Clot Busting Drugs Market Research, 2032

The global clot busting drugs market size was valued at $28.6 billion in 2022, and is projected to reach $60 billion by 2032, growing at a CAGR of 8.2% from 2023 to 2032. Pharmaceuticals used to dissolve blood clots in blood arteries are referred to as thrombolytic agents or fibrinolytic medications. These drugs are essential for treating several conditions characterized by irregular blood clotting, such as ischemic stroke, deep vein thrombosis, pulmonary embolism, and myocardial infarction (heart attack).

Market Dynamics

Clot-busting pharmaceuticals, also known as thrombolytic agents, are medications used to dissolve blood clots in specific medical disorders. These medications have numerous advantages in the treatment of certain illnesses. Clot-busting medications are extremely successful at dissolving blood clots quickly, especially in acute conditions such as ischemic strokes or myocardial infarctions (heart attacks). They function by activating the body's own clot-dissolving machinery, which helps restore blood flow to the afflicted organ. Clot-busting medications can be used as an alternative to surgery in rare circumstances. For example, in pulmonary embolism, where a blood clot stops the blood veins in the lungs, thrombolytic therapy can help break the clot and remove the obstruction. This could remove the need for more intrusive techniques like surgical embolectomy. All these factors are anticipated to boost the clot busting drugs market growth in the upcoming years.

Excessive blood loss from injuries or cuts, allergic reactions due to clot buster medicines, low blood pressure, unusual bleeding in urine or stool, and other drug side effects demand careful and controlled dosing. Alternative techniques of treating blood clots that do not involve the use of clot-busting medicines are rarely available. In some cases of deep vein thrombosis or pulmonary embolism, anticoagulant medications (such as heparin or direct oral anticoagulants) may be used as the primary treatment. The availability of alternative therapies can influence the utilization of clot buster medicines, which is expected to hamper the clot busting drugs market size during the forecast period.

Genetic testing, biomarker analysis, and individual patient characteristics can be used to design treatment plans and optimize therapy with clot buster drugs. Personalized medicine approaches enhance treatment outcomes and patient satisfaction, providing opportunities for targeted therapies. Furthermore, stroke is the world's second leading cause of death, accounting for an estimated 5.5 million deaths every year. In addition to the tremendous morbidity caused by stroke, which results in up to 50% of survivors having long-term disability, there is a significant fatality rate. Therefore, stroke is a major public health concern with considerable economic and social consequences. These are the primary factors expected to create growth opportunities for the market participants during the forecast period.

Competitive Analysis

The key players profiled in this report include Pfizer Inc., Johnson & Johnson Services Inc, Sanofi, Dr. Reddy’s Laboratories, Bayer AG, Boehringer Ingelheim Gmbh, Genentech Inc., Eli Lilly and Company, Sun Pharmaceutical Industries Ltd., and Merck & Co.

Segments Overview

The clot bursting drugs market is segmented on the basis of product, indication, route of administration, distribution channel, and region. By product, the market is divided into thrombolytic drugs, anti-platelet drugs, anticoagulants, and others. By indication, the market is classified into pulmonary embolism, deep vein thrombosis, atrial fibrillation, and others. By route of administration, the market is classified into oral and injectable. By distribution channel, the market is classified into hospital pharmacy, online pharmacy, and retail pharmacy. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The clot busting drugs market is segmented into Product, Indication, Route of Administration and Distribution Channel.

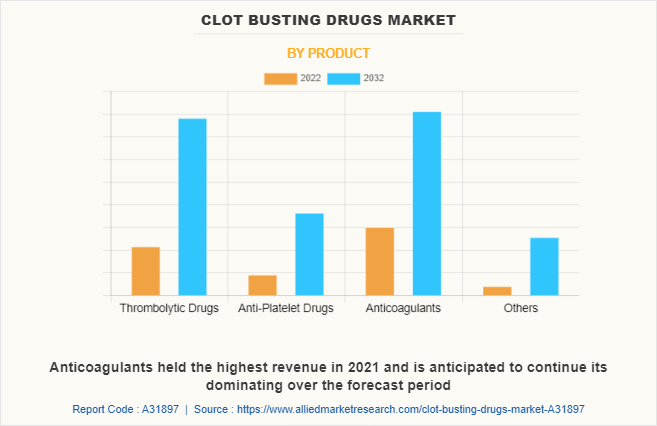

By Product

By product, the anticoagulants sub-segment dominated the market in 2022. The anticoagulants sub-segment is being driven by an increase in occurrences of coagulation disorders. Strategic agreements among major businesses are predicted to boost product penetration, driving the anticoagulants market growth in the upcoming years. An increase in the geriatric population, rise in obesity prevalence, and increase in hip and knee operations are also expected to boost the anticoagulants market during the forecast period. Anticoagulant products are being commercialized by governments and private parties. Furthermore, anticoagulant producers are focusing on increasing their presence in developing nations such as India, China, South Africa, Brazil, and Mexico in order to expand company operations and discover new markets.

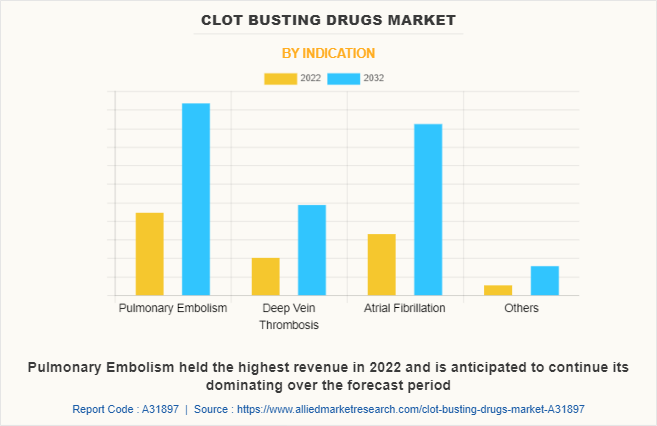

By Indication

By indication, the pulmonary embolism sub-segment dominated the global clot busting drugs market share in 2022. A pulmonary embolism (PE) occurs when a blood clot becomes lodged in a lung artery, obstructing blood flow to a part of the lung. Blood clots typically begin in the legs and move up the right side of the heart and into the lungs. This is referred to as deep vein thrombosis (DVT). The need for clot-busting medications is projected to rise as more people receive chemotherapy or have a family history of pulmonary embolism. As the number of cancer patients increases, the pharmaceutical drugs industry is likely to thrive. According to the World Health Organization, cancer was responsible for around 10 million deaths in 2020.

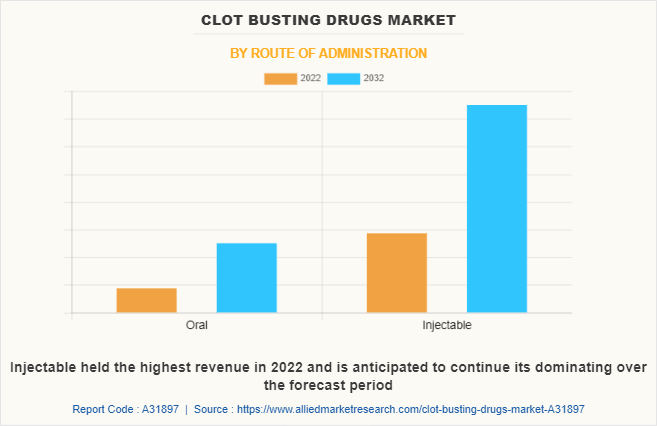

By Route of Administration

By route of administration, the injectable sub-segment dominated the global clot busting drugs market share in 2022. Injectable clot-busting medications, often known as thrombolytic agents, are extremely effective at breaking blood clots quickly. Injectable versions of clot-busting medicines frequently have higher bioavailability than oral or topical delivery. Intravenous injections ensure rapid and complete systemic distribution of the drug, reaching the clot more effectively. This enhanced drug delivery can lead to improved patient outcomes. Rising healthcare expenditure, particularly in developing countries, is contributing to the growth of the clot-busting drugs market. Governments and healthcare organizations are investing in advanced treatment options to improve patient outcomes.

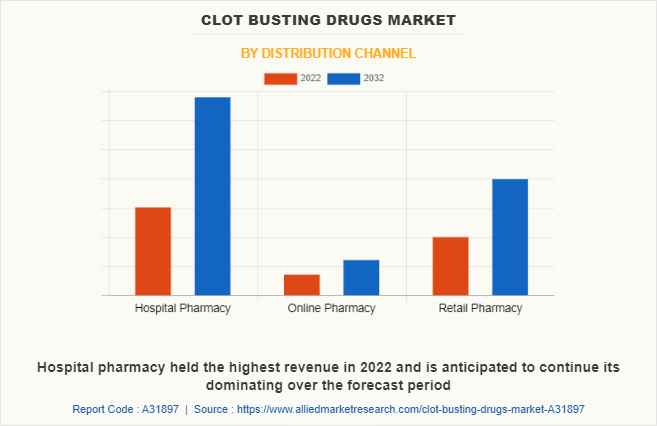

By Distribution Channel

By distribution channel, the hospital pharmacy sub-segment dominated the global clot bursting drugs market share in 2022. Hospital pharmacies play a critical role in supplying and managing these drugs for patients. The development of innovative clot bursting drugs has expanded treatment options for patients with thrombotic conditions. Newer drugs, such as thrombolytics and antiplatelet agents, offer improved efficacy and safety profiles. Hospital pharmacies need to stay updated with these advancements to ensure availability and appropriate usage of these drugs. Hospital pharmacies are responsible for procuring and storing these drugs to ensure prompt administration during critical situations. Hospital pharmacies often collaborate with pharmaceutical companies and healthcare providers to optimize the supply chain and enhance patient access to clot bursting drugs. Collaborative efforts can include joint purchasing agreements, streamlined inventory management, and knowledge sharing to improve patient outcomes. Such partnerships contribute to the growth and efficiency of the hospital pharmacy segment in the clot busting drugs market forecast period.

By Region

By region, North America dominated the global market in 2022. The demand for clot-busting medications in this region is consistently high due to the rising aging population and increasing the prevalence of cardiovascular illnesses. Older people are more likely to form blood clots, necessitating the use of clot-busting medications. This demographic trend is likely to drive the regional demand for these medications. North America has well-developed healthcare infrastructure, including advanced hospitals, clinics, and research institutions. This infrastructure supports the adoption of advanced clot-busting drugs and procedures. Reimbursement policies and coverage for clot-busting drugs in North America are generally favorable. This enables patients to access these treatments without significant financial burden, thereby driving the regional market clot busting drugs industry growth.

Impact of COVID-19 on the Global Clot Busting Drugs Industry

- During the COVID-19 pandemic, many healthcare resources and facilities were redirected towards managing COVID-19 patients. This resulted in delays in the diagnosis and treatment of non-COVID conditions, including thrombotic disorders. Patients with potential clot-related symptoms faced challenges in accessing timely diagnostic tests and clot buster drug therapies, leading to suboptimal outcomes.

- The pandemic caused significant disruptions in healthcare services, including elective procedures, non-emergency hospital visits, and outpatient care. These disruptions impacted the overall demand for clot buster drugs, as fewer procedures and treatments were performed, and patients were hesitant to seek medical attention for non-COVID-related concerns.

- COVID-19 disrupted ongoing clinical trials and research activities, including those related to the development of new clot buster drugs or evaluating their efficacy in specific patient populations. Delays or disruptions in these studies could have implications for future advancements and innovation in the field.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the clot busting drugs market analysis from 2022 to 2032 to identify the prevailing clot busting drugs market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the clot busting drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global clot busting drugs market trends, key players, market segments, application areas, and market growth strategies.

Clot Busting Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 60 billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Product |

|

| By Indication |

|

| By Route of Administration |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Genentech Inc., Bayer AG, Johnson & Johnson Services Inc, Pfizer Inc., Eli Lilly and Company, Dr. Reddy’s Laboratories, Merck & Co, Sanofi, Boehringer Ingelheim Gmbh, Sun Pharmaceutical Industries Ltd. |

The global market for clot busting drugs is expected to expand during the forecast period due to the increasing prevalence of cardiovascular diseases including heart attacks and strokes. The increasing frequency of strokes necessitates a quick response, and clot buster medications can help by dissolving blood clots collecting in veins and lowering blood pressure.

The major growth strategies adopted by clot busting drugs market players are investment and agreement.

North America is projected to provide more business opportunities for the global clot busting drugs market in the future.

Sanofi, Dr. Reddy’s Laboratories, Bayer AG, Boehringer Ingelheim Gmbh., Genentech Inc., Eli Lilly and Company, and Johnson & Johnson Services Inc. are the major players in the clot busting drugs market.

The anticoagulants sub-segment of the product acquired the maximum share of the global clot busting drugs market in 2022.

Hospital pharmacy is the major customers in the global clot busting drugs market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global clot busting drugs market from 2022 to 2032 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...