Coal Tar Market Research, 2033

The global coal tar market was valued at $15.7 billion in 2023, and is projected to reach $22.3 billion by 2033, growing at a CAGR of 3.6% from 2024 to 2033.

Market Introduction and Definition

Coal tar is a dark, thick, viscous liquid derived from the destructive distillation of coal. This process involves heating coal without air to break it down into various byproducts, including coal tar. It is composed of a complex mixture of hydrocarbons, phenols, and heterocyclic compounds. The chemical composition of coal tar can vary depending on the source of coal and the conditions under which it is processed. Its rich, black color, and sticky texture are due to many aromatic hydrocarbons.

One of the primary uses of coal tar is in the construction of roads and pavements. Coal tar pitch, a solid form of coal tar, is used as a binder in asphalt and tarmac. This material provides excellent durability and resistance to water and weather conditions, making it ideal for use on road surfaces. Coal tar is also used in roofing materials, particularly in built-up roofing systems. These systems consist of multiple layers of roofing felt or membranes, which are impregnated with coal tar pitch. The pitch acts as a waterproofing agent, protecting buildings from water infiltration and damage. Coal tar's excellent adhesive properties and resistance to environmental elements make it an effective choice for roofing applications, especially in flat or low-slope roofs.

In wood preservation, coal tar has been used to protect wood from decay and insect infestation. Creosote, a derivative of coal tar, has been employed extensively to treat railroad ties, utility poles, and other wooden structures exposed to harsh environmental conditions. The creosote penetrates the wood, providing protection against fungal decay and insect damage, thereby extending the lifespan of wooden materials.

Key Takeaways:

- The coal tar industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global coal tar market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the coal tar market size.

- The coal tar market share is highly fragmented, with several players including Himadri Speciality Chemical Ltd., Voestalpine AG, Rain Carbon Inc., JFE Chemical Corporation, DEZA, a. s., Bilbaína de Alquitranes, S.A., Koppers Inc., Nagreeka Hydrocarbons (P) Ltd., Neptune Hydrocarbons Mfg. Pvt. Ltd., and NIPPON STEEL Chemical & Material Co., Ltd. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the coal tar market growth.

Market Segmentation

The coal tar market is segmented into type, application, and region. On the basis of type, the market is divided into coal tar pitch, coal tar creosote, refined tar, and others. On the basis of application, the market is classified into aluminum smelting, graphite electrodes, road paving, roofing, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Rise in demand for coal tar in aluminum and graphite industries is expected to drive the growth of the coal tar market during the forecast period. The coal tar market is poised for significant growth, driven primarily by the increasing demand from the aluminum and graphite industries. Coal tar, a byproduct of the coking process used in steel production, finds extensive applications in various sectors due to its complex mixture of phenols, polycyclic aromatic hydrocarbons (PAHs) , and heterocyclic compounds. The automotive industry is shifting towards lighter materials to improve fuel efficiency and reduce emissions. Aluminum is a preferred choice due to its strength-to-weight ratio, leading to an increased demand for coal tar pitch for producing the necessary anodes. The aerospace sector also relies heavily on aluminum for manufacturing aircraft components. The growing aviation industry, driven by increased air travel and cargo transport, further fuels the demand for aluminum. In October 2022, Syrah Resources Ltd. announced an agreement to supply LG Energy Solution Ltd., a prominent South Korean company, with a crucial component for lithium-ion batteries. According to the agreement, Syrah Resources initially provide 2 kilotons per annum of graphite for active anode material (AAM) starting in 2025. This supply will increase to at least 10 kilotons per annum once Syrah Resources expands its production capacity at the Vidalia facility in Louisiana.

The surge in use of coal tar in pharmaceuticals and cosmetics is expected to provide lucrative opportunities in the market. Coal tar has been recognized for its therapeutic properties, especially in dermatology. It is particularly effective in treating chronic skin conditions such as psoriasis and eczema. Coal tar works by slowing down the rapid growth of skin cells and reducing inflammation, itching, and scaling. These properties make coal tar ointments a valuable treatment option for patients suffering from these conditions, offering relief and improving their quality of life. As consumers increasingly prioritize skincare and seek out effective solutions for common issues such as dandruff, seborrhea, and acne, coal tar's potential as a cosmetic ingredient is gaining recognition. Its incorporation into shampoos, creams, and other topical applications is being driven by its proven effectiveness in managing sebaceous gland activity and reducing scalp flakiness. The cosmetic industry's trend towards natural and therapeutic ingredients aligns well with coal tar's profile, providing a significant opportunity for market growth.

However, fluctuating raw material prices are expected to restrain the growth of the coal tar market during the forecast period. The coal tar market, integral to industries such as aluminum production, construction, and pharmaceuticals, faces significant challenges from the fluctuating prices of its primary raw materials: coal and crude oil. This volatility affects the cost structure of coal tar production, influencing everything from operational expenses to end-product pricing. The prices of coal and crude oil are heavily influenced by the global supply and demand balance. For instance, coal prices can fluctuate based on the production levels of major coal-producing countries such as China, India, U.S., and Australia. Any disruption in coal mining activities, whether due to labor strikes, natural disasters, or regulatory changes, can lead to a supply shortage, driving up prices. Similarly, crude oil prices are affected by the production decisions of major oil-exporting countries, particularly those within the Organization of the Petroleum Exporting Countries (OPEC) .

Competitive Analysis

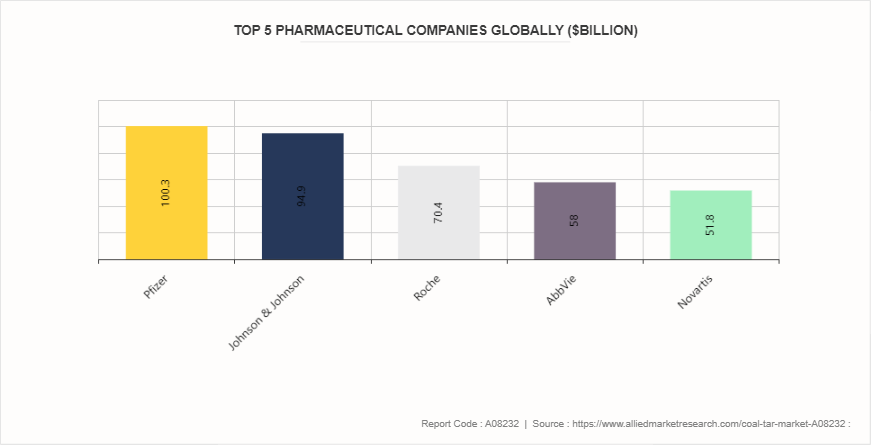

Key market players in the coal tar market include Himadri Speciality Chemical Ltd., Voestalpine AG, Rain Carbon Inc., JFE Chemical Corporation, DEZA, a. s., Bilbaína de Alquitranes, S.A., Koppers Inc., Nagreeka Hydrocarbons (P) Ltd., Neptune Hydrocarbons Mfg. Pvt. Ltd., and NIPPON STEEL Chemical & Material Co., Ltd.

Regional Market Outlook

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, coal tar is primarily used in the production of asphalt sealants and coatings. The U.S. is the major consumer, where it is widely used in maintaining road surfaces, parking lots, and driveways due to its effectiveness in sealing and extending the life of asphalt surfaces. In addition, coal tar derivatives, such as creosote, are used in wood preservation, especially for railway ties and utility poles. Asia-Pacific is the largest consumer of coal tar, driven by the rapid industrialization and infrastructural development in countries such as China and India. In this region, coal tar is used in the aluminum smelting industry as a binder for graphite electrodes and in carbon pitch for aluminum anodes. In addition, it plays a crucial role in the production of paints, coatings, and roofing materials.

Industry Trends

- In July 2023, Indian Oil Corporation Limited (IOCL) announced the commencement of commercial production of coal tar pitch at its Barauni refinery in Bihar. With a new plant boasting a capacity of 10, 000 tons per annum, IOCL aims to meet the increasing demand for coal tar pitch within the country.

- According to ALS Laboratories (UK) Ltd, between 200 and 400 million tons of coal tar were used on roads and pavements in the UK in 2022. Consequently, maintenance work on roads may involve excavating materials containing tar. The version of Regulatory Position Statement (RPS) 211 is withdrawn in June. Following its withdrawal, all unassessed waste from utility excavations must be classified as hazardous.

- In January 2023, Showa Denko K.K. (SDK) merged with Showa Denko Materials Co. Ltd (formerly Hitachi Chemical Company Ltd) , resulting in the formation of two separate entities: "Resonac Holdings Corporation" (the holding company) and "Resonac Corporation" (the manufacturing firm) . This merger unified their operations, particularly in the graphite electrode industry, streamlining their manufacturing and supply chains.

- In November 2023, HEG Limited, India's leading graphite electrode manufacturer, announced the successful completion of an expansion project that boosted its production capacity from 80, 000 tons to 100, 000 tons annually.

Historic Trends of Coal Tar Market

- In the 1900s, the use of coal tar expanded into various applications, including dyes, pharmaceuticals, and pesticides. The first synthetic dyes, such as the aniline dyes, were derived from coal tar.

- In the 1910s, coal tar derivatives were increasingly used in medicine, particularly in the treatment of skin conditions like psoriasis and eczema.

- In the 1920s, the development of synthetic chemicals and pharmaceuticals from coal tar became more advanced, leading to the creation of many new drugs and chemical products.

- In the 1960s, the environmental and health concerns related to coal tar and its byproducts, such as their carcinogenic properties, started to gain attention. Regulations began to be implemented to control the use and disposal of coal tar.

- In the 2000s, Coal tar was used in various industries, including asphalt production for road construction, roofing materials, and waterproofing. However, due to its toxic nature, its use in consumer products has become more regulated.

- In the 2010s, advances in technology led to more efficient and safer methods for handling and disposing of coal tar. There was a growing focus on alternative materials and methods to reduce reliance on coal tar.

Key Sources Referred

- National Cancer Institute

- Occupational Safety and Health Administration

- U.S. Environmental Protection Agency

- U.S. Department of the Interior

- American Academy of Dermatology

- International Tar Association

- Campaign of Safe Cosmetics

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coal tar market analysis from 2024 to 2033 to identify the prevailing coal tar market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coal tar market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coal tar market trends, key players, market segments, application areas, and market growth strategies.

Coal Tar Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 22.3 Billion |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 271 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | NIPPON STEEL Chemical & Material Co., Ltd., Himadri Speciality Chemical Ltd., Nagreeka Hydrocarbons (P) Ltd., JFE Chemical Corporation, Neptune Hydrocarbons Mfg. Pvt. Ltd., Koppers Inc., Rain Carbon Inc., Voestalpine AG, Bilbaína de Alquitranes, S.A., DEZA, a. s. |

The global coal tar market size was valued at $15.7 billion in 2023 and is projected to reach $22.3 billion by 2032, growing at a CAGR of 3.6% from 2024 to 2033.

Key market players in the coal tar market include Himadri Speciality Chemical Ltd., Voestalpine AG, Rain Carbon Inc., JFE Chemical Corporation, DEZA, a. s., Bilbaína de Alquitranes, S.A., Koppers Inc., Nagreeka Hydrocarbons (P) Ltd., Neptune Hydrocarbons Mfg. Pvt. Ltd., and NIPPON STEEL Chemical & Material Co., Ltd.

Asia-Pacific is the largest regional market for coal tar

Aluminum smelting is the leading application of coal tar market.

The surge in use of coal tar in pharmaceuticals and cosmetics are the upcoming trends of coal tar market.

Loading Table Of Content...