Cognitive Electronic Warfare System Market Research, 2033

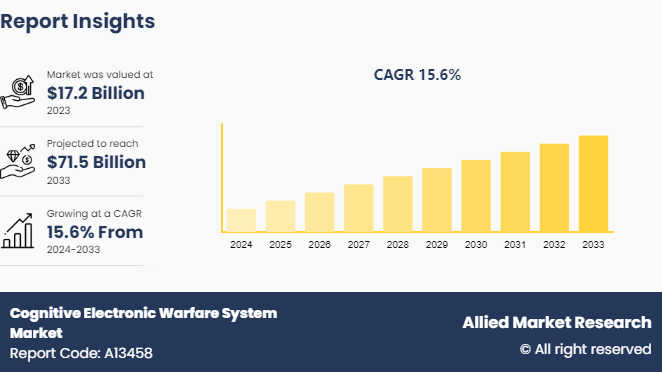

The global cognitive electronic warfare system market size was valued at $17.2 billion in 2023, and is projected to reach $71.5 billion by 2033, growing at a CAGR of 15.6% from 2024 to 2033.

Market Introduction and Definition

Cognitive electronic warfare systems utilize artificial intelligence and machine learning to process large volumes of data, recognize patterns, and make autonomous decisions to counter threats. In contrast to traditional electronic warfare systems, which rely on pre-programmed responses, CEW systems continuously learn from the electromagnetic environment and adversary behaviors to improve their effectiveness over time. Cognitive electronic warfare systems represent the next generation of electronic warfare technologies. These systems are specifically developed to dynamically understand, adjust, and react to the electronic environment in real time, offering notable benefits from a tactical perspective.

Key Takeaways

The cognitive electronic warfare system industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major cognitive electronic warfare system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

On June 6, 2024, L3 Harris Technologies Inc. received a $34 million contract from the U.S. Air Force to modernize its B-52 Stratofortress bomber series. The award is a part of Air Force’s Global Strike Command B-52 Quad Crew Program, the B-52H is currently operated by a five-person crew that includes two pilots, two navigators and an electronic warfare officer. According to the contract, the company will work on developing solutions to consolidate the functions of the electronic warfare officer and navigator into one position.

Key Market Dynamics

The global cognitive electronic warfare system market share is growing due to several factors such as increase in focus on upgrading the military, growth in the defense budget globally, and growth in trend toward adopting miniaturized and portable electronic warfare solutions. However, complexity and complication in maintaining an electronic warfare system and privacy and security concerns restrain the development of the market. In addition, growth in miniaturized and portable electronic warfare solutions and an increase in demand from emerging economies are expected to provide cognitive electronic warfare system market opportunity during the forecast period.

Cognitive electronic warfare systems protect and secure the defense infrastructures of a country. These systems use electromagnetic radiation to securely transmit data. Cyber-attacks pose a threat to electronic warfare systems by interfering with or blocking access to electromagnetic spectrum such as denial-of-service attacks; cybercriminals exploit potential vulnerabilities of electronic warfare systems and attack critical national infrastructures such as communications, intelligence, power, and surveillance systems. For instance, in 2022, Russian hackers hacked into the Ukrainian power network causing power outages, and then used malware to obstruct repair activities. Thus, cyber-attacks pose a significant threat to cognitive electronic warfare as these attacks can be operated remotely from distant locations.?

The increased involvement of cognitive electronic warfare in strategic and tactical roles played by modern warfare such as electronic support, electronic protection, and electronic attack propels the demand for affordable and effective warfare systems. The complexity and performance requirements associated with electronic warfare systems raise the deployment cost of electronic warfare. For instance, in April 2020, the U.S. estimated the cost for upgrading of cognitive AI and machine learning algorithms to advance capabilities of F-15 airborne electronic warfare (EW) systems of Japan was $745 million which increased to $2.2 billion. The massive increase in the cost of upgradation has ceased operations of the F-15 upgrade program. Upgradation and modernization of electronic warfare techniques require huge investments, which hampers the implementation by developing economies.

Parent Market Analysis

There is growth in military spending as a part of growing national security and developing defense strategies globally. The primary reason for the rise in military spending is growth in security threats, geopolitical rivalries, and territorial disputes in various regions across the globe. For instance, the ongoing territorial dispute in the South China Sea, Europe, the Korean Peninsula, the Middle East, and Africa region, as well as the growing territorial disputes, resulted in increased military spending by governments in the region.

Likewise, many countries are participating in military alliances and strategic partnerships as part of broader security arrangements aimed at collective defense and mutual security, such as NATO, CEDC, BRICS, and others. These types of agreements propel a country to spend more on military expenditure and obligations to spend a certain amount of joint military alliances.

The graphs below depict the military expenditure around the world in 2022.

Market Segmentation

The cognitive electronic warfare system market size is segmented into capability, platform, and region. By capability, the global market is segregated into electronic attack, electronic protection¸ electronic support and electronic intelligence. On the basis of platform, the market is segregated into naval, airborne, land, and space. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

Rise in military investments have increased the demand for cognitive electronic warfare systems globally. The growing military expenditure is a result of political instability and collaborative measures such as NATO members boosting defense spending to meet the alliance’s target of 2% of GDP.

North America

In 2023, the U.S. military spent approximately $820.3 billion, or roughly 13.3% of the entire federal budget for the year. In March 2023, the Department of Defense (DoD) ?requested $842.0 billion?for 2024, a 2.6% increase compared to 2023. The growing investment in defense by the U.S. is majorly due to the significant global presence of the U.S. military; the country supports various international alliances such as NATO and the United Nations. Furthermore, with the growing military tensions between Russia, China and in the Middle East region, the country has further increased its military spending.

Europe

The European region countries have significantly increased their military expenditure after the Russia-Ukraine war. Majorly the Western and Central European countries are increasing their military budgets. For instance, in 2023, the UK was the largest military spender in Europe, making up 2.3% of its gross domestic product (GDP) . Similarly, in 2022, the German government established an extra-budgetary fund to meet the NATO target of 2% of its GDP being spent on defense annually. Likewise, Poland also made Europe's largest proportional increase in its defense spending between 2022 and 2023, spending 3.8% of its GDP on defense in 2023.

Asia-Pacific

In the Asia-Pacific region, the growing geopolitical tension, especially in the South China Sea, has resulted in increased investment in militaries. For instance, China spends more on its military than any other country besides the U.S. and has been increasing its defense budget by around 10% every year. Similarly, East Asia region is increasing its military spending by around 6.2% Y-O-Y, Japan being the biggest investor since 1972.

Middle East

The Middle East region is witnessing the highest increase in investment in its military spending, owing to growth in geopolitical tension and the modernization of military programs. Likewise, the ongoing conflict in Syria, Yemen, Iraq, and Israel has resulted in growing military spending. For instance, in 2023, Israel's military spending increased by over 24%; the Gaza war forced major Middle East countries to significantly increase their military budgets.

Competitive Landscape

The major players operating in the cognitive electronic warfare system market include Leonardo S.p.A., L3 Harris Technologies Inc., Northrop Grumman Corporation, Israel Aerospace Industries, BAE System, Raytheon Technologies Corporation, General Dynamics Corporation, Cobham Advanced Electronics Solutions, Elbit Systems, and SAAB AB.

Other players in the cognitive electronic warfare system market include Lockheed Martin Corporation, Textron Inc, Thales Group, Ultra Electronic Group, Teledyne Technologies, Bharat Dynamics Limited, GBL System Corporation, Indra Sistemas S.A, Honeywell International Inc., RTX Corporation, The Boeing Company, and so on.

Industry Trends

Miniaturization of the System

Miniaturization and portability are key trends in the development of modern cognitive electronic warfare systems; the demand for miniaturization and portability is driven by the need for more versatile, efficient, and deployable solutions in military operations. Miniaturized systems are easy to integrate into a wide range of platforms, including unmanned aerial vehicles, ground vehicles, naval vessels, and even individual soldiers' gear. Traditional electronic warfare systems used phased-array antennas, which increased the overall weight and volume of the system. Modern component manufacturers are focusing on the utilization of GaN solid-state power amplifiers, which offer higher power density and bandwidth capacity, thus helping in reducing the size of the warfare system.

Unmanned platform developments

The growing technological advances in unmanned platforms have significantly shifted the cognitive electronic warfare system, as this system can effectively detect, track, and neutralize drones and other unmanned aerial vehicles. The U.S. and its allies, such as Australia, are focusing on the development of anti-access/area denial cognitive airborne jamming technologies. Moreover, the increased use of unmanned aerial vehicles in the ongoing Russia-Ukraine war, is further pushing the development of cognitive electronic warfare system market growth

Key Sources Referred

Federal Aviation Administration (FAA)

International Air Transport Association (IATA)

European Space Agency (ESA)

American Institute of Aeronautics and Astronautics (AIAA)

Armed Forces Communications and Electronics Association (AFCEA)

Defense Research and Development Organization (DRDO)

European Union Aviation Safety Agency (EASA)

Motor & Equipment Manufacturers Association (MEMA) ?

Society of Automotive Engineers (SAE) ?

Aerospace Component Manufacturers Association (ACMA)

European Association of Aerospace Industries (ASD)

Aerospace Industries Association (AIA)

Japan Aerospace Exploration Agency (JAXA)

National Aerospace Standards (NAS)

German Aerospace Industries Association (BDLI)

Key Benefits For Stakeholders

This report provides a quantitative analysis of the cognitive electronic warfare system market forecast, segments, current trends, estimations, and dynamics of the cognitive electronic warfare system Market analysis from 2022 to 2032 to identify the prevailing cognitive electronic warfare system market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the cognitive electronic warfare system market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global cognitive electronic warfare system market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global cognitive electronic warfare system market trends, key players, market segments, application areas, and market growth strategies.

Cognitive Electronic Warfare System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 71.5 Billion |

| Growth Rate | CAGR of 15.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Capability |

|

| By Platform |

|

| By Region |

|

| Key Market Players | BAE Systems, Israel Aerospace Industries, Cobham Advanced Electronics Solutions, General Dynamics Corporation, Raytheon Technologies Corporation, Elbit Systems, SAAB AB, Leonardo S.p.A., L3 Harris Technologies Inc., Northrop Grumman Corporation |

Development of advanced signal processing techniques is the upcoming trend in the global cognitive electronic warfare system market.

Land based platform is the leading application of the global cognitive electronic warfare system market.

North America is the largest region for global cognitive electronic warfare system market.

The cognitive electronic warfare system market was valued at $17.24 in 2023.

Leonardo S.p.A., L3 Harris Technologies Inc., Northrop Grumman Corporation, Israel Aerospace Industries and BAE System are some of the major companies operating in the market.

Loading Table Of Content...