Chicory Market Research, 2034

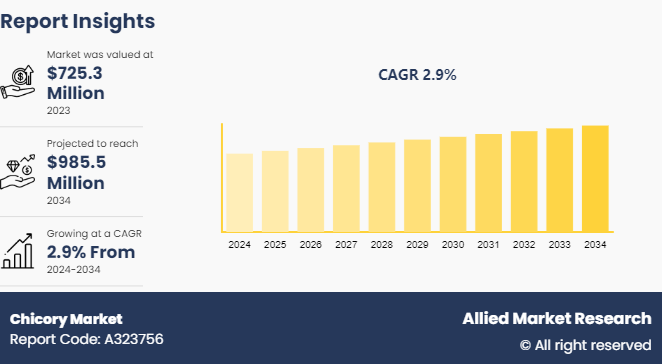

The global chicory market size was valued at $725.3 million in 2023, and is projected to reach $985.5 Million by 2034, growing at a CAGR of 2.9% from 2024 to 2034.

Market Introduction and Definition

Chicory is a perennial herbaceous plant known for its bright blue flowers and deeply lobed leaves. The plant is used widely for its edible roots and leaves. Chicory roots, when roasted and ground, are commonly used as a coffee substitute and additive, providing a similar, though slightly bitter, flavor without caffeine. The leaves, often referred to as endive or radicchio, are used in salads and cooking, which helps to offer a slightly bitter taste. Rich in fiber, vitamins, and minerals, chicory is valued for its health benefits, including improved digestion and liver function due to its high inulin content. Moreover, chicory is a versatile plant with culinary, medicinal, and agricultural applications across the globe.

Key Takeaways

The Chicory market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2034.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The growth in trend of functional foods and beverages has significantly driven the chicory market demand. As consumers increasingly prioritize health and wellness, they seek out food and drink products that offer more than basic nutrition, aiming for added health benefits. Chicory, known for its prebiotic properties and ability to support digestive health, fits perfectly into the category of functions food category. High inulin content of chicory promotes gut health, and its use as a natural, caffeine-free coffee alternative has made it a highly desirable ingredient in the functional foods sector, thus increasing the chicory market size.

Moreover, as manufacturers innovate and develop new chicory-based products, such as chicory-infused snacks, teas, and dietary supplements, the chicory industry is expected to expand rapidly. The versatility of chicory allows it to be incorporated into various formats, appealing to a broad range of health-conscious consumers. In addition, the increase in awareness of benefits of chicory and its role in promoting a healthy digestive system have further increased its demand in the functional foods and beverages market. The increase in demand for chicory has been further boosted by a global shift toward preventive health care and natural, plant-based ingredients, positioning chicory as a key component in the evolving market of functional nutrition.

Competition from other coffee substitutes and health foods restrains market demand for chicory by providing consumers with a wide array of alternatives, thereby diluting chicory market share. However, popular coffee substitutes such as matcha, mushroom coffee, and dandelion coffee each offer unique health benefits and flavors, appealing to various consumer preferences. The diversification in the market makes it challenging for chicory to establish a dominant position. Moreover, the broader health foods market, which includes superfoods such as quinoa, chia seeds, and acai berries, further diverts attention and consumer spending away from chicory. These alternatives often come with their own strong health claims and marketing strategies, which makes it harder for chicory to stand out. In addition, established brands in the health food sector invest heavily in marketing and product development, creating fierce competition for chicory-based products. The intense rivalry necessitates continuous innovation and marketing efforts from chicory producers, increasing operational costs and complicating market penetration, which is anticipated to hamper the chicory market growth.

Furthermore, the development of new chicory-based products and applications has created significant opportunities in the chicory market by diversifying its usage and appealing to broader consumer preferences. Innovations such as chicory-infused beverages, dietary supplements, and health snacks expand its appeal beyond traditional uses. The new products developed by the key players in the market help promote health benefits, such as their prebiotic and digestive properties, attracting health-conscious consumers. Moreover, creative applications in food industries, such as chicory-based sweeteners and functional ingredients in plant-based diets, are expected to help manufacturers tap into new market segments during the chicory market forecast.

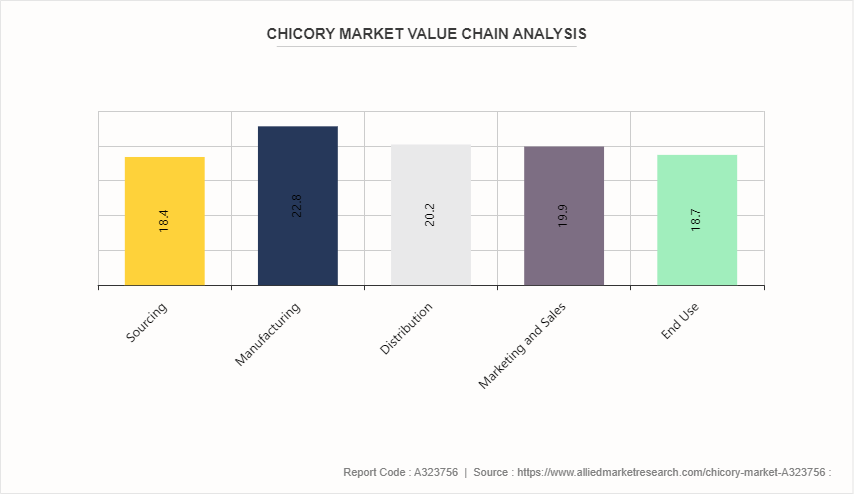

Value Chain of Global Chicory Market

The chicory value chain begins with cultivation, where farmers grow chicory roots as the primary source of the crop. Once harvested, the roots undergo processing, including cleaning, roasting, and grinding into chicory powder or extracting compounds like inulin. The processed chicory then enters the manufacturing stage, where it is used as an ingredient in various food and beverage products such as coffee substitutes, baked goods, and dietary supplements. The chicory products are distributed through wholesalers and retailers to reach consumers via supermarkets, specialty stores, and online platforms. Companies market and sell these chicory-based products to consumers, highlighting their potential health benefits, unique flavor, and use as a caffeine-free alternative to coffee. Ultimately, the value chain culminates with consumption, as individuals purchase and consume chicory products for their nutritional value, taste, or as a substitute for traditional coffee.

Market Segmentation

The chicory market is segmented into product type, form, application, and region. On the basis of product type, the market is divided into extract, roasted, instant powder, and flour. As per form, the market is segmented into powder, cubes, and liquid. On the basis of application, the market is categorized into food and beverage industry, dietary supplement, feed and pet food, cosmetics and personal care, and others. Region wise, the chicory market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The plant-based food consumption in the U.S. has surged, with sales reaching $8.0 billion in 2022, which reflects a 6.6% growth. According to the Plant Based Foods Association (PBFA) , 70.0% of all U.S. citizens consume plant-based foods, a rise from 66.0% in 2022. In the same year, these foods were consumed by 60.0% of households, with an 80.0% repeat purchase rate across all categories. The growth in trend toward plant-based eating creates a favorable environment for chicory-based products, which can be positioned as natural, healthy alternatives in various plant-based food categories, thereby driving demand and growth of chicory-based products in the U.S. chicory market.

The European region holds a significant position in the global chicory market. Countries such as Belgium, the Netherlands, France, and Germany are major producers and consumers of chicory products. Belgium, in particular, is a leading producer and exporter of chicory roots, owing to the favorable climate and soil conditions for chicory production. The Netherlands is also a prominent player, with a well-established chicory processing industry and a strong focus on inulin production. In France and Germany, chicory is widely used as a coffee substitute or additive, contributing to the market's growth. The increase in demand for natural and plant-based ingredients, coupled with the rising popularity of chicory-based products in the food and beverage industry, is expected to drive the chicory market growth in Europe over the coming years.

Industry Trends:

The rise in demand for organic and locally sourced products is set to significantly boost the sales of chicory. According to the 2023 Organic Industry Survey released by the Organic Trade Association, organic food sales in the U.S. crossed $60.0 billion in 2022, demonstrating the resilience of the organic sector. The survey also revealed that total organic sales, including non-food organic products, reached a record $67.6 billion, highlighting the continued growth and strength of the organic market. With a growing number of consumers prioritizing products that align with their values, including those grown without synthetic pesticides or fertilizers and sourced from nearby farms, there is an increased demand for organic and locally sourced chicory. As a result, producers aiming to offer organic chicory cultivated using sustainable farming practices and sourced locally are likely to experience increased sales as they cater to the preferences and concerns of consumers in the coming years.

Product innovation and diversification in the chicory market involves the development and introduction of new chicory-based products beyond traditional uses. Companies are exploring novel applications of chicory root and its derivatives like inulin. For instance, chicory flour has gained popularity as a gluten-free and fiber-rich alternative in baked goods. Chicory-based snacks, such as chips and bars, cater to the growing demand for healthy and functional snacking options. In addition, bakery items such as bread, pastries, and cookies incorporate chicory as a natural sweetener or fiber source. The diversification of chicory aims to tap into emerging consumer trends, expand the market reach, and offer innovative products with potential health benefits.

Competitive Landscape

The major players operating in the chicory market include Cargill Inc., Sudzucker AG, Sensus NV, Cosucra Groupe Warcoing SA, The Ingredient House, The Tierra Group, Nova Green Inc., Adept Impex Private Limited, Ciranda Inc., and The Green Labs LLC.

Other players in chicory industry includes Jardin, Leroux, Dilzem?t, Rossmann-Mühle GmbH, Greencore Group plc, Prewett's, Nature's Crops International, and so on.

Recent Key Strategies and Developments

In March 2022, Sensus announced its plans to expand the production of chicory root fiber (inulin) to meet the growing demand for natural prebiotics in plant-based foods and supplements.

In May 2021, Belgian group Cosucra Groupe Warcoing S.A. introduced its chicory root ingredients to the market under the brand names Fibruline, Swelite, Nastar, and Pisane, to strengthen the chicory product portfolio offered by the company.

In July 2020, BENEO GmbH invested more than $59.0 million to expand its chicory root fiber production facility in Chile by 2022 to cope up with rise in interest among global food and beverage manufacturers in chicory root fibers. BENEO's inulin and oligofructose ingredients have witnessed a surge in market demand, prompting this strategic move to cater to growing industry needs.

Key Sources Referred

Food Safety and Standards Authority of India (FSSAI)

U.S. Food and Drug Administration (FDA)

Organic Trade Association (OTA)

Euromonitor International

Plant Based Foods Association

Food and Agriculture Organization of the United Nations (FAO)

National Restaurant Association (NRA)

Agricultural & Processed Food Products Export Development Authority (APEDA)

U.S. Department of Agriculture (USDA)

Bureau of Labor Statistics (BLS)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the chicory market analysis from 2024 to 2032 to identify the prevailing chicory market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the chicory market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global chicory market trends, key players, market segments, application areas, and market growth strategies.

Chicory Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 985.5 Million |

| Growth Rate | CAGR of 2.9% |

| Forecast period | 2024 - 2034 |

| Report Pages | 398 |

| By Product Type |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | Sensus NV, Nova Green Inc., Sudzucker AG, Adept Impex Private Limited, The Green Labs LLC, The Tierra Group, Ciranda Inc, The Ingredient House, Cargill Inc., Cosucra Groupe Warcoing SA |

The global chicory market size was valued at $725.3 million in 2023, and is projected to reach $985.5 Million by 2034

The global Chicory market is projected to grow at a compound annual growth rate of 2.9% from 2024 to 2034 $985.5 Million by 2034

The major players operating in the chicory market include Cargill Inc., Sudzucker AG, Sensus NV, Cosucra Groupe Warcoing SA, The Ingredient House, The Tierra Group, Nova Green Inc., Adept Impex Private Limited, Ciranda Inc., and The Green Labs LLC.

By region, Europe held the highest market share in terms of revenue in 2023.

Development Of New Chicory-Based Products And Applications, Increase In Adoption In The Health And Wellness Industry, Growth In The Demand For Gluten-Free And Dietary Fiber-Rich Foods, Enhanced Focus On Sustainable And Organic Farming Practices

Loading Table Of Content...