The global cast polypropylene (CPP) film market size was valued at $1.8 billion in 2023, and is projected to reach $2.8 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

Market Introduction and Definition

Cast Polypropylene (CPP) film is a type of polypropylene film produced through the casting process. This process involves extruding the polypropylene resin onto a chill roll, resulting in a film with excellent clarity, gloss, and consistent thickness. The film is known for its high transparency, flexibility, and heat-sealing properties. CPP film is widely used in the packaging industry due to its excellent mechanical and optical properties. It is commonly used for food packaging, including snacks, bakery products, and fresh produce, as it provides a good barrier to moisture and gases. In addition, CPP film is used in medical packaging, textiles, and stationery products. Its versatility also makes it suitable for lamination with other films to enhance specific properties such as strength and barrier performance.

Key Takeaways

- Over 1, 500 product literatures, industry releases, annual reports, and various documents from major cast polypropylene (CPP) film industry participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

- The cast polypropylene (CPP) film market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2024-2033.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

Market Dynamics

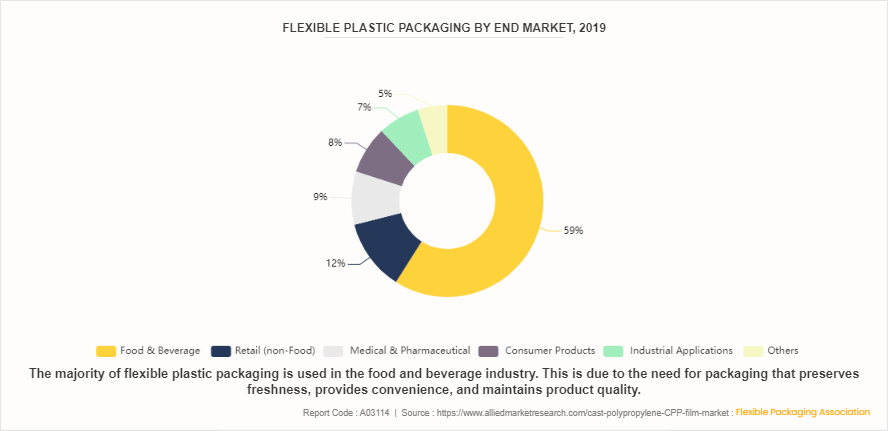

The cast polypropylene (CPP) film market is propelled by the rising demand for flexible packaging solutions, especially within the food and beverage industry. This demand is due to CPP films' excellent moisture barrier properties, high clarity, and strong sealability, making them ideal for maintaining the freshness and quality of packaged foods. In addition, the growing trend towards convenient and sustainable packaging further boosts CPP film adoption, aligning with consumer preferences and industry standards for product safety and longevity?

According to the World Packaging Organization, the global fresh food packaging market is projected to grow from $79.8 billion in 2020 to $95.2 billion by 2025, reflecting a CAGR of 3.5%. Packaging plays a crucial role in maintaining the freshness of products, preventing damage, and serving as an effective marketing tool. The growth of the fresh food packaging market parallels the overall expansion of the food packaging sector. Consequently, this growth is expected to drive the demand for cast polypropylene (CPP) film in the coming years. However, market growth is restrained by the volatility in raw material prices and the environmental concerns associated with plastic usage. Factors such as developing bio-based CPP films, addressing environmental concerns, and expanding use of CPP films in non-food applications such as medical and textile packaging offer opportunities for market growth.

Market Segmentation

The cast polypropylene (CPP) film market is segmented on the basis of type, thickness, end-use and region. By type, thickness, the market is classified into general, retort, metalized, and others. By thickness, the market is divided into 18-50 microns, 51-80 microns, and above 80 microns. By end use, the market is segregated into food & beverage, textile, healthcare, and others. Region-wise, the cast polypropylene (CPP) film market share is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The cast polypropylene (CPP) film market in Europe is witnessing steady growth, driven by rising demand for flexible packaging solutions in sectors such as food and beverages, pharmaceuticals, and textiles. Key European countries contributing to this market include Germany, France, Italy, and the UK. These countries are seeing increased adoption of CPP films due to consumer preference for sustainable and lightweight packaging materials.

Moreover, regulation of cast polypropylene (CPP) film in Europe is stringent, driven by the region's strong focus on environmental sustainability and consumer safety. The European Union has implemented various regulations, such as the EU Packaging and Packaging Waste Directive, which aims to minimize the environmental impact of packaging materials by promoting recycling and reducing waste. In addition, CPP films used in food packaging must comply with the EU's food contact material regulations, ensuring they do not release harmful substances into food. Manufacturers must also adhere to REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulations, which govern the use of chemicals in production processes to safeguard human health and the environment. These regulatory frameworks necessitate continuous innovation and adaptation by CPP film producers to meet high safety and sustainability standards.

Competitive Landscape

Key players in the cast polypropylene (CPP) film market include Uflex Ltd, Cosmo Films, Futamura Group, Mitsui Chemicals, Polyplex Corporation Ltd., Profol Group, Manuli Stretch, Polinas, Innovia Films, and Alpha Marathon Film Extrusion Technologies.

Key Developments

- In March 2024, India-based flexible packaging solutions provider Uflex achieved a significant milestone in its global expansion and innovation strategy. The company announced the commencement of commercial production of polycondensed polyester chips at its Panipat facility in India. In addition, UFlex has commissioned a new 6.5m-wide cast polypropylene (CPP) film line in Russia, with an annual production capacity of 18, 000 tonnes (t) . This expansion highlights UFlex’s commitment to vertical integration. The Panipat plant, with a capacity of 168, 000t per year, will primarily produce polycondensed polyester chips, a crucial raw material for biaxially oriented polyethylene terephthalate (BOPET) packaging films.

- In March 2023, Innovia Films, a leader in science materials and a major producer of highly differentiated specialty Biaxially Oriented Polypropylene (BOPP) , Bubble and Tenter technologies, and Cast Polypropylene (CPP) films, has announced a significant expansion at its Innovia business unit near Leipzig, Germany, located at the Dow ValuePark Schkopau. The new facility will feature an 8.8-meter wide multi-layer co-extrusion line dedicated to producing highly engineered thin gauge label films. This expansion is driven by the increasing demand for sustainable materials with lower resin content. The new technology, designed to support the growing market, boasts an annual capacity of 36, 000 tons and is optimized for best-in-class energy efficiency.

- In March 2022, Cosmo Films, a global leader in specialty films for flexible packaging, labeling, and lamination applications, as well as synthetic paper, launched a white cast polypropylene (CPP) film with a high coefficient of friction (COF) . This film was specifically developed to address the issue of layer slippage. It features a seal strength exceeding 1, 800 gf/inch with a seal initiation temperature of 95°C. The high COF ensures a uniform sealing area for final pouches by preventing inter-layer slippage. The film-to-film COF is over 0.4, while the film-to-metal COF ranges from 0.3 to 0.4. Available in thicknesses from 25 to 40 microns, this film eliminates the need for white ink and is suitable for flexible packaging applications such as lamination for noodles, biscuits, snacks, and other bakery products. The film's structure comprises three layers: a corona-treated layer, a white PP core layer, and a sealable untreated layer.

Flexible Plastic Packaging Industry Facts

Historical Trends

- Cast polypropylene (CPP) film emerged in the 1970s due to advancements in polymer science and film extrusion technologies. Initially developed as an alternative to cellophane and other flexible packaging materials, CPP offered superior moisture barrier properties and greater flexibility.

- By the 1980s, CPP film gained commercial traction, particularly in the food packaging industry. The ability to produce films with varying thicknesses and properties made CPP an attractive option for a wide range of applications, from snack packaging to lamination.

- The 1990s saw significant improvements in CPP film manufacturing processes. Innovations in multi-layer co-extrusion technology allowed for the production of films with enhanced barrier properties and tailored functionalities, such as high clarity, high gloss, and superior heat sealability. This decade also marked the beginning of widespread use of CPP films in pharmaceutical and textile packaging.

- The early 2000s brought further diversification of CPP film applications. The growing demand for flexible packaging solutions and the rising popularity of convenience foods spurred the expansion of the CPP film market. Manufacturers began to introduce specialized CPP films, such as anti-fog, metallized, and white opaque films, to meet specific industry needs.

- As environmental concerns gained prominence, the 2010s saw an increased focus on sustainable packaging solutions. CPP film manufacturers began developing recyclable and biodegradable CPP films to reduce the environmental impact of plastic packaging. Innovations in raw material sourcing and production processes aimed at enhancing the sustainability of CPP films became a priority.

- In the 2020s, the CPP film market continues to grow, driven by ongoing innovations and global expansion. Companies are investing in advanced production lines and exploring new applications in emerging markets. The development of high-performance CPP films with improved barrier properties, seal strength, and printability is ongoing, catering to the evolving demands of the packaging industry.

Key Sources Referred

- European Chemicals Agency (ECHA)

- European Food Safety Authority (EFSA)

- European Commission (EC)

- European Environment Agency (EEA)

- German Federal Institute for Risk Assessment (BfR)

- French Agency for Food, Environmental and Occupational Health & Safety (ANSES)

- UK Food Standards Agency (FSA)

- Italian National Institute of Health (ISS)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cast polypropylene (CPP) film market analysis from 2024 to 2033 to identify the prevailing cast polypropylene (CPP) film market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cast polypropylene (CPP) film market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cast polypropylene (CPP) film market trends, key players, market segments, application areas, and market growth strategies.

Cast Polypropylene (CPP) Film Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.8 Billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Type |

|

| By Thickness |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Innovia Films, LLC, Profol Group, Cosmo Films Ltd, Futamura Group, Polyplex Corporation Ltd., Uflex Ltd, Manuli Stretch, Mitsui Chemicals, Polinas, Alpha Marathon Film Extrusion Technologies |

Key players in the cast polypropylene (CPP) film market include Uflex Ltd, Cosmo Films, Futamura Group, Mitsui Chemicals, Polyplex Corporation Ltd., Profol Group, Manuli Stretch, Polinas, Innovia Films, and Alpha Marathon Film Extrusion Technologies.

The cast polypropylene (CPP) film market expansion is driven by its high clarity, excellent heat-sealing properties, and superior moisture barrier capabilities. In addition, the rise in demand for flexible packaging solutions in the food, pharmaceutical, and personal care industries fuels market growth, along with its cost-effectiveness and recyclability.

Food & beverage segment held the highest market share in 2023.

Asia-Pacific is the largest regional market for Cast Polypropylene (CPP) Film.

The cast polypropylene (CPP) film market was valued at $1.8 billion in 2023, and is estimated to reach $2.8 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

Loading Table Of Content...