Cloud Infrastructure Market Statistics, 2032

The global cloud infrastructure market was valued at $96.9 billion in 2022, and is projected to reach $440.2 billion by 2032, growing at a CAGR of 16.7% from 2023 to 2032.

Cloud infrastructure encompasses the hardware and software constituents that facilitate the computational necessities of a cloud computing model, including servers, storage, networking, virtualization software, services, and management tools. Additionally, cloud infrastructure entails an abstraction layer that virtualizes and logically presents resources and services to users through application programming interfaces and API-enabled command-line or graphical interfaces. By disintegrating the functions and features of these hardware and software components, cloud infrastructure forms the foundation of cloud computing. Subsequently, a cloud infrastructure service provider or an information technology (IT) department, in the context of a private cloud, hosts these virtualized resources and dispenses them to users via the internet or a network.

These resources encompass virtual machines (VMs) as well as various components such as servers, memory, network switches, firewalls, load balancers, and storage. Moreover, these resources frequently uphold extensive and task-specific services, such as artificial intelligence (AI) and machine learning. Cloud infrastructure pertains to the technological components situated in the rear end of enterprise data centers, encompassing servers, persistent storage, and networking equipment, albeit on a significantly grander magnitude. Certain considerable cloud providers, comprising hyperscale cloud corporations like Facebook and LinkedIn, engage in collaborations with vendors to devise bespoke infrastructure elements that are finely tuned to cater to particular demands, such as power effectiveness or workloads encompassing extensive data and artificial intelligence.

Additionally, the market is expected to witness notable growth owing to surge in demand for cloud computing, growing demand for AI cloud and hybrid cloud and growing spending on cloud. Moreover, increased adoption of IoT and connected devices is expected to provide lucrative opportunity for the growth of the market during the forecast period. On the contrary, lack of technical knowledge and expertise limits the growth of the cloud infrastructure market.

The cloud infrastructure market is segmented on the basis of component, deployment mode, end user, and region. On the basis of component, the market is categorized into hardware, software, and services. By deployment mode, it is divided into public cloud, private cloud, and hybrid cloud. On the basis of end user, the market is segregated into BFSI, IT & telecom, consumer goods & retail, healthcare, manufacturing, government, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The report focuses on growth prospects, restraints, and analysis of the global cloud infrastructure market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, threat of substitutes, and bargaining power of buyers on the global market analysis.

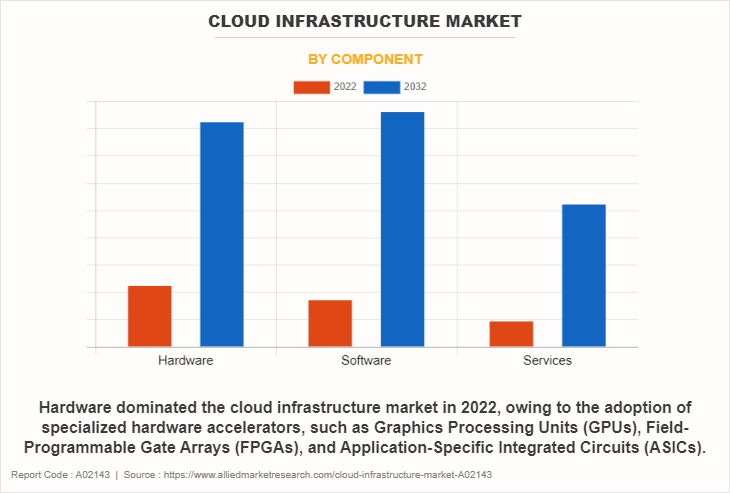

On the basis of component, the solution segment dominated the market size in 2022, owing to the adoption of dedicated hardware accelerators, such as Graphics Processing Units (GPUs), Field-Programmable Gate Arrays (FPGAs), and Application-Specific Integrated Circuits (ASICs), the effectiveness of particular workloads, including artificial intelligence (AI), machine learning (ML), and high-performance computing (HPC), is significantly enhanced through the delegation and acceleration of intricate computations.

However, the services segment is expected to witness the fastest growth, due to the increasing focus on cloud-based artificial intelligence and machine learning services, which enable businesses to draw conclusions from data and include clever elements into their apps. Furthermore, hybrid and multi-cloud services are becoming more and more popular, enabling companies to work across several cloud environments with ease or combine cloud resources with on-premises infrastructure.

Region-wise North America dominated the cloud infrastructure market share in 2022, due to the increased need for processing real-time data in close proximity to its origin, the development of edge computing has seen a rise. The most noticeable manifestation of this trend is seen in applications related to the Internet of Things (IoT) and the provision of low-latency experiences. The significance of compliance standards and cloud security protocols is growing steadily.

However, the Asia-Pacific region is predicted to experience the most rapid growth in the coming year, as a result of the adoption of cloud-native technologies and architectures. Organizations are increasingly employing containerization, microservices, and serverless computing to enhance their agility and scalability. There is an increasing trend of employing multi-cloud strategies, as businesses aim to avoid dependency on a single vendor, optimize costs, and gain access to specialized services offered by different cloud providers.

Top Impacting Factors

Surge in Demand for Cloud Computing

The rapid increase in demand for cloud computing within cloud infrastructure is also propelled by its transformative impact on traditional IT architectures. Cloud computing enables businesses to transition from a capital-intensive model to an operational one, thereby reducing upfront costs related to hardware and infrastructure investments. This financial adaptability is particularly attractive to organizations seeking to allocate resources in a more efficient manner.

Furthermore, the cloud's capacity to expedite the time-to-market for applications and services is a pivotal factor. The development and deployment cycles are streamlined, empowering businesses to promptly respond to market demands and stay ahead of the competition. The expanding ecosystem of cloud services, coupled with ongoing technological advancements, presents fresh opportunities for organizations to innovate and distinguish themselves. Due to the global reach of cloud providers, businesses can effortlessly expand their operations across borders and cater to a larger consumer base.

The surge in desire for cloud computing is a clear indication of a broader pattern in the process of digital transformation, whereby organizations employ technology to fundamentally reconsider their approaches and interactions with customers as well as to streamline their operations. The demand for the capabilities of cloud infrastructure is anticipated to remain robust as it evolves to meet the growing requirements of enterprises, stimulating ongoing creativity and transforming the digital realm.

Growing Demand for AI Cloud and Hybrid Cloud

The increasing demand for AI cloud and hybrid cloud solutions can be attributed to the rising need for advanced data processing, machine learning, and artificial intelligence capabilities in various industries. Enterprises are recognizing the potential of incorporating AI into their operations to potentially revolutionize their processes by providing valuable insights, streamlining workflows, and enhancing decision-making. The reason why cloud infrastructure is considered ideal for AI workloads is due to its scalability and flexibility, which are crucial for high processing speeds and specialized resources.

The AI cloud simplifies the deployment and operation of AI models for users by granting them access to specialized services and powerful hardware accelerators. Furthermore, the popularity of hybrid cloud solutions, which combine on-premises infrastructure with cloud services, is increasing because they offer a balanced approach that allows businesses to retain sensitive data on-premises while utilizing the cloud for AI processing and analytics. This hybrid architecture addresses worries about data protection and regulatory compliance while offering the agility of the cloud.

Competition Analysis

Competitive analysis and profiles of the major players in the cloud infrastructure industry include Hewlett Packard Enterprise Development LP, Dell Inc., Cisco Systems, Inc., IBM Corporation, Amazon Web Services, Inc., Salesforce, Inc., Intel Corporation, Oracle Corporation, Alphabet Inc. (Google LLC), and NetApp. Major players have adopted product launch, partnership, collaborations, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the cloud infrastructure industry.

Regional Insights

The market is experiencing rapid global growth, driven by the increasing adoption of cloud-based solutions across various industries. Different regions are contributing to this growth in unique ways, with varying levels of cloud infrastructure maturity and market drivers.

North America holds the largest share of the market, primarily due to the early adoption of cloud technologies and the presence of major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. The region’s strong IT infrastructure, advanced technological ecosystem, and increasing demand for scalable solutions across industries like healthcare, retail, and financial services contribute to the market’s growth. The U.S., in particular, leads the market with continuous investments in cloud technology, large data centers, and innovation in hybrid and multi-cloud environments.

Europe follows closely, driven by strong cloud adoption across major economies like Germany, the UK, and France. The European market is characterized by growing concerns around data privacy and stringent regulations like the General Data Protection Regulation (GDPR). These factors have led to an increased focus on secure and compliant cloud infrastructure solutions, which are pushing the growth of private and hybrid cloud models. The European Union’s investment in its own cloud infrastructure initiatives, such as GAIA-X, reflects its commitment to data sovereignty and independence from non-European providers.

The Asia-Pacific region is witnessing the fastest growth in the market, driven by increasing digital transformation initiatives across countries like China, Japan, India, and South Korea. Rapid industrialization, the rise of e-commerce, and the growing startup ecosystem in countries like India have led to a surge in demand for cloud infrastructure services. Moreover, governments across the region are promoting cloud-first strategies, further accelerating cloud adoption. China, in particular, is a key player, with major cloud providers like Alibaba Cloud and Tencent Cloud expanding their offerings.

In Latin America and the Middle East & Africa, cloud infrastructure adoption is gradually increasing as businesses look to modernize their IT infrastructure. While these regions have traditionally lagged behind in cloud adoption due to economic and infrastructure challenges, growing investments from global cloud providers are boosting market growth.

Recent Partnership in the Market

On April 2023, Hewlett Packard Enterprise (HPE) partnered with VAST Data, the data platform company for the AI era to provide software for HPE GreenLake for file storage.

On April 2023, Dell partnered with Ericsson to deliver added resilience and interconnectivity to aid communications service providers in their Cloud RAN. Cloud RAN customer's wider choice of infrastructure while ensuring telco-grade performance at the far edge.

On May 2023, Dell partnered with Microsoft, Red Hat, and VMware to expand its Apex multi-cloud services portfolio by engineering turnkey cloud platforms that integrate Dell infrastructure and software with its partners’ cloud operating stacks in an effort to create horizontal consistency out of distributed environments.

On September 2023, Salesforce partnered with Google to bring together Salesforce, the #1 AI CRM, and Google Workspace, the world’s most popular productivity tool, to drive productivity with AI. This partnership will deliver new bidirectional integrations that allow customers to bring together context from Salesforce and Google Workspace, including Google Calendar, Docs, Meet, Gmail, and more, to power generative AI experiences across platforms.

Recent Product Launch in the Market

On June 2023, Cisco US-based telecom gear maker launched Networking Cloud Platform to simplify the management of networking gear through a single, common interface. The platform has been rolled out alongside enhancements to several of Cisco’s products, including ThousandEyes infrastructure monitoring service, and Catalyst portfolio.

Recent Acquisition in the Market

On March 2023, HPE acquired OpsRamp, privately held IT operations management vendor, to improve its IT operation and management capabilities by integrating OpsRamp's technology with the HPE GreenLake platform.

On January 2023, Dell Technologies acquired Israeli startup Cloudify that is known for cloud orchestration to boost its cloud services business, specifically its offerings in DevOps.

Recent Collaboration in the Market

On May 2023, Intel collaborated with SAP SE to deliver more powerful and sustainable SAP software landscapes in the cloud. Designed to help customers derive greater scalability, agility and consolidation of existing SAP software landscapes, the collaboration deepens Intel’s focus on delivering extremely powerful and secure instances for SAP, powered by 4th Gen Intel Xeon Scalable processors.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cloud infrastructure market analysis from 2022 to 2032 to identify the prevailing market growth.

- The cloud infrastructure market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cloud infrastructure market forecast to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Cloud infrastructure market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cloud infrastructure market trends, key players, market segments, application areas, and market growth strategies.

Cloud Infrastructure Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 440.2 billion |

| Growth Rate | CAGR of 16.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 408 |

| By Component |

|

| By Deployment Mode |

|

| By End User |

|

| By Region |

|

| Key Market Players | Amazon Web Services, Inc., Dell Inc., Salesforce, Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Alphabet Inc. (Google LLC), Intel Corporation, NetApp, Oracle Corporation, Cisco Systems, Inc. |

Analyst Review

The COVID-19 pandemic had a positive impact on the cloud infrastructure market, emphasizing its transformative impact on the IT landscape. Analysts often highlight the scalability and flexibility that cloud services offer, enabling businesses to adapt to changing demands and efficiently manage resources. The cost-effectiveness of a pay-as-you-go model, allowing organizations to pay only for the resources they use, is frequently acknowledged. Analysts also recognize the role of cloud infrastructure in fostering innovation, supporting digital transformation, and providing a platform for emerging technologies such as artificial intelligence and machine learning. However, reviews commonly address concerns such as data security, privacy, and potential challenges associated with migrating existing systems to the cloud.

The flexibility of cloud solutions allows for the efficient deployment of new applications and services, aligning with business goals. The focus on innovation is another key aspect, with cloud infrastructure serving as a foundation for experimenting with emerging technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT). In addition, CXOs recognize the role of the cloud in enhancing collaboration and enabling remote work, especially in the context of evolving workplace dynamics. While there is a positive sentiment toward the benefits of cloud infrastructure, CXOs also navigate challenges related to data security, compliance, and the need for strategic planning to ensure a seamless transition to the cloud.

The Cloud Infrastructure Market was valued at $96,861.52 million in 2022 and is estimated to reach $440,213.30 million by 2032, exhibiting a CAGR of 16.7% from 2023 to 2032.

North America is the largest regional market for Cloud Infrastructure.

Competitive analysis and profiles of the major players in the cloud infrastructure industry include Hewlett Packard Enterprise Development LP, Dell Inc., Cisco Systems, Inc., IBM Corporation, Amazon Web Services, Inc., Salesforce, Inc., Intel Corporation, Oracle Corporation, Alphabet Inc. (Google LLC), and NetApp. Major players have adopted product launch, partnership, collaborations, and acquisition as key developmental strategies to improve the product portfolio and gain strong foothold in the cloud infrastructure industry.

Increased adoption of IoT and connected devices is the leading application of Cloud Infrastructure Market.

Surge in demand for cloud computing, growing demand for AI cloud and hybrid cloud are the upcoming trends of Cloud Infrastructure Market in the world.

Loading Table Of Content...

Loading Research Methodology...