Charge Card Market Research, 2032

The global charge card market was valued at $2.2 billion in 2022, and is projected to reach $6.2 billion by 2032, growing at a CAGR of 11.3% from 2023 to 2032.

The charge cards provide several benefits, including access to a revolving line of credit without interest charges if paid in full each month. This market promotes financial discipline, helps users avoid accumulating debt, and often offers perks such as travel rewards, cashback incentives, and extended warranties.

The increasing adoption of digital payment methods is propelling the charge card market by offering unparalleled convenience and efficiency to consumers and businesses alike. Digital payments, facilitated by smartphones and online platforms, have streamlined financial transactions, eliminating the need for physical cash or checks. Charge cards, which provide a flexible credit line and must be paid in full each month, have adapted to this trend by integrating seamlessly with digital wallets and contactless payment systems. Consumers are drawn to charge cards for their simplicity and the ability to earn rewards, such as cashback or travel points. In addition, attractive reward programs have played a pivotal role in driving the charge card market's growth and popularity. These programs offer cardholders a compelling incentive to use their charge cards for everyday transactions and larger purchases. By accumulating points, miles, or cashback rewards, consumers feel they are getting tangible benefits from their spending.

However, charge cards are not as widely accepted as credit cards due to several factors that restrain the charge card market's growth. Charge cards require users to pay their balances in full each month just like credit card charges, which is a limitation for those who prefer the flexibility of revolving credit offered by credit cards. On the other hand, the growing innovation in charge card offerings is ushering in exciting opportunities for the charge card market. Charge card providers are constantly evolving their services to meet the changing needs of consumers and businesses. These innovations include enhanced rewards programs, flexible payment options, and advanced security features.

The report focuses on growth prospects, restraints, and trends of the charge card market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the charge card market.

Segment Review

The charge card market is segmented on the basis of type, issuer, end user, and region. On the basis of type, the market is bifurcated into general purpose charge card, retail charge card, travel charge card, business charge card, and others. Based on the issuer, the market is segmented into banks and NBFCs. By end user, it is bifurcated into individuals, corporate, and government. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

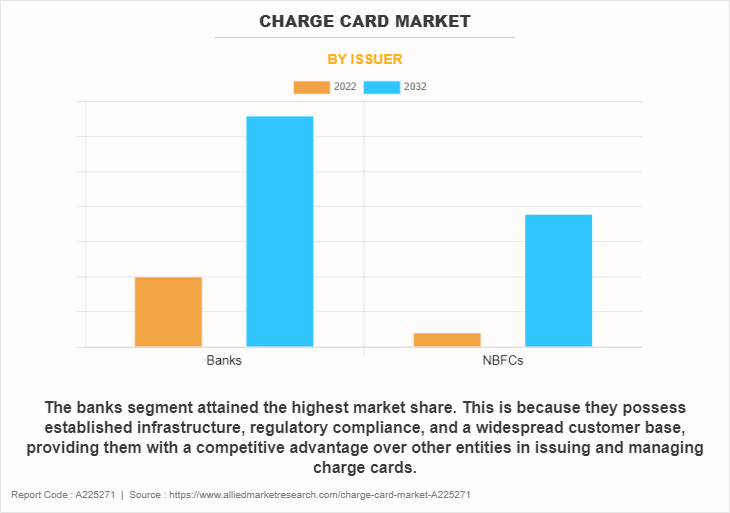

By issuer, the banks segment held the highest market. This was attributed to banks harnessing data analytics to tailor card offerings to specific customer segments, creating personalized experiences. As consumer spending habits evolve, banks adapt their card features accordingly, staying relevant in a dynamic market. In addition, the rise of digital banking and e-commerce has expanded the need for convenient and secure payment options, fueling the demand for charge cards. Meanwhile, NBFCs is forecasted to be the fastest-growing segment. This is attributed as these companies leverage digital technologies for efficient and convenient card management, appealing to tech-savvy customers. Furthermore, NBFCs adapt quickly to changing market demands, tailoring their charge card offerings to specific niches or industries, further fueling growth.

Based on region, North America attained the highest charge card market share. This be attributed to the adoption of digital payment technologies and mobile apps which must enhance the user experience for charge cardholders. Features such as digital wallets, real-time spending alerts, and mobile payment options may make charge cards more attractive in the North America region. However, the Asia-Pacific region is forecasted to be the fastest-growing segment in the charge card market size. This growth be attributed to the rise of fintech companies and startups in the Asia-Pacific region has introduced innovative payment solutions, including digital wallets and peer-to-peer lending platforms, which have increased the overall awareness and acceptance of electronic payments, including charge cards.

Some of the key players profiled in the report include American Express Company, Bank of America Corporation., Barclaycard, Citigroup Inc., Diners Club International Ltd., Discover Bank, jCB Co., Ltd., Mastercard, The Hongkong and Shanghai Banking Corporation Limited, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the charge card market growth.

Market Landscape and Trends

The charge card industry has experienced significant changes and trends in recent years. Emerging technologies and shifting consumer preferences are reshaping the landscape. One prominent trend is the rise of contactless and mobile payments, with consumers increasingly favoring the convenience and security of digital transactions. This shift has led to the development of innovative charge card features, such as integrated mobile wallets and biometric authentication. In addition, sustainability is gaining importance in the charge card market. Many consumers now seek eco-friendly options, and card issuers are responding by offering environmentally responsible card materials and promoting carbon offset programs. Another notable trend is the growth of challenger banks and fintech companies entering the charge card space. These newcomers often provide more streamlined user experiences, lower fees, and enhanced rewards programs, challenging traditional financial institutions.

Top Impacting Factors

Increasing Adoption of Digital Payment Methods and the Convenience

The increasing adoption of digital payment methods is propelling the charge card industry by offering unparalleled convenience and efficiency to consumers and businesses alike. Digital payments, facilitated by smartphones and online platforms, have streamlined financial transactions, eliminating the need for physical cash or checks. Charge cards, which provide a flexible credit line and must be paid in full each month, have adapted to this trend by integrating seamlessly with digital wallets and contactless payment systems. Consumers are drawn to charge cards for their simplicity and the ability to earn rewards, such as cashback or travel points. Moreover, the enhanced security features of digital payments, including biometric authentication and real-time fraud detection, make charge cards a trusted choice. Businesses also benefit from this shift, as charge cards offer detailed transaction data, simplifying expense management and providing insights into spending patterns. In sum, the increasing synergy between digital payments and charge cards underscores the pivotal role of technology in shaping the future of finance while ensuring the utmost convenience for users.

Charge Cards are not as Widely Accepted as Credit Cards

Charge cards are not as widely accepted as credit cards due to several factors which restrain the charge card market's growth. Charge cards require users to pay their balances in full each month, which is a limitation for those who prefer the flexibility of revolving credit offered by credit cards. This repayment structure deters potential users and limits the market's reach. In addition, credit cards are more common globally, making them the default choice for many consumers and businesses. This widespread acceptance of credit cards has led to an extensive infrastructure for processing credit card transactions, while charge cards have a smaller footprint. Furthermore, credit cards often come with rewards and cashback programs, making them more appealing to users. Charge cards, on the other hand, typically offer fewer incentives, making them less attractive. Overall, the limited acceptance, strict payment requirements, and competition from credit cards are key factors restraining the charge card industry expansions.

Growing Innovation in Charge card Offerings

The growing innovation in charge card offerings is ushering in exciting opportunities for the charge card market. Charge card providers are constantly evolving their services to meet the changing needs of consumers and businesses. These innovations include enhanced rewards programs, flexible payment options, and advanced security features. One significant opportunity arises from the increasing demand for cashless transactions and digital payments. Charge card companies are capitalizing on this trend by introducing contactless payment options and integrating their credit cards with no annual fees and digital platforms. This makes charge cards more convenient and appealing to a broader customer base.

Moreover, the rise of fintech startups and partnerships between traditional financial institutions and tech companies has sparked innovation in credit assessment and approval processes. This allows charge card providers to offer quicker approvals and tailored credit limits, opening up opportunities to attract a wider range of customers. In conclusion, innovation in charge card offerings not only enhances the user experience but also broadens the market's reach, making charge cards more accessible and relevant in today's evolving financial landscape.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the charge card market forecast from 2022 to 2032 to identify the prevailing charge card market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the charge card market outlook assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global charge card market trends, key players, market segments, application areas, and market growth strategies.

Charge Card Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.2 billion |

| Growth Rate | CAGR of 11.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Type |

|

| By Issuer |

|

| By End User |

|

| By Region |

|

| Key Market Players | Diners Club International Ltd, The Hongkong and Shanghai Banking Corporation Limited, BANK OF AMERICA CORPORATION, Citigroup Inc., Mastercard, JCB Co., Ltd., Discover Bank, American Express Company, Wells Fargo & Company, Barclaycard |

Analyst Review

Data security and privacy concerns are driving advancements in card security features, including tokenization and multi-factor authentication, to protect cardholder information from cyber threats. Furthermore, the COVID-19 pandemic accelerated the adoption of e-commerce, boosting online spending and fuelling the demand for digital-first charge card solutions. Moreover, the charge card market is evolving rapidly, driven by technological advancements, sustainability initiatives, increased competition from fintech firms, enhanced security measures, and changing consumer behaviours. Staying competitive in this dynamic landscape requires card issuers to adapt to these trends and provide innovative, secure, and sustainable solutions that cater to the evolving needs of consumers.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in August 2023, HDFC Bank partnered with Marriott Bonvoy to launch the first co-branded hotel credit card in India. The card operates on Diners Club, part of the Discover Global Network, and provides special deals on hotels. The bank said that it plans to tap the `revenge spending’ engaged by Indians in travel post-pandemic. The travel benefits, including Silver Elite Status with Marriott Bonvoy, providing priority late checkout, exclusive member rates, and Marriott Bonvoy bonus points. Furthermore, in March 2022, JCB International Co., Ltd. along with National Payments Corporation of India (NPCI) in association with BOB Financial Solutions Limited (BFSL), a wholly owned subsidiary of Bank of Baroda (BoB) and Indian Railway Catering and Tourism Corporation Ltd. (IRCTC) have joined hands to launch the IRCTC BoB RuPay JCB Credit Card. The new co-branded credit card which was unveiled on 21st February 2022 focuses on offering many special features and benefits to travellers of the Indian railways, the largest rail network in Asia and the world's second largest under one management. Besides offering significant benefits on railway ticket bookings, users of this card will also get multiple benefits for shopping across other categories ranging from groceries to fuel. This card will also be usable across merchants and ATMs globally through the JCB network.

Some of the key players profiled in the report include American Express Company, Bank of America Corporation., Barclaycard, Citigroup Inc., Diners Club International Ltd., Discover Bank, jCB Co., Ltd., Mastercard, The Hongkong and Shanghai Banking Corporation Limited, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the charge card market.

The charge card market has experienced significant changes and trends in recent years. Emerging technologies and shifting consumer preferences are reshaping the landscape. One prominent trend is the rise of contactless and mobile payments, with consumers increasingly favoring the convenience and security of digital transactions.

Consumers are drawn to charge cards for their simplicity and the ability to earn rewards, such as cashback or travel points. In addition, attractive reward programs have played a pivotal role in driving the charge card market's growth and popularity.

North America is the largest regional market for Charge Card

The global charge card market was valued at $2,169.68 million in 2022 and is projected to reach $6,156.54 million by 2032, growing at a CAGR of 11.3% from 2023 to 2032

American Express Company, Bank of America Corporation., Barclaycard, Citigroup Inc., Diners Club International Ltd., Discover Bank, jCB Co., Ltd., Mastercard, The Hongkong and Shanghai Banking Corporation Limited, and Wells Fargo.

Loading Table Of Content...

Loading Research Methodology...