Cold Flow Improvers Market Research, 2033

The global cold flow improvers market was valued at $814.1 million in 2023, and is projected to reach $1,465.1 million by 2033, growing at a CAGR of 6.1% from 2024 to 2033.

Market Introduction and Definition

Cold flow improvers (CFIs) are chemical additives used in petroleum products, particularly diesel fuels, to enhance their low-temperature properties. These additives work by modifying the crystalline structure of waxes that precipitate as the temperature drops, thereby preventing fuel flow problems in cold conditions. The primary benefit of CFIs is their ability to prevent fuel from solidifying at low temperatures. By modifying the wax crystals in the fuel, CFIs ensure that the fuel remains liquid and can flow freely through fuel lines, filters, and injectors. This is essential for maintaining the proper functioning of engines and machinery, reducing the risk of clogs and ensuring smooth operation.

In the automotive sector, CFIs are crucial for ensuring that diesel engines perform optimally in cold weather. Diesel fuels tend to gel or form wax crystals at low temperatures, which can block fuel lines and filters, leading to engine start-up issues and poor performance. By incorporating CFIs into diesel fuels, manufacturers can lower the cloud point (the temperature at which wax crystals begin to form) and the pour point (the lowest temperature at which the fuel remains pourable) , thereby improving the cold flow characteristics of the fuel. This ensures that vehicles remain operational and reliable even in severe winter conditions.

The aviation industry uses CFIs to maintain the fluidity of jet fuels during cold weather operations. Jet fuels, particularly Jet A and Jet A-1, are susceptible to freezing at high altitudes and low temperatures. CFIs help prevent the formation of ice crystals and ensure that the fuel remains fluid throughout the fuel system, from storage tanks to the engines. This is critical for the safety and efficiency of aircraft operations, especially in regions prone to extreme cold. In the transportation industry, CFIs are essential for maintaining the efficiency and reliability of diesel-powered vehicles, including trucks, buses, and trains. The need for effective cold flow improvers is particularly pronounced in regions with harsh winter climates, where temperatures can drop significantly. CFIs ensure that vehicles can start reliably and operate efficiently even in extreme cold.

Key Takeaways

- The cold flow improvers industry covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of the global cold flow improvers market overview and to assist stakeholders in making educated decisions to achieve their growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the cold flow improvers market size.

- The cold flow improvers market share is highly fragmented, with several players including Evonik Industries, Clariant, Bell Performance, Afton Chemical, Innospec, Dorf Ketal Chemicals LLC, Valvoline Global Operations, Rymax Lubricants, Baker Hughes Company, and Infineum International Limited. Also tracked key strategies such as acquisitions, product launches, mergers, and expansion of the players operating in the cold flow improvers market growth.

Market Segmentation

The cold flow improvers market is segmented into type, application, end-use, and region. On the basis of type, the market is divided into polyalpha olifin, ethylene vinyl acetate, and polyalkyl methacrylate. On the basis of application, the market is classified into diesel fuel, lubricating oil, and heating oil. On the basis of end-use the market is categorized into automotive, aerospace, and industrial. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key Market Dynamics

The rise in demand for efficient fuel is expected to drive the growth of cold flow improvers market during the forecast period. The rising demand for fuel efficiency is a significant driver behind the increasing use of cold flow improvers. As global awareness of energy conservation and environmental impact grows, there is a heightened focus on maximizing fuel efficiency across various sectors. Cold flow improvers play a crucial role in achieving this efficiency by ensuring that fuels remain fluid and functional even at low temperatures. In colder climates, fuel can experience issues such as gelling or waxing, which can severely impact performance and lead to operational disruptions. These problems arise when the fuel solidifies or becomes too thick to flow effectively through engines and fuel systems. Cold flow improvers are specifically designed to address these challenges by modifying the fuel’s physical properties, thereby preventing the formation of wax crystals and maintaining its fluidity.

Additionally, the rise in environmental awareness and regulatory standards has further amplified the need for efficient fuel use. Governments and regulatory bodies around the world are implementing stringent emissions standards to reduce the environmental impact of fuel consumption. Efficient fuel use not only helps to lower greenhouse gas emissions but also improves compliance with these regulations. Cold flow improvers contribute to this effort by optimizing fuel performance and reducing the likelihood of engine malfunctions that can lead to increased emissions.

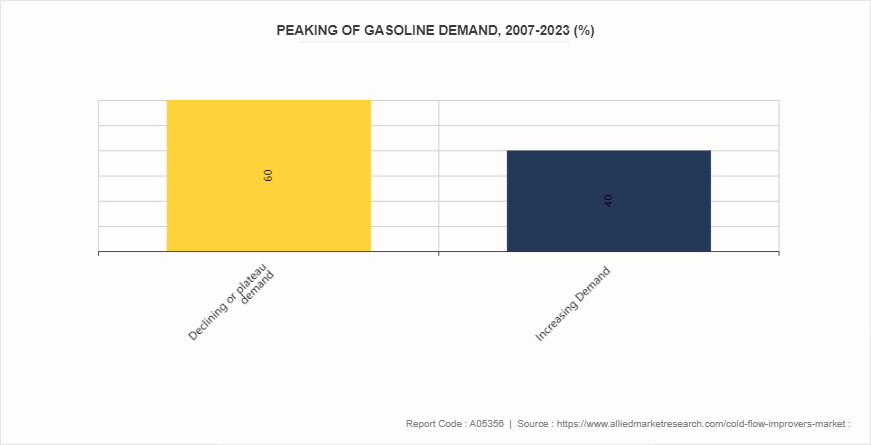

However, the availability of alternatives to cold flow improvers is expected to restraint the growth of cold flow improvers market during the forecast period. One significant factor contributing to the potential restraint of cold flow improvers is the development of advanced fuel technologies. Modern fuels are increasingly formulated to perform effectively across a wider range of temperatures without the need for additional additives. For instance, advancements in refining processes and the incorporation of new chemical treatments have led to the creation of fuels with enhanced low-temperature properties. These fuels are engineered to resist gelling and maintain fluidity even in extreme cold conditions, thereby reducing the necessity for cold flow improvers. The rise of renewable and alternative fuels also impacts the demand for traditional cold flow improvers. Biofuels and synthetic fuels, which are increasingly being adopted as more sustainable energy sources, often have different low-temperature properties compared to conventional fossil fuels. For these alternative fuels, different types of cold flow enhancement technologies may be required. As the market for renewable fuels grows, the focus may shift towards developing specific additives tailored to these new fuel types, potentially decreasing the reliance on traditional cold flow improvers.

Incorporating advanced technologies, such as nanotechnology or smart additives is expected to offer lucrative opportunities in the market. By incorporating advanced technologies such as nanotechnology and smart additives, companies can significantly enhance the efficacy and functionality of cold flow improvers. Nanotechnology, for instance, allows for the creation of additives with extremely fine particles that can more effectively modify the properties of fuels at a molecular level. This results in improved performance and stability of the cold flow improvers, leading to better fuel flow characteristics even in extremely low temperatures. The integration of smart additives presents another promising avenue. These additives can be engineered to respond to environmental changes in real-time, adjusting their performance based on factors such as temperature variations or fuel composition. This dynamic adaptability ensures that the cold flow improvers remain effective across a range of conditions, providing enhanced reliability and efficiency. In February 2024, nanotechnology is significantly advancing the coatings industry, leading to innovative developments and improving coating performance. Worldwide, around 52% of coatings are utilized for new construction projects and the upkeep of existing buildings, while about 35% are applied to industrial products for decoration and protection. The coatings markets in the U.S., Western Europe, and Asia Pacific are well-developed and often reflect broader economic trends, especially in housing, building, and transportation sectors.

Competitive Analysis

Key market players in the cold flow improvers market include Evonik Industries, Clariant, Bell Performance, Afton Chemical, Innospec, Dorf Ketal Chemicals LLC, Valvoline Global Operations, Rymax Lubricants, Baker Hughes Company, and Infineum International Limited.

Regional Market Outlook

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In North America, cold flow improvers are extensively used to enhance the performance of diesel fuel during the winter months. The region experiences significant temperature variations, particularly in Canada and the northern United States, where sub-zero temperatures are common. Cold flow improvers are crucial in preventing diesel fuel from gelling or forming wax crystals, which can clog fuel filters and injectors, leading to engine performance issues.

In the Asia-Pacific region, the usage of cold flow improvers varies significantly across different countries. While tropical countries may have limited need for such additives, countries with colder climates, such as China, Japan, and South Korea, see substantial usage. In China, the rapid industrialization and expansion of the automotive sector have led to increased demand for diesel fuel additives, including cold flow improvers. Japan and South Korea, with their advanced automotive industries, also contribute to the regional demand.

Industry Trends

- In May 2023, Petrobras, Brazil's state-owned oil company, approved a new fuel pricing policy aimed at reducing costs for drivers. This revised strategy will lead to substantial price cuts, with gasoline and diesel prices expected to drop by nearly 13%.

- In June 2022, INEOS Oligomers launched the largest single-train Low Viscosity Polyalphaolefin (LV PAO) plant globally at their Chocolate Bayou facility in Texas. This new unit, with a capacity of 120, 000 tonnes per annum, is the world's largest single PAO train. It is designed to address the growing demand for advanced efficiency in low viscosity, low volatility engine oils, as well as in electrical transmission fluids and heat transfer fluids used in data servers and electrical batteries.

- As per the LNG Publishing Company, Inc, U.S. base oil production in 2022 experienced a significant decline compared to 2021, falling by over 3 million barrels from pre-pandemic levels. Conversely, Japan saw a notable increase in lubricant sales in 2022. After a pandemic-related slump in 2021, the country not only recovered but also achieved its highest sales volumes in years.

- In June 2022, INEOS Oligomers starts up the world’s largest single train Low Viscosity Polyalphaolefin (LV PAO) plant at its Chocolate Bayou facility in Texas. The new 120, 000 tonne per annum Low Viscosity Polyalphaolefin (LV PAO) unit at Chocolate Bayou, TX is the world’s largest single PAO train. The new LV PAO plant will meet increased demand for improved efficiency from low viscosity low volatility engine oils, electrical transmission fluids and heat transfer fluids for data servers and electrical batteries.

Historic Trends of Cold Flow Improvers Market

- The 1960s marked the introduction of the first commercial Cold Flow Improvers (CFIs) . These early additives were designed to address the issue of diesel fuel gelling at low temperatures, which can lead to clogging of fuel lines and filters, ultimately causing engine failures.

- During the 1970s, significant advancements were made in the development of Cold Flow Improvers (CFIs) with the introduction of polymeric additives. These additives marked a departure from the simpler compounds used in previous decades and provided a more effective solution for improving the cold flow properties of diesel fuels.

- The 1980s saw significant advancements in the development of polymeric cold flow improvers, notably the introduction of polyalkyl methacrylates (PAMAs) . These polymers proved highly effective at modifying the wax crystal structures that form in diesel fuel at low temperatures. By preventing the wax crystals from growing too large and interlocking, PAMAs help maintain fuel flow and prevent filter plugging.

- The 2000s mark a significant shift in diesel fuel standards due to stricter environmental regulations aimed at reducing sulfur emissions. The U.S. Environmental Protection Agency (EPA) mandates the transition to Ultra-Low Sulfur Diesel (ULSD) fuel, which contains a maximum of 15 parts per million (ppm) sulfur, down from the previous standard of 500.

Key Sources Referred

- Department of Energy

- U.S. Environmental Protection Agency

- Ecolab

- U.S. Government Publishing Office

- Directorate General of Trade Remedies

- California Department of Transportation

- Bell Performance

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cold flow improvers market analysis from 2024 to 2033 to identify the prevailing cold flow improvers market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cold flow improvers market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cold flow improvers market trends, key players, market segments, application areas, and market growth strategies.

Cold Flow Improvers Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1465.1 Million |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By End-Use |

|

| By Region |

|

| Key Market Players | Valvoline Global Operations, Afton Chemical, Dorf Ketal Chemicals LLC, Rymax Lubricants, Innospec, Evonik Industries, Bell Performance, Baker Hughes Company, Clariant, Infineum International Limited |

The global cold flow improvers market was valued at $814.1 million in 2023, and is projected to reach $1,465.1 million by 2033, growing at a CAGR of 6.1% from 2024 to 2033.

Key market players in the cold flow improvers market include Evonik Industries, Clariant, Bell Performance, Afton Chemical, Innospec, Dorf Ketal Chemicals LLC, Valvoline Global Operations, Rymax Lubricants, Baker Hughes Company, and Infineum International Limited.

Asia-Pacific is the largest regional market for cold flow improvers.

Diesel fuel is the leading application of cold flow improvers market.

Incorporating advanced technologies, such as nanotechnology or smart additives are the upcoming trends of cold flow improvers market in the world.

Loading Table Of Content...