Cervical Cancer Diagnostic Market Research, 2032

The global cervical cancer diagnostic market was valued at $7.8 billion in 2022, and is projected to reach $12.7 billion by 2032, growing at a CAGR of 5% from 2023 to 2032. Cervical cancer is the type of cancer that starts in the cells of the cervix. The cervix is the lower, narrow end of the uterus (womb). The cervix connects the uterus to the vagina. It usually develops slowly over time. The cells of the cervix go through changes known as dysplasia before cancer appears in the cervix. Abnormal cells begin to appear in the cervical tissue. the abnormal cells may become cancer cells and start to grow and spread more deeply into the cervix and to surrounding areas if not destroyed or removed over time. The goal of screening for cervical cancer is to find precancerous cervical cell changes, when treatment can prevent cervical cancer from developing. The cancer if present is found during cervical screening. Cervical cancer found at an early stage is usually easier to treat.

Market Dynamics

The increase in applications of diagnostic tests of cervical cancer in healthcare organizations helps to create an opportunity for the Cervical Cancer Diagnostic Test Market. Moreover, the rise in the launch of new products made up of advanced technology by various key players across the globe is set to affect the Cervical Cancer Diagnostic Industry growth positively. For instance, in November 2021, Hologic, Inc. announced the commercial launch of its new Genius Digital Diagnostics System in Europe. The Genius Digital Diagnostics System is the next generation of cervical cancer screening that combines deep learning-based artificial intelligence (AI) with advanced volumetric imaging technology to help identify pre-cancerous lesions.

The Cervical Cancer Diagnostic Market Growth is expected to be driven by high potential in developing countries due to increase in the demand for cervical cancer diagnostics in the middle-aged patients, surge in number of research and development activities and increase in test efficiency. The hospitals and other healthcare organizations are turning to advanced systemsin the testing of the cancer presence in the cervix. Also, the cost effectiveness of cervical cancer screening tests contributes to the growth of Cervical Cancer Diagnostic Industry. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to rise in demand for enhanced diagnostics technologies, significant investments by government to improve diagnostic testing, and development of strong foothold of biotechnological industries in emerging countries.

The demand for cervical cancer diagnostic is not only limited to developed countries but is also being witnessed in the developing countries, such as China, Brazil, and India, which fuel the growth of the Cervical Cancer Diagnostic Test Market. Factors such as rise in adoption of diagnostic tests and increase in awareness about importance of cervical cancer screening in the diagnosis of the cancerous cells further drive the growth of the market. Moreover, an increase in promotional activities by manufacturers and the need for accuracy in diagnostic procedures are expected to fuel their adoption in the near future.

However, inaccurate pap smear testing, ineffective healthcare infrastructure, stringent government regulations and alternative diagnosis methods are the factors hampering the market growth. The doctor may consider various factors when choosing a diagnostic test like type of cancer, signs and symptoms, age & general health and results of earlier medical tests. Moreover, lack of awareness regarding the pap smear tests among healthcare providers are anticipated to hamper the growth of the Cervical Cancer Diagnostic Market Size.

Segmental Overview

The cervical cancer diagnostic market is segmented on the basis of type, end user and region. On the basis of type, the market is categorized into pap smear tests, ECC procedures and colposcopy tests. On the basis of end user, the market is classified into age group between 20 and 40 and age group above 40. Region wise, the market is studied across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

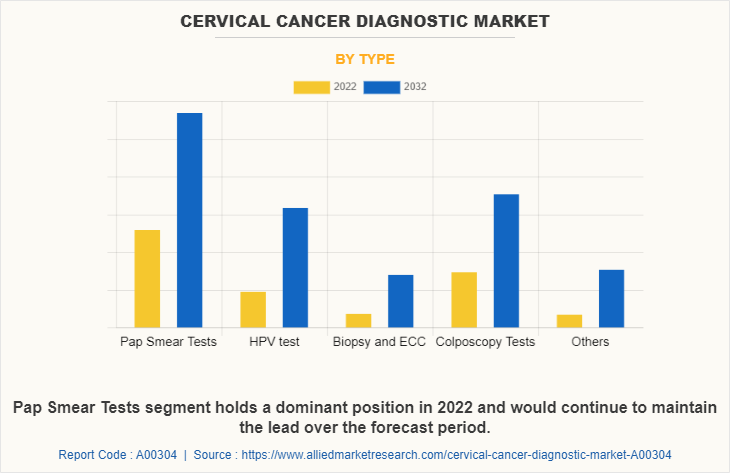

By Type

The market is classified into pap smear tests, ECC procedures and colposcopy tests. The Pap Smear Tests segment dominated the Cervical Cancer Diagnostic Market Size in 2022 and is expected to remain dominant throughout the forecast period, owing to increase in adoption of Pap Smear Tests for diagnosis of the cervical cancer. However, the HPV test segment is expected to register highest CAGR during the forecasted period owing the presence of the human papillomavirus (HPV) infection and the availability of home-based sample collection kits of HPV test.

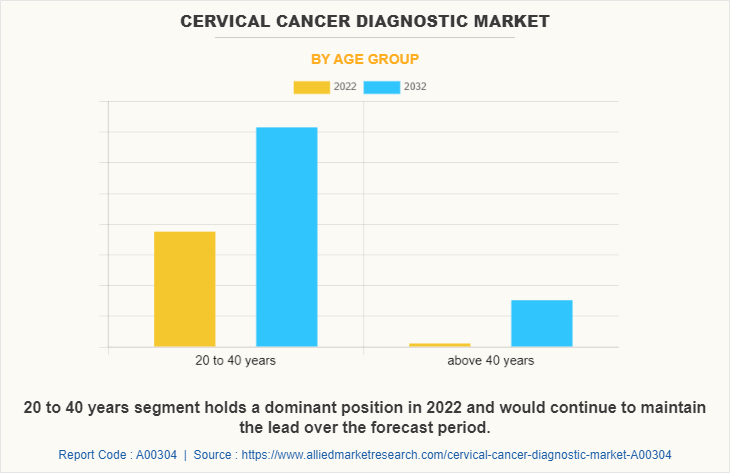

By Age Group

The market is classified into 20 to 40 years and above 40 years. The 20 to 40 years segment held the largest Cervical Cancer Diagnostic Market Share in 2022 and is expected to remain dominant throughout the Cervical Cancer Diagnostic Market Forecast period, owing to the prevalence of the cervical cancer among population of age group 20-40 along with the surge in number of patients visiting the hospitals for diagnosis of the cervical cancer. However, the above 40 years segment is expected to register highest CAGR during the forecasted period owing increase in government support for diagnosis of cervical cancer.

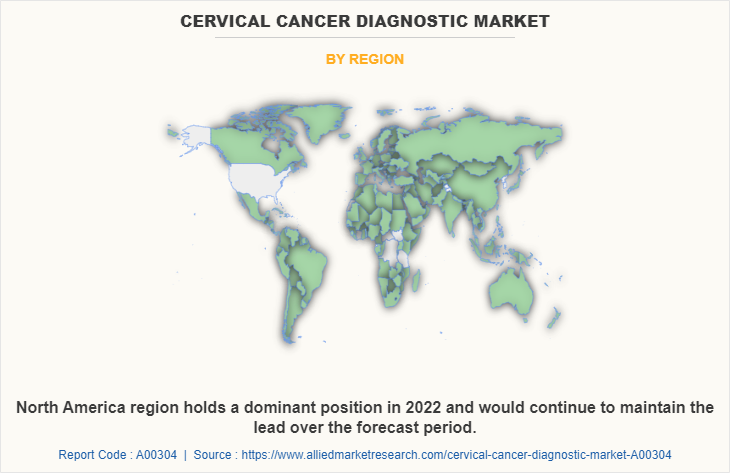

By Region

The cervical cancer diagnostic market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, North America was the dominant region and is expected to remain dominant throughout the forecast period, owing to increase in the number of patients adopting the diagnosis of cervical cancer diagnosis services in the hospitals, increase in the number of market players and surge in the number of products available in the region. However, Asia-Pacific is expected to witness the highest CAGR during the analysis period, owing to surge in obesity in women, rise in incidences of unsafe sex, particularly amongst teenagers, and increase in number of various strategies and trends adopted by the market players.

Competition Analysis

Competitive analysis and profiles of the major players, such as Abbott Laboratories, Qaigen NV, Carl Zeiss AG, Thermo Fisher Scientific Inc., Becton, Dickinson and Company, Hologic Inc, F. Hoffmann-La Roche AG, Siemens Healthineers, CooperSurgical Inc., Dysis Medical ltd, in the cervical cancer diagnostic market are provided in this report. Some important players in the market include Becton, Dickinson and Company, Hologic Inc, F. Hoffmann-La Roche AG, and Siemens Healthineers. Various players have adopted strategies like product approval, product launch, partnership, and collaboration as key developmental strategies to improve their product portfolio.

Product Launchs in the Cervical Cancer Diagnostic Market

- In November 2021, Hologic, Inc. announced the commercial launch of its new Genius Digital Diagnostics System in Europe. The Genius Digital Diagnostics System is the next generation of cervical cancer screening that combines deep learning-based artificial intelligence (AI) with advanced volumetric imaging technology to help identify pre-cancerous lesions and cervical cancer cells in women.

- In November 2021, Roche AG announced the launch of the cobas 5800 System, a new molecular laboratory instrument, in countries accepting the CE mark. Testing is one of the first lines of defense to protect a patient's general well-being and is vitally important in quickly guiding their treatment. The cobas 5800 System helps address challenges that laboratories are facing from an increase in patient testing, reimbursement complexities and the need for a more diverse testing menu while providing meaningful and timely results.

Product Approvals in the Cervical Cancer Diagnostic Market

- In February 2023, BD and Company (Becton, Dickinson and Company) announced that U.S. Food and Drug Administration (FDA) has approved its product the BD Onclarity HPV Assay to be used with the ThinPrep Pap Test.

- In April 2019, Hologic, Inc. announced that the ThinPrep Genesis processor for cytology slide and molecular test preparation has received a CE IVD mark in Europe. The system features increased automation capabilities, together with ergonomic and chain of custody benefits, compared to older instruments. Most importantly, the instrument will prepare slides for cytology as well as aliquot samples for molecular testing, reducing manual sample handling.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the global cervical cancer diagnostic market analysis from 2022 to 2032 to identify the prevailing global Cervical Cancer Diagnostic Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the global cervical cancer diagnostic market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global global cervical cancer diagnostic market trends, key players, market segments, application areas, and market growth strategies.

Cervical Cancer Diagnostic Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12.7 billion |

| Growth Rate | CAGR of 5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 228 |

| By Type |

|

| By Age group |

|

| By Region |

|

| Key Market Players | F. Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Hologic Inc., Siemens Healthineers, Qaigen NV, Carl Zeiss AG, Abbott Laboratories, Becton, Dickinson and Company, CooperSurgical Inc., Dysis Medical ltd. |

Analyst Review

This section provides opinions of the top-level CXOs in the cervical cancer diagnostic market. In accordance with several interviews conducted, the cervical cancer starts in the cells lining the cervix which is the lower part of the uterus. The cervix connects the body of the uterus that is the upper part where a fetus grows to the vagina or birth canal. Cancer starts when cells in the body begin to grow out of control. Cells in the transformation zone do not suddenly change into cancer. Instead, the normal cells of the cervix first gradually develop abnormal changes that are called pre-cancerous. Screening tests can help detect cervical cancer and precancerous cells that may one day develop into cervical cancer.

Asia-Pacific is expected to witness the highest CAGR during the analysis period, owing to the increase in the prevalence of cervical cancer and rise in cases of HPV infections that surge the adoption rate of diagnostic testing products including the diagnostic medical devices. Moreover, increase in awareness about the strictness in cervical cancer screening, and surge in in government support on cervical cancer diagnostics or treatment and other related trends adopted by the market players help to increase the growth of the market.

The total market value of the Cervical Cancer Diagnostic Market is $7,836.54 million in 2022.

North America is the largest regional market for Global Cervical Cancer Diagnostic.

The forecast period in the report is from 2023 to 2032.

The top companies that hold the market share in the Abbott Laboratories, Qaigen NV, Carl Zeiss AG, Thermo Fisher Scientific Inc., and Hologic Inc,

The base year for the report is 2022.

Yes, the competitive landscape included in the Cervical Cancer Diagnostic market report.

Yes, Cervical Cancer Diagnostic companies are profiled in the report.

There are 10 Cervical Cancer Diagnostic manufacturing companies are profiled in the report.

Loading Table Of Content...

Loading Research Methodology...