The global coffee pod market was valued at $1.2 billion in 2022, and is projected to reach $2.8 billion by 2032, growing at a CAGR of 8.5% from 2023 to 2032.

Market Dynamics

A coffee pod is a single-serve coffee container that is used to prepare various types of coffee drinks. These pods are made with recyclable paper-based, flat bags, inside which a pre-measured dose of pressed coffee is packed. Unlike coffee capsules, pods contain a higher volume of coffee and can be used with multiple machines that are equipped with portafilter.

The coffee pod market is witnessing tremendous growth due to awareness about sustainability and environmental footprint. These pods are offering the most suitable alternative to existing single-serve containers in the market such as aluminum-based capsules that are becoming more challenging to manage in terms of waste generated. A global trend that is heading towards minimizing the environmental impact is making people opt for products and services that do minimum harm to their surroundings is contributing to growth in coffee pod market. Coffee pods are made with biodegradable packaging which uses compostable paper which makes it easier to dispose of. Pods are also popular due to being compatible with multiple machines that increases coffee pod market demand.

Consistently increasing coffee consumption globally is another key factor that impacts its coffee pod market growth. Increased consumption of coffee also presents new and emerging markets to seize new opportunities. The market also benefits from the high demand for coffee including the growth in sales of coffee machines, which is linked to the adoption of complementary coffee products such as coffee pods. Consumers seek more quality coffee which is supported by the introduction of advanced production methods to reduce time and difficulty and at the same time maintain quality. According to the International Coffee Organization (ICO), coffee consumption increased by 4.2% in the year 2021/22. This surge was caused by the market recovery after the pandemic in many industries, nations, and overall economic growth.

With countries recovering from economic shocks caused by the pandemic, many industries are stabilizing, including travel, hospitality, restaurants, and catering. These industries play an important role in advancing economic value, for the coffee pod industry by increasing customer flow in cafes, bars, and other places. This leads to an increase in the number of consumers who are buying coffee in the away-from-home food and beverage channels. Thus, to address such demand fluctuations, numerous businesses, especially small and medium scale are opting for coffee pods, as these pods offer more economical and efficient alternatives to conventional methods of coffee preparation. Furthermore, changes in working habits among employees, such as hybrid work systems, have increased demand for cafe like coffee in workplaces due to changes in consumption habits, and companies are using this as an incentive through vending and office coffee machines to increase in-office working. Changes in coffee drinking habits have also brought significant development in the in-home coffee consumption segment. Leading companies like Illycaffe and Caffe Motta offer numerous E.S.E (Easy serve espresso) coffee machines, through which the preparation of coffee becomes much easier due to the elimination of the need for coffee grinding and measuring.

With the simplification of coffee preparation by single-serve coffee containers like coffee pods, consumers are demanding a higher variety of flavors and premium quality coffee contributes to growth of coffee pod market size. Consumers are increasingly demanding a diverse variety of flavors and spending more money for higher quality coffee that resembles cafes. Manufacturers are using different types of production methods and are sourcing specific types of coffee beans from different origins to elevate naturally present flavors in coffee which appeals to many consumers. Flavored coffee is particularly popular among younger generations like Gen Z, who not only consume more coffee but also experiment with their tastes and prefer more customization. These consumers also focus on monitoring their caffeine consumption and are more health conscious. People are aware of the side effects of caffeine consumption such as insomnia, restlessness, and elevated blood pressure, and the demand for decaffeinated coffee is increasing.

Caffeine, a natural stimulant, provides various advantages such as improvement in metabolism, alertness, and cognitive function. With changes in lifestyles that are making lives busier and compounded with factors like decreased social interactions, isolation, and other mentally challenging aspects coffee is sought after as a break. In numerous settings like meetings, reading, work, and casual meetups, coffee plays an important role in enhancing their experience. Consumers also struggle with fear and anxiety coffee breaks are often taken to reduce stress. Due to the convenience offered by coffee pods, they are becoming largely popular.

Consumers in developed economies in regions like Europe, and North and South America, demand more innovative products and are likely to be the first to try. These consumers have high disposable incomes and are potentially leading in terms of coffee pod adoption. Countries in these regions have more developed technology, literacy rate, and other developmental indicators due to which people become more aware of new solutions and are in a better position to accommodate new changes in their lifestyles. In addition, coffee machines are a prerequisite in using a coffee pod, and people in richer countries are more likely to afford it, thus posing a greater potential for coffee pod industry, unlike developing economies.

However, the market is significantly impacted by the surrounding challenges in the supply chain, ecological, and environmental aspects. Caffe Borbone, a leading coffee pod manufacturing company, reported a fall in profits of 27% due to increased production costs. Increased costs result in more expensive products, thus impacting profitability and sales. Many companies in the coffee market have reported an impact due to the war between Russia and Ukraine. In addition, soaring inflation in many regions also contributes to elevating prices. According to the report published by the International Coffee Organization (ICO), coffee production in the year 2021/22 decreased by 1.4% to 168.5 million bags. These decreased production volumes were attributed to worsening weather, environmental conditions, and increased cost of fertilizers.

With the increased demand for coffee pods companies are expanding their geographical presence in their international markets. As the potential for coffee pods becomes apparent companies are seeking partnerships, collaborations, and other strategies. Caffe Borbone and Illycaffe are investing to expand their businesses in the U.S. market. However, international markets pose higher competition challenges.

Coffee pods are popular among consumers in developed economies such as Italy, France, Germany, Brazil, and the U.S. However, companies face competition with business expansion in international markets. Illycaffe, an Italian coffee company, that has established itself as a strong coffee pods and other products supplier in the Europe region stated expanding in the international market is challenging and requires an enormous amount of effort to sustain, compared to domestic markets. However, global expansion presents newer opportunities to companies.

Segmental Overview

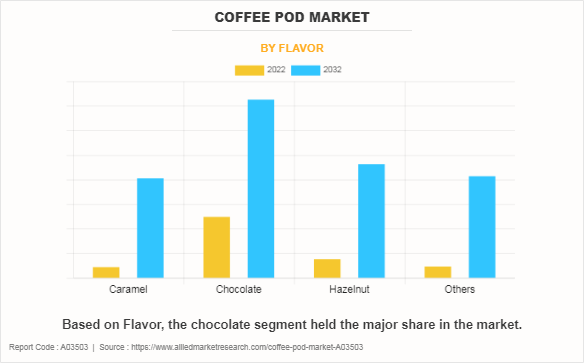

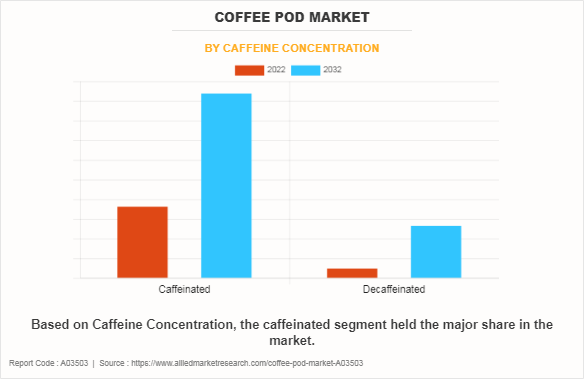

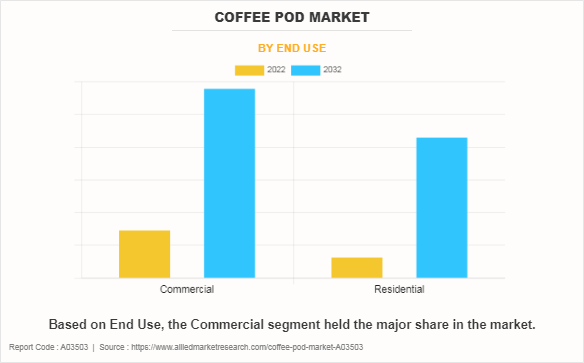

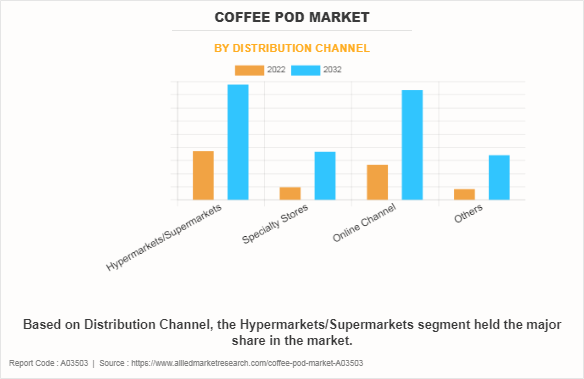

The coffee pods market is analyzed on the basis of flavor, caffeine concentration, end use, distribution channel, and region. By flavor, the market is classified into caramel, chocolate, hazelnut, and others. By caffeine concentration, the market is classified as caffeinated and decaffeinated. By end use the market is classified into commercial and residential. By distribution channel the market is classified into hypermarket/supermarket, specialty stores, online channels, and others. By region, the market is analyzed for North America (U.S., Canada, and Mexico), Europe (the UK, Germany, Spain, France, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, Australia, New Zealand, South Korea, Singapore, and Rest of Asia-Pacific) and LAMEA (Saudi Arabia, Brazil, UAE, Argentina, South Africa, and Rest of LAMEA).

By Flavor

According to flavor, the chocolate segment dominated the market in the year 2022 and is expected to maintain its trend during the forecast period. Chocolate is added to the coffee by naturally enhancing the already present notes in coffee beans or through cocoa extracts and powder. Globally, chocolate is a highly preferred flavor in a variety of foods and beverage items like ice creams, protein shakes and bars, desserts, and many others. This constructs a denser consumer base for coffee pods. Furthermore, with consistent advancement in production methods, manufacturers are now also focusing on increasing the chocolate flavor naturally through different roast levels and the use of coffee beans cultivated in certain regions. These methods allow manufacturers to avoid the use of synthetic and chemical-based approaches to infuse flavor in coffee that appeals to many health-conscious consumers, and thus it is a leading segment during the coffee pod market forecast.

By Caffeine Concentration

According to caffeine concentration, the caffeinated segment dominated the market in the year 2022, however, the decaffeinated segment is expected to grow at the fastest rate during the forecasted period. The growth is accredited to increased awareness about health and problems associated with unmonitored caffeine intake which is often elevated by carbonated and energy drinks. The most prominent health issues include insomnia and restlessness. It can further increase headaches, upset stomach, and faster heart rate. Decaffeinated coffee also allows people with insomnia and blood pressure issues to enjoy the taste of coffee while maintaining their health.

By End Use

According to end use, the commercial segment dominated the market in the year 2022, however, the residential segment is expected to grow at the fastest rate. As people change their lifestyles and adopt more advanced tools and consumption habits, coffee pods gain more demand. A large number of people in developed countries own coffee machines and in numerous developing countries like Brazil, India, and China where number of coffee machines at home is increasing. This leads to an increasing adoption rate as machines are a prerequisite to using a coffee pod.

By Distribution Channel

According to the distribution channel, hypermarket/supermarket dominated the market in the year 2022, however, the online segment is expected to grow at the fastest rate during the forecasted period. Online distribution channels allow brands to reach a wider audience without less cost. Moreover, online channels are largely becoming popular due to advancements in technology and the integration of various tools to enhance customer shopping experience. Many e-commerce sites focus on personalized production recommendations through the utilization of shopping history, search optimization, and video reviews. Social commerce is largely based on the use of social media as a medium for sales, through product reviews from celebrities and influencers.

By Region

According to region, Europe dominated the market in the year 2022. The region has the highest coffee consumption according to a report by ICO. Coffee pods are popular in this region as it has the largest manufacturing base, with industry-leading companies like illycaffe and Lavazza Group which has a strong presence in Europe. Furthermore, high disposable income levels and sustainability awareness in this region have contributed to high market growth for coffee pods.

Competition Analysis

Players operating in the coffee pod market have adopted various developmental strategies to expand their coffee pod market share, increase profitability, and remain competitive in the market. Key players profiled in this report include illycaffe S.p.A., Lavazza Group, Gruppo Izzo S.r.l., Procaffe S.p.A., Labcaffe S.r.l., Kimbo S.p.A., Gruppo Gimoka S.p.A., Blasercafe AG, Caffe Borbone S.r.l., and Segafredo Zanetti S.p.A.

Recent Developments in the Coffee Pod Market

- In 2023, Lavazza Group acquired MaxiCoffee, a France-based coffee retailer and operates 60 stores. With this acquisition Lavazza Group will strengthen its business position in the international market.

- In 2023, Massimo Zanetti Beverage Group parent company of Segafredo Zanetti S.p.A., has partnered with Selecta, an European self-service retailer. Through this partnership, it will expand Segafredo coffee distribution across European market.

- In 2023, Caffe Borbone S.r.l. established new subisdiary in the U.S. to expand its international sales and strengthen its business position in coffee market.

- In 2022, Gruppo Gimoka S.p.A. and Caffe Mauro collaborated to strengthen their market position in the coffee market and to increase their competitiveness. Through this collaboration these brands will expand their consumer reach and bring improvement in production chain.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the coffee pod market analysis from 2022 to 2032 to identify the prevailing coffee pod market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the coffee pod market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global coffee pod market trends, key players, market segments, application areas, and market growth strategies.

Coffee Pod Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.8 billion |

| Growth Rate | CAGR of 8.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 299 |

| By Caffeine Concentration |

|

| By Flavor |

|

| By Distribution Channel |

|

| By End Use |

|

| By Region |

|

| Key Market Players | illycaffe S.p.A., Lavazza Group, Gruppo Gimoka S.p.A., Gruppo Izzo S.r.l., Kimbo S.p.A., Blasercafé AG, Segafredo Zanetti S.p.A., Procaffé S.p.A., Caffe Borbone S.r.l., Labcaffè S.r.l. |

Analyst Review

According to CXOs, consumers are taking a conscious approach towards consumption which is credited to widespread awareness about sustainability and an environmental footprint, thus it is the leading factor for the growth of the coffee pods market. People in developed nations, especially the younger generation, monitor their individual carbon footprint and make consistent efforts to minimize the impact of their consumption and lifestyle on the environment. With the increasing population worldwide and ever-rising popularity compounded with the introduction of various flavors, enhanced naturally present notes in coffee beans, which appeal to the younger generation is fueling the market growth for coffee pods.

Moreover, rising health consciousness and changing consumption habits are factors that also contribute to the rising demand for coffee pods. With more people willing to spend more on quality foods and beverages the demand for café like coffee at home is increasing. Brands are introducing a wider variety of flavored coffee pods, that make the preparation of coffee at home more efficient and quicker by reducing the hassle of grinding and measuring the coffee. Also, the introduction of decaffeinated coffee pods is in high demand due to increasing risks associated with unmonitored caffeine intake, this presents a challenge to people with insomnia and blood pressure problems. Decaffeinated coffee provides a way for people who are suffering from such issues to still enjoy coffee.

Also, the away-from-home channel is also recovering from pandemic shocks and provides coffee pods with growth opportunities. Due to being fast and economical, it is gaining popularity in many businesses including small and medium scale. Many organizations have also added premium coffee options to increase employee flow in the office.

Increased awareness about sustainability and environmental footprint are the upcoming trends of Coffee Pod Market in the World.

Chocolate is the leading flavor of Coffee Pod Market.

Europe is the largest regional market for Coffee Pod.

The global coffee pod market was valued at $1,212.3 million in 2022, and is projected to reach $2,809.1 million by 2032, registering a CAGR of 8.5 % from 2023 to 2032.

The key players profiled in the study include illycaffe S.p.A., Lavazza Group, Gruppo Izzo S.r.l., Procaffé S.p.A., Labcaffè S.r.l., Kimbo S.p.A., Gruppo Gimoka S.p.A., Blasercafé AG, Caffe Borbone S.r.l., and Segafredo Zanetti S.p.A. The key players in the market have been actively engaged in the adoption of various strategies such as partnership, acquisition, collaboration, and expansion to strengthen their market position.

Loading Table Of Content...

Loading Research Methodology...