Centralized Refrigeration Systems Market Research, 2032

The Global Centralized Refrigeration Systems Market size was valued at $29.8 billion in 2022, and is projected to reach $49.5 billion by 2032, growing at a CAGR of 5.2% from 2023 to 2032. The centralized refrigeration systems market was 3,822,782 units in 2022 and is estimated to reach 4,989,771 units by 2032, exhibiting a CAGR of 2.7% from 2023 to 2032.

A Centralized Refrigeration System mainly includes components such as compressor, condenser, and evaporator, along with its control systems and other miscellaneous components. These components cool the space or other processes by distributing the refrigerant through a network of pipes to various evaporators present in the location to be cooled. The refrigerant is then brought back to the compressor, cooled, and then circulated once more.

Market Dynamics

Refrigeration systems are widely used in the food & beverage industries. Due to the rise in demand for packaged and processed food and beverages in developing nations, FMCG product consumption has increased in recent years. Semi-processed foods and beverages are protected from decomposition with the help of industrial refrigerators. In addition, according to the American Frozen Food Institute (AFFI), the retail sales of frozen food increased significantly by 23% in 2021, as compared to 2019.

Moreover, cold storage facilities are also widely used for the storage of perishable agricultural produce, such as vegetables, fruits, and meat products, as well as temperature-sensitive chemicals. Commercial cold storage facilities are mostly used by farmers, fishing companies, and others to store their produce and sell them during the off-season. Moreover, in the last few years cold-chain industry has witnessed increased growth owing to increased demand for fruit and vegetables, and increased e-commerce in the world.

Moreover, the food & beverages, and pharmaceutical industries are witnessing a surge in growth across the world. The primary reason for the growth of the food & beverages industry is the increased disposable income of the people and change in general lifestyle trends where dining out and fast food are promoted. Thus, various companies are expanding their production capabilities. For instance, in October 2022, Hi-Food, a subsidiary of CSM Ingredients, opened its new headquarters and production plant for producing and developing ingredients for the food and beverage sectors in Parma, Italy.

However, centralized refrigeration systems that are widely used in various industrial applications such as food processing, product preservation, and others, consume enormous amounts of energy to control the temperature in a facility. Additionally, these systems require continuous monitoring to regulate the flow of refrigerant and come with greater maintenance costs. Therefore, it is anticipated that these factors will impede market expansion.

In March 2022, Vietnam commenced construction of two industrial zones. Both of the zones spread over an area of more than 10 sq km. This is expected to attract foreign investment in both high-tech and labor-intensive industries. In most of the industries, refrigeration systems are crucial to keep the machines and processes cool, so that no accidents occur due to uncontrolled chain reactions, especially in compounds with low boiling points. In addition, refrigeration systems are also used for maintaining conducive environment for workers and machines, where machines inherently produce high amounts of heat. Thus, growth in industries is anticipated to have positive impact on the market growth.

The demand for centralized refrigeration systems decreased in 2020 globally, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic led to shutdown of the various end users of centralized refrigeration systems including restaurants, hotels, retail stores, and others, leading to a halt in demand for centralized refrigeration systems. However, rise in food & beverages sector and pharmaceuticals sector prevented the market from taking a steep negative dive.

Fortunately, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic reduced significantly, leading to the full-fledged reopening of businesses involved in the centralized refrigeration systems market. Furthermore, it has been more than three years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery. Contrarily, during the beginning of 2023, the number of COVID-19 cases surged again, especially in China, which brought negative sentiments to the overall global and regional market. In addition to COVID-19, another global event; worldwide inflation, driven by the Ukraine-Russia war and quantitative easing done in some parts of the world during COVID-19 has also negatively affected the centralized refrigeration systems market growth.

Segmental Overview

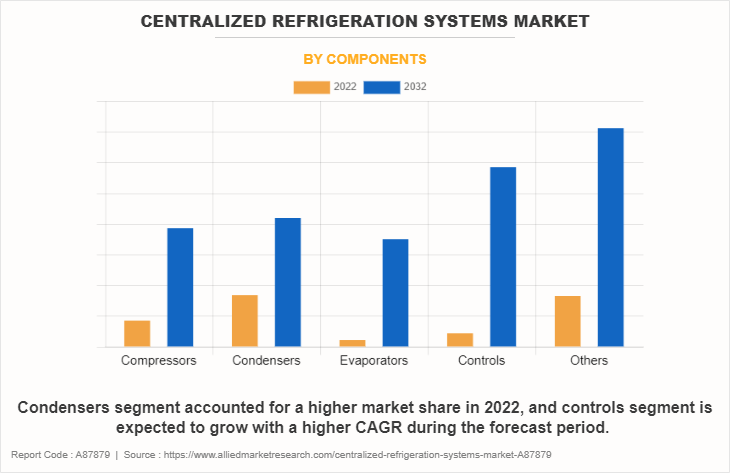

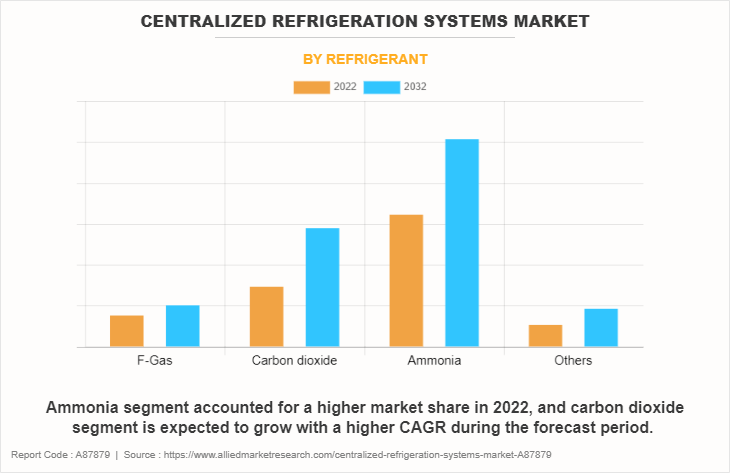

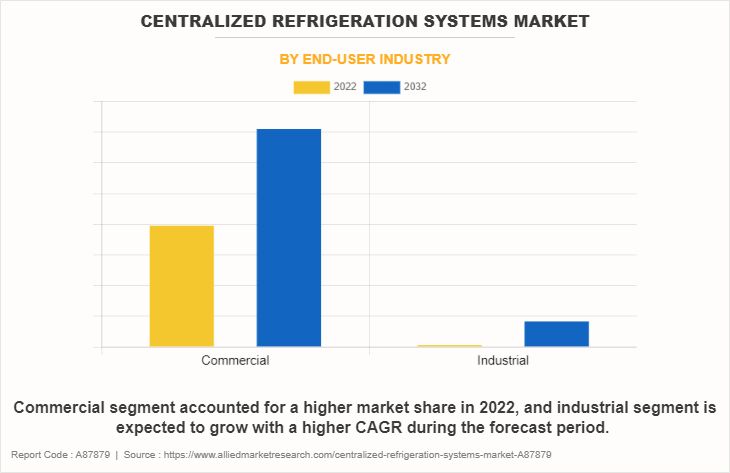

The Centralized Refrigeration Systems Market is segmented into components, refrigerants, end-user industry, and region. By component, it is segregated into compressor, condenser, evaporator, control, and others. Depending on the refrigerant type, it is classified into ammonia, carbon dioxide, F-gases, and others. Based on end-user industry, the market is divided into commercial (hotel, restaurant, catering, and retail) and industrial (refrigerated warehouse, food processing, healthcare, and others).

By Component Type:

The Centralized Refrigeration Systems Market is divided into compressor, condenser, evaporator, control, and others. Condenser segment accounted for a higher market share in 2022. However, the controls segment is expected to grow with a higher CAGR during the forecast period.

By Refrigerant Type:

The Centralized Refrigeration Systems Market is divided into ammonia (NH3), carbon dioxide (CO2), F gases, and others. The ammonia segment accounted for a higher market share in 2022, owing to the increased demand for natural refrigerants in large industrial plants. However, the carbon dioxide segment is expected to grow with a higher CAGR during the forecast period. The demand for carbon dioxide refrigerant has rapidly increased in the industrial refrigeration market, as various industries prefer using carbon dioxide as a refrigerant where toxicity or flammability is a key concern.

By End User:

The centralized refrigeration systems market is divided into commercial (hotel, restaurant, catering, and retail) and industrial (refrigerated warehouse, food processing, healthcare, and Others). Out of these, the commercial segment accounted for a larger market share in terms of revenue in 2022, owing to the large-scale utilization of centralized refrigeration systems in places such as hotels, restaurants, catering, and retail stores.

For instance, Bacharach presented its comprehensive system at ASHRAE 15 for ensuring refrigerant safety compliance at the AHR Expo held in Florida in 2020. The system includes features such as combustion and emissions analysis, leak rate reduction, VRF leak detection in occupied spaces, and refrigerant gas analysis and identification. Similarly, in April 2022, Coca Cola, one of the top beverages producing companies, announced investing around $79 million for opening a new beverage-producing plant in Telangana state of India. Similarly, in July 2022, PepsiCo, a major beverage producer announced opening a 1.2 million sq ft manufacturing facility.

Region Wise:

Centralized Refrigeration Systems Market share is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competition Analysis

Competitive analysis and profiles of the major players in the centralized refrigeration systems market are provided in the report. Major companies in the report include Johnson Controls, Carrier Global Corporation, Emerson Electric Co., GEA Group, Bitzer Kühlmaschinenbau GmbH, LU-VE S.p.A., Danfoss, EVAPCO Inc., Daikin, and Industrial Frigo Srl.

Major companies in the market have adopted acquisition, product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the centralized refrigeration systems market. For instance, in March 2023, Emerson Electric Co., a manufacturer of refrigeration systems, launched the industry’s first transcritical CO2 screw compressor for industrial applications in North America. The CO2 refrigerant is used as a sustainable and safer alternative to HFCs and ammonia. Moreover, the demand for refrigeration compressors is expected to grow largely in the food & beverage, and cold-chain industry during the forecast period.

Key Benefits for Stakeholders

- The report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the centralized refrigeration systems market analysis from 2022 to 2032 to identify the prevailing centralized refrigeration systems market opportunity.

- In-depth centralized refrigeration systems market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

- Extensive analysis of the centralized refrigeration systems market overview is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The centralized refrigeration systems market forecast analysis from 2023 to 2032 is included in the report.

- The key players within the centralized refrigeration systems market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the centralized refrigeration systems industry.

- The report includes the analysis of the regional as well as global centralized refrigeration systems market trends, key players, market segments, application areas, and market growth strategies.

Centralized Refrigeration Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 49.5 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 154 |

| By Components |

|

| By Refrigerant |

|

| By End-user Industry |

|

| By Region |

|

| Key Market Players | Industrial Frigo S.R.L, Emerson Electric Co., LU-VE S.p.A., Danfoss, EVAPCO, Inc., Bitzer SE (Bitzer Kuhlmaschinenbau GmbH), GEA Group, CARRIER GLOBAL CORPORATION, Johnson Controls, Daikin Industries Ltd. |

Analyst Review

The centralized refrigeration systems market has witnessed significant growth in the past few years, owing to an increase in demand for fresh fruits & vegetables, meat, poultry, fish, dairy & ice cream, beverages, chemicals, pharmaceuticals, and other products. Moreover, the rapid expansion and upgrades in cold storage facilities have led to a higher demand for centralized refrigeration systems and related equipment in various countries such as China, U.S., Germany, Italy, the UK, and Spain. Industrial refrigerators aid in preventing the decomposition of semi-processed and processed foods and drinks.

Moreover, demand for frozen and chilled foods is increasing due to changes in lifestyles of people around the globe. Rise in production, consumption, and trade of perishable and temperature-sensitive products which are transported and stored in a temperature-controlled or refrigerated medium is driving the growth of the cold-chain industry. For instance, in October 2022, the Guangzhou Nansha international logistics center began its operation of cold-chain import business. Guangzhou Nansha international logistics center is the largest single cold storage in China.

Moreover, in December 2022, a 5,000 metric ton capacity cold-storage facility began its operation in the Assam state of India. This cold storage facility is said to be the largest in the Northeastern region of the country. These facilities significantly require various refrigeration systems; therefore, many companies in the refrigeration market have launched their refrigeration products for cold-chain industry. For instance, in October 2022, Daikin Europe NV unveiled Monoblock and other new sustainable cold chain refrigeration solutions. Thus, growth in cold-chain industry is driving the growth of the centralized refrigeration system market.

Increase in food and beverages industry and technological advancement in refrigeration systems are trends of Centralized Refrigeration Systems Market in the world

The commercial is leading end user of Centralized Refrigeration Systems Market

Asia-Pacific is the largest regional market for Centralized Refrigeration Systems

The centralized refrigeration systems market was valued for $29,817.70 million in 2022

Daikin Industries, Ltd., Emerson Electric Co., Evapco, Inc., GEA Group AG, Johnson Controls, Inc., Ingersoll Rand, LU-VE Group, Mayekawa Mfg. Co. Ltd., The Danfoss Group, and Carrier.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance in terms of revenue, various strategies, and recent developments.

The 2023-2032 is the forecast period in the global centralized refrigeration systems market report

The centralized refrigeration systems market is estimated to reach $49,502.80 million by 2032, exhibiting a CAGR of 5.2% from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...