Cloud Accounting Software Market Research, 2032

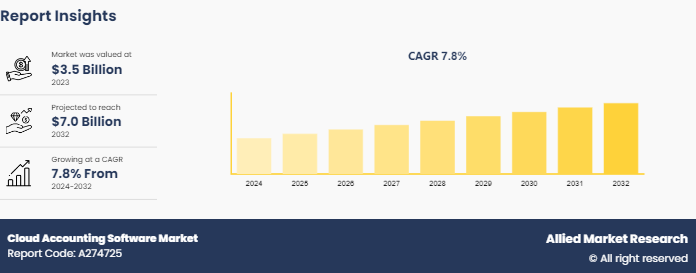

The global cloud accounting software market was valued at $3.5 billion in 2023, and is projected to reach $7.0 billion by 2032, growing at a CAGR of 7.8% from 2024 to 2032. Cloud accounting software market growth is driven by increasing adoption of cloud-based solutions among businesses seeking flexibility and scalability in their accounting processes. Additionally, advancements in technology and integration capabilities with other enterprise systems are further propelling the market expansion.

Market Introduction and Definition

The cloud accounting software market encompasses software solutions that manage financial transactions, bookkeeping, and accounting processes through cloud-based platforms. This market is characterized by the provision of accounting tools and services that are accessible via the internet, eliminating the need for local installations and extensive IT infrastructure. These solutions offer real-time financial data access, collaboration capabilities, and enhanced security features. Cloud accounting software is widely adopted by businesses of all sizes for its cost-efficiency, scalability, and ease of use, enabling streamlined financial management and improved accuracy in financial reporting. The market is driven by the growing demand for digitalization, remote work capabilities, and the need for efficient financial operations.

Key Takeaways

The cloud accounting software industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period.

More than 1,500 product literature, industry releases, annual reports, and other such documents of major cloud accounting software industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

The global cloud accounting software market is experiencing robust growth driven by several key factors. Its primary drivers include the increase in demand for efficient financial management solutions, advancements in digital technology, and the surge in trend of business digitalization. However, high initial costs and data privacy concerns pose challenges to the growth of cloud accounting software market size. Despite these restraints, the rise of small and medium enterprises (SMEs) adopting cloud solutions and the increase in emphasis on remote work and collaboration offer significant growth opportunities for the cloud accounting software market size during the forecast period. A comprehensive cloud accounting software market analysis reveals key trends, competitive landscapes, and growth opportunities driving the industry's expansion.

The cloud accounting software market has witnessed substantial growth due to the increase in demand for streamlined financial operations and real-time data access. Leading players such as Intuit, Xero, and Sage offer comprehensive cloud accounting software systems that provide features like automated bookkeeping, financial reporting, and payroll processing. The growth of e-commerce and the need for efficient financial management among startups and SMEs have fueled the demand for cloud accounting software. In addition, the digital transformation of various industries has led to the development of advanced accounting platforms and tools that simplify financial data collection and analysis. The COVID-19 pandemic has accelerated the adoption of cloud-based solutions, as businesses seek to reduce operational costs and enhance their financial management capabilities, ensuring business continuity and efficiency in a remote working environment.

PESTLE Overview: Global Cloud Accounting Software Market

The global cloud accounting software market is experiencing growth due to various external factors. Politically, governments worldwide are advocating for digitalization and transparency, impacting the adoption of cloud-based accounting solutions. Economically, businesses are increasingly embracing these systems to streamline operations and reduce costs, though economic downturns can slow this trend. Socially, the acceptance of remote work and the demand for more flexible, accessible accounting tools are driving market expansion. Technological advancements in AI and ML are revolutionizing accounting processes, offering features like automated data entry and real-time financial insights. Legally, compliance with data protection laws, such as GDPR and CCPA, is a significant consideration for cloud accounting software providers. Environmentally, cloud solutions contribute to sustainability efforts by reducing paper usage and energy consumption compared to traditional accounting methods. Despite challenges such as initial costs and data security concerns, the market is poised for continued growth, fueled by the ongoing digital transformation of businesses worldwide.

Market Segmentation

The cloud accounting software market is segmented into type, enterprise size, and region. On the basis of type, the market is divided into browser-based, SaaS, and application service providers (ASPs). As per the enterprise size, the market is bifurcated into SMEs and large enterprises. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North America cloud accounting software market share is poised for substantial growth, driven by several key factors. The region's stringent regulatory environment, particularly in the U.S. and Canada, mandates the use of cloud-based accounting solutions, boosting market demand. The presence of key industry players and advanced technological infrastructure further propels market expansion. In addition, the region's high disposable income levels and a strong inclination toward adopting advanced financial technologies contribute significantly towards, North America cloud accounting software market share. The increase in acceptance of remote work and the surge in trend of digitalization in financial management also drive market expansion. However, challenges such as data security concerns and the high cost of implementation are the factors projected to limit market growth. Overall, North America presents a lucrative landscape for cloud accounting software providers, with ample opportunities for innovation and growth. The size and diversity of the market create opportunities for telematics providers to offer specialized solutions tailored to different segments and niches.

In March 2023, Focus Softnet, a Hyderabad-based software company offering composable Enterprise Resource Planning (ERP) solutions, developed and launched its new accounting software – FocusLyte. It is a cloud-based system that assists in handling invoices and company payments. FocusLyte is primarily designed for small and medium enterprises; however, it is equally efficient for enterprises with complex financial accounting processes. The system is popular among users due to its ease of use and extensive reporting capabilities. Also, there are no restrictions on the number of masters or the volume of transactions within this software. FocusLytecomes with a free CA login that users can create for audit purposes. It is also easily scalable to integrate with FocusSoftnet’sin-house GSP application Services as customers’ GST compliance responsibility increases, like generating E-Invoices, EWay Bills Online Returns, etc.

In March 2024, Wolters Kluwer Tax & Accounting (TAA) has launched CCH iFirm, its award-winning cloud-based practice management and compliance software platform, in the UK The integrated and scalable platform is designed to help make tax and accountancy practices more efficient and productive. The new platform offers efficient and automated workflows and full integration and visibility across a range of accounting tools. It enables access to real-time data, while adhering to the top industry security standards. CCH iFirm thereby allows users to access new opportunities driven by data analysis, visualization, and reporting.

Industry Trends

In May 2024, AI Account launched Asia's first cloud-based accounting solution exclusively for SMEs. Leveraging AI technology, AI Account ensures real-time compliance with local regulatory frameworks, offering SMEs a user-friendly platform tailored to their needs. The cloud accounting software seeks to break down barriers for SMEs looking to streamline their financial operations. AI Account enables them to experience the power of AI-driven accounting first-hand by offering access to its wide array of features.

In November 2023, UPDOT’S is anticipated to launch cloud accounting software in 2024. UPDOT’s new product, Balance Flow, is a cloud accounting software built by a team of adept software engineers and financial professionals with the vision to transform digital accounting and financial management for novices and professionals alike. In addition, Balance Flow was devised with a huge focus on simplifying the user flow and keeping the steps crisp and easy to follow.

Competitive Landscape

The major players operating in the cloud accounting software market forecast include Sage Group plc, Oracle Corporation, Infor Inc., Workday Inc., Xero Limited, Intuit Inc., and Microsoft Corporation. Other players in the cloud accounting software market include Epicor Software Corporation, Unit4 N.V, SAP SE, and others.

Recent Key Strategies and Developments

In December 2023, Xero has integrated with Quadient’s accounts payable (AP) capabilities to add intelligent AP automation to its cloud-based accounting software. With the companies’ new strategic partnership in North America and the UK, small and midsized businesses (SMBs) using Xero’s software will gain these capabilities. The AP automation solution of the company’s new partner, Quadient, eliminates the need for manual data import or export in everything from receiving invoices and purchase orders to inputting payment data, the release said. With the new integration, data can be collected and inputted into Xero using Quadient’s optical character recognition (OCR) capability, eliminating 83% of data entry and reducing the average cost of processing an invoice from $16 to $2, per the release.

In May 2023, Accounting software specialist, Bright, launched its new cloud tax and compliance product at Accountex 2023. In response to the increase in surge in businesses migrating to the cloud, its new software will match the engine and support that drives award-winning BTCSoftware for desktop with a streamlined and efficient interface to create a new tax and accounts product for UK accountants. The launch of BrightTax offers a new answer to the desire from the accounting industry to adopt cloud-based software which combines secure and essential tools with an enjoyable user experience.

Key Sources Referred

American Institute of Certified Public Accountants (AICPA)

Cloud Security Alliance (CSA)

The Chartered Institute of Management Accountants (CIMA)

International Federation of Accountants (IFAC)

Institute of Management Accountants (IMA)

Xero Users Group (XUG)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the cloud accounting software market segments, current trends, estimations, and dynamics of the market analysis from 2023 to 2032 to identify the prevailing market opportunities.

The study provides an in-depth analysis of the global cloud accounting software market forecast along with current & future trends to explain the imminent investment pockets.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cloud accounting software market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global cloud accounting software market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global cloud accounting software market trends, key players, market segments, application areas, and market growth strategies.

Cloud Accounting Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.0 Billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Type |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Intuit Inc., Microsoft Corporation, Workday Inc., Oracle Corporation, Unit4 N.V, Xero Limited, Sage Group plc, SAP SE, Epicor Software Corporation, Infor Inc. |

The cloud accounting software Market is estimated to grow at a CAGR of 7.8% from 2024 to 2032.

The cloud accounting software Market is projected to reach $7 billion by 2032.

The cloud accounting software Market is expected to witness notable growth due to the increase in demand for streamlined financial operations and real-time data access.

The key players profiled in the report include Sage Group plc, Oracle Corporation, Infor Inc., Workday Inc., Xero Limited, Intuit Inc., Microsoft Corporation, Epicor Software Corporation, Unit4 N.V, and SAP SE.

The key growth strategies of cloud accounting software Market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...