Cheerleading Equipment Market Research, 2032

The global cheerleading equipment market was valued at $1.7 billion in 2022, and is projected to reach $2.5 billion by 2032, growing at a CAGR of 4.4% from 2023 to 2032.Cheerleading equipment refers to a wide range of specialized gear and accessories used for cheerleading. This includes items like pom-poms, uniforms, footwear, safety gear such as mats and padding, training aids, megaphones, and other related products. Cheerleaders, whether part of school teams, professional squads, or individual enthusiasts, rely on this equipment to enhance their performances, showcase team spirit, and ensure safety during stunts and routines.

Market Dynamics

The cheerleading equipment market serves the needs of these athletes and their teams, providing essential tools and apparel to support their energetic and dynamic displays such factors surge the cheerleading equipment market size.

School and college sports programs play a pivotal role in surging cheerleading equipment market demand. These institutions actively promote cheerleading as part of their sports offerings, leading to more teams and participants. Thus, there is a greater need for quality gear, uniforms, and safety equipment. This increased participation and institutional support boost the growth of the cheerleading equipment market share by increasing both consumer demand and sales.

The rise in popularity of cheerleading as a sport, both at the school and professional levels, has significantly surged the demand for cheerleading equipment. There is a greater need for specialized gear and apparel to support performances and ensure safety as more individuals and teams engage in cheerleading activities. This growing interest expands the market's customer base and also fuels innovation in equipment design and technology. In addition, the increase in fanbase and media coverage further elevate the sport's visibility, driving demand for high-quality equipment to meet the needs of both athletes and enthusiasts.

Moreover, media and entertainment play a crucial role in surging demand for cheerleading equipment by increasing the visibility of cheerleading events through television broadcasts, live streaming, and social media platforms. This increased exposure fosters greater interest and participation in the sport, motivating teams, and individuals to invest in quality gear and accessories, ultimately driving the market growth.

The presence of governing bodies and organizations, such as USA Cheer, that oversee the sport and establish safety standards, encourages the use of proper equipment. Compliance with these standards drives the market by ensuring the safety and well-being of participants. Supportive regulatory bodies, by establishing safety standards and guidelines for cheerleading, instill confidence in participants, teams, and their parents. This assurance of safety and adherence to recognized norms encourages greater participation in the sport. Teams invest in high-quality cheerleading equipment to meet these standards, thereby driving market demand as the sport's reputation for safety and legitimacy grows.

Growing fitness and wellness trends have increased the demand for cheerleading equipment, as more individuals seek unique and dynamic workouts. Incorporating cheerleading elements into fitness routines attracts fitness enthusiasts. This trend has fueled the market growth by driving interest in basic cheerleading equipment, such as pom-poms and mats, to support engaging and active workouts, while also expanding the consumer base for cheerleading gear.

In addition, the rise of online retail and e-commerce has significantly boosted the cheerleading equipment market by offering a convenient and accessible platform for customers to browse, compare, and purchase gear. This surge in online availability has expanded the market's reach, making it easier for enthusiasts and teams to source a wide range of products, ultimately increasing demand for cheerleading equipment and contributing toward the market growth.

Segmental Overview

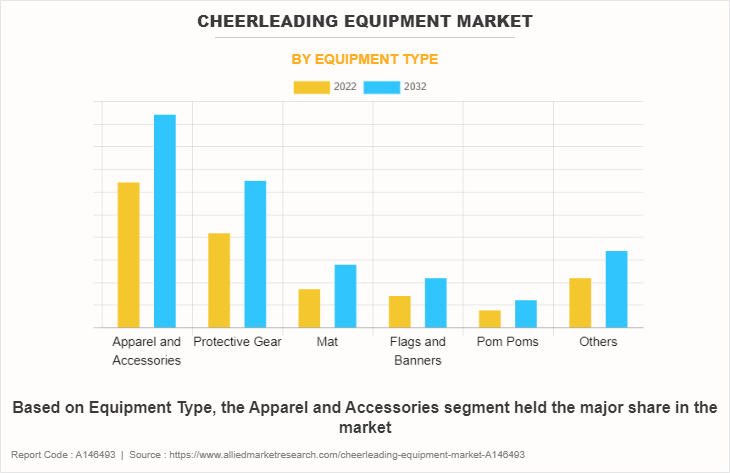

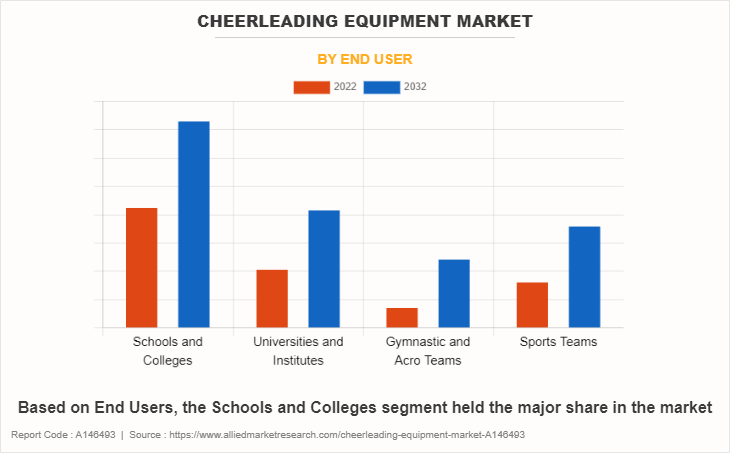

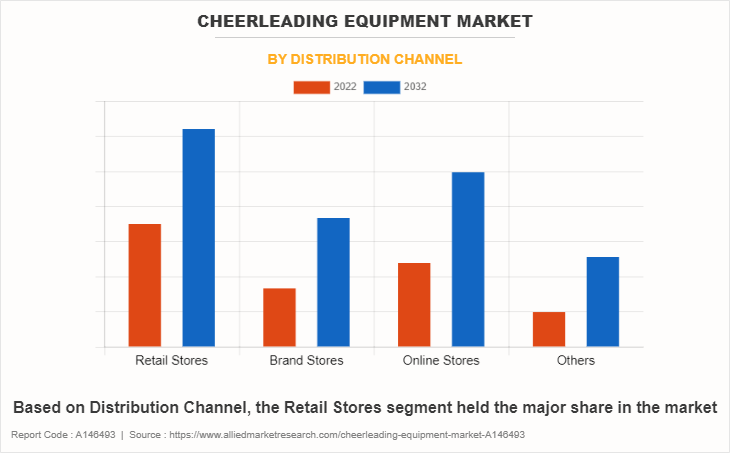

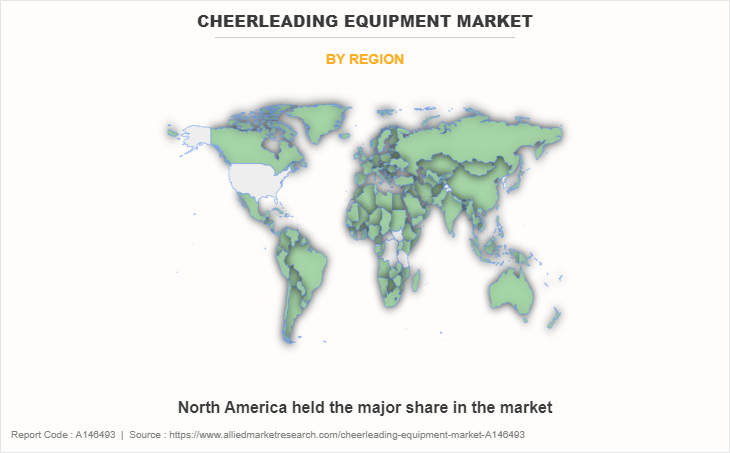

The cheerleading equipment market forecast on the basis of equipment type, end-user, distribution channel and region. On the basis of equipment type, the market is divided into apparel & accessories, protective gear, mat, flags & banners, pom poms and others. On the basis end user, the market is segregated into schools & colleges, universities & institutes, gymnastic & acro teams, and sports teams. On the basis of distribution channel, the market is categorized into retail stores, brand stores, online stores and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Equipment Type

On the basis of equipment type, the apparel and accessories segment dominate the cheerleading equipment market in 2022 and is anticipated to maintain its dominance throughout the forecast period. Apparel and accessories are important for the performance, safety, and overall spirit of cheerleaders. These accessories are meant to provide cheerleaders style, comfort, and support so they can perform and interact with the audience. Cheerleading outfits, shoes, shorts, socks, tights, warm-up clothes, hair accessories, water bottles, spirit wear, and other items are included in the cheerleading apparel and accessories. Furthermore, the ongoing innovation in clothing and accessories with cutting-edge fabrics that offer performance advantages like flexibility, durability, and moisture-wicking has shown to be a compelling selling feature.

By End User

On the basis of end user, the market is segregated into schools & colleges, universities & institutes, gymnastic & acro teams, and sports teams. The schools & colleges segment dominates the cheerleading equipment market in 2022 and is anticipated to maintain its dominance throughout the forecast period. There has been a notable increase in the demand for cheerleading equipment in both schools and colleges, in recent years.

By Distribution Channel

On the basis of distribution channels, the cheerleading equipment industry is categorized into retail stores, brand stores, online stores and others. The retail store segment dominated the cheerleading equipment market in 2022 and is anticipated to maintain its dominance throughout the forecast period. Cheerleading equipment products are sold in retail outlets as specific brick-and-mortar businesses or as departments inside bigger athletic goods and sports stores. These shops provide a large selection of cheerleading equipment, clothing, and accessories to cheerleaders, coaches, and enthusiasts.

By Region

North America dominated the market in 2022 and is anticipated to remain dominant during the forecast period. This is attributed to the increased popularity of cheerleading in North American universities and institutions. Customers in North America are tech-aware and choose digital solutions for easy and knowledgeable shopping. The market is expected to experience growthduring the forecast period. The outbreak of the pandemic has disrupted the global supply chains. This has caused shortages of some products and delays in production and distribution. In addition, the pandemic has led to changes in consumer behavior and the changes in consumer behavior may have had both positive and negative impacts on the cheerleading equipment market.

Competition Analysis

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships in cheerleading equipment market statistics. They have also been focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the cheerleading equipment market include Adidas AG, ASICS Corporation, Mizuno Corporation, Fruit of the Loom, Inc., Wolverine World Wide, Inc., Nfinity, Nike, Inc., Puma SE, DICKS Sporting Goods, Inc, and Iconix International.

Recent Developments in the Cheerleading Equipment Market

- In 2023, Adidas AG partnered with RHEON Labs, to incorporate and develop high-tech sporting apparel for training application based on RHEONTM. technology. Through this partnership it will launch adidas Techfit Control apparel range to expand its product offering and strengthen its business presence in the market.

- In 2023,Sweaty Betty brand of Wolverine World Wide, Inc. partnered with NewStore, which is an mobile-first omnichannel cloud platform. With this is will improve retail experience for customers in UK.

- In 2022, Asics Corporation launched Asics retail stores in Gulf Cooperation Council (GCC), including countries Qatar, Bahrain. Under this expansion it will partner with Apparel Group, which is a leading apparel and fashion retailer in the region.

- In 2022, Nike, Inc., partnered with JD Sports and Zalando, which are retailers with presence in Europe. Through this partnership it will provide its customers shopping benefits such as access to exclusive products and new digital experiences.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cheerleading equipment market analysis from 2022 to 2032 to identify the prevailing cheerleading equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cheerleading equipment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cheerleading equipment market trends, key players, market segments, application areas, and market growth strategies.

Cheerleading Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.5 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Distribution Channel |

|

| By Equipment Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | DICKS Sporting Goods, Inc, Adidas AG, Iconix International, ASICS Corporation, Wolverine World Wide, Inc., Nfinity, Mizuno Corporation, Nike, Inc., Fruit of the Loom, Inc., Puma SE |

Analyst Review

According to CXOs, the cheerleading equipment market is expected to be driven by factors such as the rise in popularity of sports, especially in schools and colleges, and its increasing competitiveness at the professional level. Innovation in product development, with a focus on safety and performance enhancement, is likely to surge the demand. The inclusion of cheerleading in global sports events and the growth of fitness trends incorporating cheerleading elements will further contribute to market expansion.

Moreover, the supportive role of governing bodies in standardizing safety measures is expected to attract the consumers. The proliferation of online retail and e-commerce is making equipment more accessible, which helps to attract more customers and reach a larger audience. These trends, combined with the media's attention to cheerleading events, are likely to create a dynamic market environment with continuous growth opportunities in the cheerleading equipment industry. However, market dynamics can also be influenced by factors like economic conditions, consumer preferences, and unforeseen events.

Increased participation in cheerleading are the upcoming trends of Cheerleading Equipment Market in the world

Apparel and Accessories is the leading equipment type of Cheerleading Equipment Market

North America is the largest regional market for Cheerleading Equipment

The cheerleading equipment market was valued at $1653.1 million in 2022 and is projected to reach $2,539.2 million by 2032, registering a CAGR of 4.4% from 2023 to 2032.

Adidas AG, ASICS Corporation, Mizuno Corporation, Fruit of the Loom, Inc., Wolverine World Wide, Inc., Nfinity, Nike, Inc., Puma SE, DICKS Sporting Goods, Inc, and Iconix International.

Loading Table Of Content...

Loading Research Methodology...