Coated Steel Market Research, 2033

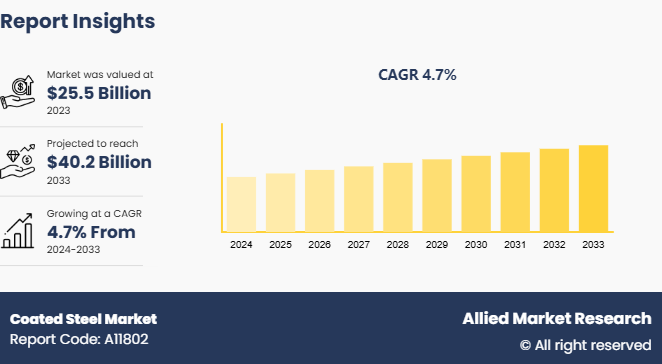

The global coated steel market was valued at $25.5 billion in 2023, and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033.

Market Introduction and Definition

Coated steel refers to steel products that have been covered with a layer of protective material to enhance their properties and extend their lifespan. This protective layer can be made from a variety of substances, including zinc, aluminum, and polymer coatings. The coating serves to prevent corrosion, improve aesthetic appeal, and provide additional mechanical properties such as enhanced durability and resistance to environmental factors.

Coated steel plays a crucial role in the construction industry. Its corrosion-resistant properties make it ideal for structural components, roofing, and cladding materials. Galvanized steel, in particular, is widely used for outdoor structures such as bridges, balconies, and staircases, where exposure to the elements can lead to rapid degradation of uncoated steel. Aluminized steel's heat-resistant properties make it suitable for applications such as chimneys, furnaces, and ductwork.

In architecture, coated steel is used for aesthetic purposes as well. Pre-painted steel, often coated with a polymer, is used in the creation of attractive building facades and interior design elements. The variety of colors and finishes available allows architects to design visually appealing and durable structures. The automotive industry relies heavily on coated steel for its production processes. Zinc-coated steel is used extensively in car bodies to provide corrosion resistance, enhancing the durability and longevity of vehicles. This is particularly important in regions with harsh weather conditions and the use of road salts, which can accelerate the corrosion process

Key Takeaways

- The coated steel industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global coated steel market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the coated steel market size.

- The coated steel market share is highly fragmented, with several players including ArcelorMittal, Nippon Steel Coated Sheet Corporation, POSCO Coated Steel (Thailand) Co., Ltd, JFE Steel Corporation, Tata Steel Europe Limited, thyssenkrupp Steel Europe, Nucor, Gerdau S/A, JSW, and United States Steel Corporation. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the coated steel market growth.

Market Segmentation

The coated steel market is segmented into product type, coating type, application, and region. On the basis of product type, the market is divided into metallic coated steel, and organic coated steel. On the basis of coating type, the market is classified into hot-dip galvanizing, electro-galvanizing, galvalume coating, and others. On the basis of application, the market is categorized into building & construction, automotive, appliances, and electrical & electronics. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Rapid urbanization and infrastructure development is expected to drive the growth of coated steel market during the forecast period. In the construction industry, coated steel is highly valued for its superior corrosion resistance, aesthetic appeal, and structural integrity. Urbanization necessitates the development of robust infrastructure that can withstand environmental challenges such as humidity, pollution, and extreme weather conditions. Coated steel provides a reliable solution, ensuring the longevity and safety of buildings and infrastructure projects. Its versatility allows for its use in various applications, from roofing and cladding to structural frameworks and reinforcement. The automotive industry also benefits significantly from the infrastructural boom. As emerging economies grow, there is a corresponding increase in the demand for automobiles. Coated steel is integral to automotive manufacturing, offering lightweight yet strong materials that enhance vehicle performance and fuel efficiency. The protective coatings on steel components prevent rust and corrosion, extending the lifespan of vehicles and reducing maintenance costs. This makes coated steel an indispensable material in the production of cars, trucks, and other vehicles in rapidly urbanizing regions.

Moreover, the appliance industry experiences heightened demand for coated steel due to infrastructure development. Urbanization leads to a rise in residential complexes and commercial establishments, which, in turn, drives the need for various appliances such as refrigerators, washing machines, and HVAC systems. Coated steel is utilized in these appliances for its durability, aesthetic finishes, and resistance to wear and tear. As more households and businesses emerge in urban areas, the consumption of appliances made from coated steel correspondingly increases. According to Invest India in July 2024, the Indian construction industry encompasses real estate and urban development, including residential, office, retail, hotel, and leisure park sectors. With the UN projecting India's population to reach 1.64 billion by 2047 and over half expected to live in urban areas, the industry is poised for growth. Foreign direct investment is fully permitted under the automatic route for completed projects related to townships, malls, and business constructions. The sector is anticipated to hit $1.4 trillion by 2025, with cities projected to contribute 70% of India's GDP by 2030.

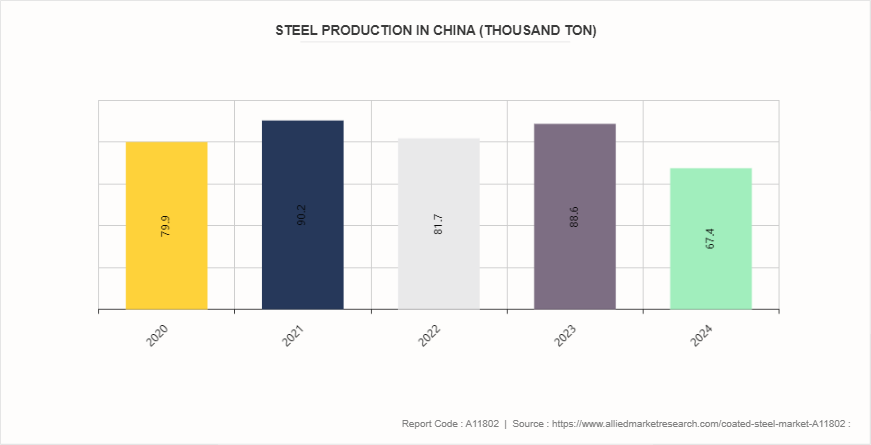

However, volatility in the prices of raw materials, such as steel and coating chemicals is expected to restraint the growth of coated steel market during the forecast period. Fluctuating raw material prices are a significant concern in the coated steel market, as volatility in the costs of steel and coating chemicals can profoundly impact production costs and profitability. The prices of these raw materials can be influenced by various factors, including global supply and demand dynamics, geopolitical events, and economic conditions. Steel, a primary raw material in coated steel production, is subject to price fluctuations driven by changes in the global steel market. Factors such as shifts in production capacities, trade policies, and tariffs can cause steel prices to rise or fall unexpectedly. When steel prices increase, the cost of raw materials for coated steel manufacturers also rises, leading to higher production costs. This can squeeze profit margins, especially if manufacturers are unable to pass these costs on to customers through higher prices. In June 2024, China's steel production dropped to 91.6 million tons, down from 92.9 million tons in May. Over the period from 1990 to 2024, the country's average monthly steel output was 40.8 million tons, with a record high of 99.5 million tons in May 2021 and a low of 4.9 million tons in February 1990.

Moreover, the development of eco-friendly and sustainable coating technologies is expected to offer lucrative opportunities in the market. Green coating technologies offer a compelling value proposition to customers who prioritize sustainability. Coated steel products that use environmentally friendly coatings can attract consumers and businesses looking to reduce their ecological footprint. These coatings, which may include water-based, low-VOC (volatile organic compounds) , or bio-based formulations, contribute to reduced emissions and lower environmental impact during production and use. By highlighting these sustainable attributes, manufacturers can differentiate their products in the market and appeal to a broader, eco-conscious customer base. As environmental regulations become increasingly stringent, particularly in regions with strong environmental policies, green coating technologies help manufacturers comply with these standards. Regulations such as the European Union’s REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) or the U.S. EPA’s rules on hazardous air pollutants drive the demand for coatings that are free from harmful chemicals and have minimal environmental impact. Utilizing green coating technologies ensures that coated steel products meet these regulatory requirements, reducing the risk of compliance issues and potential penalties.

Regional Market Outlook

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, coated steel is widely used across several industries, particularly in automotive, construction, and appliance sectors. In the United States and Canada, the automotive industry utilizes coated steel for car body panels and components to enhance durability and corrosion resistance. The construction sector employs coated steel in roofing, siding, and structural components due to its aesthetic appeal and long-lasting performance.

Europe has a significant market for coated steel, driven by its extensive use in automotive, construction, and consumer goods industries. In Western Europe, countries such as Germany, France, and Italy use coated steel for automotive parts, architectural panels, and building materials, leveraging its superior corrosion resistance and visual appeal. In Eastern Europe, the demand is growing due to increasing industrialization and infrastructure projects. European regulations and standards emphasize the use of coated steel to meet environmental and durability requirements, which further boosts market growth.

In the Asia-Pacific region, coated steel is used extensively in countries like China, Japan, South Korea, and India. China, being a major manufacturing hub, utilizes coated steel in various sectors including construction, automotive, and appliances. Japan and South Korea have high standards for coated steel in automotive and electronics industries, focusing on high-quality and innovative coatings.

Competitive Analysis

Key market players in the coated steel market include ArcelorMittal, Nippon Steel Coated Sheet Corporation, POSCO Coated Steel (Thailand) Co., Ltd, JFE Steel Corporation, Tata Steel Europe Limited, thyssenkrupp Steel Europe, Nucor, Gerdau S/A, JSW, and United States Steel Corporation.

Industry Trends

- In May 2024, JSW Steel is launching a new Zinc-Magnesium-Aluminium alloy coated steel product called JSW Magsure, aiming to capture 50% of the domestic market share by FY25. As of July, the company has an order book of 35, 000-40, 000 metric tonnes, having already fulfilled nearly 15, 000 metric tonnes. This includes 5, 000 metric tonnes supplied to Adani Green Energy, with an additional 5, 000 metric tonnes to be supplied to Adani's green energy arm. JSW Steel is also in talks with Reliance, NTPC, Whirlpool, LG, Samsung, and Haier. Currently, JSW Steel holds a 71% market share in the solar sector with its existing steel products.

- In January 2022, NLMK Group introduced a new steel product with an antibacterial coating. This innovative coating protects the metal's surface from harmful microorganisms, making it ideal for use in medical facilities and other environments with stringent cleanliness and safety standards.

- In April 2022, China Baowu Steel Group announced its acquisition of a 51% stake in Xinyu Iron & Steel Co. (XISCO) , a leading state-owned steel manufacturer in Jiangxi province, China. This strategic acquisition will bolster Baowu's overall steel production capacity. XISCO, the largest steel producer in Jiangxi Province, had a total output of approximately 9.89 million tons in 2020.

Historic Trends of Coated Steel Market

- In the 1930s, the concept of zinc coating, known as galvanizing, indeed became more widely adopted. Galvanizing involves applying a layer of zinc to steel or iron to protect it from corrosion. Zinc acts as a sacrificial anode, meaning it corrodes in place of the underlying steel, thus extending the life of the metal.

- In the 1950s, the steel industry saw significant advancements in coating technologies, particularly with the development and refinement of electrogalvanizing. The electrogalvanizing process allows for the application of a more consistent and thinner zinc layer compared to traditional hot-dip galvanizing. This thinner coating is often preferred for applications where a smoother surface is important, such as in automotive parts and appliances.

- In the 1980s saw the introduction of Galvalume, a significant advancement in coated steel technology. Galvalume is a coating made from a combination of aluminum (55%) , zinc (43.4%) , and silicon (1.6%) . This blend provides a unique set of properties that enhance the performance of coated steel.

- In the 1990s, the introduction of high-performance coatings marked a significant advancement in coated steel technology. These coatings became popular due to their excellent durability, color retention, and resistance to UV radiation. They are used in various applications, from roofing panels to home appliances.

- In the 2000s, the coated steel industry saw several significant developments, particularly in terms of environmental impact and technological advancements. Powder coating technology, which involves applying a dry powder to metal surfaces and then curing it with heat, gained traction during this period. Powder coatings are known for their durability, resistance to corrosion, and ability to produce a variety of finishes.

Key Sources Referred

- Department of Energy

- Directorate General of Trade Remedies

- California Department of Transportation

- Ministry of Steel

- Federal Highway Administration

- United States International Trade Commission

- U.S. Government Publishing Office

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coated steel market analysis from 2024 to 2033 to identify the prevailing coated steel market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coated steel market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coated steel market trends, key players, market segments, application areas, and market growth strategies.

Coated Steel Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 40.2 Billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Product Type |

|

| By Coating Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Gerdau S/A, thyssenkrupp Steel Europe, Nippon Steel Coated Sheet Corporation, POSCO Coated Steel(Thailand) Co.,Ltd, ArcelorMittal, Tata Steel Europe Limited, JFE Steel Corporation, JSW, Nucor, United States Steel Corporation |

Key market players in the coated steel market include ArcelorMittal, Nippon Steel Coated Sheet Corporation, POSCO Coated Steel(Thailand) Co.,Ltd, JFE Steel Corporation, Tata Steel Europe Limited, thyssenkrupp Steel Europe, Nucor, Gerdau S/A , JSW, and United States Steel Corporation.

The global coated steel market was valued at $25.5 billion in 2023, and is projected to reach $40.2 billion by 2033, growing at a CAGR of 4.7% from 2024 to 2033.

Asia-Pacific is the largest regional market for coated steel.

Building & construction is the leading application of coated steel market.

The development of eco-friendly and sustainable coating technologies are the upcoming trends of coated steel market.

Loading Table Of Content...