Cell Cryopreservation Market Research, 2032

The global cell cryopreservation market size was valued at $10.3 billion in 2022, and is projected to reach $76.6 billion by 2032, growing at a CAGR of 22.2% from 2023 to 2032. Cryopreservation is the technique of freezing tissues and cells at low temperatures to keep the biological material metabolically inert, to maintain its viability, and to prevent ice crystal formation. Ice crystals are small crystals of ice, which are formed when the temperature is extremely low. These can disturb the cell membrane of the cell or tissue and the cell can die. Cells are cryopreserved to minimize genetic change and prevent loss through contamination. Cryopreservation is used for the preservation of microorganisms, tissue cells, established cell lines, small multicellular organisms, and complex cellular structures such as embryos, nucleic acid, and proteins. Various types of medium or serum are used to freeze cells. Glycerol and dimethyl sulfoxide (DMSO) are the most commonly used alternatives. Glycerol and dimethyl sulfoxide are mixed into a solution with serum or media in which cells are placed and frozen in a liquid nitrogen freezer.

Market dynamics

The cell cryopreservation market in expected to grow significantly owing to increase in number of egg freezing cycles, rise in R&D activities for stem cells, and rise in number of biobanks, and surge in demand for personalized medicines. The increasing number of egg freezing cycles has emerged as a major driver of the cell cryopreservation market. Egg freezing, also known as oocyte cryopreservation, involves the process of harvesting and freezing a woman's eggs for future use. This technique has gained significant popularity in recent years due to its potential benefits, such as preserving fertility options for women who wish to delay childbearing or are at risk of fertility-related issues. According to the Society for Assisted Reproductive Technology, the number of healthy women freezing eggs rose to 12,438 in 2020 from 7,193 in 2016.

According to the Society for Assisted Reproductive Technology, in 2020, 12,438 healthy women choose to freeze their eggs. The same source reported that the number of women freezing their eggs rose 72.76% from 2016 to 2020. As more women are choosing to undergo egg freezing cycles, there is a growing need for reliable and effective cryopreservation techniques to ensure the long-term viability of the frozen eggs. This has fueled the demand for advanced cell cryopreservation technologies and infrastructure, driving the growth of the market.

Furthermore, increase in R&D activities for stem cells has emerged as a significant driver of the cell cryopreservation market. Stem cells possess remarkable regenerative properties and have the potential to revolutionize medical treatments for various diseases and injuries. Researchers are exploring their applications in fields such as regenerative medicine, cell therapy, tissue engineering, and drug discovery. According to 2022 report by the National Library of Medicines, recent advancements in stem cell technology open a new door for patients suffering from diseases and disorders that have yet to be treated. Stem cell-based therapy, including human pluripotent stem cells (hPSCs) and multipotent mesenchymal stem cells (MSCs), has recently emerged as a key player in regenerative medicine. Stem cell therapy is a novel therapeutic approach that utilizes the unique properties of stem cells, including self-renewal and differentiation, to regenerate damaged cells and tissues in the human body or replace these cells with new, healthy and fully functional cells by delivering exogenous cells into a patient.

Rise in the number of biobanks and surge in demand for personalized medicines have emerged as the significant drivers of the cell cryopreservation market. Biobanks play a crucial role in storing and preserving biological samples, including cells and tissues, for various research and clinical purposes. According to National Library of Medicines, as of 2022, economically developed countries possess at least 11 biobanks per million population. Furthermore, collaborative efforts contribute in the surge in number of biobanks. For instance, the Global Biobank Meta-analysis Initiative (GBMI) was established by scientists from the Broad Institute of MIT and Harvard, along with collaborators from the University of Michigan and researchers worldwide. Its purpose is to facilitate the integration of international biobanks, allowing for larger and more robust investigations of genetic data. By incorporating greater genetic ancestry diversity, this initiative aims to enhance the likelihood of identifying novel disease-associated genetic variants. As of 2023, the initiative has grown to include 24 biobanks across five continents and contains data from more than 2.2 million people. In addition, personalized medicine aims to provide tailored healthcare solutions that are specifically designed for individual patients based on their unique genetic makeup, lifestyle, and medical history. This approach recognizes that each person responds differently to treatments, and by customizing therapies, better patient outcomes can be achieved. Cell cryopreservation plays a crucial role in personalized medicine as it enables the preservation of cells and tissues for future use in regenerative medicine, cell-based therapies, and transplantation

However, the availability of alternative techniques for cell cryopreservation is expected to act as a significant restraint of the cell cryopreservation market size. On the other hand, increase in government support for R&D activities creates lucrative opportunities for the growth of cell cryopreservation. For instance, the Indian Government has played a crucial role in establishing advanced stem cell research centers in 40 leading institutions focused on health research and education. Moreover, the government has promoted stem cell research across multiple departments and institutions, providing support for both fundamental and applied studies through national funding agencies such as the ICMR, Department of Biotechnology (DBT), and Department of Science and Technology (DST).

The COVID-19 pandemic had a positive impact on the cell cryopreservation market. The increased focus on R&D related to vaccines and therapies necessitated the storage and preservation of cells for future use. This led to a rise in demand for cell cryopreservation products and services. The pandemic highlighted the importance of preparedness for future health crises, further driving the cell cryopreservation market growth. In post-pandemic phase the cell cryopreservation market is expected to continue growing steadily owing to the research activities and need to store biological material.

Segmental Overview

The cell cryopreservation market share is segmented into type, application, end user, and region. On the basis of type, the market is bifurcated into cryopreservation media and equipment. The cryopreservation media segment is further subsegmented into ethylene glycol, dimethyl sulfoxide, glycerol, and others. The equipment segment is subsegmented into freezers, liquid nitrogen supply tanks, and others. Depending on application, the market is classified into stem cells, oocytes cells, sperm cells, and others. By end user, it is segregated into pharmaceutical & biotechnology company, research institute, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

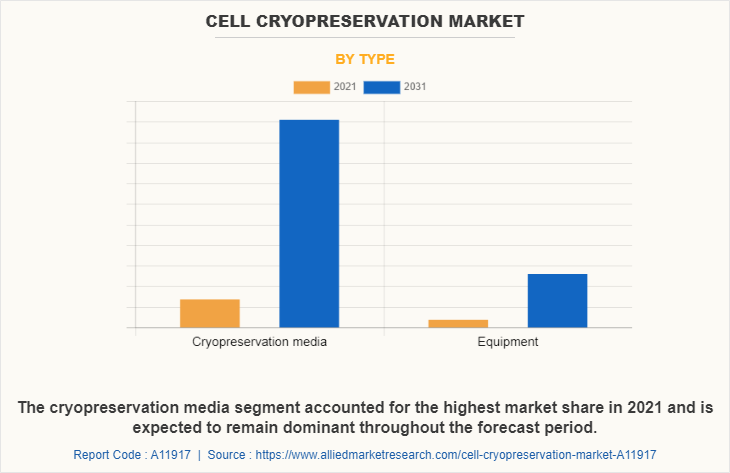

By Type

The cryopreservation media segment was the highest revenue contributor in 2022 owing to wide application of cryopreservation media across various fields, including stem cell regeneration, drug discovery, regenerative medicines, and biobanking. However, the equipment segment is expected to grow at the fastest rate during the cell cryopreservation market forecast owing to rise in use of equipment in the facilities such as biobanks and research institutes to store and preserve biological material.

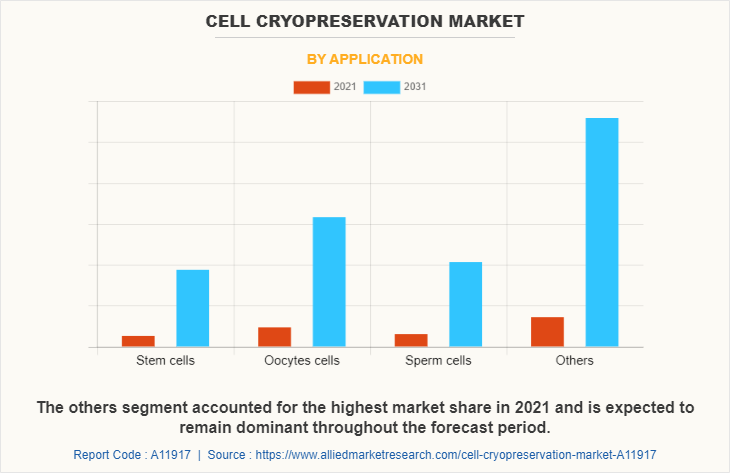

By Application

The other segment was the largest revenue generator in the market in 2022 due to increase in prevalence of traumatic injuries and surge in demand for blood product cryopreservation process. However, the stem cells segment is anticipated to register fastest growth rate during the forecasted period owing to increase in research activities in the stem cell therapy development.

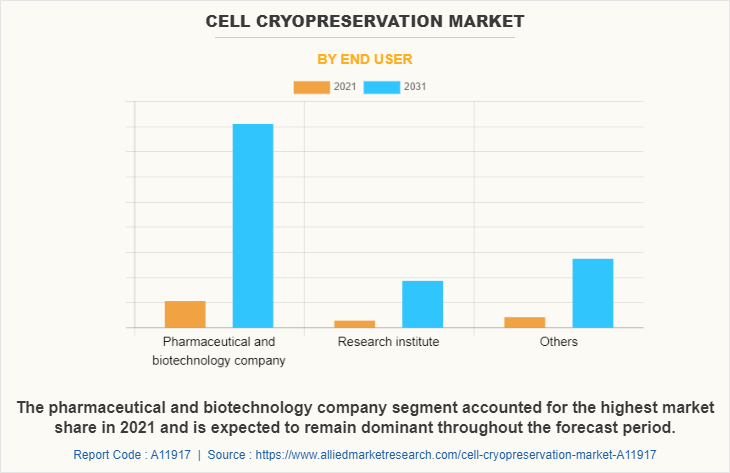

By End User

The other segment was the major revenue generator in 2022, and is expected to lead the market in the coming years. This is attributed to surge in demand for cell culture and increase in number of cell banks and clinical centers for R&D activities.

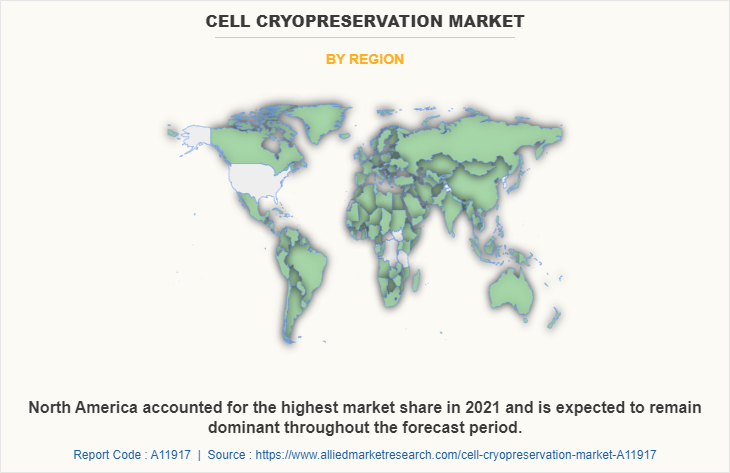

By Region

North America was the key shareholder in 2022, and is expected to maintain its lead during the forecast period, owing to high prevalence rate of chronic disease and strong presence of cell cryopreservation industry in the region. However, Asia-Pacific is expected to witness the highest CAGR during the analysis period owing to improvement in healthcare awareness, increase in R&D activities in the pharmaceutical & biotechnical industries, and rise in government funds for research activities.

Competition Analysis

The major players operating in the cell cryopreservation market include Merck Group KGaA, HiMedia Laboratories, Thermo Fisher Scientific Inc., Eppendorf Corporate, BioLife Solutions, Inc., Lonza, Sartorius AG, Creative Biolabs, Sartorius AG, and PromoCell GmbH. These players have adopted product launch, expansion, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the cell cryopreservation market.

Recent Product launch in the cell cryopreservation market

In June 2023, BioLife Solutions, Inc., leading supplier of cell and gene therapy bioproduction tools and services, announced the launch of a new, large-capacity controlled-rate freezer (CRF) to expand its CRF product line, which now stands at three different form factors. This tabletop freezer fulfills a crucial customer need for higher volume production of cell therapies.

Recent Expansion in the cell cryopreservation market

In November 2022, BioLife Solutions, Inc., leading supplier of cell and gene therapy bioproduction tools and services, announced an update on the expansion of its intellectual property estate. In 2022, the company received notice of the granting of 7 patents by the USPTO and other patent authorities outside the U.S. BioLife also filed 43 new applications for novel inventions related to its cell processing, media, storage containers, freezers, and thaw systems platforms.

Recent Acquisition in the cell cryopreservation market

In May 2021, BioLife Solutions, Inc., leading supplier of cell and gene therapy bioproduction tools and services, announced that it has closed the previously announced acquisition of Stirling Ultracold, a privately held manufacturer of ultra-low temperature (ULT) mechanical freezers. Stirling will supply approximately 100 energy-efficient ULT mechanical freezers to support customer's cold chain capabilities for biologics and emerging modalities.

In March 2020, Danaher Corporation, a global medical equipment manufacturer, announced the acquisition of the Biopharma business from General Electric Company's Life Sciences division. As part of Danaher, the business will be called Cytiva and will be a standalone operating company within Danaher's Life Sciences segment.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cell cryopreservation market analysis from 2022 to 2032 to identify the prevailing cell cryopreservation market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cell cryopreservation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cell cryopreservation market trends, key players, market segments, application areas, and market growth strategies.

Cell Cryopreservation Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 76.6 billion |

| Growth Rate | CAGR of 22.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 266 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Lonza, HiMedia Laboratories, Merck Group KGaA, Creative Biolabs, BioLife Solutions, Inc., Eppendorf Corporate, Sartorius AG, Danaher Corporation, PromoCell GmbH, Thermo Fisher Scientific Inc. |

Analyst Review

According to the insights of the CXOs of leading companies cell cryopreservation has gained high traction among pharmaceutical & biotechnology companies and research institutes as it freezes cells, tissue, or organs in a controlled manner allowing them to be stored for extended without significant degradation, ensuring they remain viable until they are ready for analysis or experimentation. The key players have adopted various strategies to strengthen their foothold in the competitive market.

For instance, in June 2023, BioLife Solutions, Inc., a global biotechnology company, announced the launch of a new, large-capacity controlled-rate freezer (CRF) to expand its CRF product line, which now stands at three different form factors. Branded as the IntelliRate i67C, this tabletop freezer caters to a crucial customer need for higher volume production of cell therapies.

In May 2021, BioLife Solutions, Inc., a global biotechnology company, announced that it has closed the previously announced acquisition of Stirling Ultracold, a privately held manufacturer of ultra-low temperature (ULT) mechanical freezers. Stirling will supply approximately 100 energy efficient ULT mechanical freezers to support customer's cold chain capabilities for biologics and emerging modalities. In March 2021, Eppendorf Corporate, a leading life science company, announced that it has re-designing the CryoCubeF570 (all voltages). The well-known standard-sized ULT freezer is now completely equipped with future-proof green cooling liquids and green insulation foam as well as better performance.

The upcoming trends of cell cryopreservation market include the increase in research and development activities for stem cells, increase in government support for research and development activities and increase in prevalence of chronic diseases.

The leading application of cell cryopreservation is in the freezing and storage of hematopoietic stem cells, which are found in the bone marrow and peripheral blood.

North America is the largest regional market for cell cryopreservation market?

The estimated industry size of cell cryopreservation market is $76.6 billion in 2032.

The top companies to hold the market share in cell cryopreservation market include BioLife Solutions, Inc., Creative Biolabs Inc., Danaher Corporation (Cytiva), Eppendorf AG, HiMedia Laboratories Pvt. Ltd., Lonza Group, MERCK Group (Sigma-Aldrich), PromoCell GmbH, Sartorius AG, Thermo Fisher Scientific Inc.

The base year calculated in the Cell Cryopreservation market report is 2022.

The forecast period in the market report is from 2023 t o 2032.

Yes, the cell cryopreservation market companies are profiled in the report.

Loading Table Of Content...

Loading Research Methodology...