Carpet Market Research, 2033

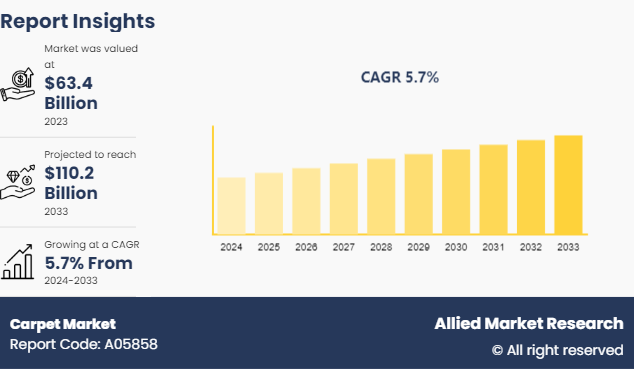

The global carpet market size was valued at $63.4 billion in 2023, and is projected to reach $110.2 Billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Market Introduction and Definition

A carpet is a textile floor covering composed of a top layer of pile linked to a backing. The pile is often constructed of wool or synthetic fibers including polypropylene, nylon, or polyester, that provide softness, durability, and a wide range of colors and patterns.

The growing need for environmentally friendly and sustainable products is driving producers to create carpets that utilize recycled resources and natural fibers for manufacturing. Additionally, technological developments are making carpets increasingly stain-resistant and durable, which makes them more desirable to families with children and pets. Furthermore, the growing popularity of home renovation and improvement initiatives, fueled by increased disposable money and the impact of interior design developments on social media, is driving up carpet sales.

Key Takeaways

The carpet market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major carpet industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

??????Key market dynamics

The increase in need for sustainable and green goods is a primary driver, with both consumers and producers prioritizing environmentally responsible operations. This transition has resulted in the creation of carpets produced from reused supplies, organic fibers, and low-VOC adhesives, which cater to a rising consumer segment concerned about environmental effects. In addition, technical improvements have transformed the business, with breakthroughs including higher resistance to stains, antimicrobial treatments, and enhanced resilience making carpets attractive to a wider audience. Furthermore, the development in urbanization and the associated increase in building both residential and commercial projects is driving up carpet market demand as a favored flooring option owing to their aesthetic variety and comfort.

Traditional carpet production procedures have an environmental impact, such as the use of non-recyclable synthetic fibers and chemical treatments, which add to waste and contamination. Increasing regulatory demands and the requirement for environmentally friendly procedures may result in higher production costs and significant investment in green technology. Furthermore, competition from alternative flooring alternatives such as hardwood, laminated flooring, and luxury vinyl tiles (LVT) , which are frequently considered more durable and simpler to maintain, threatens carpet market share.

The rise in customer desire for sustainable and environmentally friendly products creates considerable potential for carpet manufacturers. These manufacturers capitalize on this by creating carpets utilizing recycled materials and natural fibers, as well as using eco-friendly manufacturing processes, to appeal to environmentally concerned customers. In addition, ?technological advancements can establish high-performance carpeting with features such as improved stain resistance, antimicrobial properties, and increased durability, making them more appealing to households with children and pets, as well as commercial spaces that require durable flooring solutions.

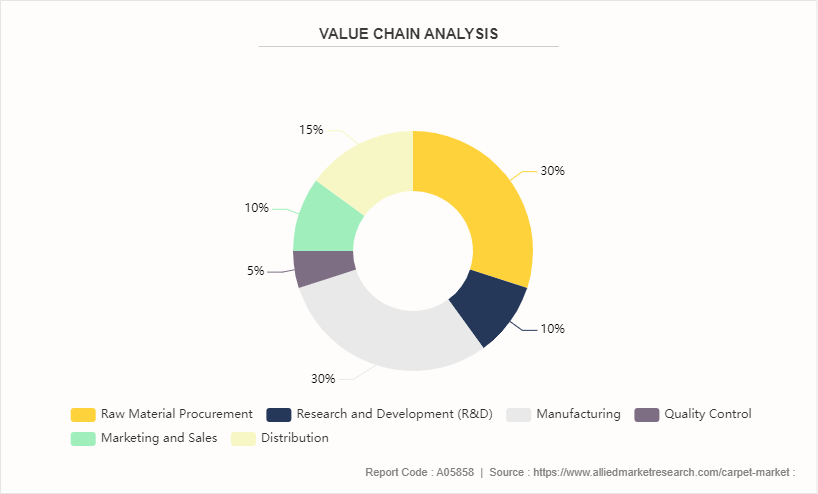

Value Chain Analysis of Global Carpet Market

Raw Material Procurement

Raw material procurement is the first stage where a manufacturer acquires natural fibers (wool, cotton) and synthetic fibers (nylon, polyester, polypropylene) from suppliers.

Research and Development (R&D)

In this stage, the manufacturers focus on the creation of innovative?carpet technologies such as stain-resistant and antimicrobial treatments, as well as a variety of designs, patterns, and colors, to satisfy market trends and customer preferences.

Manufacturing

The raw fibers are turned into yarn and dyed in the right colors before they are woven or tufted into carpets to ensure quality and longevity. Finally, finishing treatments are used to increase stain resistance, antibacterial qualities, and durability.

Quality Control

Manufacturers undertake extensive inspections at various stages of production to assure product quality, test for longevity, color permanence, and treatment efficacy, and guarantee compliance with industry norms and laws.

Marketing and Sales

Manufacturers analyze market trends, customer preferences, and rival products, create an influential brand identity and positioning, and promote items through advertising, online platforms, and influencer marketing.

Distribution

Producers manage effective transportation and storage to ensure that items are delivered on time and distributed through a variety of channels, including remodeling stores, specialized merchants, and online platforms.

Market Segmentation

The carpet market is segmented into material, end user, sales channel, price point, and region. On the basis of material, the market is classified into nylon, olefin, polyester, and others. Depending on the end user, the market is bifurcated into residential and commercial. On the basis of sales channel, the market is studied across hypermarkets & supermarkets, specialty stores, and online sales channels. On the basis of price point, the market is categorized into economy and luxury. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA

Regional/Country Market Outlook

The carpet business demonstrates a variety of regional and national patterns that reflect changing economic situations, customer preferences, and manufacturing capacities. In the U.S., the sector has expanded rapidly due to a robust housing market and rise in remodeling operations, as well as a high demand for luxury and ecological carpets. Turkey, as one of the world's major producers, uses its enormous knowledge and talented labor force to contribute considerably to global exports, mainly to Europe and the Middle East. India's carpet business is also growing, because of its long heritage of handwoven and elaborate designs, which makes it a major player in the global market according to handmade carpet market statistics.

European nations, notably in Western Europe, are showing an increasing preference for eco-friendly and creative carpet solutions, with Germany and the Netherlands emphasizing high-quality, sustainable materials. In contrast, China's carpet sector, while expanding, has obstacles such as rising labor costs and environmental laws, requiring producers to implement more efficient and environmentally friendly production processes. Overall, the worldwide carpet market forecast period is expected to offer continuous expansion, owing to technical improvements, sustainable practices, and shifting customer expectations across regions.

Industry Trends:

In February 2024, Tarkett recently expanded its QuickShip program for its carpet range. This program includes 73 soft surface goods carefully selected for dealers, architects, and designers. The program offers the?items to?be delivered anywhere in the nation within five working days.

In February 2024, Shaw Contract created Creative Zone, an innovative carpet tile set measuring 24 x 24. This collection was inspired by the intriguing moments seen in everyday life and has been thoughtfully designed to support a variety of learning contexts.

In September 2023, Shaw Industries Group, Inc. announced an exciting cooperation with the Classen Group, a pioneering hard surface flooring company based in Germany recognized for its PVC-free solutions designed for residential as well as commercial uses. Shaw will sell Classen Group's newest line of commercial flooring items exclusively in North America as part of this strategic relationship.

Recent Key Strategies and Developments

In January 2024, B.I.G. Yarns completed its first industrial production batches of virgin polyester BCF yarns designed for automotive carpet uses, as part of a strategic commitment to expand its products into high-end and elegant automotive interiors. These newly launched polyester yarns complement the company's current assortment of polyamide PA6 superior yarns, expanding its entire range of automobile interior solutions.

In July 2022, Obeetee Carpets, an India-based handwoven carpet company, introduced a new line called the Ajmer collection. The new carpet line has designs and themes inspired by the stunning design of Ajmer Fort.

In September 2021, Jaipur Rugs, a handcrafted carpet maker, established a new flagship store in Milan. The new store spans more than 160 square meters and features a diverse selection of transitional, modern, contemporary, and traditional hand-knotted carpets.

Competitive Landscape

The major players operating in the carpet industry include Armstrong Flooring, Inc., Balta Group, Beaulieu International Group N.V., Berkshire Hathaway, Inc., Brumar, Dorsett industries, Mannington Mills, Inc., Mohawk Industries, Inc., Tarkett S.A., and The Dixie Group

Other players in carpet market includes Tai Ping Carpets International Ltd, Lowe's Companies Inc., Victoria Carpets Ltd., Shaw Industries Group Inc, Inter Ikea Systems B.V., Genie Carpet Manufacturers, Beaulieu International Group, Royalty Carpet Mills Inc, Oriental Weavers Company, and others

Key Sources Referred

Carpet and Rug Institute (CRI)

European Carpet and Rug Association (ECRA)

International Wool Textile Organisation (IWTO)

National Floorcovering Alliance (NFA)

American Floorcovering Alliance (AFA)

Indian Carpet Export Promotion Council (CEPC)

All India Carpet Manufacturers' Association (AICMA)

British Carpet Manufacturers' Association (BCFA)

National Institute of Carpet and Floorlayers (NICF)

National Wood Flooring Association (NWFA)

Association of Rug Care Specialists (ARCS)

Turkish Carpet Exporters' Association (IHIB)

Persian Carpet Exporters’ Association (PCEA)

Canadian Flooring, Cleaning and Restoration Association (CFCRA)

World Floor Covering Association (WFCA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carpet market analysis to identify the prevailing carpet market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the carpet market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global carpet market trends, key players, market segments, application areas, and market growth strategies.

Carpet Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 110.2 Billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Material |

|

| By End User |

|

| By Price Point |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Mannington Mills, Inc., Berkshire Hathaway, Inc., Armstrong Flooring, Inc., The Dixie Group Inc., Balta Group, Beaulieu International Group N.V., The Dixie Group, Dorsett industries, MOHAWK INDUSTRIES, INC., Brumark Corporation., Tarkett S.A. |

The global carpet market was valued at $63.4 billion in 2023, and is projected to reach $110.2 Billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

The carpet market registered a CAGR of 5.7% from 2024 to 2033.

The top companies that hold the market share in the carpet market include Armstrong Flooring, Inc., Balta Group, Beaulieu International Group N.V., Berkshire Hathaway, Inc., and others.

The carpet market report has 4 segments. The segments are material, end user, sales channel, and price point.

The forecast period in the carpet market report is from 2024 to 2033.

Loading Table Of Content...