Coating Pretreatment Market Research, 2033

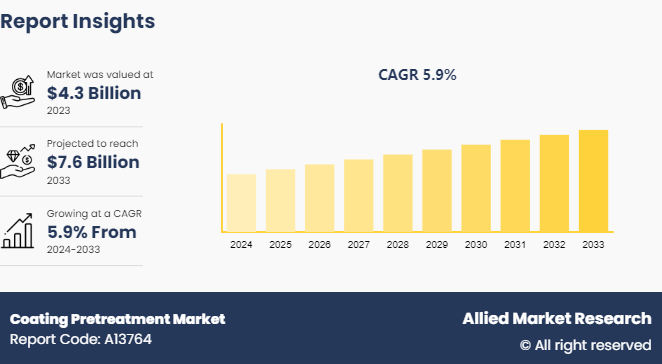

The global coating pretreatment market was valued at $4.3 billion in 2023, and is projected to reach $7.6 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

Market Introduction and Definition

Coating pretreatment is a crucial process in surface engineering, involving the preparation of a substrate before applying a protective or decorative coating. This preparation process enhances adhesion, improves corrosion resistance, and prolongs the durability of the final coating. Coating pretreatment involves several techniques, each tailored to the specific requirements of the substrate and the intended application. The process typically includes cleaning, surface modification, and the application of conversion coatings.

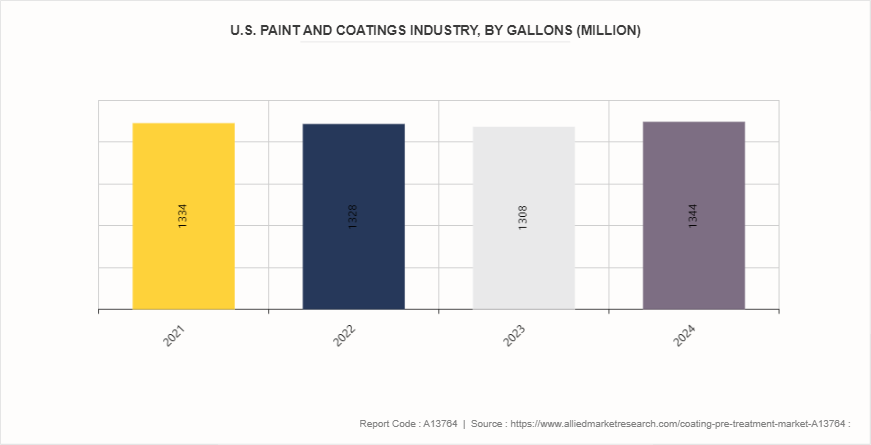

The primary application of coating pretreatment is in the paint and coatings industry. Pre-treated surfaces offer superior adhesion, ensuring that the applied coatings remain intact and effective for extended periods. This is particularly important in industries where aesthetic appeal and durability are critical, such as automotive, aerospace, and consumer electronics. Coating pretreatment plays a significant role in anti-corrosion treatments for various metal substrates. By creating a chemically stable surface, pretreatment processes such as phosphating and chromating enhance the corrosion resistance of metals. This is crucial in industries like construction and marine, where exposure to moisture and corrosive environments is common.

Surface modification techniques are employed to alter the surface properties of the substrate, improving its adhesion characteristics. These techniques include mechanical abrasion, chemical etching, and plasma treatment. Mechanical abrasion, such as sandblasting or grinding, creates a roughened surface that enhances mechanical interlocking with the coating. Chemical etching uses acids or alkalis to create a micro-roughened surface and improve chemical bonding. In the automotive industry, coating pretreatment is essential for ensuring the longevity and aesthetics of vehicle components. Car bodies, chassis, and other metal parts undergo rigorous pretreatment processes to prevent corrosion and improve paint adhesion. Phosphating is commonly used in this sector, providing a robust base for subsequent paint layers. This process is particularly important for underbody components exposed to harsh environmental conditions, such as road salt and moisture.

Key Takeaways

- The coating pretreatment industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global coating pretreatment market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3, 700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the coating pretreatment market size.

- The coating pretreatment market share is highly fragmented, with several players including Henkel AG & Co. KGaA, PPG Industries, Inc, AkzoNobel N.V., Nippon Paint Holdings Co., Ltd., BASF SE, Axalta Coating Systems, LLC, The Sherwin-Williams Company, DuPont, Becker Holding GmbH, and KCC CORPORATION. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the coating pretreatment market growth.

Market Segmentation

The coating pretreatment market is segmented into type, application, and region. On the basis of type, the market is divided into phosphate coating, chromate coating, blast clean, and others. On the basis of application, the market is classified into automotive, aerospace, building & construction, appliances, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

Innovations in coating formulations and application techniques is expected to drive the growth of coating pretreatment market during the forecast period. Advancements in coating technologies have significantly impacted the need for effective pretreatment processes. Innovations in coating formulations are one of the primary drivers of this trend. Modern coatings are designed to provide superior performance characteristics such as enhanced corrosion resistance, improved adhesion, and longer durability. These advanced formulations often require surfaces to be meticulously prepared to ensure that the coatings can bond effectively and perform as intended. For instance, the development of high-performance, eco-friendly coatings necessitates pretreatment processes that can clean and prepare surfaces without leaving residues that could interfere with coating adhesion. Application techniques have also seen substantial improvements, contributing to the heightened importance of pretreatment. Methods such as electrostatic spray deposition, thermal spraying, and advanced dip-coating techniques require surfaces to be uniformly clean and free of contaminants. These techniques are highly sensitive to the condition of the substrate; any impurities or inconsistencies can lead to defects in the final coating, reducing its effectiveness and lifespan. As a result, pretreatment processes have evolved to include more sophisticated cleaning, etching, and conditioning steps that are tailored to the specific needs of these advanced application methods. In August 2022, PPG announced an investment of $11 million to double the production capacity of powder coatings at its San Juan del Rio plant in Mexico. The expansion project is scheduled for completion by mid-2023, positioning the plant to meet the anticipated future demand for powder coatings in Mexico.

However, the high cost of advanced pretreatment processes and materials is expected to restrain the growth of coating pretreatment market. High costs associated with advanced pretreatment processes and materials can significantly impact the overall expenses of coating operations. These expenses stem from several factors. Advanced pretreatment technologies often involve the use of specialized chemicals and equipment, which come at a premium. The initial investment in these technologies can be substantial, especially for small to medium-sized enterprises that may struggle with the financial outlay required for new systems. The high costs of pretreatment materials themselves can also be a significant factor. High-quality pretreatment chemicals that provide superior performance and compliance with environmental regulations often come at a higher price. This cost is usually passed on to the end users, making the overall coating process more expensive. As a result, companies may face challenges in balancing cost-efficiency with the need for high-performance pretreatment solutions.

Moreover, advancements in nanotechnology and surface engineering is expected to offer lucrative opportunities in the market. Technological innovations, particularly in nanotechnology and surface engineering, are significantly advancing the field of coating pretreatment. Nanotechnology, which involves manipulating materials at the atomic or molecular level, has led to the development of nanocoatings and nanomaterials that offer enhanced properties for surface preparation. These advancements enable the creation of ultra-thin, highly durable coatings that improve adhesion, resistance to corrosion, and overall performance. Nanotechnology also allows for more precise control over surface roughness and chemical reactivity, which can enhance the effectiveness of the pretreatment process and lead to superior coating outcomes. In February 2024, nanotechnology emerged as a key player in the coatings industry, driving innovations and enhancing the effectiveness of coatings. Globally, about 52% of coatings are applied to new construction and for the maintenance of existing structures, while approximately 35% are used to decorate and protect industrial products. The coatings market in the U.S., Western Europe, and Asia Pacific is well-established and tends to mirror economic trends, particularly in sectors such as housing, building, and transportation.

Competitive Analysis

Key market players in the coating pretreatment market include Henkel AG & Co. KGaA, PPG Industries, Inc, AkzoNobel N.V., Nippon Paint Holdings Co., Ltd., BASF SE, Axalta Coating Systems, LLC, The Sherwin-Williams Company, DuPont, Becker Holding GmbH, and KCC CORPORATION.

Regional Market Outlook

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, coating pretreatment is extensively used across various industries including automotive, aerospace, and construction. The primary focus is on enhancing the adhesion and durability of coatings on metal substrates, which is crucial for industries subject to harsh environmental conditions. The automotive industry, in particular, relies heavily on pretreatment processes like phosphate and chromate coatings to ensure the longevity of vehicle components.

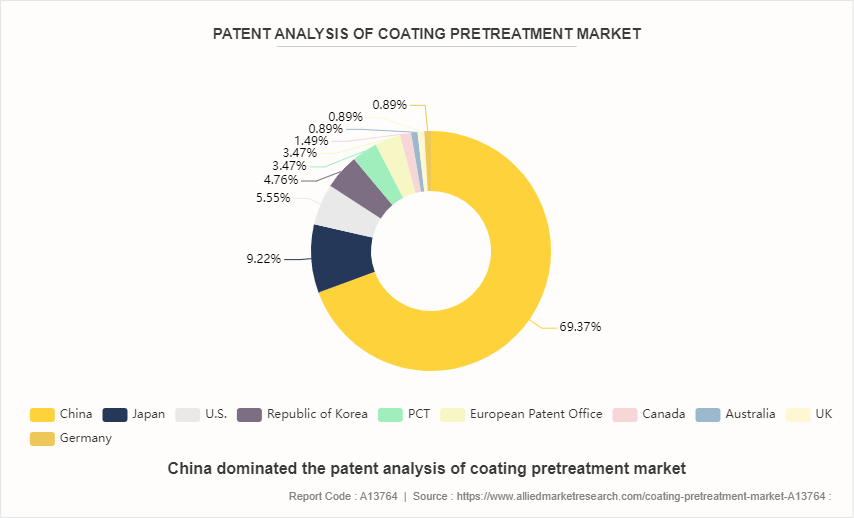

Asia-Pacific, being a diverse and rapidly industrializing region, shows significant variation in coating pretreatment practices. In countries like China and India, pretreatment is critical in supporting the fast-growing automotive and construction sectors. Traditional methods, such as iron phosphating and chromating, are still widely used. However, there is an increasing adoption of advanced pretreatment technologies driven by rising environmental concerns and regulatory pressures. Countries such as Japan and South Korea are leading in the development and application of sophisticated pretreatment solutions, including eco-friendly alternatives and automated systems, to meet both industry demands and environmental regulations.

Industry Trends

- In June 2024, Henkel introduced innovative technology for metal pretreatment aimed at the metal industry. This new solution significantly streamlines the pretreatment process, reducing the number of steps by half, while conserving water and energy. Henkel’s technology effectively tackles the challenges of cleaning and coating metal surfaces, which are essential for corrosion protection and enhancing paint adhesion.

- In October 2023, Sherwin-Williams Aerospace Coatings launched Jet Prep Pretreatment, a chrome-free, water-based, translucent sol-gel metal pretreatment solution tailored for the aerospace industry. This two-component kit ensures excellent adhesion and corrosion protection for aluminum substrates and is designed to be used with aerospace-grade corrosion-protective epoxy primers and topcoat paint systems.

- In October 2022, BASF has inaugurated the Chemetall Innovation and Technology Center for surface treatment solutions in China. Spanning 2, 600 square meters, this new facility will concentrate on creating advanced surface treatment solutions and product innovations tailored specifically for various industries and market segments across Asia.

- In February 2022, The Sherwin-Williams Company entered into an agreement with the state of North Carolina, Iredell County, and the city of Statesville to considerably enhance its architectural paint and coatings manufacturing capacity. As part of this initiative, the company will also develop a larger distribution facility in Statesville, North Carolina. Sherwin-Williams is committing at least $300 million to this project.

Key Regulations of Coating Pretreatment Market

The pretreatment process is influenced by several regulations aimed at minimizing environmental impact and ensuring safety:

- REACH Compliance: This European regulation restricts the use of harmful substances in coatings and pretreatment processes. The shift towards chromate-free pretreatments is partly driven by these regulations, promoting safer alternatives that are less harmful to human health and the environment.

- VOC Emission Standards: Many jurisdictions have established limits on volatile organic compounds (VOCs) emitted during the pretreatment process. Water-based pretreatment methods are increasingly favored to meet these standards, reducing environmental pollution.

- Industry Standards: Organizations such as the American Society for Testing and Materials (ASTM) provide guidelines for pretreatment processes to ensure quality and consistency in coating applications

Key Sources Referred

- Department of Energy

- U.S. Environmental Protection Agency

- Powder Coated Tough

- Directorate General of Trade Remedies

- California Department of Transportation

- Gardner Business Media, Inc

- U.S. Government Publishing Office

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coating pretreatment market analysis from 2024 to 2033 to identify the prevailing coating pretreatment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coating pretreatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coating pretreatment market trends, key players, market segments, application areas, and market growth strategies.

Coating Pretreatment Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 7.6 Billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Nippon Paint Holdings Co., Ltd., Becker Holding GmbH, The Sherwin-Williams Company, Henkel AG & Co. KGaA, KCC CORPORATION, PPG Industries, Inc, DuPont, AkzoNobel N.V., BASF SE, Axalta Coating Systems, LLC |

The global coating pretreatment market was valued at $4.3 billion in 2023, and is projected to reach $7.6 billion by 2033, growing at a CAGR of 5.9% from 2024 to 2033.

Key market players in the coating pretreatment market include Henkel AG & Co. KGaA, PPG Industries, Inc, AkzoNobel N.V., Nippon Paint Holdings Co., Ltd., BASF SE, Axalta Coating Systems, LLC, The Sherwin-Williams Company, DuPont, Becker Holding GmbH, and KCC CORPORATION.

Asia-Pacific is the largest regional market for coating pretreatment

Automotive is the leading application of coating pretreatment market.

Advancements in nanotechnology and surface engineering are the upcoming trends of coating pretreatment market.

Loading Table Of Content...