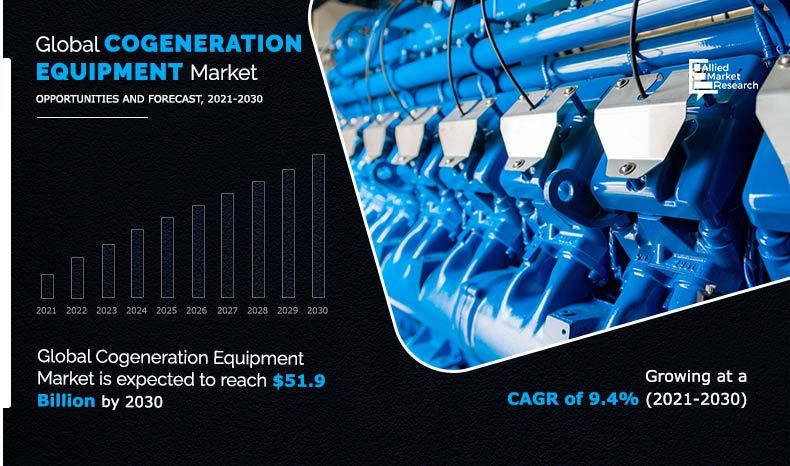

Cogeneration Equipment Market Growth-2030

The global cogeneration equipment market size was valued at $21.2 bn in 2020, and is projected to reach $51.9 bn by 2030, growing at a CAGR of 9.4% from 2020 to 2030. Cogeneration, also known as combined heat and power (CHP), is the utilization of energy in two different forms simultaneously, typically mechanical energy and thermal energy by utilizing fuel energy at optimum efficiency in a cost-effective and environmentally responsible way. The equipment used in the cogeneration system such as motor, pump, compressor, steam turbines, air compressor, combustion chamber, gas turbine and many others, are known as cogeneration equipment. Cogeneration production of energy and usable heat is done in the same plant with the help of steam turbine and gas turbine. In addition, with the use of cogeneration system the efficiency is around 90% since, 40% of energy can be converted into electrical energy, 50% of energy can be converted into heat and only 10% of loss is done with this system. The main equipment used in the cogeneration are steam turbine & engines, gas turbine & engines, blades, air compressor, combustion chamber, rotor, stationary nozzle, rotating and rigged pallets, boiler, generator, condenser, pump and many other.

Cogeneration system helps to mitigate the climate change and rise in environmental concerns led to increase in demand for cogeneration system. In addition, cogeneration often reduces energy use and it is a cost-effective process that also improves security of energy supply, which lead to increase in demand for cogeneration system may act as the major growth factor for the global cogeneration equipment market during the forecast period. Moreover, rising gas infrastructure across the globe also led to increase in demand for cogeneration system and may act as the major growth factor for the market. Furthermore, high investment cost involved in development of cogeneration system and regulatory framework is anticipated to act as a restraining factor for the market.

The global cogeneration equipment market is segmented on the basis of fuel, capacity, technology, application and region. Depending on fuel, the market is categorized into natural gas, biogas, diesel and others.

On the basis of capacity, it is bifurcated into high capacity and medium capacity. On the basis of technology, it is segmented into steam turbine, gas turbine, combined steam/gas turbine-based cogeneration system and reciprocating engine. The applications covered in the study include commercial, industrial and residential. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global cogeneration equipment market analysis covers in-depth information about the major industry participants. The key players operating and profiled in the report include Tecogen, Inc., Siemens, General Electric, Kawasaki heavy industries Ltd., Robert BOSCH Gmbh, Clarke Energy, Mitsubishi heavy industries Ltd., A.B. Holding S.P.A., and 2G Energy AG.

Global cogeneration equipment market, by fuel type

By fuel type, the natural gas segment dominated the global cogeneration equipment market in 2020, and is projected to remain the fastest-growing segment during the forecast period. This is attributed to its environment friendly nature and effective mileage.

By Fuel

Natural gas is projected as the most lucrative segment.

Global cogeneration equipment market, by capacity type

By capacity type, the high-capacity segment accounted for the highest market share of around 43.6% in 2020, and is projected to maintain the same during the forecast period. This is attributed to its extensive use in pulp & paper mills, cement industry and other industries.

By Capacity

high capacity(>50 MW) up-to 500 MW is projected as the most lucrative segment.

Global cogeneration equipment market, by technology

By technology, the steam turbine segment accounted for around 56.9% of the global cogeneration equipment market share in 2020. This is attributed to increase in demand for steam engines in power generation industries across the globe.

By Technology

Combined Steam is projected as the most lucrative segment.

Global cogeneration equipment market, by application

By application, the industrial segment accounted for around 30.56% of the global market share in 2020. This is attributed to increase in demand for power generation in various industries such as power plants, pulp & paper, cement and many other across the globe.

By Application

Commercial is a most lucrative segment over forecats period.

Global cogeneration equipment market, by region

By region, North-America is projected to be the fastest growing market, owing to presence of large population and rise in infrastructure activities. Demand for retro-reflective material is anticipated to boost the industry growth during the forecast period.

By Region

Europe holds a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Key Benefits For Stakeholders

- The report provides an in-depth analysis of the global cogeneration equipment market trends along with the current and future market forecast.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analyses during the forecast period.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the cogeneration equipment industry for strategy building.

- A comprehensive global cogeneration equipment market analysis covers factors that drive and restrain the market growth.

- The qualitative data in this report aims on market dynamics, trends, and developments.

Impact Of Covid-19 On The Cogeneration Equipment Market

- As a result of the global economic slowdown, the production of major industries such as pulp & paper mills, cement, and many others was stopped for a shorter period. The strict regulations of government led to decrease in the sector due to which there is a sluggish decline in the growth of the global cogeneration equipment market.

- The power generation industry accounts for a major share in terms of consumption of cogeneration equipment globally. After the major lockdown across the globe, there is a significant growth in the electric usage, which led to increase the demand of cogeneration equipment across the globe. However, there is a sluggish effect on the cogeneration equipment due to Covid-19.

- The production of fuel was not stopped due to lockdown which led to increase the supply of fuel which in turns directly increase the co-generation and do not affect the market.

- Automobile plants, construction, agrochemicals and many other industries have been affected badly amid the lockdown imposed due to the COVID-19 outbreak and recorded decline in the industry in 2020. This decline in such industries led to decrease in the demand for cogeneration equipment and shows the sluggish decline in the market.

- The construction industry accounts for significant share in terms of use of cogeneration globally. Attributed to the outbreak of COVID-19 pandemic, the construction of various big projects has been halted amid the lockdown. As a result, the demand for cogeneration equipment has declined, which led to the downfall of the global market.

Cogeneration Equipment Market Report Highlights

| Aspects | Details |

| By FUEL |

|

| By CAPACITY |

|

| By TECHNOLOGY |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | A.B. HOLDING S.P.A., General Electric, Tecogen, Inc., Clarke Energy, Siemens, Sundrop Fuels Inc., 2G Energy AG, Mitsubishi heavy industries Ltd, Kawasaki heavy industries Ltd, Robert BOSCH Gmbh |

Analyst Review

According to the CXOs, the cogeneration equipment market has registered a dynamic growth over the past few years, owing to drastic growth in cogeneration system power plants in developing countries such as India, China, Japan, and others. In addition, cogeneration system is an environment-friendly power generation process since, in cogeneration, renewable energy is extensively used such as biomass and natural gas, which is expected to drive the growth of the cogeneration equipment market. Moreover, stringent environmental regulations might enhance the demand of cogeneration system which led to boost the cogeneration equipment market.

The lower carbon emission regulation such as P2 law (by U.S. EPA), Air act 1981 and Environment Act 1986 (by Indian government) is anticipated to reduce the pollution, which led to increase in demand for cogeneration system and could create the wide opportunities for the cogeneration equipment market. According to some CXOs, with increase in gas production activities, the gas-based cogeneration system is expected to witness growth in emerging economies, which in turn boost the demand for cogeneration equipment market. Moreover, factors contributing toward cogeneration equipment market are increasing regulation of electric generation and low energy costs, which represent a small percentage of industrial costs, advances in technology such as packaged boilers, availability of liquid or gaseous fuels at low prices, and tightening environmental restrictions.

Furthermore, cogeneration systems are efficient and can utilize alternative fuels and become more important in the face of price rises and uncertainty of fuel supplies. In addition to decreased fuel consumption, cogeneration results in decrease of pollutant emissions. For these reasons, governments in Europe, the U.S., Southeast Asia and Japan are taking an active role in the increased use of cogeneration. In India, the policy changes resulting from modernized electricity regulatory rules have induced 710 MW of new local power generation projects in the sugar Industry. Other core sector industries are also already moving toward complete self-generation of heat and electricity.

The surge in energy consumption and resulting increase in power generation shifts focus on cogeneration is driving the market.

The key trend for the market is smart energy statergies of global Cogeneration Equipment market

The report sample for global Cogeneration Equipment market report can be obtained on demand from the website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

The market players are adopting various growth strategies and also investing in R&D extensively to develop technically advanced unique products which are expected to drive the market size.

Europe region will provide more business opportunities for Cogeneration Equipment market in coming years

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Steam turbine segment holds the maximum share of the Cogeneration Equipment market

Tecogen, Inc., Siemens, General Electric, Kawasaki heavy industries Ltd., Robert BOSCH Gmbh, Clarke Energy, Mitsubishi heavy industries Ltd., A.B. Holding S.P.A., 2G Energy AG are the top players in Cogeneration Equipment market.

Natural gas and power generation industries are the potential customers of Cogeneration Equipment industry

The global Cogeneration Equipment market was valued at $51.9 bn Billion by 2030

Loading Table Of Content...