Citric Acid Regulators Market Research, 2031

The global citric acid regulators market size was valued at $1.8 billion in 2021, and is projected to reach $3.1 billion by 2031, growing at a CAGR of 5.3% from 2022 to 2031.

Citric acid regulators (INS 330 or E330) are naturally formed from citrus fruits such as lemons, grapefruit, limes, and others. It is synthesized artificially by the fungus Aspergillus Niger and Candida Lipolytic (Y-1095), which generates more citric acid than other yeasts available in the market. Citric acid comes in two varieties: anhydrous and monohydrate. Citric acid anhydrous or monohydrate is the most common acidulant used to provide a sour flavor to foods & beverages, and also serves as a preservative, pH indicator, antioxidant, and coloring agent.

The availability of ready-to-eat and processed food products such as ready-to-eat meals, meats, dairy products, and others in the market has attracted consumers for the past two to three decades. With time, packaged products are developing according to market demand and consumer necessities. Currently, consumers expect the best quality of food & beverage products offered by manufacturing companies. Pre-cooked or ready meals are extremely convenient, less time-consuming, cost-efficient, and less effort is required for meal preparation. The benefit has increased demand for ready meals, particularly among the working population and students. Citric acid plays an important role in the processing of food & beverage items, and they help improve the quality of products, adds texture, and acts as a preservative. Food manufacturing companies are trying different combinations of citric acids in their foods that would help increase overall production. Therefore, a rise in sales of packaged food fuels the growth of the citric acid regulators industry.

Phosphate additives, such as sodium phosphate, are mostly found in meat and dairy products as they work as an emulsifying agent in meat and as a preservative in both meat and dairy products. In processed meat products, polyphosphates are known to enhance both quantities of water and the strength of meat particles. However, various health problems associated with phosphate usage have deterred food makers from switching to organic additions. Long-term phosphate consumption causes renal damage, colitis, heart disease, and other problems. In the short term, phosphate additions cause bloating, discomfort, headaches, increased heart rate, and other symptoms. The negative effects of sodium phosphate have provided an opportunity for increased usage of citric acid in foods and beverages. Citric acid is the appropriate substitute for sodium phosphate additives as it can act as a preservative and emulsifying agent. The rise in use of citric acid propels the growth of the citric acid regulators market size.

An increase in demand for ready-to-eat meals & fast food is a key driver for the citric acid regulators market across the globe. Moreover, innovative technologies, the introduction of production techniques, and a heavy inflow of investments in R&D activities are other factors that are expected to supplement the citric acid regulators market growth. There is an upcoming trend of using natural flavor essence such as citric acid, owing to a rise in health awareness. Furthermore, high demand for stabilizers and antioxidant food ingredients across European countries to produce commercialized clean-label or green food products that are free of additives and other harmful chemicals propel the growth of natural citric acid regulators. Technological strides make it possible for manufacturers to develop innovative flavors to cater to changes in customer taste requirements. Applications of advanced technologies provide innovative and novel tastes in food. Innovation in citric acid production and their growth in demand across emerging economies are expected to open new avenues for market players in the future.

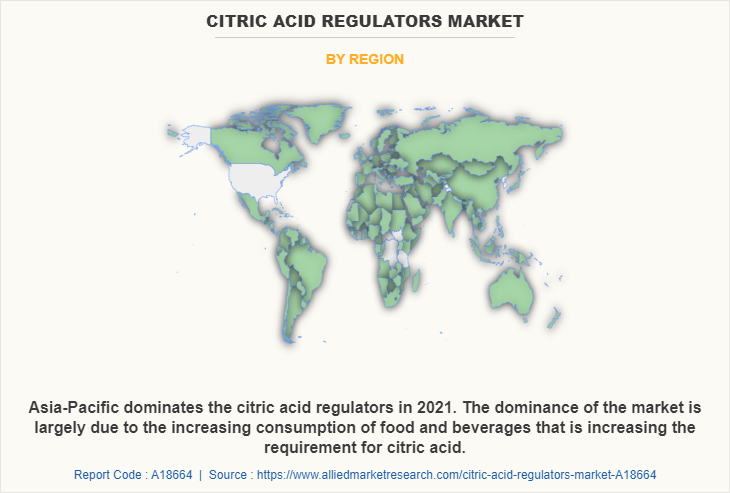

Emerging markets such as Asia-Pacific, Latin America, and Africa are witnessing a rise in population, economic growth, urbanization, and an increase in knowledge of the benefit of consuming foods rich in citric acid. More than 75 %of the world's population is projected to dwell in Asia and Africa. The majority of countries in these two regions are emerging nations and are experiencing strong economic growth. The rise in penetration of quick-service restaurants and fast-food chains, beverage processing companies, and food processing companies boosts demand for citric acid. Moreover, a significant rise in the consumption of soft drinks and sodas fuels the growth of developing regions. The presence of a large population and their consumption behavior propel the demand for meat products, soft drinks, and processed foods across developing regions. This is expected to propel the demand for citric acid among food and beverage manufacturers in developing regions.

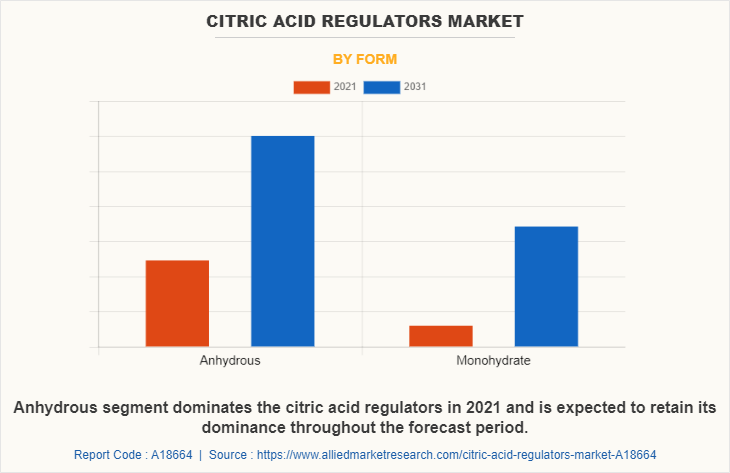

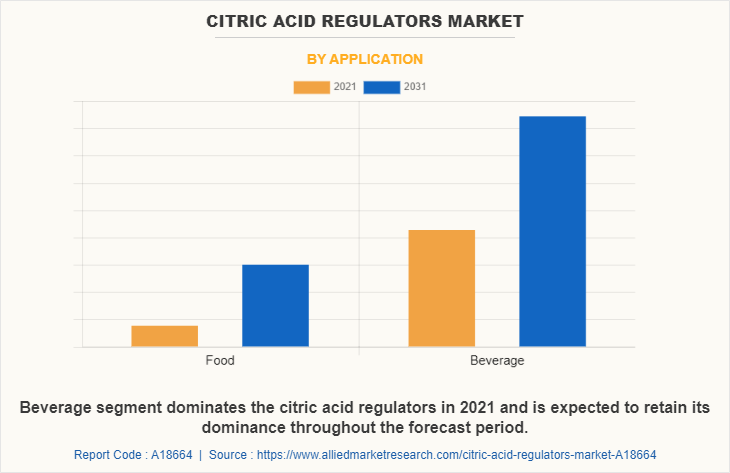

The citric acid regulators market is segmented on the basis of form, application, and region. On the basis of form, the market is categorized into anhydrous and monohydrate. On the basis of application, it is divided into food and beverages. On the basis of region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and the rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

According to citric acid regulators market trends, on the basis of form, the anhydrous segment has gained a major share in the citric acid regulators market in 2021 and is expected to sustain its market share during the citric acid regulators market forecast period. Citric acid anhydrous is the water-free version of citric acid and the chemical is colorless and odorless. Anhydrous citric acid is more widely available in the market due to its dry nature, the product can be easily transported and is easily soluble in foods and beverages.

According to citric acid regulators market analysis, on the basis of application, the beverages segment has dominated the citric acid regulators market, registering a CAGR of 5.0%. Soft drinks & sodas, energy drinks, and juices are one of the major products in the beverages industry in which citric acid is used for production. The beverages market is one of the top growing markets globally, with an increase in population, a rise in the popularity of flavored carbonated drinks, and a rise in product launches by beverage manufacturers. The increasing growth rate of the sports industry fuels the demand for energy drinks in the market by athletes and consumers. Moreover, the endorsement and promotion of soft drinks and energy drinks by influencers propels the demand for soft drinks and energy drinks in the market, which increases the usage of citric acid in beverages.

Region-wise, Asia-Pacific dominated the citric acid regulators market in 2021 and is expected to be dominant during the forecast period. The dominance of the global market is largely attributed to the existence of foods & beverages operations in Asia-Pacific, and the demand for these products increases every year, which propels the demand for citric acid regulators and fuels the citric acid regulators market demand. Asia-Pacific consumers acknowledge the consumption of packaged foods as they help to save time & replenish hunger. China is the largest citric acid manufacturing country in the globe and has the highest share of export for citric acid. With evolving regulatory dynamics in the area and an increase in demand for natural variants, the citric acid regulators market is expected to expand.

The development of new citric acid production technology is projected to reduce demand and supply imbalance as demand for food-grade citric acid climbs by 5% per year. Aspergillus Niger is a fungus that is used in the fermentation process to produce citric acid. More than 90% of citric acid production is contributed by the fermentation sector, providing huge hurdles to standard industrial recovery methods and procedures. Precipitation, extraction, adsorption, and membrane are some of the recovery strategies accessible. The incorporation of modern technologies into traditional manufacturing processes provides a new method to increase the production of citric acid without the use of microorganisms. The process includes the use of calcium citrate mixed with water and compressed carbon dioxide to produce citric acid and calcium carbonate as its by-product.

Players operating in the global citric acid regulators industry have adopted various developmental strategies to expand their citric acid regulators market share, increase profitability, and remain competitive in the market. Key players profiled in this report include Archer Daniels Midland, ATP Group, BASF SE, Cargill Incorporated, CHEMELCO INTERNATIONAL B.V., Citrique N.V., Cofco, E. I. du Pont de Nemours and Company, F.B.C. Industries, Inc., Foodchem International Corporation, Gadot Biochemical Industries Ltd., S.A., Huangshi Xinghua Biochemical Co. Ltd, JUNGBUNZLAUER SUISSE AG, Merck Group KGaA, Kenko Corporation, Koninklijke DSM N.V., TTCA, Co., LTD, RZBC Group Co, Ltd., Tate & Lyle, and Shandong Ensign Industry Co., Ltd.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the citric acid regulators market analysis from 2021 to 2031 to identify the prevailing citric acid regulators market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the citric acid regulators market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the citric acid regulators market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global citric acid regulators market trends, key players, market segments, application areas, and market growth strategies.

Citric Acid Regulators Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.1 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 235 |

| By Application |

|

| By Form |

|

| By Region |

|

| Key Market Players | COFCO, Archer Daniels Midland Company, Jungbunzlauer Suisse AG, Cargill, Incorporated, ATP GROUP, F.B.C Industries, Inc., Merck Group KGaA, Gadot Biochemical Industries Ltd., Kenko Corporation, Shandong Ensign Industry Co.,Ltd., RZBC GROUP CO., LTD., Foodchem International Corporation, Huangshi Xinghua Biochemical Co, Ltd., E. I. du Pont de Nemours and Company, Chemelco International B.V., Koninklijke DSM N.V., Citribel NV, BASF SE, Tate & Lyle, TTCA, Co., LTD |

Analyst Review

Citric acid regulators are vital ingredients used in beverages and food products. They are expected to witness notable growth in the future owing to their wide application as a preservative, flavoring agent, taste enhancer, or taste modifier in meats, confectionery, sauces, condiments, and dressings. Moreover, growth in demand for fast food, cold drink, and other food & beverages supplements the market growth. The impact of these drivers is expected to increase significantly due to a rise in awareness about the benefits of citric acid regulators. However, overconsumption of these regulators leads to health issues such as diarrhea, nausea, and vomiting, thus hindering the market growth. With the advancement in technology, the cost of citric acid regulators is expected to reduce in the near future.

According to CXOs, the introduction of a new production process for citric acid is expected to close down the demand and supply gap, as every year the demand for food-grade citric acid rises by 5%. Fungus Aspergillus niger is a fungus used in the production of citric acid by the process of fermentation. The fermentation industry contributes more than 90% of citric acid production, posing enormous challenges for conventional industrial recovery methods and processes. There are several recovery technologies available, such as precipitation, extraction, adsorption, and membrane. The introduction of new technology in the conventional production process will offer a new perspective where calcium citrate compressed with water and carbon dioxide will produce citric acid without the use of any living organism.

The global citric acid regulators market size was valued at $1,808.1 million in 2021, and is estimated to reach $3,087.3 million by 2031, registering a CAGR of 5.3% from 2022 to 2031.

The global citric acid regulators market registered a CAGR of 5.3% from 2022 to 2031.

Raise the query and paste the link of the specific report and our sales executive will revert with the sample.

The forecast period in the citric acid regulators market report is from 2022 to 2031.

The top companies that hold the market share in the citric acid regulators market include Archer Daniels Midland, BASF SE, Cargill Incorporated, E. I. du Pont de Nemours and Company, and Jungbunzlauer Suisse AG

The citric acid regulators market report has 2 segments. The segments are form and application.

The emerging countries in the citric acid regulators market are likely to grow at a CAGR of more than 7% from 2022 to 2031.

Post-COVID-19, the ease of lockdown had improved the supply chain for citric acid regulators products and with the increasing consumption of beverages in the Asia-Pacific and European region the sales of citric acid are expected to increase.

Asia-Pacific will dominate the citric acid regulators market by the end of 2031.

Loading Table Of Content...

Loading Research Methodology...