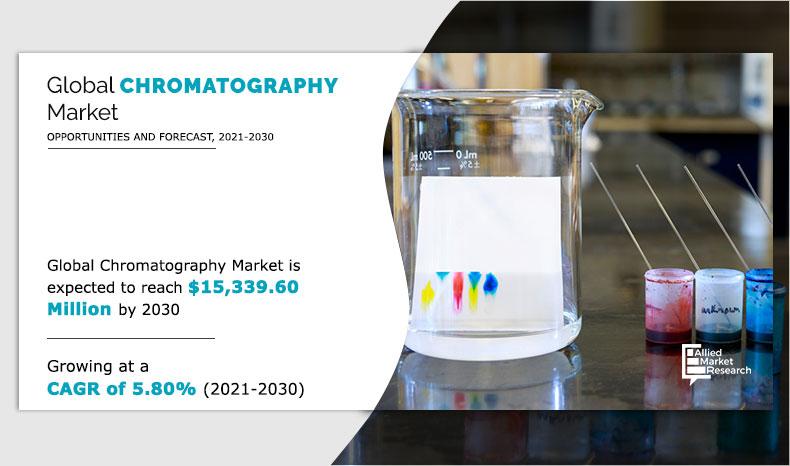

Chromatography Market Overview 2030

The global chromatography market size was valued at $8,706.00 million in 2020 and is projected to reach $15339.60 million by 2030 registering a CAGR of 5.80% from 2021 to 2030. Chromatography is a technique for separating the components, or solutes of a mixture on the basis of the relative amounts of each solute distributed between a moving fluid stream, called the mobile phase, and a contiguous stationary phase. The mobile phase may be either a liquid or a gas, while the stationary phase is either a solid or a liquid. Chromatography techniques are used in various application areas such as pharmaceutical, biotechnology, food production, diagnostics, genetic engineering, and drug discovery and water analysis.

Growing applications of chromatography in various fields such as pharmaceutical industries, chemical, and food industry, environmental testing laboratories, forensic science as well as rise in adoption of chromatography techniques in drug discovery process are some factors that drive the chromatography market. In addition, increase in popularity of hyphenated chromatography techniques such as LC-MS, GC-MS, LC-NMR, and LC-FTIR, further boost the growth of the chromatography market. However, high cost of chromatography equipment, and shortage of skilled professionals to operate chromatography instruments, are some factors that may hamper the growth of the market. In addition, presence of alternative technologies to chromatography such as precipitation, high-resolution ultrafiltration, crystallization, high-pressure refolding, charged ultra-filtration membranes, protein crystallization, capillary electrophoresis, aqueous two-phase extraction, three-phase partitioning, monoliths, and membrane chromatography, also hinder the growth of the market. On the contrary, advancement in gas chromatography columns for petrochemical applications, and adoption of chromatography in R&D in cancer creates an opportunity for the manufacturers to tap and capitalize on the market.

The outbreak of COVID-19 has disrupted workflows in the healthcare sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of healthcare. However, due to an increase in the prevalence of infectious disease COVID-19, there has also been a positive effect and growth in demand for various services, including chromatography technologies such as liquid chromatography, as chromatography is a powerful laboratory-based analytical method that is being employed by researchers as the scientific community strives to understand the Sars-CoV-2 virus and develop better therapies, vaccines, and diagnostic tools to aid in the fight against the COVID-19 pandemic. For instance, in a study published online in June 2020, liquid chromatography coupled with mass spectrometry was used to quantify remdesivir in the blood plasma of a COVID-19 patient and thus, provide data on its efficacy as a treatment for SARS-CoV-2. Hence, the outbreak of COVID-19 has positively impacted the chromatography market.

Chromatography Market Segmentation

The global chromatography market is segmented on the basis of type, product, end user, and region to provide a detailed assessment of the market. By type, it is segmented into liquid chromatography, gas chromatography, thin-layer chromatography, and others include column chromatography, supercritical fluid chromatography systems, and paper chromatography. Liquid chromatography further classified into high-pressure liquid chromatography, ultra-pressure liquid chromatography, flash chromatography, and others include medium-pressure liquid chromatography systems, ion-exchange chromatography, partition chromatography, size exclusion chromatography. By product, the market is segmented into instruments, consumables, and accessories. In addition, the consumable segment is classified into columns, syringe filters, vials, tubing, and others include valves, gauges, liners, sealers. Moreover, accessories segment again divided into detectors, auto samplers, pumps and flow meters, fraction collectors, and others include mixers, regulators, and mobile phase accessories. Based on end user, it is categorized into pharmaceutical & biotechnology company, academic & research institutes, food & beverage company, and others that include oil & gas company, environmental agencies. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Segment Review

Based on type, the market is segmented into liquid chromatography, gas chromatography, thin-layer chromatography, and others include column chromatography, supercritical fluid chromatography systems, and paper chromatography. Liquid chromatography is further classified into high-pressure liquid chromatography, ultra-pressure liquid chromatography, flash chromatography, and others that include medium-pressure liquid chromatography systems, ion-exchange chromatography, partition chromatography, and size exclusion chromatography. The liquid chromatography segment dominated the global market in 2020 and is expected to remain dominant throughout the forecast period owing to factors such as various applications of liquid chromatography to the fields of pharmaceutical chemistry, bioanalysis, antibiotics, metabolomics, proteomics, drug analysis, medical sciences, and plant, agricultural, environmental and food chemistry.

By Type

Liquid Chromatography segment holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Based on product, it is segmented into instruments, consumables, and accessories. In addition, the consumable segment classified into columns, syringe filters, vials, tubing, and others include valves, gauges, liners, sealers. Moreover, the accessories segment is divided into detectors, autosamplers, pumps and flow meters, fraction collectors, and others include mixers, regulators, and mobile phase accessories. The consumable segment dominated the global market in 2020 and is anticipated to continue this trend during the forecast period. This is attributed to, growing adoption of consumables to separate, identify, and analyze various compounds such as vitamins, preservatives, additives, proteins, and amino acids in the pharmaceutical industry.

By Product

Consumables segment is projected as one of the most lucrative segment.

Based on end user, it is classified into pharmaceutical & biotechnology company, academic & research institutes, food & beverage company, and others include oil & gas company, and environmental agencies. The pharmaceutical & biotechnology company held the largest market share in 2020 and is expected to remain dominant throughout the forecast period owing to increase in application of chromatography techniques by pharmaceutical & biotechnology companies for various purposes such as for identifying and analyzing samples for the presence of chemicals or trace elements, for preparing huge quantities of extremely pure materials, for separating chiral compounds, for detecting the purity of mixture and the unknown compounds present, as well as content uniformity, drug development, and validation of drugs.

Snapshot of the Asia-Pacific Chromatography Market

Asia-Pacific offers profitable opportunities for key players operating in the chromatography market, thereby registering the fastest growth rate during the forecast period, owing to growing healthcare infrastructure, rising disposable incomes, and well-established presence of domestic companies in the region. In addition, investments in biomedical industries in the Asia-Pacific region is also a key factor fueling the growth of the global chromatography market. Thus, rising government support and affiliated agencies is projected to boost the market in the region.

By Region

North America is expected to experience growth at the highest rate, registering a CAGR of 4.80% during the forecast period.

List Of Key Companies

- Agilent Technologies

- Bio-Rad Laboratories

- Danaher Corporation

- Hitachi Ltd.

- Merck KGAA

- PerkinElmer, Inc.

- Restek Corporatio

- Shimadzu Corporation

- Thermo Fisher Scientific, Inc.

- Waters Corporation.

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the global chromatography market along with the current trends and future estimations to explain the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the chromatography market growth is provided in the report.

- Comprehensive quantitative analysis of the industry from 2020 to 2028 is provided to enable the stakeholders to capitalize on the prevailing chromatography market opportunities.

- Extensive analysis of the key segments of the industry helps to understand the application and products of chromatography used across the globe.

- Key market players and their strategies have been analyzed to understand the competitive outlook of the market.

Chromatography Market, by Type Report Highlights

| Aspects | Details |

| By Type |

|

| By Product |

|

| By End User |

|

| By Region |

|

| Key Market Players | Bio-Rad Laboratories, Inc., Waters Corporation, Merck KGAA, PerkinElmer, Inc., Hitachi, Ltd., DANAHER CORPORATION, Restek Corporation, Shimadzu Corporation, THERMO FISHER SCIENTIFIC, INC., Agilent Technologies Inc. |

Analyst Review

Chromatography is a physicochemical method for separation of compound mixtures, based on the distribution of components between two phases, one of which is stationary (sorbent), and the other, mobile, flowing through a layer of the stationary phase.

Rise in applications of chromatography in various fields, increase in adoption of chromatography in drug discovery process, and growth in popularity of hyphenated chromatography techniques are some factors that boost the growth of the market. Furthermore, advancement in gas chromatography columns for petrochemical applications, and adoption of chromatography in R&D in cancer are expected to create a lucrative opportunity for the market growth. However, high cost of chromatography equipment, lack of adequate skilled professionals, and presence of alternative technologies to chromatography are some factors that are expected to hinder the growth of the market.

The liquid chromatography segment is expected to remain dominant during the forecast period, owing to factors such as various applications of liquid chromatography in the fields of pharmaceutical chemistry, bioanalysis, antibiotics, metabolomics, proteomics, drug analysis, medical sciences, and plant, agricultural, environmental and food chemistry. Moreover, North America is expected to offer lucrative opportunities to the market during the forecast period, owing to increase in adoption of chromatographic techniques for drug discoveries and drug approvals by biopharmaceutical and pharmaceutical firms in the region.

Chromatography is a separation method where the analyte is combined within a liquid or gaseous mobile phase., which is pumped through a stationary phase.

Chromatography techniques are used in various application areas such as pharmaceutical, biotechnology, food production, diagnostics, genetic engineering, and drug discovery and water analysis.

Liquid Chromatography segment is the most influencing segment owing to various applications of liquid chromatography to the fields of pharmaceutical chemistry, bioanalysis, antibiotics, metabolomics, proteomics, drug analysis, medical sciences, and plant, agricultural, environmental and food chemistry.

Top companies such as Hitachi, Merck KGAA, Shimadzu Corporation, Thermo Fisher, Danaher Corporation, Agilent Technologies held a high market position in 2020.

Rise in applications of chromatography in various fields, increase in adoption of chromatography in drug discovery process, and growth in popularity of hyphenated chromatography techniques are some factors which boost growth of the market

Asia-Pacific is expected to experience the highest growth rate during the forecast period, owing to growing healthcare infrastructure, rising disposable incomes, and well-established presence of domestic companies in the region.

The total market value of Chromatography Market is $8,706.00 million in 2020.

The forcast period for Chromatography Market is 2021 to 2030

The market value of Chromatography Market in 2021 is $9271.90 million.

The base year is 2020 in Chromatography Market

Loading Table Of Content...