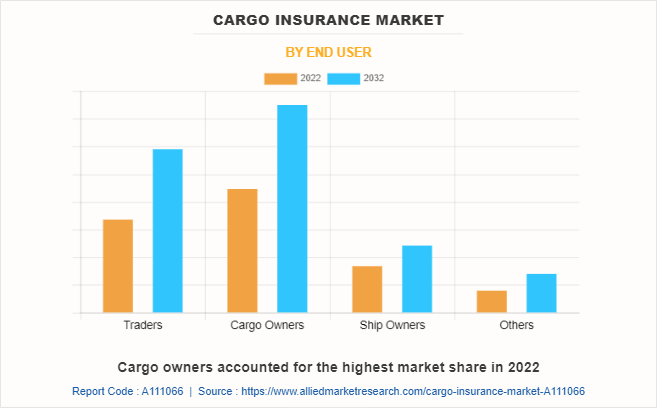

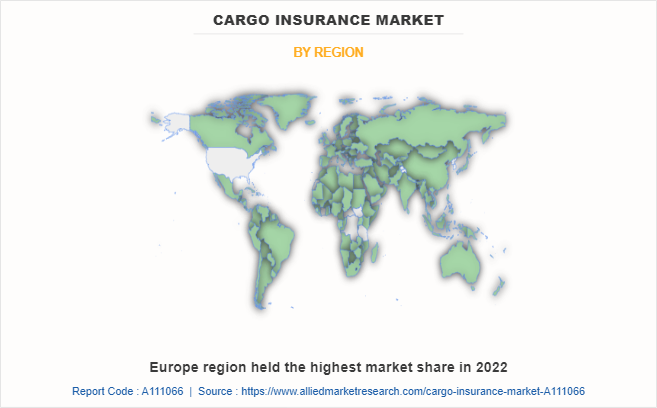

The market is segmented on the basis of insurance type, distribution channel, end user, and region. By insurance type, the market is divided into air cargo, land cargo, and marine cargo. By distribution channel, the market is classified into direct sales and indirect sales. By end user, the market is classified into traders, cargo owners, ship owners, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

The cargo insurance market is segmented into End User, Insurance Type and Distribution Channel.

By insurance type, the land cargo sub-segment dominated the market in 2022. Land cargo insurance is subject to various regulatory requirements, including compliance with transportation regulations, customs regulations, and insurance regulations specific to the country or region. Insurers need to stay updated with these regulations and ensure compliance to provide adequate coverage to their clients. Efficient claims management is essential in the land cargo segment. Insurers must have robust claims handling processes to assess and process claims promptly. Timely settlement of claims is crucial to maintaining client satisfaction and ensuring the smooth flow of goods within the supply chain. Cargo insurance providers often collaborate with transporters, logistics providers, and other stakeholders under the land cargo insurance type. These partnerships help insurers gain insights into the specific risks and challenges faced in land transportation and develop tailored insurance solutions to address them. These are predicted to be the major factors boosting the cargo insurance market opportunities during the forecast period.

By distribution channel, the direct sales sub-segment dominated the global market share in 2022. Direct sales generate valuable data and insights for insurance companies. By analyzing customer data, insurers can gain a deeper understanding of customer behavior, preferences, and risks. These insights can inform product development, pricing strategies, and risk management practices. Online channels and digital platforms are frequently used to facilitate direct sales in the market. Insurance companies provide self-service websites or portals where customers can request quotes, buy policies, manage their coverage, and submit claims. Customers benefit from these platforms' convenience, accessibility, and simplified purchasing process. Customers can see the cost breakdown and choose the coverage options that best fit their budget when they buy directly. Customers can make informed decisions because insurers provide detailed information on premium rates, deductibles, and coverage limits upfront.

By end user, the cargo owners sub-segment dominated the global cargo insurance market share in 2022. Cargo owners may include manufacturers, wholesalers, retailers, exporters, importers, or individuals shipping personal belongings. Cargo owners prefer safe and timely delivery of the goods and seek insurance coverage to mitigate the risks associated with transportation. Cargo insurance policies typically cover physical loss or damage to the goods caused by risks such as accidents, theft, fire, natural disasters, and other unforeseen events. The coverage can be tailored based on the specific needs of the cargo owner, including the type of goods, mode of transportation, and geographical coverage. Cargo owners review the terms and conditions of the insurance coverage offered by insurance providers. This includes understanding coverage limits, deductibles, exclusions, and claims procedures. Cargo owners ensure that the insurance policy meets their requirements and adequately covers the risks associated with the transportation of their goods.

By region, Europe dominated the global market in 2022 and is projected to be the fastest-growing region during the forecast period. Europe's economic output and employment are heavily reliant on the maritime industry. Therefore, marine insurance is required for ship owners transporting goods by sea in order to mitigate business risks. Several ships and cargo owners in this region purchase marine insurance to protect themselves from liabilities arising from the cargo they care for and handle. Cargo ship owners can obtain freight liability insurance through marine insurance to cover such duties in Europe.

Furthermore, whether delivered domestically or internationally, marine companies are responsible for transporting goods that require insurance to cover loss or damage during transit. Experts in maritime insurance and experienced risk managers provide customers with advice, information, and assistance while they are abroad. Europe has a vibrant insurtech ecosystem, with numerous startups developing innovative solutions for the insurance industry.

Impact of COVID-19 on the Global Cargo Insurance Industry

- The COVID-19 pandemic led to new risks and uncertainties in the market. Supply chain disruptions, delays, and the potential for cargo damage or loss due to disruptions in transportation networks, port closures, or reduced operational capacities posed challenges for insurance providers in evaluating and managing risks effectively.

- The pandemic resulted in a higher number of insurance claims and increased loss ratios in the cargo insurance sector. Cargo shipments faced delays, damage, or loss due to lockdowns, reduced staffing, and operational challenges. The increased claims activity and potentially higher claim payouts posed pressure on the profitability of cargo insurance providers.

- The COVID-19 led to the need for insurance providers to reassess and adapt their risk models and coverage offerings to account for future pandemic-related risks and uncertainties. Thus, disruptions in the supply chain, transportation & logistics, and a decline in the volume of cargo being shipped have affected the cargo insurance industry demand during the pandemic.

Key Benefits For Stakeholders

- The report provides exclusive and comprehensive analysis of the global cargo insurance market trends along with the cargo insurance market forecast.

- The report elucidates the cargo insurance market segmentation along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the cargo insurance market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the cargo insurance market demand.

Cargo Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 106 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 290 |

| By End User |

|

| By Insurance Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Chubb, Lockton Companies, LLC, MARSH LLC., Lloyd’s, American International Group, Inc., Allianz SE, Arthur J. Gallagher & Co., Aon plc., AXA, Zurich Insurance Group Ltd |

The cargo insurance market is evolving to adapt to changing needs and advancements in technology. For example, there is a rising interest in insurtech solutions that leverage data analytics, IoT (Internet of Things) devices, and blockchain to streamline claims processing, enhance risk assessment, and provide real-time tracking of cargo. This is one of the major driving factors projected to create opportunities in the market.

The major growth strategies adopted by cargo insurance market players are investment and agreement.

Asia-Pacific is projected to provide more business opportunities for the global cargo insurance market in the future.

Allianz, AXA, Aon PLC, American International Group Inc, Arthur J. Gallagher & Co., Chubb, Lloyd's, Marsh LLC, Zurich Insurance Group Ltd, and Lockton Companies are the major players in the cargo insurance market.

The rising application of cargo insurance across the international trade & logistics, shipping sector, and specialty cargo sector is anticipated to drive the cargo insurance market growth.

Cargo insurers are offering additional value-added services to their clients. This includes risk management consultancy, loss prevention guidance, supply chain visibility solutions, and assistance with compliance and regulatory requirements. By helping clients identify and mitigate risks, insurers aim to reduce losses and improve overall risk management practices. These trends will influence the market in the upcoming years.

The land cargo sub-segment of the insurance type acquired the maximum share of the global cargo insurance market in 2022.

Loading Table Of Content...

Loading Research Methodology...