Commercial Fish Feed Market Research, 2033

The global commercial fish feed market was valued at $15.3 billion in 2023, and is projected to reach $25.0 billion by 2033, growing at a CAGR of 5.1% from 2024 to 2033.

Market Introduction and Definition

Commercial fish feed is specially formulated food designed to meet the nutritional needs of farmed fish. It is essential for aquaculture, ensuring fish receive balanced nutrients for optimal growth, health, and productivity. There are several types of commercial fish feed, including extruded (pellets) , floating, and sinking feeds. Extruded feed is processed under high heat and pressure, making it more digestible. Floating feed is ideal for surface feeders, allowing farmers to monitor consumption, while sinking feed is suitable for bottom dwellers. Ingredients typically include fishmeal, soybean meal, grains, vitamins, and minerals, tailored to the specific dietary requirements of different fish species.

Key Takeaways

The Commercial Fish Feed Industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2035.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

Global populations rise and the demand for seafood increases, aquaculture has become a vital source of fish and shellfish. This surge in aquaculture activities necessitates high-quality, nutritionally balanced feed to ensure optimal growth, health, and productivity of farmed fish. Efficient feed formulations are crucial for maximizing yield, reducing mortality rates, and improving feed conversion ratios, which directly impacts the profitability of aquaculture operations. As more farmers adopt advanced aquaculture practices, the reliance on specialized aquafeed products intensifies, fueling market expansion and increasing the Commercial Fish Feed Market Size.

Furthermore, the diversification of farmed species within the aquaculture sector propels the demand for varied types of aquafeed. Different species have specific dietary requirements, leading to the development of species-specific feeds tailored to enhance growth rates and immune responses. Innovations in feed ingredients, such as the inclusion of probiotics, prebiotics, and other functional additives, further bolster the appeal of commercial aquafeed. As sustainability becomes a growing concern, the industry is also witnessing a shift towards eco-friendly and sustainable feed options, driving further research and development in the aquafeed market to meet the evolving needs of the aquaculture industry.

According to Commercial Fish Feed Market Forecast, environmental concerns over fishmeal and fish oil sourcing significantly restrain the market demand for commercial fish feed. Fishmeal and fish oil, traditionally derived from wild-caught forage fish, are crucial ingredients in many aquafeed formulations due to their high protein and omega-3 fatty acid content. However, the large-scale harvesting of these forage fish has raised sustainability issues, such as overfishing and the depletion of marine biodiversity. Environmental organizations and regulatory bodies are increasingly advocating for the reduction of fishmeal and fish oil in aquafeeds, prompting the industry to seek sustainable alternatives. This shift complicates the sourcing process and adds to the cost and research investments required to develop effective substitutes. In addition, the environmental impact of fishmeal and fish oil production, including habitat destruction and carbon emissions, has led to stricter regulations and consumer scrutiny. These challenges create barriers for aquafeed manufacturers who must now navigate a complex landscape of compliance and sustainability standards. The pressure to reduce reliance on fishmeal and fish oil while maintaining feed efficacy and nutritional quality limits market growth and increasing the Commercial Fish Feed Market Share.

Sustainable protein sources, such as insect meal, algae, and plant-based proteins, offer viable alternatives that reduce the reliance on wild-caught forage fish, thereby alleviating overfishing concerns and promoting marine biodiversity. These alternative proteins can be produced with lower environmental impact, including reduced carbon emissions and land use, aligning with the growing demand for eco-friendly and sustainable aquaculture practices. This shift towards sustainability is driven by both regulatory pressures and consumer preferences, opening new market segments for innovative feed products. Furthermore, the development of alternative protein sources spurs technological advancements and research in feed formulation, enhancing the nutritional profile and efficacy of commercial fish feed. Companies investing in these novel ingredients can differentiate themselves by offering high-quality, sustainable feed options that meet the specific dietary needs of various farmed fish species. Thus, all these factors several opportunities for the market, increasing the Commercial Fish Feed Market Growth.

Value Chain of Commercial Fish Feed Market

The value chain of the Commercial Fish Feed Market encompasses several interconnected stages from raw material sourcing to end-user consumption. It begins with the procurement of key ingredients such as fishmeal, fish oil, soybean meal, corn, wheat, and various vitamins and minerals. These raw materials are sourced from suppliers including fisheries, agricultural producers, and specialty ingredient manufacturers.

Next, feed manufacturers process and combine these ingredients to formulate balanced fish feeds tailored to different species and growth stages. This involves activities like grinding, mixing, extrusion, and pelletizing to create products with specific nutritional profiles and physical characteristics. Quality control measures are implemented throughout production to ensure consistency and safety. The manufactured feed is then packaged and distributed through various channels. This may include direct sales to large aquaculture operations, as well as distribution through wholesalers, retailers, and agricultural supply stores to reach smaller fish farmers. Transportation and logistics play a crucial role in maintaining product freshness and quality during distribution. Aquaculture farms and fish hatcheries represent the primary end-users of commercial fish feed. They utilize the feed in their operations to support fish growth and health. The efficacy of the feed directly impacts the quality and yield of fish produced, which in turn affects the profitability of aquaculture businesses and Aqua feed.

Finally, the farmed fish enter the consumer market through various channels such as seafood processors, wholesalers, retailers, and food service establishments. The nutritional quality of the fish, influenced by the feed used, impacts consumer satisfaction and overall market demand, thus completing the value chain cycle.

Market Segmentation

The commercial fish feed market is segmented into species, ingredients, form, and region. On the basis of species, the market is divided into carp, salmon, trout, catfish, sea bass and others. As per ingredients, the market is segregated into soybean, fishmeal, fish oil, grains, vitamins and minerals. On the basis of form, the market is bifurcated into pellets, powder, flakes and liquid. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/ Country Market Outlook

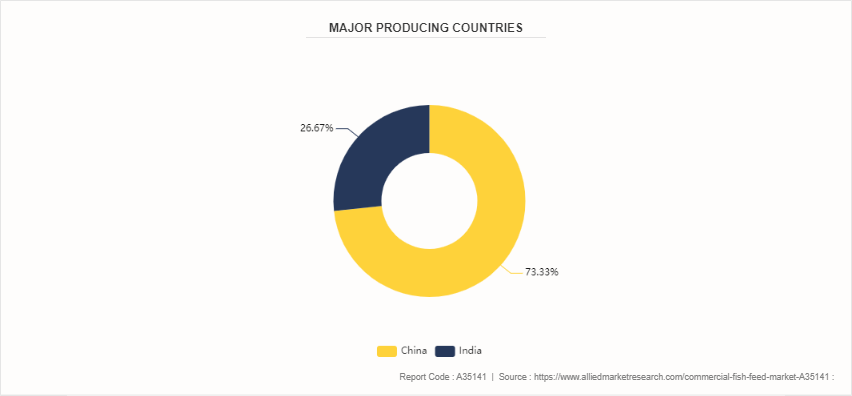

Asia Pacific dominates the commercial fish feed market due to its extensive aquaculture industry, which is the largest and fastest growing in the world. Countries like China, India, Vietnam, and Thailand are major contributors to global fish production, driven by favorable climatic conditions, abundant water resources, and a strong tradition of fish farming. The region's burgeoning population and rising income levels have led to increased demand for seafood, further propelling the growth of aquaculture. Consequently, there is a high demand for commercial fish feed to support the intensive farming practices required to meet this demand.

Moreover, the Asia Pacific region benefits from significant investments in aquaculture infrastructure and technology, enhancing productivity and efficiency. Governments in the region actively support the aquaculture sector through favorable policies, subsidies, and research initiatives, fostering an environment conducive to growth. Additionally, the presence of numerous local and multinational feed manufacturers provides a robust supply chain and competitive market, driving innovation and quality improvement in fish feed products. The region's focus on sustainable and eco-friendly aquaculture practices also aligns with global trends, further reinforcing its leading position in the market. Overall, the combination of high demand, supportive policies, and continuous innovation makes Asia Pacific the most dominant region in the commercial fish feed market.

Competitive Landscape

The major players operating in the commercial fish feed market include Altech Inc, Aller Aqua, Archer Daniels Midland Company, BASF, Biomin GmHs, Cargill Inc, BioMar Group, Beneo, Nutreco and Ridley Corporation.

Recent Key Strategies and Developments

In September 2022, Skretting introduced NovoCare, a new fish feed designed to enhance fish health and growth. The feed includes specialized ingredients to boost immunity and improve feed conversion ratios, targeting the needs of the aquaculture industry to produce healthier and more productive fish stocks?.

In March 2023, Cargill expanded its AquaXcel line of fish feeds, incorporating new formulations with alternative protein sources such as insect meal and algae. This move aligns with Cargill’s commitment to sustainability and reducing reliance on traditional fish meal and fish oil in aquaculture feeds.

Key Sources Referred

World Bank

Comstat Data Hub

Aquatic Food Studies

U.S. Bureau

Food and Agriculture Organization (FAO)

British Frozen Food Federation (BFFF)

Sea Food Organization

International Institute of Refrigeration

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial fish feed market analysis from 2024 to 2033 to identify the prevailing commercial fish feed market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial fish feed market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial fish feed market trends, key players, market segments, application areas, and market growth strategies.

Commercial Fish Feed Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 25.0 Billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 234 |

| By Species |

|

| By Ingredients |

|

| By Form |

|

| By Region |

|

| Key Market Players | Aller Aqua, BioMar Group, BASF, Archer Daniels Midland Company, Ridley Corporation Ltd, Biomin GmHs, Altech Inc, Beneo, Nutreco, Cargill Inc |

The global commercial fish feed market was valued at $15.3 billion in 2023, and is projected to reach $25.0 billion by 2033

The global Commercial Fish Feed market is projected to grow at a compound annual growth rate of 5.1% from 2024 to 2033

The key players profiled in the reports includes Cargill Inc, Ridley Corporation Ltd, Altech Inc, Beneo, Archer Daniels Midland Company, BASF, Aller Aqua, BioMar Group, Biomin GmHs, Nutreco

Asia Pacific dominates the commercial fish feed market due to its extensive aquaculture industry, which is the largest and fastest growing in the world.

Growth of aquaculture industry, Advancements in feed formulation and technology , Rising awareness about fish nutrition

Loading Table Of Content...