Carrier Screening Market Research, 2031

The global carrier screening market size was valued at $1.9 billion in 2021 and is projected to reach $6.5 billion by 2031, growing at a CAGR of 13.8% from 2022 to 2031. Carrier screening is a type of genetic test that can tell if the person carries a gene for certain genetic disorders. It allows us to find out the chances of having a child with a genetic disorder if it is done before or during pregnancy. Carrier screening involves testing a sample of blood, saliva, or tissue from the inside of the cheek. Test results can be negative which means to not have the gene or positive which means to have the gene. Typically, the partner who is most likely to be a carrier is tested first. If test results show that the first partner is not a carrier, then no additional testing is needed. If test results show that the first partner is a carrier, the other partner is tested.

Historical overview

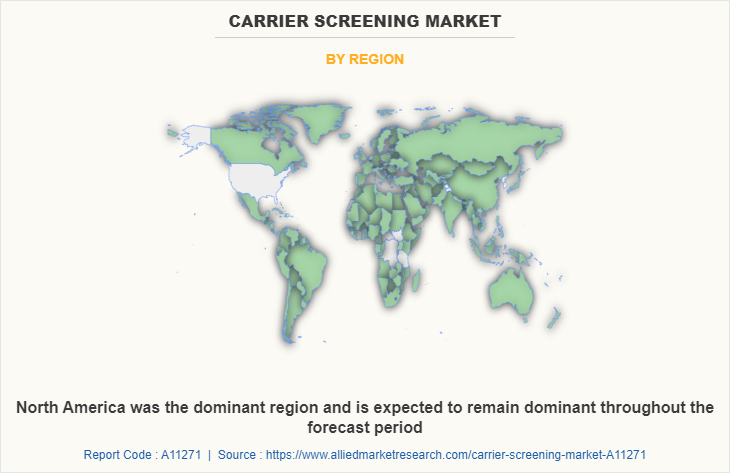

The market has been analyzed qualitatively and quantitatively from 2021 to 2031. The carrier screening market witnessed growth at a CAGR of around 13.8% from 2022 to 2031. Most of the growth during this period was from North America owing to the increase in the adoption of genetic screening, the rise in incidences of genetic diseases among the population, as well as the well-established presence of domestic market players in the region.

Market dynamics

Growth & innovations in the diagnostic and biotechnology industry for the adoption of carrier screening technology owing to a massive pool of genetic diseases incidences which creates an opportunity for the carrier screening market size. The rise in the launch of new tests made up of advanced technology by various key players across the globe is set to affect market growth positively. For instance, in June 2019, QIAGEN announced the launch of a novel Sample to Insight solution for translational and clinical research into genetic drivers of rare and inherited diseases. The new QIAseq Expanded Carrier Screening Panel provides the identification of targets, genes, and other regions of interest responsible for more than 200 disease indications. The growth of the carrier screening market share is also expected to be driven by the high potential for adoption of the technology in developing countries due to an increase in the prevalence of genetic disorders, an increase in practice to diagnose people for genetic carriers, and a surge in demand for carrier screening. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to the rise in demand for enhanced diagnostics technologies, significant investments by the government to improve diagnostic testing and the development of a strong foothold of biotechnological industries in emerging countries. In addition, the cost-effectiveness of the carrier screening tests may also decide the adoption of the tests. For instance, according to the data by MedlinePlus that was updated on July 2021, the cost of genetic testing can range from under $100 to more than $2,000 in the U.S., depending on the nature and complexity of the test. The cost increases if more than one test is necessary or if multiple family members must be tested to obtain a meaningful result. This cost may vary by state for newborn screening. Some states cover part of the total cost, but most charge a fee of $30 to $150 per infant. Hence, the cost-effectiveness factor for carrier screening is attributed to further support the market growth. The demand for carrier screening is not only limited to developed countries but is also being witnessed in developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as the rise in the adoption of genetic screening among couples and an increase in awareness of genetic disease risk further drive the growth of the market. Furthermore, a rise in consumer awareness related to preventive healthcare of newborns boosts the adoption of carrier screening. Moreover, an increase in research activities by manufacturers for developing innovative solutions in carrier screening technology is expected to fuel their adoption in the near future.

However, the stringent regulations for the approval of carrier screening tests and ethical concerns about carrier screening among the population are hampering the market growth. Moreover, the implementation barriers like lack of standardization among different laboratories, pre-and post-test follow-up management, and provider misperceptions are anticipated to hamper the growth of the market.

Segmental Overview

The carrier screening market is segmented based on type, technology, end-user, and region. On the basis of type, the market is bifurcated into expanded carrier screening and targeted disease carrier screening. The expanded carrier screening segment is further classified into customized panel testing and predesigned panel testing. On the basis of technology, the market is classified into DNA sequencing, polymerase chain reaction, microarrays, and others. On the basis of end users, the market is classified into hospitals & clinics, reference laboratories, physician offices, and others. Region-wise, the market is studied across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and the Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

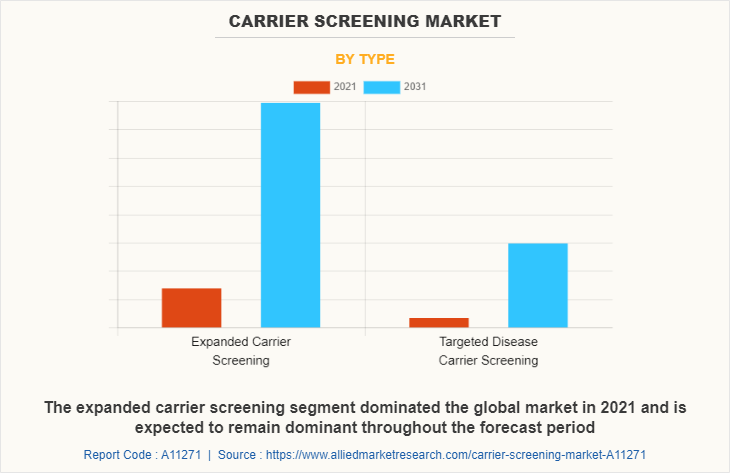

By Type

On the base of type, the market is classified into expanded carrier screening and targeted disease carrier screening. The expanded carrier screening segment dominated the global market in 2021 and is expected to remain dominant throughout the forecast period, owing to the increase in the adoption of expanded carrier screening for genetic testing and the availability of several types of tests developed by various key players in the market.

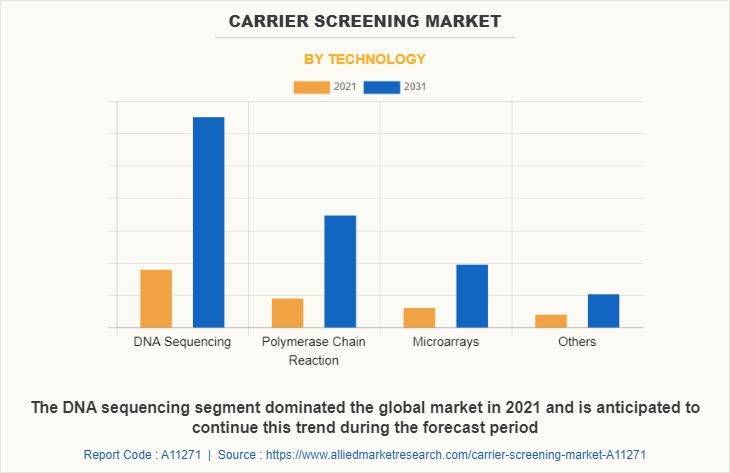

By Technology

By technology, the carrier screening market is segregated into DNA sequencing, polymerase chain reaction, microarrays, and others. The DNA sequencing segment dominated the global market in 2021 and is anticipated to continue this trend during the Carrier Screening Market Forecast period. This is attributed to the increase in the prevalence of genetic diseases among the population. In addition, growth in awareness regarding genetic testing without any concerns of ethics and increase in the applications of the technology are expected to propel the growth of the market.

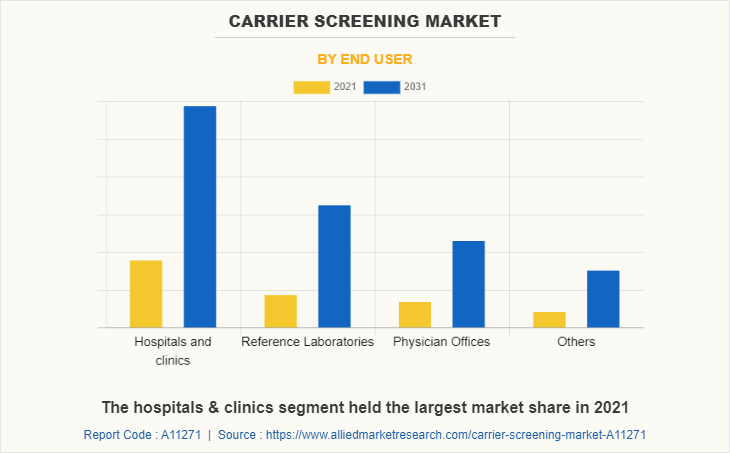

By End User

By end user, the market is classified into hospitals & clinics, reference laboratories, physician offices, and others. The hospitals & clinics segment held the largest market share in 2021 and is expected to remain dominant throughout the forecast period, owing to the preference of population for the genetic testing in hospitals & clinics and ease of the accessibility of the hospitals and clinics post-COVID-19 pandemic situation.

By Region

By region, the carrier screening market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America was the dominant region and is expected to remain dominant throughout the forecast period, owing to a high prevalence rate of genetic diseases like cystic fibrosis, an increase in the number of market players and a surge in the number of tests available in the region. However, Asia-Pacific is expected to witness the highest CAGR during the analysis period, owing to the presence of high populace countries such as India and China, which in turn increases the number of chances of suffering from genetic conditions, and the increasing number of strategies and Carrier Screening Market trends adopted by the market players.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the carrier screening, such as Diasorin S.p.A (Luminex Corporation), Eurofins Scientific, Fulgent Genetics Inc., Illumina Inc., Invitae Corporation, Myriad Genetics Inc., Natera Inc., Opko Health Inc., Quest Diagnostics Incorporated, Thermo Fisher Scientific Inc. are provided in this report. There are some important players in the market such as Illumina Inc., Invitae Corporation, Quest Diagnostics Incorporated, and Thermo Fisher Scientific Inc. Various players have adopted strategies like a partnership, and acquisition as key developmental strategies to improve the product portfolio of the carrier screening industry.

Partnership in the market

In April 2021, Illumina announced a partnership with Kartos Therapeutics, Inc. to co-develop a TP53 companion diagnostic (CDx) based on the content of Illumina’s comprehensive genomic profiling assay, TruSight Oncology. It will expand the TruSight Oncology offerings into hematologic malignancies of illumine.

In January 2019, Fulgent entered into a partnership with Precision Genomics Laboratory (PGL) to make on-site performed, expanded carrier screening available to Columbia patients. This partnership will leverage both parties’ expertise in laboratory management, bioinformatics, clinical genetics, and next-generation sequencing to deliver an expanded carrier screening test with many advantages over other currently available tests.

Acquisitions in the market

In August 2021, Fulgent acquired CSI Laboratories (CSI) to expand its presence in somatic molecular diagnostics and cancer testing. CSI offers cytogenetic analysis, fluorescence in-situ hybridization (“FISH”), immunohistochemistry, and molecular genetics.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the carrier screening market analysis from 2021 to 2031 to identify the prevailing carrier screening market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the carrier screening market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes analysis of the regional as well as global carrier screening market trends, key players, market segments, application areas, and Carrier Screening Market growth strategies.

Carrier Screening Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 6.5 billion |

| Growth Rate | CAGR of 13.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 350 |

| By Type |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Natera Inc., Illumina Inc., InVitae Corporation, Fulgent Genetics Inc., Quest Diagnostics Inc., Thermo Fisher Scientific Inc., Opko Health Inc, Eurofins Scientific, Myriad Genetics, Inc., Diasorin S.p.A. |

Analyst Review

The number of individuals who could benefit from carrier screening is substantial because roughly 2 million women give birth to their first child each year in the U.S. The disorders for which testing is recommended vary based on several different patient-specific factors. For instance, the American Congress of Obstetricians and Gynecologists recommends that screening for cystic fibrosis be offered to all women of reproductive age and that testing be performed for additional disorders if indicated by family history, partner’s carrier status, or ethnicity.

Asia-Pacific is expected to witness the highest CAGR during the analysis period, owing to the increase in the research and development expenditure for the development of new products that increases the adoption rate of carrier screening, increase in awareness about the polymer chain reaction applications for increasing the adoption of technology in the laboratories and increase in government support on research activities and other related trends adopted by the market players.

Adoption of novel technologies and utilization of recently launched products are few upcoming trends in Carrier Screening Market

The DNA sequencing segment dominated the global market in 2021

North America was the dominant region and is expected to remain dominant throughout the forecast period

High cost associated with carrier screening and dearth of skilled professionals is one of the major restraints in the Carrier Screening Market

Diasorin S.p.A (Luminex Corporation), Eurofins Scientific, Fulgent Genetics Inc., are few major players operating in the carrier screening market

The global carrier screening market was valued at $1,849.4 million in 2021 and is projected to reach $6,454.6 million by 2031, registering a CAGR of 13.8% from 2022 to 2031

An increase in the prevalence of genetic disorders coupled with rising in the technological advancements are the two major drivers in the Carrier Screening Market

Yes, competitive landscape is covered in the Carrier Screening Market

Loading Table Of Content...