Clear Aligners Market Research, 2031

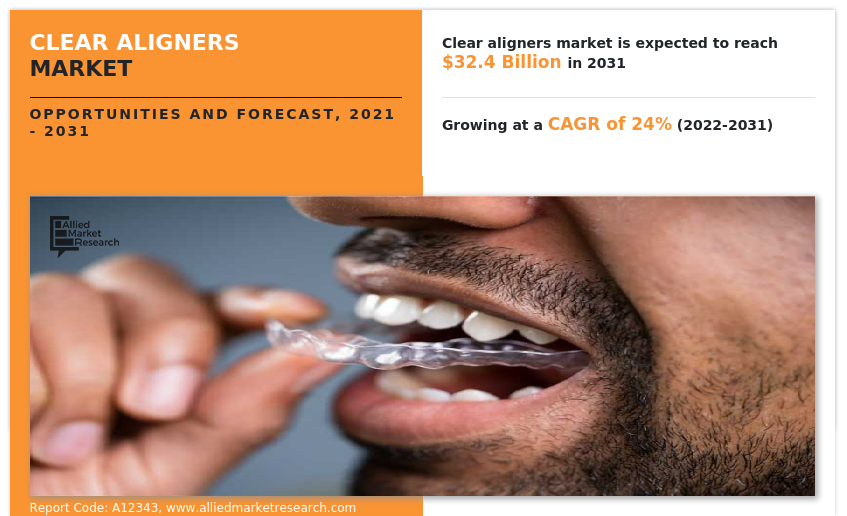

The global clear aligners market size was valued at $3.8 billion in 2021, and is projected to reach $32.4 billion by 2031, growing at a CAGR of 24% from 2022 to 2031. Clear aligner is an invisible medical device used to improve teeth alignment by moving teeth into the proper positions. It can be produced from medical grade plastic such as polyurethane, polyethylene terephthalate glycol, and poly-vinyl chloride, via manual setup and using CAD-CAM technologies to design and produce it. It is used by children, teenagers, and aged people for treating diastema, and crooked or misaligned teeth. In addition, clear aligners have gained popularity over metal and ceramic braces as they are removable, allowing patients to brush, floss, and rinse without the use of any orthodontic appliances. Studies also show that clear aligners, like the Invisalign system, have improved periodontal health in comparison to patients wearing fixed appliances, like metal and ceramic braces.

Historical overview

The clear aligners market forecast was analyzed qualitatively and quantitatively from 2018 to 2020. Most of the growth during this period was derived from the Asia-Pacific owing to the improving dental health awareness, rising disposable incomes, as well as the well-established presence of domestic companies in the region.

Market dynamics

The clear aligners market share witnessed growth, owing to an increase in focus on smiles, an increase in the trend of cosmetic dentistry, and the prevalence of malocclusion including crowded teeth, open bites, crossbite, overbite, underbite, and diastema that require clear aligners for teeth alignment.

For instance, according to the review article “Prevalence of Dental Malocclusions in Different Geographical Areas”, published in 2021, the World Health Organization (WHO) considers malocclusion one of the most important oral health problems, after caries and periodontal disease. Its prevalence is highly variable and is estimated to be between 39% and 93% in children and adolescents. As per SMR Journal of Research, the prevalence of malocclusion is almost 25% in the U.S., 88% in Columbia, 62.4%, and 20-43% respectively in Saudi Arabia and India.

In addition, the surge in demand for clear aligners is the result of the rising number of people going for dental aesthetics all across the world. Clear aligners are nearly invisible and can help with the correction of mild-to-moderate orthodontic problems. With technological advancements, the designs of clear aligners have been majorly improved, thereby increasing the preference for clear aligners among patients over traditional dental braces. This factor fosters the growth of the clear aligners market size.

There is an increase in the per capita income of the population across the world year after year, which is why people are now able to easily spend on aesthetic procedures. This factor further boosts the growth of the clean aligners market. The rise in clear aligners market trends, owing to inconvenience caused by the metal and ceramic braces and the long-term gum sensitivity increases the demand for alternative teeth aligners like clear aligners. According to Dental Tribune, clear aligners are the best alternative to metal and ceramic braces. Furthermore, advancement in digital scanning technology and computer-aided design (CAD-CAM) drives the growth of the clear aligners market.

In addition, technological advancements in clear aligners; the launch of various products, and strategies among key players such as acquisition, collaboration, and agreement drive the growth of the clear aligners market. For instance, in January 2021, Dentsply Sirona acquired Byte, a leading direct-to-consumer, doctor-directed clear aligner company, Dentsply Sirona announced that the company acquired Byte, rapidly growing clear aligner company. Byte holds a leadership position in the direct-to-consumer clear aligner market.

Segmental Overview

The clear aligners market is segmented on the basis of material type, age group, end user, and region. On the basis of material type, the market is classified into polyurethane, polyethylene terephthalate glycol, polyvinyl chloride, and others. On the basis of age group, it is classified into adults and teens. Depending on the end user, it is fragmented into hospitals, dental clinics, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, and the rest of Europe), Asia-Pacific (Japan, China, Australia, India, and the rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

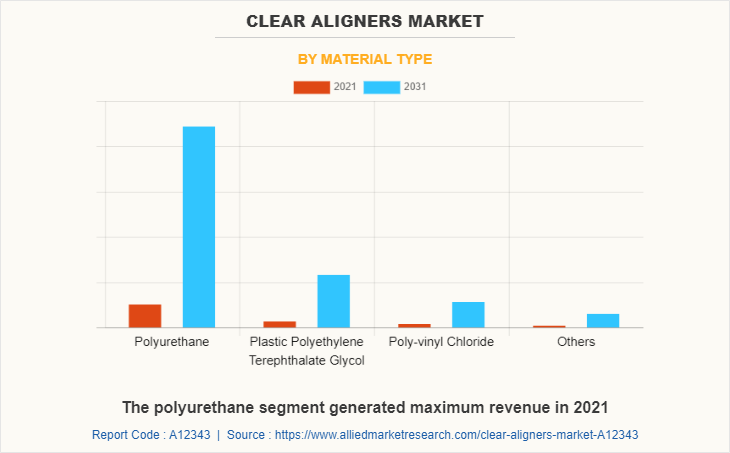

By Material Type

The clear aligners market is segmented into polyurethane, polyethylene terephthalate glycol, polyvinyl chloride, and others. On the basis of polymer, the polyurethane segment generated maximum revenue in 2021, owing to its flexible property, high adoption of polyurethane polymer for manufacturing clear aligners, and increase in technological advancements in polyurethane.

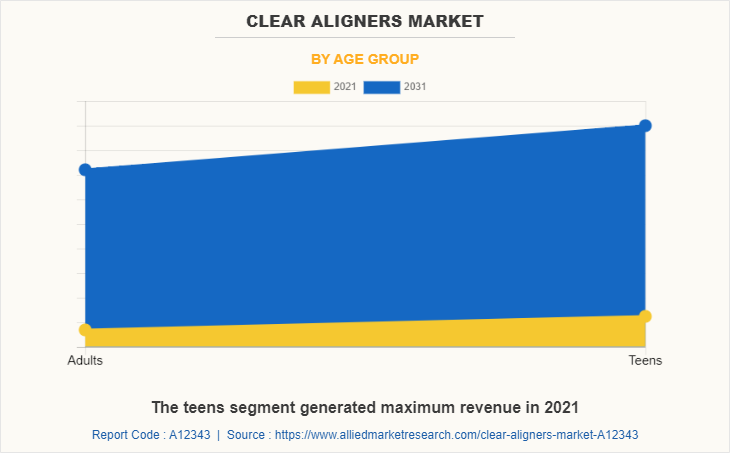

By Age Group

The clear aligners market is segregated into adults and teens. The teens generated maximum revenue in 2021, owing to the high adoption of clear aligners in teens and the rise in problems of diastema, crowded teeth, open bites, crossbites, overbites, and underbites in children and teenagers during their growth. The growth of the teen segment is also associated with an increase in focus on smiling and oral hygiene, which leads to an increase in the use of clear aligners and boosts clear aligners market growth.

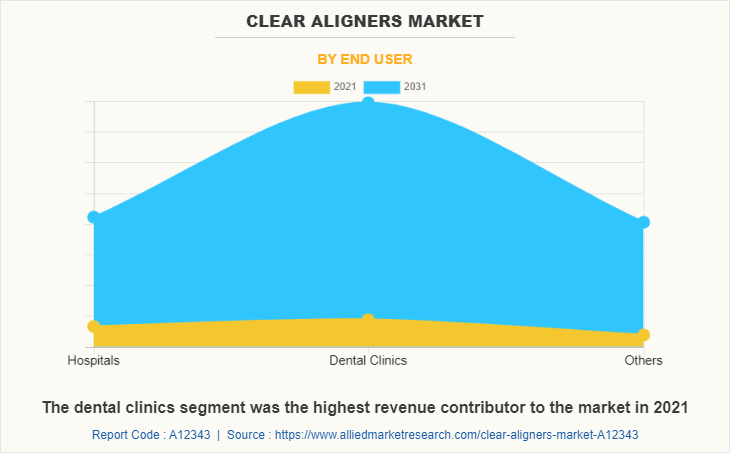

By End User

The clear aligners market is classified into hospitals, dental clinics, and others. The dental clinics were the highest revenue contributor to the market in 2021, owing to an increase in patients with dental diseases, the presence of advanced diagnostic products, and well-trained specialists of dental diseases. The rise in healthcare expenditure also boosts the growth of the dental clinic's segment in clear aligners market analysis.

By Region

The clear aligners market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the clear aligners market in 2021 and is expected to maintain its dominance during the forecast period.

Presence of several major players, such as 3M, Align Technology, Dentsply Sirona Inc., Envista Holdings Corporation, G&H Orthodontics, Inc. Henry Schein, Inc., T.P. Orthodontics, Inc., and Vincismile Group LLC and advancement in manufacturing technology of clear aligners in the region drive the growth of the market.

Furthermore, the presence of well-established healthcare infrastructure, high purchasing power, and a rise in the adoption rate of clear aligners are expected to drive market growth. Furthermore, product launches, mergers, collaborations, and acquisitions adopted by the key players in this region boost the growth of the market. For instance, in July 2021, Henry Schein launched Reveal Clear Aligners approved by dentists which is a convenient solution for patients to enhance their smile. Designed with patient comfort and aesthetics in mind, the aligners reduce or eliminate the need for attachments in mild to moderate cases, featuring a smooth scalloped edge that enhances patient comfort. Clear aligner solution that not only allows for patient comfort and aesthetics but also provides excellent customer support with a unique array of marketing materials

Asia-Pacific is expected to grow at the highest rate during the clear aligners market forecast period. The clear aligners market growth in this region is attributable to the rise in the prevalence of malocclusion, an increase in awareness regarding the use of clear aligners for teeth alignment in this region as well as growth in the purchasing power of populated countries, such as China and India. As per the SMR Journal of Research, the prevalence of malocclusion is almost 20-43% in India. Thus, as high prevalence and the existence of a largely untapped market in Asian countries offer a potential market for manufacturers of clear aligners and boost growth in this region during clear aligners market analysis.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the clear aligners market, such as 3M Company, Align Technology, Inc., Avinent Implant System, S.L, Dentsply Sirona Inc., and Envista Holdings Corporation, G&H Orthodontics, Inc., and Henry Schein Inc., and Institut Straumann AG, and T.P. Orthodontics, Inc., and Vincismile Group LLC are provided in this report. There are some important players in the market such as 3M Company, Align Technology, Inc., Dentsply Sirona, Envista Holdings Corporation

Henry Schein Inc., and Institut Straumann AG. Major players have adopted product launches, collaboration partnerships, and acquisitions as key developmental strategies to improve the product portfolio of the clear aligners market.

Some examples of product launches in the market

In July 2021, 3M Oral Care introduced Clarity Aligners Flex + Force: a new aligner system that empowers orthodontists to choose from two unique aligner materials in one treatment design and gives patients a customized treatment experience. This next-generation aligner system elevates 3M's powerful portfolio of advanced digital solutions by offering Advanced Tx Design through the 3M Oral Care Portal, which provides treatment from simple to complex cases. 3M Clarity Aligners are also indicated for the alignment of teeth during orthodontic treatment of malocclusion and can be used to address patients with mixed dentition.

In May 2021, Henry Schein has launched Reveal Clear Aligners approved by dentists which is a convenient solution for patients to enhance their smile. Designed with patient comfort and aesthetics in mind, the aligners reduce or eliminate the need for attachments in mild to moderate cases, featuring a smooth scalloped edge that enhances patient comfort. Clear aligner solution that not only allows for patient comfort and aesthetics but also provides excellent customer support with a unique array of marketing materials.

Acquisitions in the market

In January 2021, Dentsply Sirona acquired Byte, a leading direct-to-consumer, doctor-directed clear aligner company, Dentsply Sirona announced that the company acquired Byte, a rapidly growing clear aligner company. Byte holds a leadership position in the direct-to-consumer clear aligner market.

In July 2020, the Straumann Group further invested in the growing clear aligners industry by acquiring DrSmile, a leading provider of doctor-led clear aligner treatment solutions in Europe. DrSmile complements the clear aligner business with valuable direct-to-consumer marketing expertise.

Collaboration in the market

In December 2021, Dentsply Sirona announced a new partnership with Wrights the Dental Supply Company with patients increasingly seeking “invisible” orthodontic treatment and reflecting the overwhelmingly positive response to SureSmile from orthodontists and general practitioners.

Partnership in the market

In February 2021, Envista Holdings Corporation ("Envista") announced a four-year contract extension with Heartland Dental, the U.S.'s largest dental support organization. This partnership positions Envista as a trusted Heartland Dental supplier in several key categories for its supported dentists, including dental implants, consumables, infection prevention, handpieces, and imaging technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the clear aligners market analysis from 2021 to 2031 to identify the prevailing clear aligners market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the clear aligners market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global clear aligners market trends, key players, market segments, application areas, and market growth strategies.

Clear Aligners Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 32.4 billion |

| Growth Rate | CAGR of 24% |

| Forecast period | 2021 - 2031 |

| Report Pages | 240 |

| By Age Group |

|

| By Material Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | institut straumann ag, Dentsply Sirona Inc., AVINENT IMPLANT SYSTEM, S.L, T.P. ORTHODONTICS, INC., Henry Schein Inc., Align Technology, Inc., VINCISMILE GROUP LLC, 3M Company, G&H ORTHODONTICS, INC., ENVISTA HOLDINGS CORPORATION |

Analyst Review

According to the top CXOs operating in the clear aligners market, the clear aligners industry has gained prominence in 2021 and is expected to witness a significant rise soon, owing to an increase in demand for cosmetic dentistry, and a rise in the prevalence of dental diseases, a diastema, crowded teeth, open bites, crossbite, overbite, and underbite. In addition, an increase in incidences of dental disorders and a rise in the emergence of advanced innovative invisible clear aligners are the key factors that drive the market growth. Furthermore, the clear aligners market gained the interest of healthcare & pharmaceutical, and biotechnology companies, owing to the high utilization of CAD-CAM systems technology for capturing the impression of the teeth and processing the information with software that can be used for the production of clear aligners. This leads to an increase in demand for clear aligners that drives the growth of the market. Moreover, the rise in well-equipped hospitals and dental clinics for dental disorders and the increase in awareness among people for oral health in the region is responsible for the growth of the market.

North America is expected to witness the highest growth, in terms of revenue, owing to an increase in cases of misalignment of teeth, robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to a rise in demand for cosmetic dentistry, initiatives by key players to promote awareness regarding the use of clear aligners and an increase in public–private investments in the healthcare sector.

The utilization of clear aligners made of a mixture of plastics is one of the major trends in the Clear Aligners Market

The teens segment dominated the market in 2021

North America accounted for a major share of the clear aligners market in 2021

The clear aligners market was valued at $3,820.2 million in 2021, and is estimated to reach $32,434.1 million by 2031, growing at a CAGR of 24.0% from 2022 to 2031.

3M Company, Align Technology, Inc., Dentsply Sirona Inc., and Envista Holdings Corporation are a few major players in Clear Aligners Market

The high cost of Clear Aligners is one of the major restraining factors impacting the market growth

Yes

The increase in the trend of cosmetic dentistry coupled with the prevalence of malocclusion including crowded teeth and other tooth-related disorders are a few major drivers in the market

Loading Table Of Content...

Loading Research Methodology...