Coated Solar Control Glass Market Research, 2032

The global coated solar control glass market was valued at $5.3 billion in 2023, and is projected to reach $13.1 billion by 2032, growing at a CAGR of 10.5% from 2024 to 2032.

Market Introduction and Definition

Coated solar control glass is a specialized type of glass designed to reflect and absorb solar radiation, thereby reducing heat gain within buildings. This glass is treated with a variety of coatings that enhance its performance by controlling the transmission of light and heat. The coatings typically consist of thin layers of metal or metal oxide, which can be applied through processes such as magnetron sputtering, pyrolysis, or chemical vapor deposition. These coatings are engineered to selectively filter out specific wavelengths of solar radiation, allowing visible light to pass through while blocking a significant portion of infrared and ultraviolet rays.

In the architectural and construction industries, coated solar control glass is extensively used in the design of commercial buildings, residential homes, and skyscrapers. Its ability to regulate indoor temperatures and provide natural daylight without the associated heat gain makes it ideal for facades, windows, skylights, and curtain walls. The glass helps maintain a comfortable indoor environment, reducing reliance on HVAC systems and lowering energy costs. Additionally, it contributes to achieving green building certifications such as LEED (Leadership in Energy and Environmental Design) by enhancing the energy performance of buildings.

The automotive sector also benefits significantly from coated solar control glass. It is commonly used in the production of windshields, side windows, and rear windows of vehicles. By blocking a substantial amount of solar heat, it enhances passenger comfort and reduces the load on the vehicle's air conditioning system. This not only improves fuel efficiency but also extends the life of the vehicle's interior materials by protecting them from UV radiation. The glass also reduces glare, enhancing visibility and safety for drivers.

Key Takeaways

- The coated solar control glass industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global coated solar control glass market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the coated solar control glass market size.

- The coated solar control glass market share is highly fragmented, with several players including Saint-Gobain Glass India, Guardian Industries Holdings, AGC Glass Europe, Nippon Sheet Glass Co., Ltd, Vitro, Şişecam, Xinyi Glass Holdings Limited, CARDINAL GLASS INDUSTRIES, INC, Euroglas GmbH, and Jinjing (Group) Co., Ltd. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the coated solar control glass growth.

Market Segmentation

The coated solar control glass market is segmented into type, coating method, application, and region. On the basis of type, the market is bifurcated into low-e (low-emissivity) glass, and reflective coated glass. On the basis of coating method, the market is classified into pyrolytic, and sputtered. On the basis of application, the market is divided into residential buildings, commercial buildings, and automotive. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Increase in awareness and demand for energy-efficient solutions is expected to drive the growth of coated solar control lass market during the forecast period. Coated solar control glass is designed to manage the amount of solar radiation that enters a building, thus playing a crucial role in regulating indoor temperatures. The glass features a specialized coating that reflects or absorbs solar energy, thereby controlling the amount of heat transmitted through the glass. This innovative solution helps in maintaining a comfortable indoor environment while minimizing the reliance on heating, ventilation, and air conditioning (HVAC) systems. As a result, buildings equipped with coated solar control glass often experience reduced energy consumption, lower utility bills, and a decreased carbon footprint.

The growing demand for energy-efficient solutions is influenced by several factors. The increasing recognition of the environmental impact of excessive energy use. With climate change becoming a pressing global issue, both consumers and businesses are seeking ways to reduce their environmental footprint. Coated solar control glass provides a practical solution by enhancing the energy efficiency of buildings, thereby contributing to the broader goal of reducing greenhouse gas emissions. By optimizing the use of natural light and minimizing heat gain, this glass helps lower the need for artificial lighting and cooling, leading to significant energy savings. In February 2023, Enphase Energy, Inc., a global energy technology company and the world's largest manufacturer of microinverter solar arrays and batteries, announced that it began supplying IQ Batteries to Austrian customers in order to extend their availability throughout Europe.

However, the higher initial cost of coated solar control glass compared to regular glass is expected to restraint the growth of coated solar control glass market during the forecast period. The production of coated solar control glass requires advanced manufacturing techniques. This includes the application of thin-film coatings onto the glass surface, which are designed to selectively reflect, absorb, or transmit solar radiation. The technology used to apply these coatings is sophisticated and requires precision to ensure that the coatings are evenly distributed and adhere correctly to the glass substrate. These processes not only demand high-tech machinery but also skilled labor, which further escalates production costs. The need for rigorous quality control measures to maintain the efficacy and durability of the coatings adds another layer of expense, ultimately making the end product more costly than regular glass. The materials used in the coatings for solar control glass are often specialized and can be expensive. These materials include various metal oxides and other compounds that possess the necessary properties to control solar radiation effectively. The procurement of these specialized materials adds to the overall cost of production.

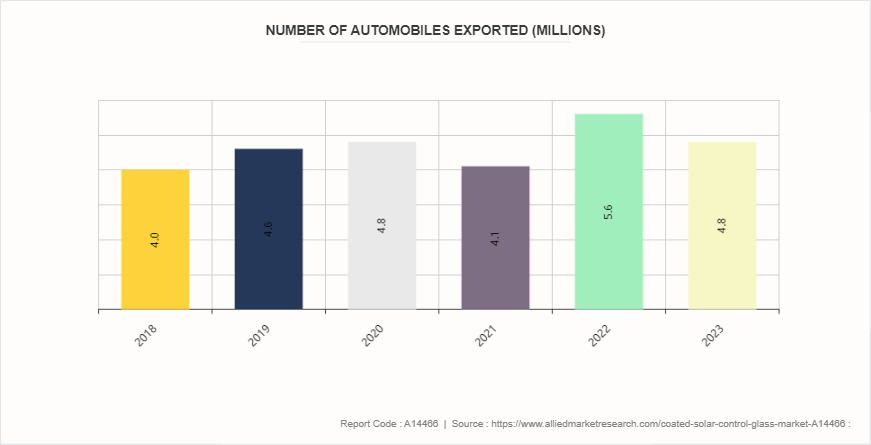

Moreover, the use of coated solar control glass in the automotive industry is expected to provide lucrative opportunities in the market. The automotive sector is increasingly adopting coated solar control glass, recognizing its significant advantages in enhancing passenger comfort and reducing the air conditioning load in vehicles. This shift is driven by multiple factors, including rising consumer demand for comfort and efficiency, stringent regulatory requirements, and technological advancements. One of the primary drivers for the increased use of coated solar control glass in automobiles is the growing consumer demand for enhanced comfort. In regions with high temperatures, the interior of a parked vehicle can quickly become unbearably hot. Coated solar control glass can significantly mitigate this issue by blocking a substantial portion of solar radiation from entering the vehicle. This reduction in heat ingress not only makes the interior more comfortable for passengers but also helps in maintaining a cooler cabin temperature when the vehicle is parked under the sun. This is particularly beneficial in luxury and premium vehicles, where customer expectations for comfort and convenience are higher. According to the China Association of Automobile Manufacturers (CAAM) , vehicle production in China reached 30.16 million units in 2023, witnessing a growth of 11.6% compared to the previous year. According to the International Organization of Motor Vehicle Manufacturers (OICA) , vehicle production in China reached a total of 27.02 million units in 2022, which is an increase of 3% over 2021 for the same period.

Competitive Analysis

Key market players in the coated solar control glass market include Saint-Gobain Glass India, Guardian Industries Holdings, AGC Glass Europe, Nippon Sheet Glass Co., Ltd, Vitro, ?i?ecam, Xinyi Glass Holdings Limited, CARDINAL GLASS INDUSTRIES, INC, Euroglas GmbH, and Jinjing (Group) Co., Ltd.

Regional Market Outlook

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, the adoption of coated solar control glass has been steadily increasing due to rising energy costs and a strong focus on sustainability. The U.S. and Canada are the primary markets driving this growth. In the commercial sector, buildings are increasingly being designed with energy efficiency in mind, leading to a higher demand for advanced glazing solutions.

Europe is a significant market for coated solar control glass, driven by the region's strong environmental regulations and commitment to reducing carbon emissions. Countries such as Germany, France, and the UK are leading the adoption of energy-efficient building materials. The European Union's directives on energy performance in buildings have been a major catalyst for the increased use of solar control glass. The Asia-Pacific region is experiencing rapid growth in the coated solar control glass market, primarily driven by the booming construction industry in countries like China, India, Japan, and South Korea. Urbanization and industrialization are key factors contributing to the demand for energy-efficient building materials. In China and India, government initiatives to promote green buildings and energy-saving technologies are boosting the adoption of solar control glass.

Industry Trends

- In August 2022, NSG Group announced an expansion plan for TCO (transparent conductive oxide) coated glass production in Malaysia. This plan includes installing a new float line at the Johor Bahru facility of Malaysian Sheet Glass SDN BHD, part of the NSG Group. The expansion will add online coating capacity and aims to begin producing TCO glass for solar panel manufacturers by the end of 2024.

- According to the Statistical Review of World Energy report, Europe accounts for 22.5% of the world's installed solar power capacity in 2022, which accounted for 236.96 gigawatts, an increase of 19.8% compared to last year, with Germany, Itlay, and Spain being the leading producers.

- In June 2023, AGC introduced Stopray Ultraselect 60/27, an advanced solar control glass. This product features a triple silver coating that offers exceptional selectivity (S = 2.22) and a solar factor of 27%, helping to prevent room overheating and reduce air conditioning usage. It allows 60% light transmission for bright, well-lit interiors and has low light reflection rates (11% external, 15% internal) for clear and neutral views.

Key Regulations of Coated Solar Control Glass Market

Building Regulations

Energy Efficiency Requirements: Many regions have adopted building codes that mandate energy-efficient materials, including solar control glass. These regulations often specify minimum performance metrics such as the Solar Heat Gain Coefficient (SHGC) and U-value, which measure a window's ability to reduce heat gain and loss, respectively. Low-E (low emissivity) glass is frequently cited as a minimum requirement in these regulations, as it enhances thermal performance by reflecting heat while allowing light to pass through.

Sustainability Goals: As part of broader sustainability initiatives, regulations may encourage or require the use of materials that contribute to reduced energy consumption and greenhouse gas emissions. Solar control glass helps achieve these goals by minimizing the reliance on air conditioning and heating systems, thus lowering overall energy use in buildings.

Health and Safety Regulations

UV Protection: Solar control glass is also regulated in terms of its ability to block harmful ultraviolet (UV) rays. This is particularly important for protecting occupants' health and preserving interior furnishings from UV damage. Regulations may require that glazing products provide a certain level of UV protection to enhance indoor environmental quality.

Fire Safety Compliance: In some jurisdictions, solar control glass must meet fire safety standards, particularly in high-rise buildings or those with large glass facades. Compliance with these standards is vital to ensure the safety of occupants and the structural integrity of buildings.

Key Sources Referred

- Department of Energy

- Nippon Sheet Glass Co., Ltd.

- Directorate General of Trade Remedies

- Solar Control Window Film Retrofit

- FunGlass – Centre for Functional and Surface Functionalized Glass

- U.S. Government Publishing Office

- Lawrence Berkeley National Laboratory

- National Institute of Standards and Technology

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coated solar control glass market analysis from 2024 to 2033 to identify the prevailing coated solar control glass market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coated solar control glass market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coated solar control glass market trends, key players, market segments, application areas, and market growth strategies.

Coated Solar Control Glass Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.1 Billion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2024 - 2032 |

| Report Pages | 300 |

| By Type |

|

| By Coating Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | Guardian Industries Holdings, AGC Glass Europe, Euroglas GmbH, Saint-Gobain, Xinyi Glass Holdings Limited, Sisecam, Nippon Sheet Glass Co., Ltd, Vitro, Jinjing (Group) Co., Ltd., CARDINAL GLASS INDUSTRIES, INC |

Key market players in the coated solar control glass market include Saint-Gobain Glass India, Guardian Industries Holdings, AGC Glass Europe, Nippon Sheet Glass Co., Ltd, Vitro, ?i?ecam, Xinyi Glass Holdings Limited, CARDINAL GLASS INDUSTRIES, INC, Euroglas GmbH, and Jinjing (Group) Co., Ltd.

The global coated solar control glass market was valued at $5.3 billion in 2023, and is projected to reach $13.1 billion by 2032, growing at a CAGR of 10.5% from 2024 to 2032.

Asia-Pacific is the largest regional market for coated solar control glass.

Sputtered is the leading application of coated solar control glass market.

The use of coated solar control glass in the automotive industry are the upcoming trends of coated solar control glass market.

Loading Table Of Content...