Central Lab Market Research, 2031

The global central lab market size was valued at $3.3 billion in 2021, and is projected to reach $6 billion by 2031, growing at a CAGR of 6% from 2022 to 2031. Central labs, also known as central laboratories, are facilities that provide specialized and comprehensive testing services for clinical trials conducted by pharmaceutical and biotech companies. In addition, central labs offer a wide range of laboratory services such as biomarker analysis, pharmacokinetic testing, safety testing, and other clinical laboratory services required for drug development. Central labs play a critical role in clinical research by providing standardized, high-quality testing services across multiple clinical trial sites, ensuring consistent and reliable data collection.

Market Dynamics

Growth & innovations in the pharmaceutical industry create an opportunity for the central lab market. Rise in the number of clinical trials and increase in investments for R&D activities by various key players across the globe are set to affect the market growth positively. The growth of the central lab market is expected to be driven by emerging markets, due to the availability of improved healthcare infrastructure, increase in unmet healthcare needs, and rise in prevalence of chronic diseases in adults which results in rise in number of clinical trials.

Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced healthcare services, significant investments by government to improve healthcare infrastructure, and development of the healthcare industry in emerging countries. The increase in biological research and development institutions, the expansion of genomics research, and the rising incidence of chronic diseases are all contributing factors to the central lab market's expansion. The global demand for clinical trials is growing rapidly, driven by the need to develop new treatments and therapies for various diseases. Thus, central labs play a critical role in clinical trials by providing high-quality laboratory services and ensuring reliable data collection across multiple clinical trial sites.

In addition, biotech companies develop new drugs, vaccines, and diagnostic tools to improve patient outcomes and treat diseases. Thus, central lab offers services such as genetic testing, biomarker analysis, clinical trial testing, and quality control testing that can help biotech companies to validate the safety and efficacy of their products. Further, governments and regulatory bodies around the world have implemented favorable policies to encourage clinical research and drug development, thereby driving the growth of the market. The rise in the incidence of chronic diseases is significantly influencing the demand for the central laboratories. The demand for central lab techniques is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the market. Factors such as rise in adoption of central lab, and increase in investments, further drive the growth of the market.

However, logistics and sample handling are critical components of central lab services, and issues with these processes can limit the growth of the central lab market. Further, proper collection, storage, and transportation of samples are crucial to ensure the quality and reliability of central lab services. However, sample collection and transportation can be challenging, especially for clinical trials conducted across multiple sites in different regions or countries. Moreover, samples need to be maintained at specific temperatures and conditions to ensure their integrity and stability during transportation and storage. Thus, any deviation from these conditions can compromise the accuracy of central lab results.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The pandemic affected management of clinical trials and research activities, owing to disruptions in supply chains, travel restrictions, and social distancing measures. In addition, delay in subject enrollment and operational gaps in most ongoing clinical trials showed negative impact on trial programs and data integrity resulting in delay in timelines and a complete halt of operations. However, many central labs offer diagnostic testing to identify cases of COVID-19, working closely with diagnostic manufacturers & suppliers, and with regulators and public health authorities. In addition, many central labs received samples for identification of COVID-19, thus driving the growth of the market. Thus, COVID-19 had moderately positively impacted the central lab market growth.

Segmental Overview

The global central lab market is segmented into services, end user, and region. On the basis of services, the market is divided into genetic services, biomarker services, anatomic pathology and histology, specimen management and storage, and others. As per end user, the market is categorized into pharmaceutical companies, biotechnology companies, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

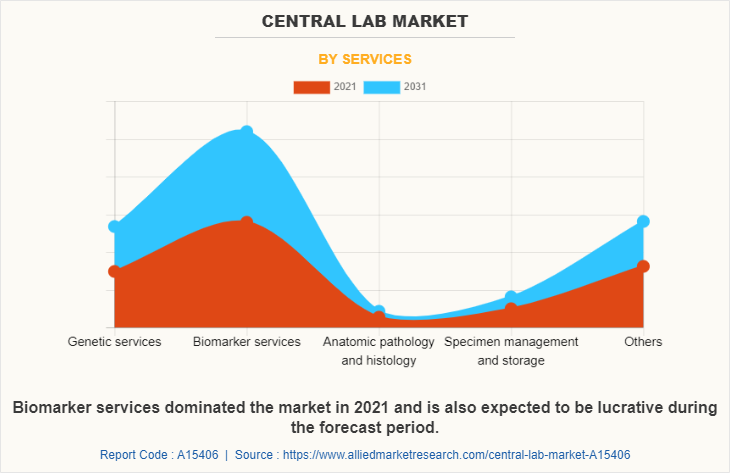

By Services

On the basis of services, the market is bifurcated into genetic services, biomarker services, anatomic pathology and histology, specimen management and storage, and others. The biomarker services segment occupied largest central lab market size in 2021 and is expected to register highest CAGR during the forecast period owing to increasing use of biomarkers in drug development & clinical research, and to measure physiological or disease-related processes, such as response to treatment, disease progression, and patient prognosis.

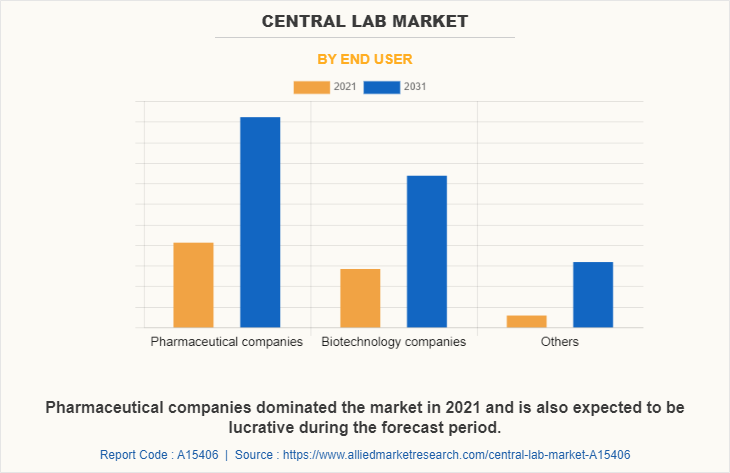

By End User

On the basis of end user, the market is categorized into pharmaceutical companies, biotechnology companies, and others. The pharmaceutical companies segment occupied largest central lab market share in 2021 and is expected to register highest CAGR during the forecast period owing to rise in number of clinical trials for new drugs, increase in investments in R&D activities, and surge in prevalence of chronic diseases.

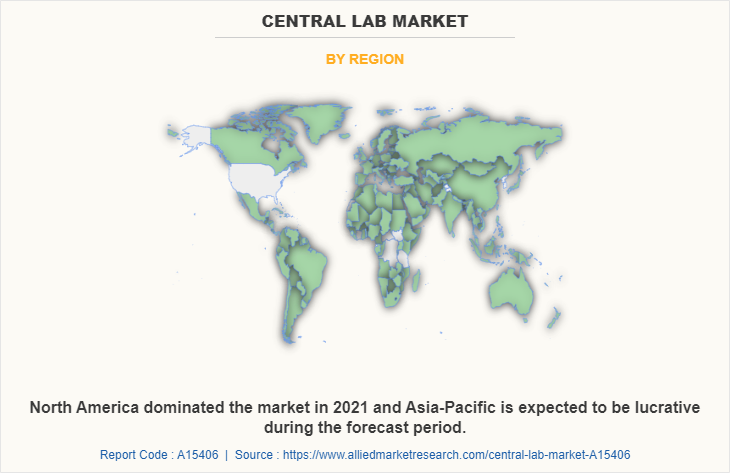

By Region

The central lab market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a majority of the global central lab market share in 2021, and is anticipated to remain dominant during the forecast period. This is attributed to strong presence of key players along with availability of advanced technologies, large presence of pharmaceutical and biotech companies, and rise in government initiatives promoting research activities for development of novel drugs which majorly drives the market growth in North America.

However, Asia-Pacific is anticipated to witness notable growth, owing to increase in number of clinical studies, rise in number of central labs services provider companies, increase in investments in pharmaceutical research and development activities, and favorable regulatory guidelines for clinical trials in the region which will drive the growth of the market during the forecast period.

Presence of several major players, such as Laboratory Corporation of America, IQVIA Inc (Q2 Solutions), Eurofins Scientific, and Rochester Regional Health (ACM Global Laboratories), and wide availability of service offerings in the region drives the growth of central lab market. Furthermore, presence of well-established healthcare infrastructure, and rise in adoption rate of sequencing services for disease detection are expected to drive the market growth.

Moreover, rise in adoption of strategies such as expansion of central labs, acquisition, and agreement in this region further boost the growth of the market. For instance, in October 2021, IQVIA, announced the opening of a state-of-the-art, 160,000-square-foot lab facility for its Q2 Solutions subsidiary. The new facility has an innovative suite of laboratory capabilities, including cutting edge bioanalytical, vaccine, biomarker, and genomics laboratories.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The Asia-Pacific region has become a hub for clinical trials due to its large population, diverse patient pool, and relatively lower costs compared to developed countries. This has led to an increase in demand for central lab services to support clinical trials. In addition, rise in prevalence of chronic diseases, such as cancer in the Asia-Pacific region, provides a boost to the growth of the market. This has led to an increase in demand for clinical research to develop new treatments and therapies, driving the growth of the central lab market size.

Moreover, governments in the Asia-Pacific region have implemented favorable regulatory policies to encourage clinical research and drug development, which has created a conducive environment for the growth of the central lab market. Asia-Pacific offers profitable opportunities for key players operating in the central lab market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rising research, as well as well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region, driving the central lab market forecast.

Competition Analysis

Competitive analysis and profiles of the major players in the central lab market, such as Laboratory Corporation of America, Rochester Regional Health (ACM Global Laboratories), ICON plc, Medpace, IQVIA Inc. (Q2 Solutions), Eurofins Scientific, LabConnect, Cerba HealthCare (Cerba Research), Frontage Labs, and CIRION BioPharma Research Inc. are provided in this report. Major players have adopted acquisition, expansion, and agreement as key developmental strategies to improve the services of the central lab industry.

Recent Expansion in the Central Lab Market

- In June 2022, Labcorp, a leading global life sciences company, announced that it is enhancing its central laboratory presence and drug development capabilities in Japan through an expansion of CB trial laboratory, the central laboratory co-managed by Labcorp Drug Development and BML, a leading Japanese provider of clinical laboratory testing services.

- In June 2021, Q2 Solutions, a leading global clinical trial laboratory services organization and a wholly owned subsidiary of IQVIA, has announced the expansion of its laboratory and operational capabilities at its Alba Campus in Livingston, Scotland. This expansion of central labs, genomics, flow cytometry, and translational science laboratory services will support new growth areas for biopharma and pharma clients around the world and drive better patient outcomes.

Recent Agreement in the Central Lab Market

- In September 2021, Emmes, a leading global full-service clinical research organization (CRO), together with its rare disease CRO Orphan Reach, announced it has signed a new five-year service agreement to extend its current relationship with Eurofins Central Laboratory.

Recent Acquisition in the Central Lab Market

- In February 2019, ICON plc, a global provider of drug development solutions and services to the pharmaceutical, biotechnology, and medical device industries, announced that it has acquired MolecularMD, a molecular diagnostic specialty laboratory that enables the development and commercialization of precision medicines in oncology. The acquisition enhances ICON’s laboratory offering in molecular diagnostic testing and brings to ICON expanded testing platforms, including next generation sequencing and immunohistochemistry (IHC).

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the central lab market analysis from 2021 to 2031 to identify the prevailing central lab market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the central lab market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global central lab industry.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global central lab market trends, key players, market segments, application areas, and market growth strategies.

Central Lab Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 6 billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 223 |

| By End user |

|

| By Services |

|

| By Region |

|

| Key Market Players | Eurofins Scientific, ICON Plc, Medpace, CIRION BioPharma Research Inc., LabConnect, Frontage Labs, Rochester Regional Health, Laboratory Corporation of America Holdings, IQVIA Inc., Cerba Healthcare |

Analyst Review

This section provides various opinions of top-level CXOs in the global central lab market. According to the insights of CXOs, increase in demand for central lab services and escalating demand for novel drugs globally is expected to offer profitable opportunities for the expansion of the market

CXOs further added that pharmaceutical and biotech industries are investing heavily in research & development and clinical trials to bring new drugs and treatments to market. Central labs play a key role in supporting these efforts by providing specialized laboratory services to support drug development and clinical trials.

Furthermore, North America is expected to witness highest growth, in terms of revenue, owing to ongoing technological advancements, increasing number of pharmaceutical companies, and rise in government initiatives promoting research activities for development of novel drugs which drives the market growth. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in number of clinical studies and rise in number of central lab services providers in the region, thus, driving the growth of market during the forecast period.

Rise in investments in R&D activities, increase in number of clinical trials are the upcoming trends of central lab market.

Biomarker services is the leading application of central lab market.

North America is the largest regional market for central lab.

The global central lab market was valued at $3.3 billion in 2021, and is projected to reach $6 billion by 2031, growing at a CAGR of 6% from 2022 to 2031.

Laboratory Corporation of America, Rochester Regional Health (ACM Global Laboratories), ICON plc, Medpace, IQVIA Inc. (Q2 Solutions), Eurofins Scientific, LabConnect, Cerba HealthCare (Cerba Research), Frontage Labs, and CIRION BioPharma Research Inc., are the top companies to hold the market share of central lab market.

2021 is the base year of central lab market.

2022 to 2031 are the forecast years of central lab market.

Loading Table Of Content...

Loading Research Methodology...