The global commercial aircraft video surveillance systems market was valued at $170.82 million in 2020, and is projected to reach $257.02 million by 2030, growing at a CAGR of 4.3% from 2021 to 2030.

Video surveillance is the act of viewing a scene or scenes and looking for specific actions that are wrong or that may reflect the formation or presence of inappropriate behavior. A video surveillance system is a network of one or more surveillance cameras that collect data in the form of video and audio and send it to a specific location. During ground operations and flight time, commercial aircraft video surveillance systems (CAVSS) are utilized to monitor the aircraft's internal and external security. These systems can be used for a variety of tasks, including aircraft cockpit & cabin surveillance, refueling, passenger safety, taxi operations, and other ground support tasks.

The need for enhanced aircraft security, due to an increase in the number of offensive incidences in aircraft & terrorist activities, and supportive regulatory compliance are factors that fuel the demand for advanced commercial aircraft video surveillance services. In addition, the introduction of advanced & innovative technologies, an upsurge in budgetary expenses for aerospace applications, and enhanced emphasis on passenger safety drive the growth of commercial aircraft video surveillance systems market during the forecast period.

However, reduced profit margins in aerospace business, deployment of technologically advanced products while maintaining profitability, and aircraft crew opposition to installation of cameras in cockpit hamper the market growth. On the contrary, surge in R&D initiatives and increase in focus to improve operational efficiency are expected to provide lucrative opportunities for market growth.

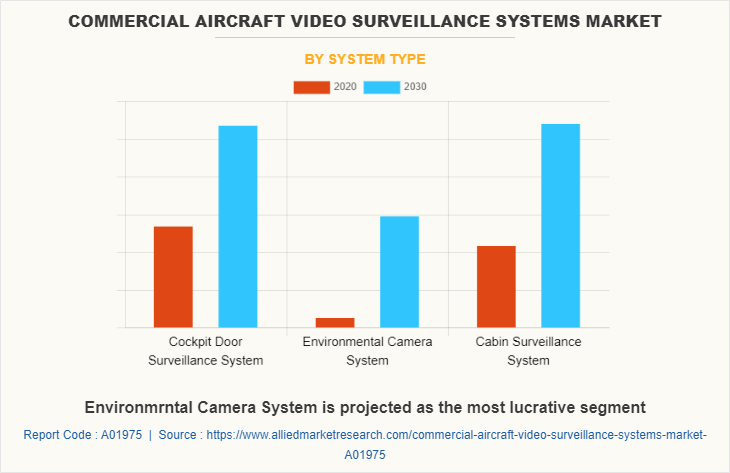

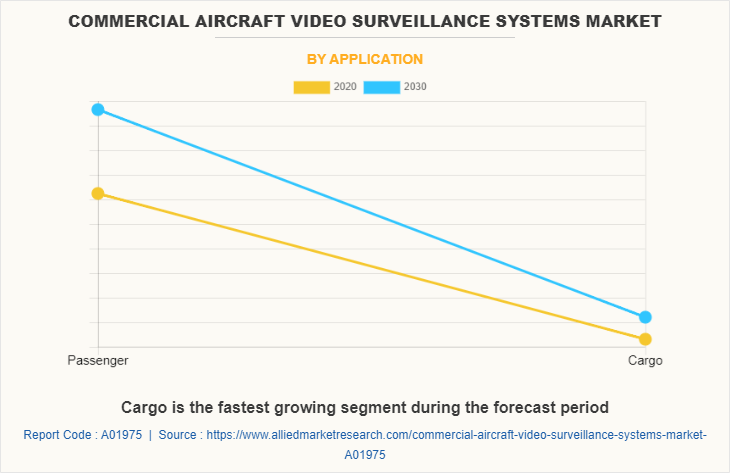

The commercial aircraft video surveillance systems market is segmented on the basis of system type, aircraft type, application, and region. By system type, it is classified into cockpit door surveillance system, cabin surveillance system, and environmental camera system. Depending on aircraft type, it is categorized into narrow body aircraft, wide body aircraft, regional & business aircraft, and freighter aircraft. By application, it is bifurcated into the passenger and cargo. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this commercial aircraft video surveillance systems market report include Aerial View System Inc., AD Aerospace, Avionics Services, Eirtech Aviation Services, Global ePoint Inc., Kappa Optronics GmbH, KID Systeme GmbH, Meggitt Plc., Ontonomy Aviation, and Raytheon Technologies Corporation.

Supportive growth of commercial aviation industry through regulatory compliance

The growth of commercial aviation industry is driven by supportive regulatory compliances. Regulatory compliance refers to a company's adherence to applicable state, federal, and international laws and regulations. Particular needs may differ depending on the industry and type of business. It is mandatory for cabin & cockpit surveillance system manufacturers to adhere to various standards and certifications issued by regulatory bodies such as Federal Aviation Administration (FAA), European Aviation Safety Agency (EASA), International Civil Aviation Organization, International Aerospace Quality Group, and European Aerospace Quality Group. For instance, AS 9100 quality standards, EN 9100 & JISQ 9100 quality standard, European Aviation Safety Agency (EASA) approval for manufacturing (UK.21G.2205) and maintenance: (UK.145.00613), federal aviation regulation part 145 (FAR145) approval for maintenance, ED 112 minimum operational performance standards for crash protected airborne recorder systems certification, s supplemental type certificates (STC) ST01518NY certificate, and the radio technical commission for aeronautics (RTCA)/DO-160D requirements are some of the industry standards that enhance the authenticity associated with the security features of video surveillance systems.

Need for enhanced security

Increase in number of offensive incidences in an aircraft gives rise to the need for a safer and more efficient commercial aviation surveillance network. Key commercial airline players in the market focus on investing a significant amount to improve overall safety. According to the data provided by the Federal Aviation Administration (FAA), it was reported that, in 2021, a $5 million fine was collected from around 5,981 unruly passengers, and 350 enforcement actions & 1116 investigations were initiated. Cases of abusive behavior, sexual harassment, and acts of terrorism witnessed a significant rise in the past few years. Thus, video footage serves as a source of evidence during the legal proceedings of such criminal cases. According to the information released by the aviation safety network, the number of airline hijacking incidences declined considerably, due to the adoption of advanced security measures that include commercial aircraft video surveillance systems (CAVSS). This, in turn, increased the reliability of commercial aircraft networks on video surveillance systems and is anticipated to drive the market growth during the forecast period.

Increase in security issues & cyber threat

Cyber threat to the aviation industry increased at a considerable rate in the recent years. Instances such as hacking an aircraft system that includes video surveillance systems negatively affected the commercial aircraft video surveillance systems (CAVSS) industry growth. In November 2021, according to the Chinese officials, a foreign intelligence agency hacked into several Chinese airlines and stole passenger data. Furthermore, incidences of aircraft infected with malware or security breaches-initiated delays in flight timings, loss of information, and raised concerns among regulatory & public authorities. In January 2019 there were more than 30 cyber-attacks reported. In addition, the increase in rate of cyber-attacks on low-cost airlines hamper the growth of the market. For instance, in May 2020, EasyJet, the low-cost British airline was attacked by Chinese hackers. Such factors raised concerns over the level of security provided through video surveillance systems, thus restraining the growth of the commercial aircraft video surveillance systems market.

Technological advancements

Consistent technological advancements in video surveillance systems are fueling the growth of the commercial aircraft video surveillance systems (CAVSS) market. For instance, in May 2019, the Otonomy Aviation developed a prototype of 4K (horizontal resolutions of around 4,000 pixels) camera designed specifically for business aviation. It is a full HD 1080 aeronautical onboard camera, offering expanded usage modes with improved view angles, resolution, speed & quality, and increases functionality. In addition, in June 2020, AD Aerospace developed a prototype version of its in-house new aerospace camera module, CAM2020. This new camera integrated with a ¼” image sensor features over 120 dB’s of dynamic range.

Furthermore, innovations such as full HD resolution, electronic image stabilization for distortion-free HD images, wide viewing angle, motion detection, and infrared & night vision are expected to provide lucrative growth opportunities for the market in the future

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial aircraft video surveillance systems market analysis from 2020 to 2030 to identify the prevailing commercial aircraft video surveillance systems market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial aircraft video surveillance systems market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial aircraft video surveillance systems market trends, key players, market segments, application areas, and market growth strategies.

Commercial Aircraft Video Surveillance Systems Market Report Highlights

| Aspects | Details |

| By System Type |

|

| By Aircraft Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Ontonomy Aviation, Aerial View System Inc., Global ePoint Inc., AD Aerospace, Kappa Optronics Gmbh, a.s avionics services, Eirtech Aviation Services, KID Systeme Gmbh, Raytheon Technologies Corporation, Meggitt PLC |

Analyst Review

The utilization of commercial aircraft video surveillance systems (CAVSS) in airline industry increased, due to the increase in focus on airline safety. Moreover, increase in support for the growth of market through regulatory compliance, rise in aerospace expenditure, growth in demand for advanced aircraft security systems, and surge in passenger traffic drive the growth of the market. In addition, recent innovations and increase in adoption of advanced security solutions systems fuel the market growth.

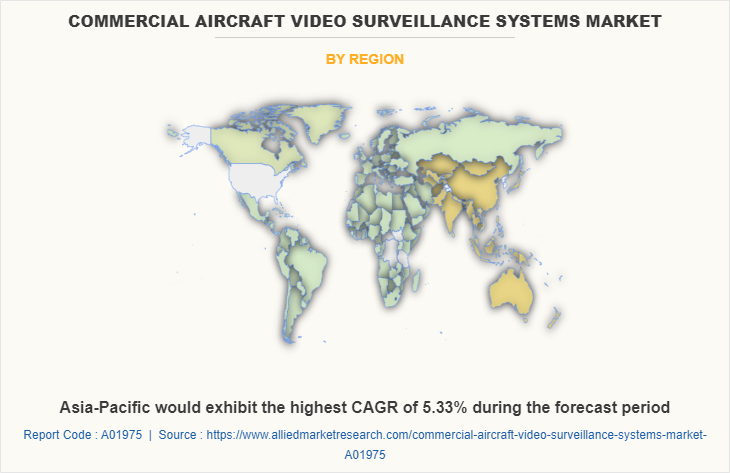

Moreover, increase in economic strength of developing nations, including China, India, Indonesia, and Thailand and surge in passenger safety expenditure are expected to provide lucrative opportunities for the market growth. Asia-Pacific is expected to dominate the market during the forecast period, and emerging countries in Asia-Pacific and Latin America are projected to offer significant growth opportunities.

Furthermore, numerous developments carried out by key players operating in the industry are expected to create lucrative opportunities for the expansion of the market during the forecast period. For instance, in June 2020, AD Aerospace developed a prototype version of its in-house new aerospace camera module, CAM2020. In addition, in May 2019, Otonomy Aviation developed a prototype of 4K (horizontal resolutions of around 4,000 pixels) camera designed specifically for business aviation.

The commercial aircraft video surveillance systems market is segmented on the basis of system type, aircraft type, application, and region. By system type, it is classified into cockpit door surveillance system, cabin surveillance system, and environmental camera system. Depending on aircraft type, it is categorized into narrow body aircraft, wide body aircraft, regional & business aircraft, and freighter aircraft. By application, it is bifurcated into the passenger and cargo. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this report include Aerial View System Inc., AD Aerospace, Avionics Services, Eirtech Aviation Services, Global ePoint Inc., Kappa Optronics GmbH, KID Systeme GmbH, Meggitt Plc., Ontonomy Aviation, and Raytheon Technologies Corporation

The global commercial aircraft video surveillance system market valued at $170.82 million in 2020, and is projected to reach $257.02 million by 2030, registering a CAGR of 4.3% between 2021 and 2030

Increase in the implementation of mandates regarding the safety inside aircraft, rise in demand for lighter and reliable aircraft video surveillance systems globally

The report sample for global commercial aircraft video surveillance system market report can be obtained on demand from the website

Yes, with the rise in air passenger traffic across the globe, the demand for ensuring high safety of aircraft is propelling the growth of commercial aircraft video surveillance system market globally

Commercial Aircraft Video Surveillance Systems (CAVSS) incorporate a comprehensive range of products, solutions, and techniques interrelated closely to information and operational aerospace safety. CAVSS uses technologically advanced camera systems to deliver improved monitoring services while optimizing profits for the airline industry

The company profiles of the top players of the market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the industry along with their last three-year revenue, segmental revenue, product offerings, key strategies adopted, and geographical revenue generated

By application, the passenger segment held the highest market share in 2020

The leading companies operating in the commercial aircraft video surveillance system market are Raytheon Technologies Corporation, AD Aerospace, Global ePoint, and Meggitt Plc

Loading Table Of Content...