Commercial Flood Insurance Market Research, 2033

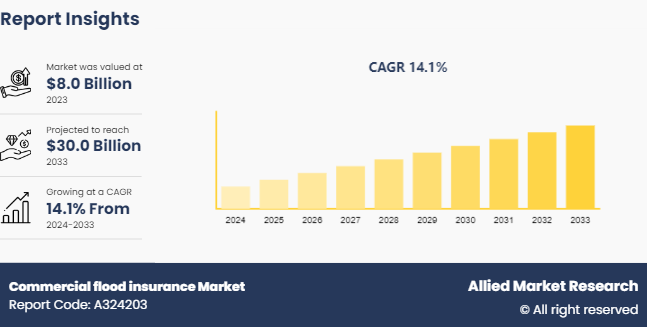

The global commercial flood insurance market size was valued at $8.0 billion in 2023, and is projected to reach $30.0 billion by 2033, growing at a CAGR of 14.1% from 2024 to 2033. Commercial flood insurance provides financial protection for businesses against damage or loss caused by flooding. It covers buildings, contents, and loss of income due to flood events, helping businesses recover and maintain operations after such incidents.

Market Introduction and Definition

Commercial flood insurance is a specialized insurance policy designed to secure businesses from the financial repercussions of flood-related damages. Unlike standard commercial property insurance, which typically excludes flood damage, commercial flood insurance explicitly covers the structural damage to business buildings and the loss or damage to their contents caused by flooding. This type of insurance is decisive for businesses placed in flood-prone areas, as it facilitates protection against the substantial costs associated with repairing or replacing buildings, equipment, inventory, and other business assets. Coverage under commercial flood insurance generally includes protection for the physical structure of the building, such as its walls, floors, and permanent fixtures, as well as the business's personal property, including furniture, machinery, and inventory.

Commercial flood insurance policies can be obtained through the National Flood Insurance Program (NFIP) , which is managed by the Federal Emergency Management Agency (FEMA) , offering standardized coverage with specific limits, or through private insurers, who may provide more tailored policies with higher limits and broader coverage options. A critical aspect of commercial flood insurance is the 30-day waiting period before coverage becomes effective unless it is mandated by a lender for loan closing. Premiums for these policies are influenced by the flood risk zone, the building's elevation, and other factors. By securing commercial flood insurance, businesses can mitigate the risk of significant financial loss, ensuring faster recovery and continuity of operations following a flood event.

Key Takeaways

The commercial flood insurance market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period 2024-2033.

More than 1, 500 product literature, industry releases, annual reports, and other documents of major commercial flood insurance industry participants, along with authentic industry journals, trade associations' releases, and government websites, have been reviewed to generate high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The commercial flood insurance market growth is driven by the increasing flood events and severity of floods, the growing government programs and management to improve floodplain management, and the increasing number of insurance markets. However, the high premium costs of commercial flood insurance policies, along with the lack of awareness and misconceptions about flood risks restrain the development of the commercial flood insurance market. In addition, increasing urbanization and infrastructure development across developing countries, along with technological enhancements in improving the accuracy of flood hazards will provide ample opportunities for the market's development during the forecast period.

Furthermore, the rising sea levels due to climate change increase the risk of coastal flooding. Storm surges associated with hurricanes and cyclones can cause significant damage to businesses in these areas, thus creating a significant demand for commercial flood insurance across the globe. According to the Save Our Beaches San Clemente Organization, it was found that the global mean sea level was 101.2 millimeters (4 inches) above 1993 levels, making it the highest annual average in the satellite record (1993-present) . The rise in water level is mostly caused by a combination of melt-water from glaciers & ice sheets, and the thermal expansion of seawater. As a result, this factor is creating an alarming need for commercial flood insurance among commercial end-users globally, which drives the commercial flood insurance market forecast period. Moreover, the changes in building codes and zoning laws often require additional coverage, prompting businesses to seek comprehensive flood insurance policies, which provides the commercial flood insurance market opportunity.

PESTEL Overview: Global Commercial Flood Insurance Market

Although the growth of the commercial flood insurance market has been more rapid in recent years, the industry is influenced by a range of political, socioeconomic, and legal factors.

Political Factors

Favorable government policies and programs, such as the National Flood Insurance Program (NFIP) and National Disaster Mitigation Program (NDMP) .

Policies related to climate change adaptation and disaster management influence the availability and requirements for flood insurance, which can positively influence the commercial flood insurance market.

Economic Factors

Economic development and increasing commercial activities lead to a higher demand for flood insurance to protect assets and ensure business continuity.

The affordability of flood insurance policies impacts their uptake by businesses, especially small and medium enterprises (SMEs) , which positively shapes the commercial flood insurance market growth.

Social Factors

Increasing awareness of flood risks and the importance of insurance through education campaigns boosts market demand.

Social initiatives aimed at enhancing community resilience to flooding often promote or require commercial flood insurance.

Technological Factors

Improved flood modeling and risk assessment tools enable insurers to offer more accurate and tailored policies, enhancing their attractiveness.

Technological advancements in claims processing, such as digital platforms and automation, improve customer experience and reduce processing times.

Legal Factors

Legal frameworks governing insurance practices and standards impact the operations of flood insurance providers.

Legal aspects related to liability, coverage limits, and exclusions influence the terms and conditions of flood insurance policies.

Environmental Factors

Increasing frequency and severity of flood events due to climate change significantly drive the demand for flood insurance.

The occurrence of natural disasters and the associated economic losses underscore the need for comprehensive flood insurance, driving commercial flood insurance market growth.

Market Segmentation

The commercial flood insurance market is segmented into coverage type, policy provider, distribution channel, and region. Based on coverage type, the market is divided into building coverage, content coverage, and combined coverage. As per the policy provider, the market is bifurcated into national flood insurance program (NFIP) and private flood insurance. By distribution channel, the market is divided into direct sales and agents & brokers. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has been one of the leading countries in the commercial flood insurance market outlook, primarily due to the increased events of floods due to climate change, along with the large presence of commercial flood insurance providers. Further, governments in North America are increasingly implementing regulations that mandate flood insurance for businesses in designated high-risk flood zones. This ensures financial preparedness for rebuilding and reduces the burden on government assistance programs after floods. The National Flood Insurance Program (NFIP) in the U.S. is a prime example, requiring flood insurance for federally-backed mortgages on properties in high-risk zones. Thus, the rising government support for flood risk management and increased financial preparedness among businesses for natural calamities is expected to drive the demand for the commercial flood insurance market in this region. Moreover, growing initiatives involving public-private partnerships are promoting the development of more comprehensive flood insurance products, which drives commercial flood insurance market growth across North America.

However, Asia-Pacific is expected to register significant growth prospects during the forecast period, due to rapid urbanization and economic development, creating the alarming need to prepare against flood risks, thereby necessitating comprehensive insurance coverage in developing countries such as China, India, and Singapore. In addition, the adoption of digital platforms and insurtech innovations is making it easier for businesses to access, purchase, and manage flood insurance policies. Online marketplaces and digital brokers are increasing market penetration. This is likely to support the growth of the commercial flood insurance market.

Industry Trends

In February 2024, in response to the increased flooding and flood risk caused by climate change, the Federal Emergency Management Agency (FEMA) proposed a few recent updates to the "Standard Flood Insurance Policy" issued under the National Flood Insurance Program (NFIP) . Many of the changes proposed by FEMA are intended to modernize NFIP policies to make them more legible by policyholders, claims adjusters, and agents to raise public awareness for this program. Significantly, FEMA's proposed rulemaking will promote policyholders to rebuild flood-damaged properties to a more resilient standard.

In October 2023, the Minister for Enterprise, Trade, and Employment in Ireland introduced two Emergency Business Flooding Schemes for small businesses, voluntary organizations, sports clubs, and communities unable to secure flood insurance and affected by current flooding in Counties Cork, Waterford, Limerick, Kilkenny, and Louth. The schemes offer humanitarian support towards the costs of returning small businesses, sporting, voluntary, and community premises to their pre-flood condition, such as the replacement of flooring, fixtures & fittings, and damaged stock.

Competitive Landscape

The major players operating in the commercial flood insurance market include Assurant, Inc., Chubb Group, FloodFlash Limited, Hylant Group, Inc., Insurance America LLC, JMG Insurance Corp, Main Street America Insurance, Nationwide Mutual Insurance Company, Sutcliffe Insurance Brokers Limited, and The Hartford. Other players in the commercial flood insurance market include Advisory Insurance Brokers Limited, Neptune Flood, Prizm Solutions Ltd, Pyron Group Insurance, Reliant Assurance Brokers LLC, Selective Insurance Group, Inc., and so on.

Recent Key Strategies and Developments in Commercial Flood Insurance Industry

In April 2024, FloodFlash, ?the world’s leading sensor-based parametric flood provider, launched its first Flood BI (business interruption) product that covers all aspects of BI including non-damage BI and denial of access. The rapid-payment claims in line with the core FloodFlash offering imply that claimants receive their policy's full value within weeks of flooding. Flood BI often helps the commercial sector, including hospitality, retail, healthcare, real-estate, manufacturing, municipality, and more.

In March 2024, Chubb launched a new self-service Flood Insurance System for agents. The new platform, which will likely integrate with the Chubb Agent Portal and the Masterpiece EZ Quote homeowners platform, will facilitate Chubb’s personal lines business for primary and excess flood. It typically offers quotes for low-hazard properties in less than two minutes. The system will be accessible in all states where Chubb writes flood insurance.

In February 2024, Neptune Flood, the major provider of private flood insurance in the U.S., officially introduced its excess flood insurance product for commercial, residential, and condominium (RCBAP) properties. A Neptune excess flood policy offers coverage above the maximum limit accessible through the National Flood Insurance Program (NFIP) , enabling consumers to keep their NFIP policy in line with the market rate if they have yet to reach it. A Neptune excess flood policy also allows policyholders to purchase enhanced protections inaccessible through the NFIP.

Key Sources Referred

National Flood Insurance Program (NFIP)

Association of State Floodplain Managers (ASFPM)

Flood Insurance Producers National Committee (FIPNC)

National Association of Professional Insurance Agents (PIA)

Independent Insurance Agents & Brokers of America (IIABA)

Risk Management Society (RIMS)

National Association of Insurance Commissioners (NAIC)

National Association of Mutual Insurance Companies (NAMIC)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the commercial flood insurance market analysis from 2024 to 2033 to identify the prevailing commercial flood insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the commercial flood insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global commercial flood insurance market trends, key players, market segments, application areas, and market growth strategies.

Commercial flood insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 30.0 Billion |

| Growth Rate | CAGR of 14.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 250 |

| By Coverage Type |

|

| By Policy Provider |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Advisory Insurance Brokers Limited, FloodFlash Limited, Hylant Group, Inc., Chubb Group, Main Street America Insurance, Insurance America LLC, Sutcliffe Insurance Brokers Limited, The Hartford, Pyron Group Insurance, Prizm Solutions Ltd, Assurant, Inc., Neptune Flood, JMG Insurance Corp, Reliant Assurance Brokers LLC, Nationwide Mutual Insurance Company |

The total market value of commercial flood insurance market is $8.0 billion in 2023.

The market value of commercial flood insurance market in 2033 is $30.0 billion.

The forecast period for commercial flood insurance market is 2024 to 2033.

The base year is 2023 in commercial flood insurance market.

Commercial flood insurance provides coverage for businesses against damages caused by flooding. It helps protect commercial properties, including buildings, contents, and loss of income due to flood events.

Loading Table Of Content...