Cell Analysis Market Research, 2032

The global cell analysis market size was valued at $17.1 billion in 2022 and is estimated to reach $42.9 billion by 2032, exhibiting a CAGR of 9.5% from 2023 to 2032. Cell analysis is a scientific process that involves examining and analyzing individual cells from a sample, often from human tissue. The process can involve a variety of techniques, including microscopy, cell culturing, immunohistochemistry, flow cytometry, and imaging. Cell analysis is used to identify, measure, and study different aspects of cell structure, function, and behavior. It can be used to detect disease and evaluate the effectiveness of treatments. Cell analysis is an important tool in medical research, and it is increasingly used in fields such as biotechnology, drug discovery, and forensic science.

The rise in the prevalence of chronic diseases such as autoimmune disease, cardiovascular disease, and neurological disorders, among others across the world is the major factor that drives the growth Cell Analysis Market Growth. Cell analysis is an important tool in the development of treatments for chronic diseases. Cell analysis is used to study the molecular and genetic basis of chronic diseases, as well as to identify potential treatments and therapies.

Cell analysis is used to monitor the progress of treatments and to identify potential biomarkers that can help predict outcomes. By understanding the underlying mechanisms of chronic diseases, cell analysis can help develop more effective treatments and interventions. For instance, according to World Health Organization (WHO) in 2022, it was estimated that around 50 million people worldwide live with epilepsy and making it one of the most common neurological diseases globally.

In addition, the rise in advancements in cell analysis is the major factor expected to drive the growth of the market in the upcoming years. Technological advancements have enabled the development of automated cell analysis systems that can provide accurate and reliable results in a timely manner. For instance, automated systems can reduce the time and cost associated with manual testing and can be used to monitor patients in real time.

Moreover, the development of advanced technologies such as automated cell counting, cell imaging, and flow cytometry has enabled researchers to study cells on a much larger scale. For instance, in January 2020, Illumina, Inc., announced a significant advancement in cell analysis with the launch of the NextSeq 1000 and NextSeq 2000 Sequencing Systems. These next-generation sequencers are designed to provide researchers with advanced capabilities for cell analysis, including single-cell RNA sequencing (scRNA-seq) and other multi-omics applications.

In addition, the surge in R&D activities in the pharmaceutical and biotechnology industry and the growing focus on personalized medicines further provides lucrative Cell Analysis Market Opportunity in upcoming years. However, the high cost of cell analysis products and the dearth of skilled professionals are anticipated to hamper the market growth in the upcoming years.

The COVID-19 outbreak has disrupted workflows in the healthcare sector worldwide. The disease has forced several industries to shut their doors temporarily, including several sub-domains of health care. The COVID-19 outbreak had a positive impact on the cell analysis market. The demand for cell analysis has increased during the pandemic as researchers are utilizing cell analysis techniques to gain further insights into the virus and develop potential treatments. In addition, an increase in government funding during the pandemic for research and development of COVID-19-related therapies has led to an increase in the usage of cell analytics across the world.

For instance, according to the research article published in the American Journal of Physiology-Lung Cellular and Molecular Physiology in 2021, cell analysis through mass cytometry by time-of-flight (CyTOF) was used to study the changes in the peripheral blood mononuclear cells of COVID-19-infected patients. Thus, COVID-19 has highlighted the importance of cell-based assays for understanding the virus's behavior and evaluating potential treatments, which increases the demand for cell-based assays to study virus-host interactions, screen antiviral drugs, and assess the immune response. This has led to a surge in demand for cell analysis tools such as flow cytometers, microscopes, and cell counters, which will boost the growth of the Cell Analysis Market Size in upcoming years.

Global Cell Analysis Market Segmental Overview

The cell analysis market is segmented into product, application, technique, end user, and region. According to product, the market is categorized into consumables, services, software, and instruments. By application, it is segregated into oncology, immunology, cardiology, stem cell, genetic disease, and others. According to techniques, the market is categorized into flow cytometry, next-generation sequencing, polymerase chain reaction, mass spectrometry, and others. On the basis of end users, it is segmented into academic & research laboratories, biotechnology & pharmaceutical companies, hospitals & diagnostic laboratories, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

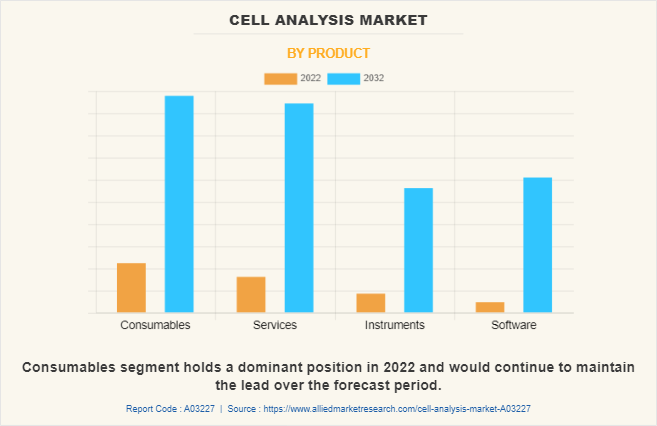

By Product Type

The cell analysis market is segmented into consumables, services, software, and instruments. The consumable segment dominated the market in 2022 and is expected to remain dominant during the Cell Analysis Market Forecast period, owing to the rise in the prevalence of chronic disease among the adult population, the increase in the number of geriatric patients population, and the surge in the government funding for cell analysis-based services drive the growth of the segment. In addition, an increase in the demand for advanced and innovative consumables such as multi-omics assays among research and academic institutes boosts the growth of the market.

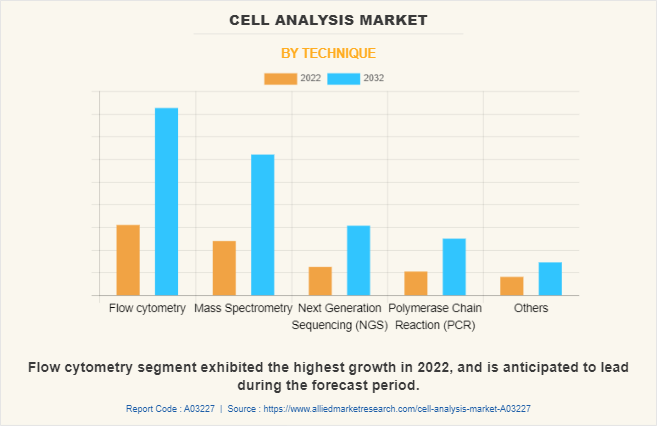

By Technique

The cell analysis market is divided into flow cytometry, next-generation sequencing (NGS), polymerase chain reaction (PCR), mass spectrometry, and others. In 2022, the flow-cytometry segment accounted for the largest Cell Analysis Market Share attributed to the rise in technological advancements and an increase in the adoption of flow cytometry technology for cell analysis in various research and diagnostic labs drives the growth of the market.

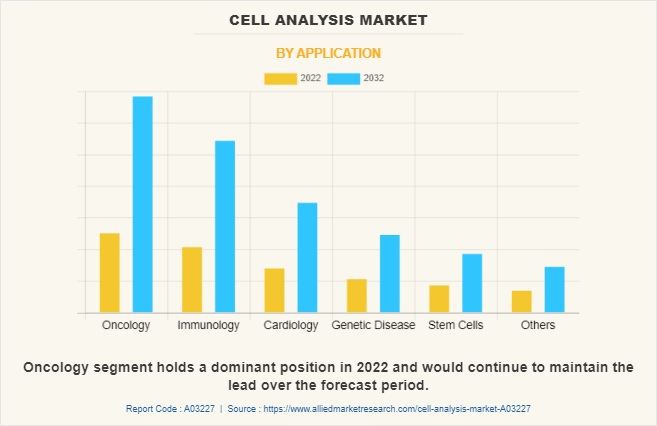

By Application

The cell analysis market is divided into oncology, immunology, genetic disease, cardiology, stem cells, and others. In 2022, the oncology segment accounted for the largest share of the market attributed to the rise in the prevalence of cancer across the world. In addition, the rise in the adoption of cell analysis technology among research institutes to develop novel therapeutics for the treatment of cancer is the key factor that drives the growth of the market.

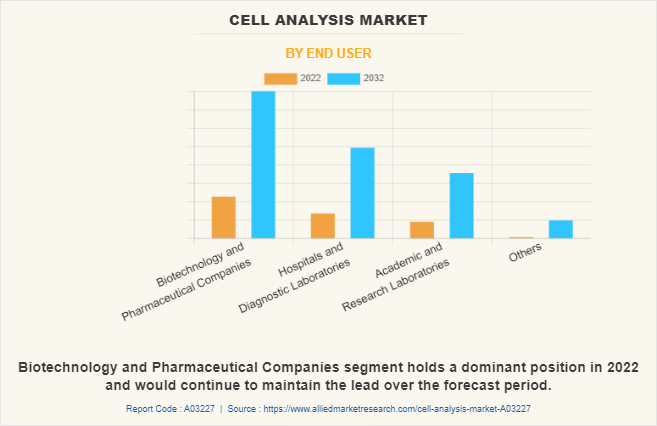

By End User

The cell analysis market is fragmented into hospitals & diagnostic laboratories, pharmaceutical and biotechnology companies, research and academic institutes, and others. The pharmaceutical and biotechnology companies segment exhibited the highest Cell Analysis Market Share in 2022 and is anticipated to lead during the forecast period, owing to technological advancements such as the use of microfluidics for the development of next-generation therapies have increased the adoption of cell analysis by biotechnology and pharmaceutical companies across the world drives the growth of the market.

By Region

The Cell Analysis Industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the rehabilitation equipment market in 2022 and is expected to maintain its dominance during the forecast period. The cell analysis market is mainly driven by the rise in the prevalence of various types of cancer such as lung cancer, breast cancer, and others. For instance, according to a report published by the American Cancer Society, in 2021, there will be an estimated 1.8 million new cancer cases diagnosed and 606,520 cancer deaths in the U.S. Furthermore, an increase in the demand for automated cell analysis technologies among pharmaceutical industries to develop novel therapeutic for the treatment of chronic disease drives the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in the Asia-Pacific region is supplemented by the rise in technological innovations, an increase in government funding, and a surge in the geriatric population, who suffer from chronic disease. Moreover, an increase in demand for advanced healthcare services in emerging economies like India and China further boosts the growth of the Asia-Pacific market. For instance, according to a report shared by United Nations Population Fund (UNPFA), by 2050. The estimated number of geriatric populations in Asia-Pacific is projected to reach 1.3 billion. As per the same source, one in four people in Asia-Pacific is expected to be over 60 years old.

Competition Analysis

The Cell Analysis Industry provides competitive analysis and profiles of the major players in the cell analysis market, Becton, Dickinson and Company, Danaher Corporation, QIAGEN N.V., Thermo Fisher Scientific, Inc., Illumina, Inc., Bio-Rad Laboratories, Agilent Technologies, Inc., Sartorius AG, Biomerieux SA, and Standard BioTools Inc.

Recent examples of product launches in the Cell Analysis Market

- In 2021, ELITechGroup launched the ELITe BeGenius, a CE-IVD stand-alone, compact, total automated direct sample to provide results in real-time PCR (polymer chain reaction) solution.

- In 2022, Mission Bio, Inc launched a single-cell Multi-omics MRD (scMRD) assay which is capable of determining measurable residual disease (MRD) in cancer down to the level of individual cells and preventing relapse in patients with acute myeloid leukemia and other cancers. However, these assays are limited to one type of measurement at a time, such as flow cytometry for immunophenotyping or bulk sequencing for mutation detection.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cell analysis market analysis from 2022 to 2032 to identify the prevailing cell analysis market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the cell analysis market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global cell analysis market trends, key players, market segments, application areas, and market growth strategies.

Cell Analysis Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 43 billion |

| Growth Rate | CAGR of 9.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 249 |

| By Technique |

|

| By Application |

|

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Biomerieux SA, Bio-Rad Laboratories, Inc. , Thermo Fisher Scientific, Inc., Sartorius AG, Danaher Corporation, Agilent Technologies, Inc., Becton, Dickinson and Company, Illumina, Inc., Qiagen N.V., Standard BioTools Inc. |

Analyst Review

This section provides various opinions of top-level CXOs in the cell analysis market. According to several interviews conducted, the cell analysis market is expected to witness significant growth in the future owing to surge in a number of research projects undertaken to prove the therapeutic and diagnostic potential of cell analysis, which in turn is expected to stimulate the demand for cell analysis techniques.

As per the insights of CXOs, the cell analysis market is expected to witness steady growth in the future owing to rise in the prevalence of cancer, initiatives taken by governments for large scale sequencing projects, and an increase in cell-based research. Moreover, rise in funding by various governments and private organizations is expected to drive the growth of the cell analysis market. In addition, the cell analysis market has piqued the interest of healthcare professionals and researchers owing to its therapeutic and diagnostic potential. However, the high cost of single cell analysis products is expected to hamper market growth.

The CXOs further added that North America is expected to dominate the global cell analysis market during the forecast period, followed by Europe, owing to heavy government expenditure on R&D activities. In addition, emerging economies such as India, China, Mexico, and Brazil are expected to offer lucrative opportunities owing to increase in prevalence of chronic diseases and advancement in cell analysis technology.

The upcoming trends are rise in technological advancement in cell analysis coupled with an increase in R&D activities for cell analysis in the pharmaceutical and biotechnology industry. In addition, an increase in focus on the usage of cell analysis in biomarker discoveries and clinical diagnostics for the diagnosis & treatment of diseases propel the growth of the market.

The total market value of the Cell Analysis Market is $42.9 billion by 2032

North America is the largest regional market for Cell Analysis

There are 10 Cell Analysis Market companies are profiled in the report

Becton, Dickinson and Company, Danaher Corporation, Thermo Fisher Scientific, Inc., Illumina, Inc., Bio-Rad Laboratories, Agilent Technologies, Inc., are the top companies to hold the market share in Cell Analysis Market

The forecast period in the report is from 2023 to 2032

The base year for the Cell Analysis Market report is 2022

Yes, the Cell Analysis Market report includes a competitive landscape

Loading Table Of Content...

Loading Research Methodology...